Some NFT collectors are even selling Punks and Apes at a loss

NFT trading has taken an interesting turn over the past seven days. CryptoPunks and Bored Ape Yacht Club dominate the list, which is no surprise. But it’s the extent to which these two collections account for a large proportion of the top 50 most expensive sales that suggests the market is shifting. This shift is probably the result of the ongoing bear market, fallout from the FTX crash and the wider global economic downturn.

Punks and Apes dominate top sales

Of the top 50 most expensive NFT sales over the past week, 42 were either a Bored Ape or a CryptoPunk. This equates to 94% of top sales coming from just two collections. What does this tell us?

It shows that lots of holders are selling their blue-chip NFTs. Ape and Punks have maintained a lot of value since the FTX collapse, and it seems that people want to free up their ETH by trading away these still-expensive assets.

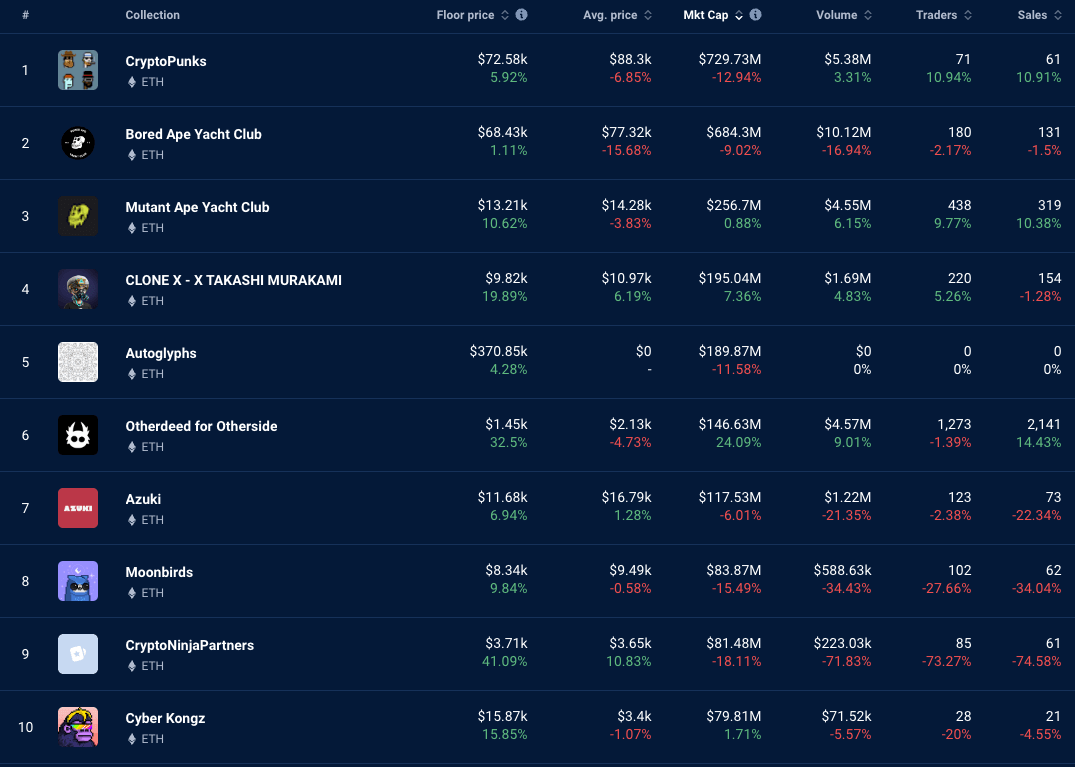

Buyers are looking for a bargain. These two collections still maintain a level of prestige that collectors with spare cash feel it’s the right time to buy into. The average sale price over the past week for Bored Apes was $68,430, a much lower price point than the ATH average sale price of $312,101 (in April 2022).

The average sale price for CryptoPunks in the past week was $88,300, down 6.85% from the week before. At their peak, CryptoPunks had a floor price of $429,564. So if this is a project the Web3 community still believes in, current prices represent good value.

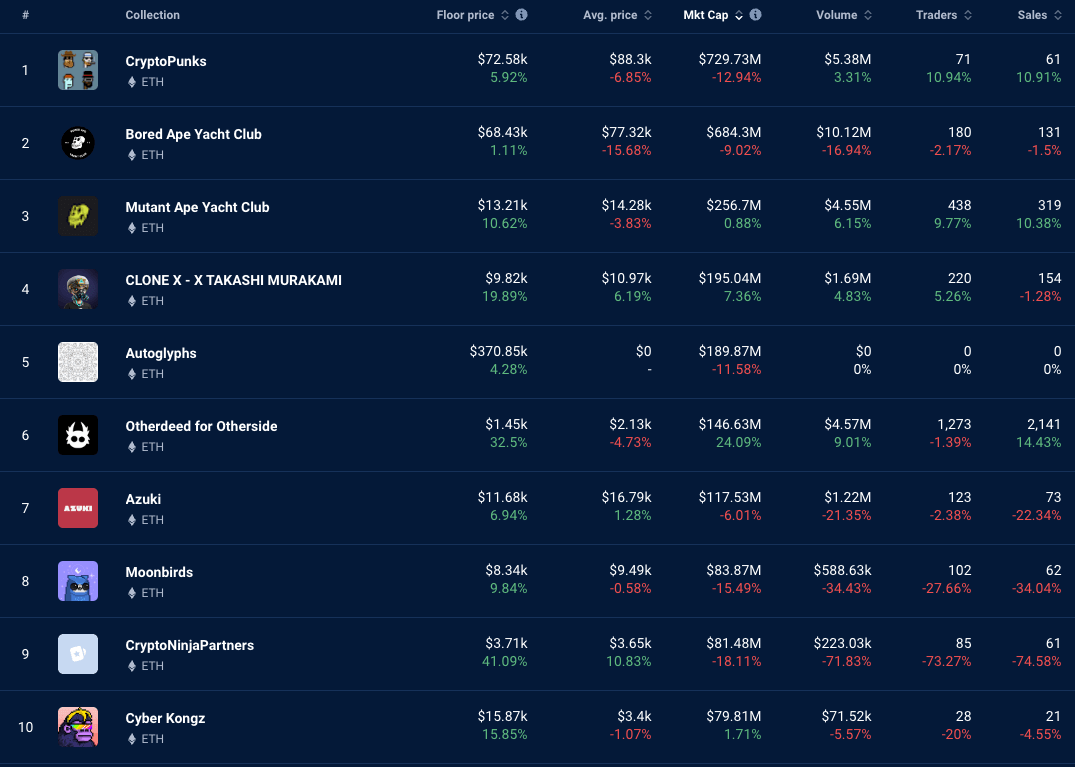

Overall trading volumes are down

Of the top 10 NFT projects by market cap, the number of people trading them is down across 70% of the collections. Trading volumes – the amount of dollars that changed hands via buying and selling – is down across half of the collections, which means it’s up across the other half.

Interestingly, floor prices are up across all of the collections, which shows that we may be seeing some sort of consolidation at current prices. This might suggest we’re at the bottom and prices could go up from here, but this is unlikely.

If we look at a 30-day view, we can see that average sale prices, floor prices and market caps are down for most collections, and most of them by double digits. With less free money in the system due to higher interest rates in many countries, people may start viewing PFP collections as a luxury too far.

Check out the list of NFT sales highlights

N.B. Dollar values given are correct at the time of sale.

Every week, DappRadar highlights not only the most expensive NFT sales but also the most interesting in the previous seven days. While huge numbers are sure to capture headlines, it’s also essential to highlight emerging trends and keep the DappRadar community ahead.

A look at these interesting sales

Looking at the first two wallets in the list above, we can see two whales collecting more blue-chip NFTs. What’s amazing is the price of BAYC #8633. In today’s, or any other day’s market, $738,130 for an Ape is a lot of money. Check the owner’s wallet and dig into the activity. You might find something interesting.

An Azuki and a Fidenza also sold well among the many Punk and Ape sales. Interestingly, an Otherside land NFT sold for $109,280. This item is certainly worth paying more attention to, as is the wallet of the buyer. So can and check out both of these now to see if you can find out why someone just paid so much for a collection that hasn’t been doing that well of late.

A Legendary Seahorse sold for $106,090, which is surprising for a collection that only dropped in September this year and isn’t that well known in the NFT space. As always with shock sales, use DappRadar’s tools to check on-chain activity around the collection and delve into the buyer’s wallet. We’re not saying this is unscrupulous activity, but it could be a sign of wash trading. So definitely DYOR.

The final item in the list – ”Bored Ape Yacht Club” #0 – has the look of someone who has been tricked. The Black Paint by Durmann collection is similar to the Splat project, where people could throw a can of digital tomato soup over an NFT of their choice. In this one, users can throw a tin of black paint over an NFT.

It seems that someone threw an NFT over a picture of Bored Ape, and then an unassuming person paid Bored Ape prices for something that isn’t the genuine article. It’s a shame to see this sort of thing happen, and we hope that this isn’t what happened here. Alternatively, the buyer could be trying to draw attention to the project (and this could be another example of wash trading).

Carry your Web3 journey with you

With the DappRadar mobile app, never miss out on Web3 again. See the performance of the most popular dapps, and keep an eye on the NFTs in your portfolio. Your account on DappRadar syncs with our mobile app, giving you soon the option to receive alerts live as they happen.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet