Bitcoin (BTC) has been in a rut, and BTC’s worth is prone to keep in its present downtrend. But like I mentioned last week, when no one is speaking about Bitcoin, that’s often the most effective time to be shopping for Bitcoin.

In the final week, the worth took one other tumble, dropping under $19,000 on Sept. 6 and at the moment, BTC bulls are struggling to flip $19,000–$20,000 again to help. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing actually no matter it takes to fight inflation “until the job is done,” and market analysts have elevated their rate of interest hike predictions from 0.50 foundation factors to 0.75.

Basically, rate of interest hikes and quantitative tightening are supposed to crush client demand, which in flip, ultimately results in a lower in the price of items and providers, however we’re not there but. Additional charge hikes plus QT are prone to push equities markets decrease and given their excessive correlation to Bitcoin worth, a further downside for BTC is the most certainly consequence.

So, yeah, there’s not a robust funding thesis for Bitcoin proper now from the angle of worth motion and short-term features. But what about those that have an extended funding horizon?

Let’s rapidly overview 3 charts that counsel traders ought to be shopping for Bitcoin.

Bitcoin investor device: 2-year MA multiplier

Bitcoin’s worth is at the moment 72% down from its all-time excessive at $69,000. In the earlier bear markets, BTC’s worth noticed a 55% correction (July 21), a 71% drop by March 2020 and an 84% correction in December 2018. While brutal to endure, the present 72% correction will not be outdoors of the norm when in comparison with earlier drawdowns from all-time highs.

Comparing this drawdown information towards the 2-year MA multiplier, one will discover that the worth dropped under the 2-year shifting common, carved out a trough after which consolidated for a number of months earlier than resuming the 12-year-long uptrend.

These areas are the “shaded” zones under the inexperienced 2-year shifting common. Zooming in on the correct aspect of the chart, we will see that worth is once more under the 2-year shifting common, and whereas there isn’t any signal of a “trough” being dug, if historicals are to be relied upon, the worth is at the moment in what could possibly be described as a consolidation zone.

The golden ratio multiplier

Another fascinating shifting common and Fibonacci sequence-based indicator that implies Bitcoin’s worth is undervalued is the golden ratio multiplier.

According to LookIntoBitcoin creator Philip Swift:

“The chart explores Bitcoin’s adoption curve and market cycles to understand how price may behave on medium to long term time frames. To do this, it uses multiples of the 350 day moving average (350DMA) of Bitcoin’s price to identify areas of potential resistance to price movements.”

Swift additional defined that “specific multiplications of the 350DMA have been very effective over time at picking out intracycle highs for Bitcoin price and also the major market cycle highs.” Essentially, the indicator is:

“An effective tool because it is able to demonstrate when the market is likely overstretched within the context of Bitcoin’s adoption curve growth and market cycles.”

Currently, BTC’s worth is under the 350DMA and much like the 2-year MA multiplier. Dollar-cost-averaging into excessive lows has confirmed to be a smart technique for constructing a Bitcoin place.

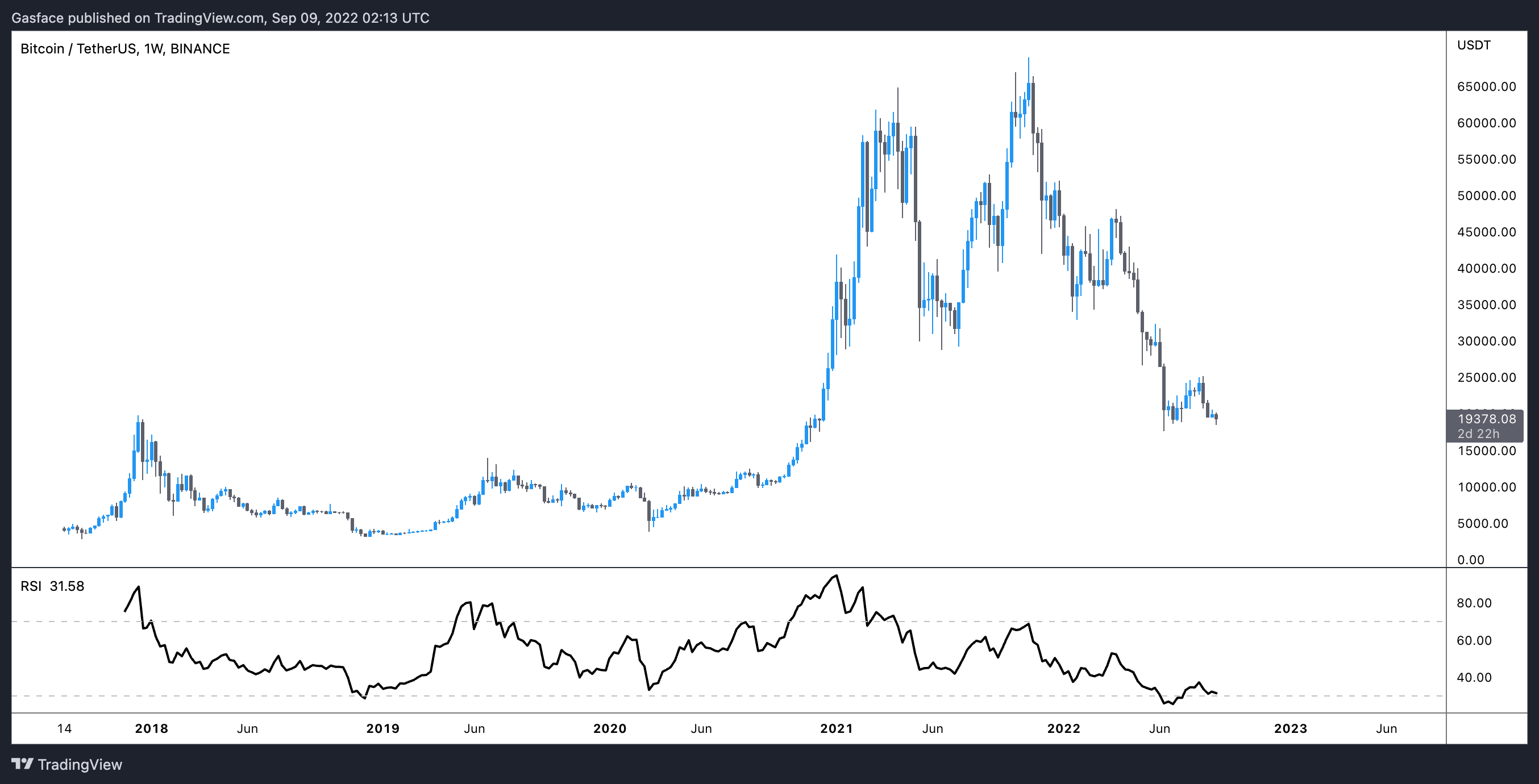

Taking a have a look at Bitcoin’s one-week relative power index (RSI) additionally reveals that the asset is sort of oversold. When evaluating the weekly RSI to BTC’s candlestick chart, it’s clear that accumulation throughout oversold intervals can be a worthwhile tactic.

Related: A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin’s MVRV Z-score

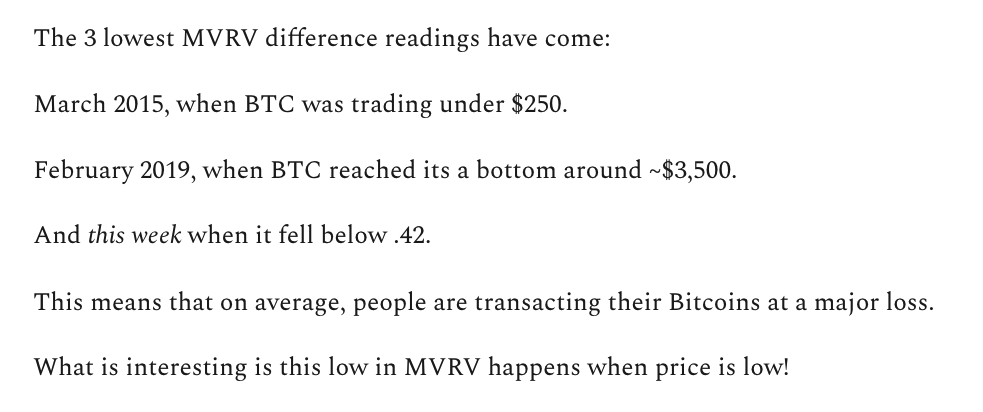

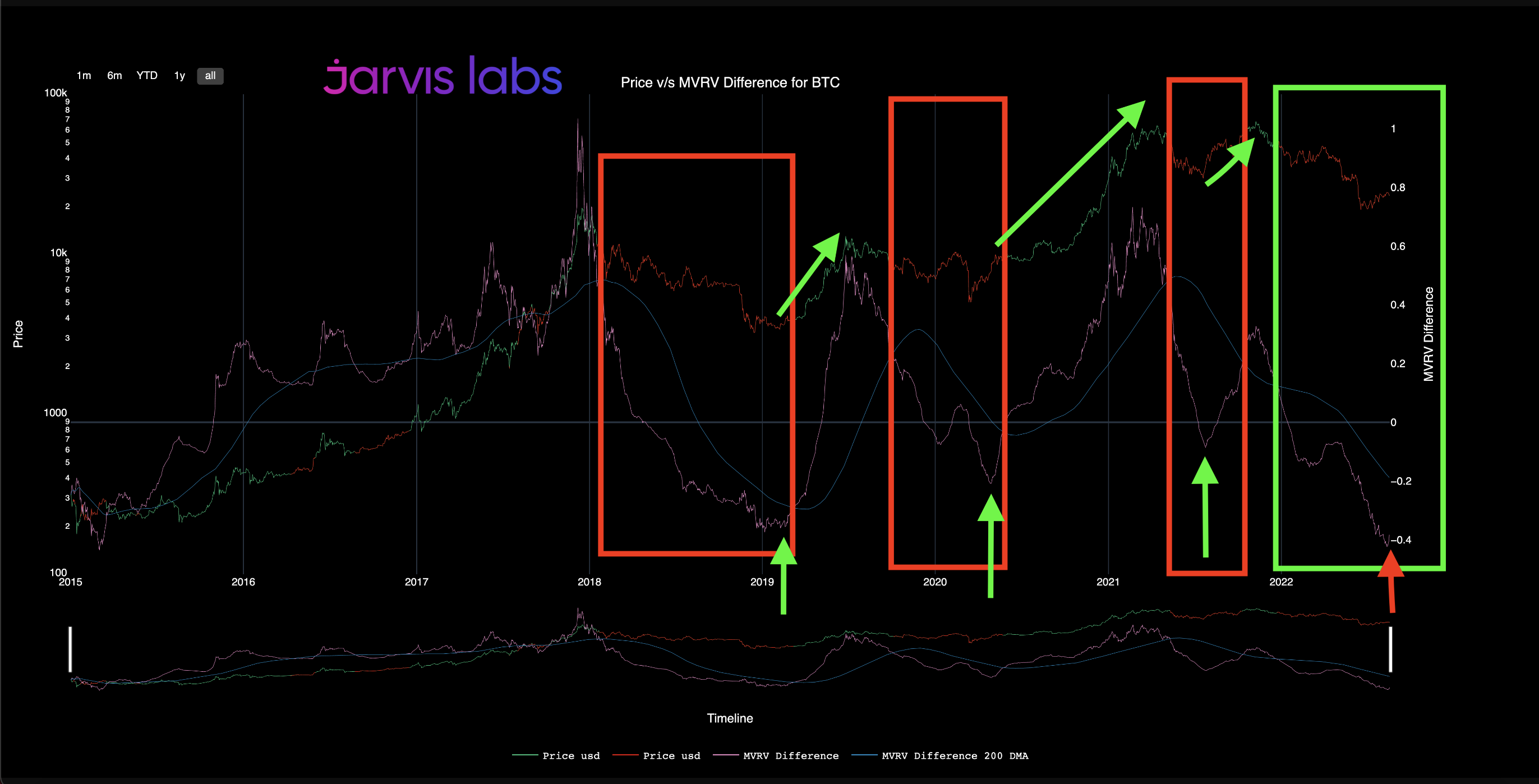

An on-chain indicator known as the MVRV not too long ago hit its lowest rating since 2015. The metric is actually a ratio of BTC’s market capitalization towards its realized capitalization, or in less complicated phrases, the quantity individuals paid for BTC in comparison with the asset’s worth now.

According to Jarvis Labs analyst “JJ,” Bitcoin’s MVRV (market capitalization versus realized capitalization) indicator is printing a studying that’s extraordinarily low. The analyst elaborated:

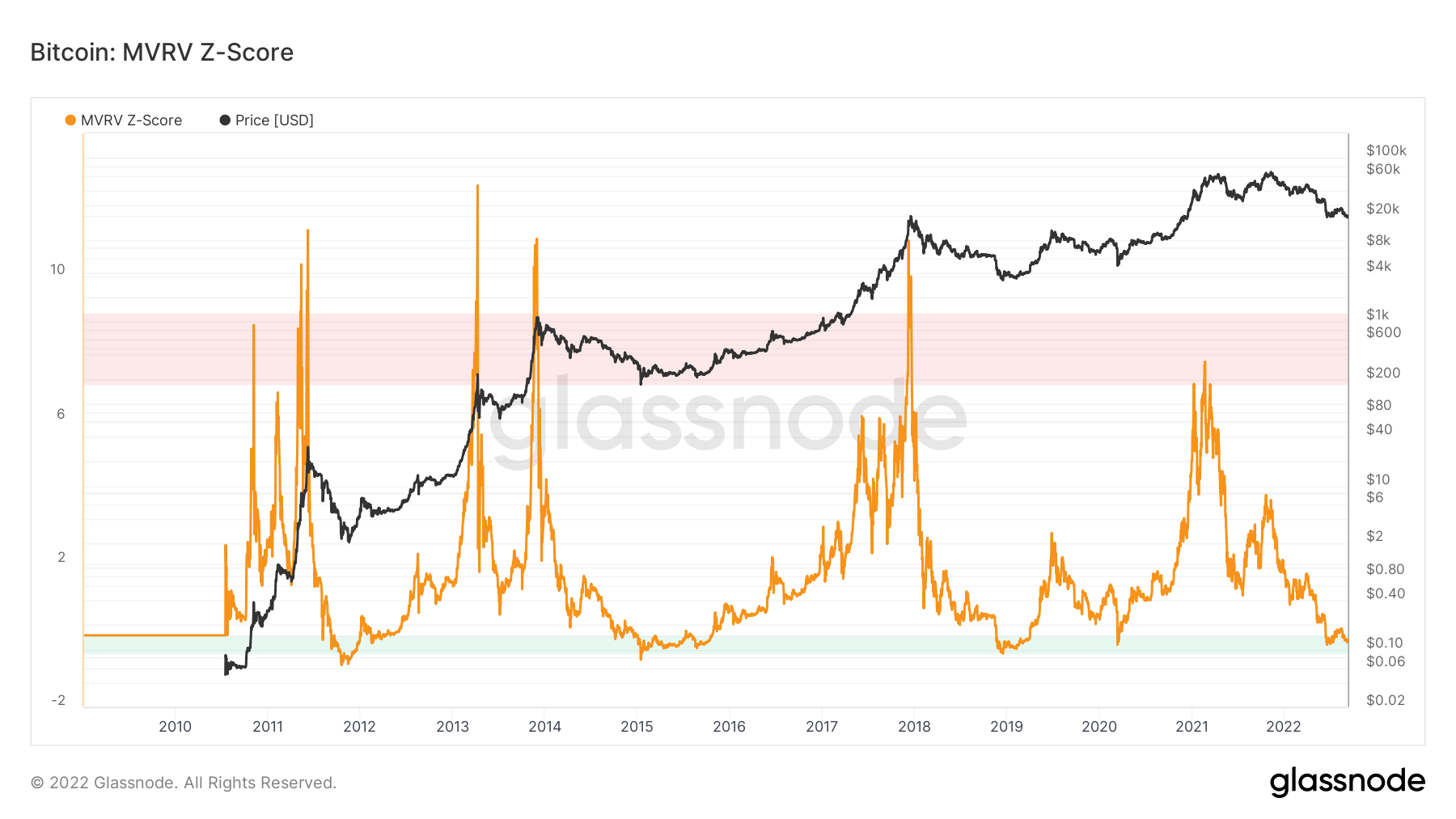

The MVRV Z-score gives perception into when Bitcoin is undervalued and overvalued relative to its honest worth. According to analytics agency Glassnode, “when market value is significantly higher than realized value, it has historically indicated a market top (red zone), while the opposite has indicated market bottoms (green zone).”

Looking on the chart, in contrast towards BTC’s worth, the present -0.16 MVRV rating is in the identical vary as earlier multi-year and cycle bottoms for Bitcoin’s worth. A pure interpretation of the info would counsel that Bitcoin is within the midst of a bottoming course of and presumably getting into the early phases of accumulation.

Of course, its worth may drop a lot additional, and the bearish components which are battering equities markets will probably additionally proceed to impression crypto costs, so not one of the indicators talked about above ought to be relied on because the solitary rationale for investing.

The crypto market is in dangerous form, and that appears unlikely to alter within the brief time period, however timing market bottoms can be unattainable for many merchants. So, what traders ought to search for is confluence amongst quite a lot of metrics and indicators that align with one’s thesis.

At the second, most of Bitcoin’s on-chain metrics and technical evaluation indicators counsel smart dollar-cost-averaging right into a manageable place. The secret is threat administration. Don’t make investments greater than you’ll be able to afford to lose, and also you gained’t have to fret about shedding your shirt.

This e-newsletter was written by Big Smokey, the creator of The Humble Pontificator Substack and resident e-newsletter creator at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird analysis on potential rising tendencies throughout the crypto market.

Disclaimer. Cointelegraph doesn’t endorse any content material of product on this web page. While we intention at offering you all essential info that we may acquire, readers ought to do their very own analysis earlier than taking any actions associated to the corporate and carry full duty for his or her choices, nor this text could be thought-about as an funding recommendation.

- Bitcoin

- Bitcoin News

- Bitcoin Upload

- blockchain

- blockchain compliance

- blockchain conference

- breaking news

- BTC

- Bullish

- coinbase

- coingenius

- Consensus

- crypto

- crypto conference

- crypto mining

- Crypto News

- cryptocurrencies

- cryptocurrency

- Cryptocurrency News

- decentralized

- DeFi

- Digital Assets

- ethereum

- Latest Cryptocurrency News

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- reasons

- Traders

- W3

- zephyrnet