A conveyor belt of optimized yields

Belt Finance is a multi-strategy yield optimization tool operating on the Binance Smart Chain (BSC) network. Born from one of the largest IFOs ever conducted on PancakeSwap the platform proceeded to grow at a lightning pace. Reaching over $700 million total value locked (TVL) within the platform in its first 48 hours. Additionally, Belt marked its entry into the competitive world of DeFi by recording £168 billion in transaction volume firmly placing it as one of the leading applications on BSC.

The platform may sound similar to other recent DeFi offers but has one vital difference. At its core, Belt Finance operates as a passive vault. Passive in this sense means that users simply deposit their assets into the platform and Belt Finance takes care of the rest. Basically, Belt Finance users do not need to actively move their assets around to get optimal yield.

What does it do?

Belt Finance’s optimal yield aggregator can be thought of as something very similar to an Exchange Traded Fund (ETF). ETFs track indexes, sectors, or assets with the best ones having groups of the most effective assets (e.g. Tesla 50%, Apple 30%, Amazon 20%). A strategy designed to give the largest returns but also a sense of security to users.

This is what Belt Finance is, they aim to choose the most secure, highest yields, and create a portfolio of returns for their users. Rather than users going at it actively, Belt wants to make it easier and more effective by making programmatic algorithmic decisions on how to split the strategy across different protocols. Effectively, saving time, energy, and potential mistakes.

Yearning for more

Users of Yearn Finance may be thinking the similarities with Belt are huge. While there are definitely similarities between Belt and Yearn it’s important to look at the TVL of each platform and consider how long each has been operating, and on which network.

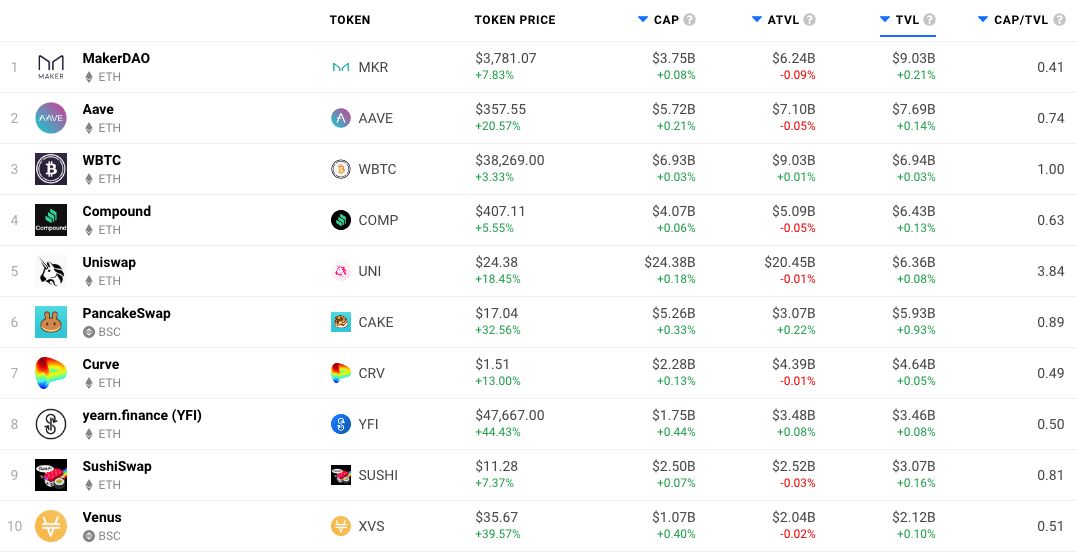

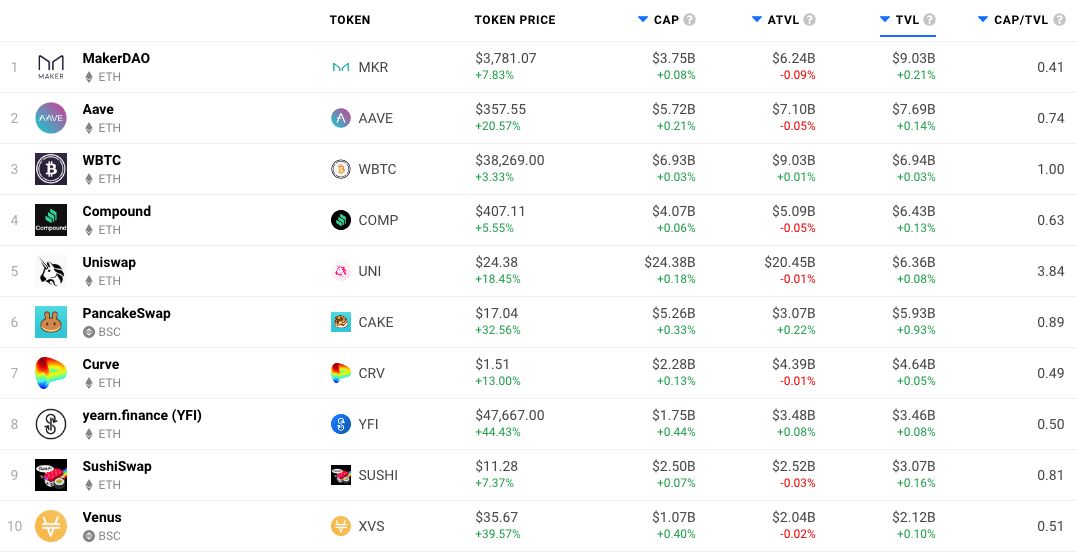

At the time of writing according to DappRadar data Yearn Finance has a total value locked of over $3.4 billion dollars. The platform has consistently operated on the Ethereum network and arguably made its mark riding on the coattails of the governance token hype caused by Compound in July 2020. It’s fair to say in the DeFi world Yearn could be considered a veteran.

Belt Finance, at the time of writing, has a TVL of over $2.1 billion but operates on Binance Smart Chain and is less than three months old. When you think about the relative sizes of Belt in BSC DeFi and Yearn in Ethereum DeFi. Belt’s power becomes more obvious. In a nutshell, while the TVL of Yearn is higher. Belt is as, if not more powerful than Yearn as decisions on Belt can affect the whole of the BSC DeFi ecosystem.

To put that into more perspective it’s interesting to see where Belt Finance would feature in the top 10 DeFi apps on DappRadar. With their current TVL of $2.1 billion, they would be in 10th place and not that far away from getting much closer to Yearn.

Another difference is that Belt has plans to focus wholeheartedly on offering the best ETFs. In order to attempt to provide users with the best strategy and yields. Importantly, the platform has expansion plans outside of BSC and plans to eventually be present across the entire DeFi ecosystem with the use of cross-chain bridges. The first steps of this were made recently as users can now access Belt on Huobi Eco Chain, better known as HECO.

In summary

In a similar way to how PancakeSwap has established itself as the leading token swapping service on BSC and essentially determines the price of an asset. The ambition is for Belt to become the premium place to find the best yield rates in the DeFi world. Moreover, Belt believes that with their high and rising TVL, they will eventually decide the best interest rates on BSC.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet