Thursday, July 8, saw another bloodbath on Satoshi Street with Bitcoin (BTC) and altcoins coming crashing down in the early hours. At press time, Bitcoin is trading 2.57% down at $32,556 levels with a market cap of $608.

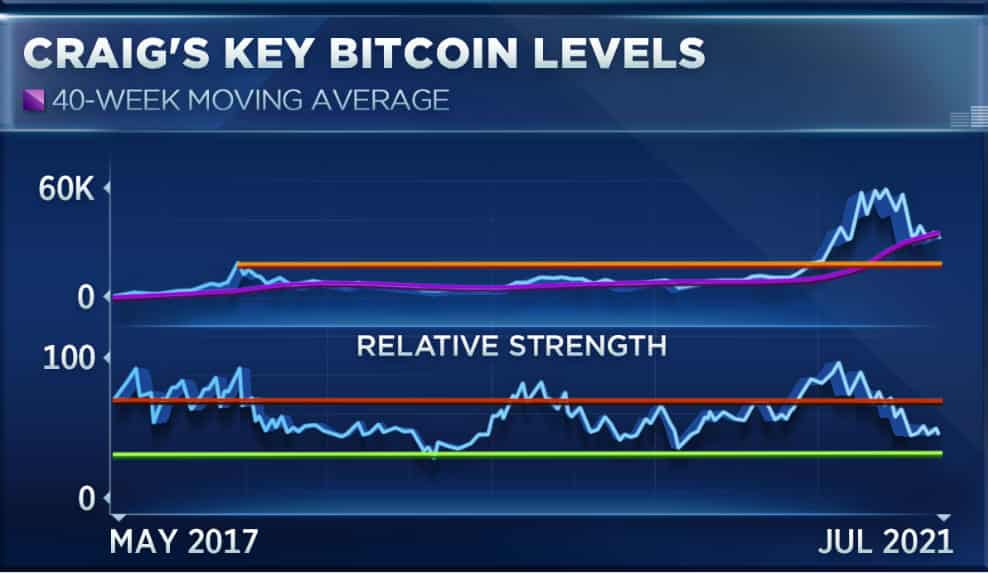

The world’s largest cryptocurrency has been showing high volatility over the last few weeks but remains range-bound between $31,000-$35,000. Citing the Fibonacci retracement levels on technical charts, Craig Johnson, chief market technician at Piper Sandler, points out key support and resistance levels. Speaking to CNBC, Johnson noted:

“We broke out in January. A few months ago, we made this peak. I actually would go back and put the retracement levels on top of bitcoin, and when you see that, you can see that around 33,000 to 34,000 is a very important retracement level”.

However, Johnson adds that BTC has already corrected over 45% from its peak in April 2021. Thus, he believes that BTC is unlikely to correct further but at the same time, he does spot a prolonged period of consolidation. He notes that historically, these consolidation cycles have lasted for around 1000 days.

On the other hand, Blue Line Capital President Bill Baruch told CNBC that he’s waiting for the next big opportunity to add more BTC to his portfolio.

“Give me $25,000 on bitcoin, and I’d be buying more. I’ve been in the space since 2017. There’s times where I’m in it, there’s times when I’m not, I totally exited through early this year,” he added.

BTC Funding Rates Negative, Novogratz Stays Bullish

One bullish indicator for Bitcoin investors is that since the May correction, the Bitcoin funding rate on perpetual futures has remained negative. Positive funding rates usually indicate the market tops while negative funding rates are followed by price jumps.

#Bitcoin funding rates on Perpetual Futures markets have been consistently negative since the Sell-off in May.

The last time funding rates remained negative for such an extended period of time was in Mar-Apr 2020.

Live Chart: https://t.co/pjP4J54Wwl pic.twitter.com/QTR3jKDhYN

— glassnode (@glassnode) July 9, 2021

Speaking of these recent developments, Wall Street veteran and Galaxy Digital CEO Mike Novogratz spoke about how Bitcoin is at the center stage of the emerging cold war between the U.S. and China. With China declaring war on BTC and crypto, the U.S. hedge funds have continued to accumulate it in big numbers.

“We are consolidating here between $30K-$35K,” says @Novogratz on #bitcoin. “Asia sells it off, and then the U.S. buys it back….China has declared war on #crypto as part of this broader cold war that we are getting into.” pic.twitter.com/U5YuAzSJr4

— Squawk Box (@SquawkCNBC) July 8, 2021

Subscribe to our newsletter for free

- "

- 000

- 2020

- 9

- Ads

- Altcoins

- April

- around

- asia

- avatar

- Bill

- Bitcoin

- blockchain

- blockchain technology

- border

- Box

- BTC

- Bullish

- Buying

- capital

- ceo

- Charts

- chief

- China

- CNBC

- coming

- consolidation

- content

- crypto

- cryptocurrencies

- cryptocurrency

- digital

- Early

- Economics

- finance

- financial

- fintech

- Free

- funding

- funds

- Futures

- Galaxy Digital

- Glassnode

- good

- Hedge Funds

- here

- High

- hold

- How

- HTTPS

- interest

- investing

- Investors

- IT

- Johnson

- July

- Key

- knowledge

- learning

- Line

- Market

- Market Cap

- market research

- Markets

- Mike Novogratz

- months

- Newsletter

- Novogratz

- numbers

- Opinion

- Opportunity

- Other

- portfolio

- president

- press

- price

- Rates

- research

- Satoshi

- Share

- skills

- Space

- Spot

- Stage

- street

- support

- Technical

- Technology

- time

- top

- Trading

- u.s.

- veteran

- Volatility

- Wall Street

- war

- Watch

- year