Bitcoin is down by about 5%, with the global currency starting to fall two hours prior to the inflation report, after a further dive on its publishing.

It initially went down to $18,700, to then fall further to a brief $18,100 before slightly recovering to $18,300 at the time of publishing.

As we can see on one minute candles, at 10:20 UTC, or 6:20 ET, there’s a clear sell-off, with another one following once the report was published at 8:30 ET.

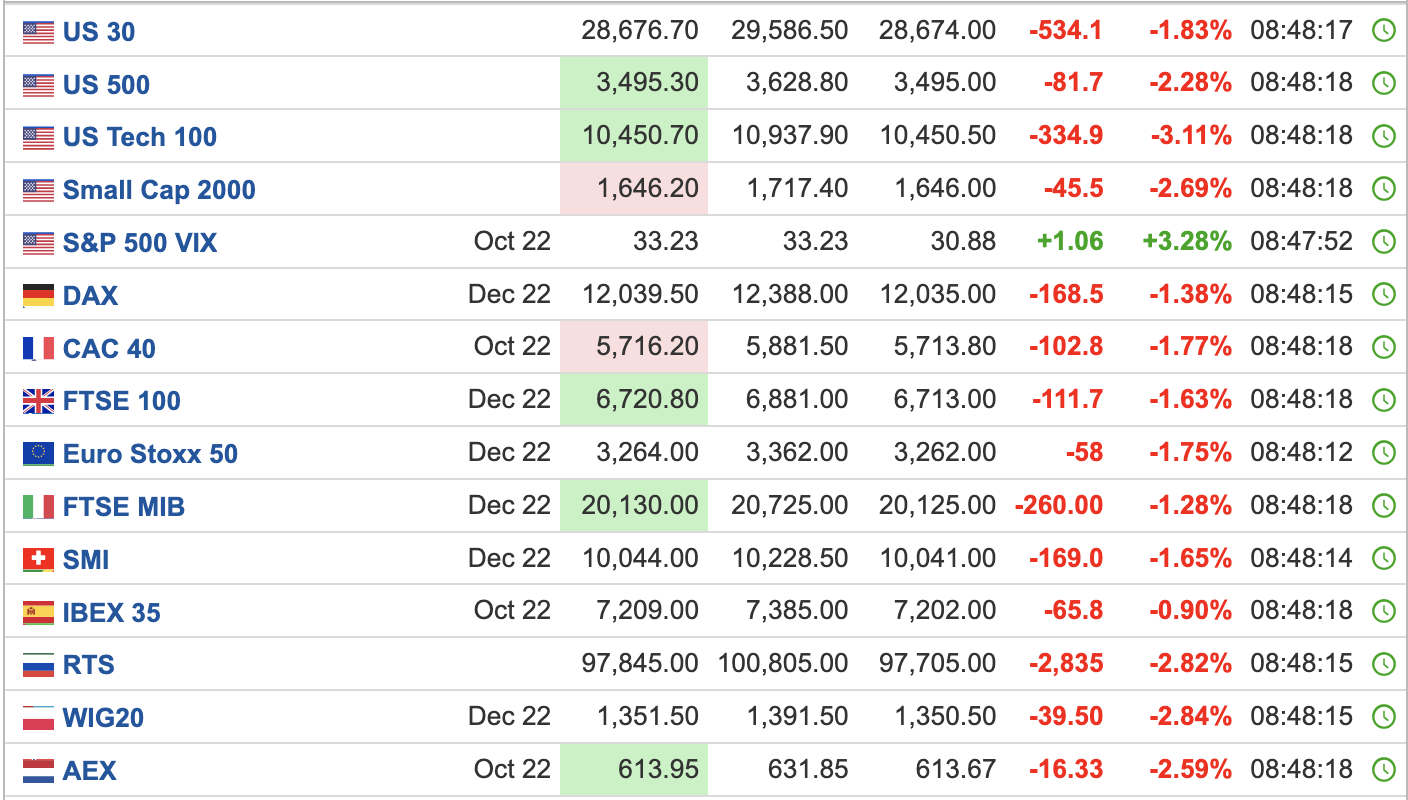

Insider trading? Or just traders taking bets? Futures however were green at that 10:20 UTC and did not change that green until the report was published. Now they’re very red:

At least VIX is green though. That’s the volatility index, which has seen one of its best year in years.

While Nasdaq may see another -3% as it continues its worst year since 2008, with no respite in sight from Fed which may now keep hiking emergency chunks of 0.75% to 4%.

Or, now that we all expect it, Fed plays with us. They are humans afterall with the inflation report presenting some good data in as far as it is down from last month to 8.2% year on year.

That downtrend has been on-going for now three months, with gas prices falling further since September, and so inflation may fall even further.

Oil fell 1% on the report, while gas is seemingly headed towards reasonable levels, but markets are probably done second guessing Jerome Powell, and so now everyone is expecting 4% as a done deal so that the only surprise can be a nice one.

As such, you’d expect that to be priced in, but speculators like speculating, and since CPI has now become the news, they’re having a speculating bonanza.

Bonds however might be affected at the fundamentals level, with US 10 year treasury yields spiking above 4%.

Debt has now become very expensive, and it’s just in time because the US government is deep in debt.

Pensions might bear the brunt of it as treasuries of course are safe, except they’ve had a big crash this year, and in recent months have been more volatile than bitcoin.

No one has time currently to debate how the government is going to cover this huge rise in interest rates, or indeed the equity of such interest rates on money printed from nothing.

But, in real terms the interest rates for the government are actually -4%, because inflation is at 8.2%.

Since the government depends on income, taxes, rather than assets, which have crashed, then this may well be what deflating away your debt looks like.

It is also what a stealth tax rise looks like because of thresholds. In UK, for example, anyone earning above £45,000 has to pay 40% in taxes, a crushing sum.

The good news is that tax rate is kind of going up by another 10% to 50% because £45,000 last year is £40,000 this year.

That affects more those at the margins of the thresholds. Raising a simple question in regards to why not make such thresholds a lot smoother, instead of jumping from 20% to 40% over £20,000.

For those that have an income which can keep up with inflation, however, rather than expensive debt, they’re having their debt inflated away.

But for the vast majority, especially many seeing layoffs in cushy tech jobs and other industries, they may well feel more like they’ve fallen in a debt trap.

The hope is obviously that this is temporary, that the energy re-adjustment lowers pressure, and that the economy comes out the stronger at the other end.

But for now many challenges are being addressed at the same time, and the economy has to withstand them all.

That includes a moving of the economic center from China to the West, a Gulf that thinks they’re dealing with fools, a peripheral midget that has not yet learned their days of a global power are long gone, and all while trying to fast lane the economy but not too fast.

So good luck to them. Bitcoin will be fine, and at these levels a movement of $1,000 is five percent now. Significant progress in nearly 12 months as it used to require a movement of $10,000.

And at these levels, it’s not too clear whether bitcoin cares anymore beyond speculators speculating because presumably we’re long past the point where anyone left is not ‘in for the tech.’

The holdlers, that unlike their forefathers don’t want to just give away their digital gold. Not least because though the macro isn’t great, presumably it won’t stay not-great forever as they are taking action to address all the matters and some of those actions may well succeed.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- featured

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Stocks

- Trustnodes

- W3

- zephyrnet