The post Bitcoin Price To Hit $28,000 By The End Of 2022, Claims Deutsche Bank Analysts appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

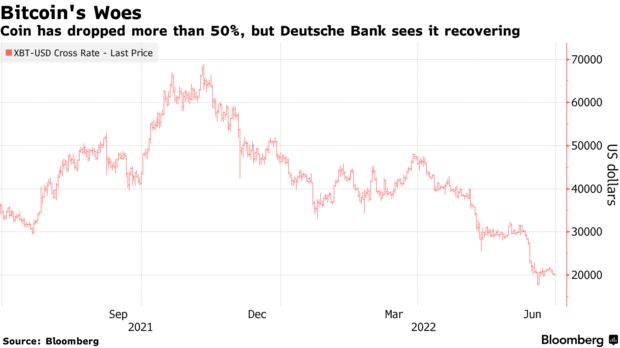

As per Deutsche Bank research, the Bitcoin price might hit $28,000 before the year 2022 ends. The reason is how strongly it has traded with US markets.

The world’s first cryptocurrency, Bitcoin has seen a massive drop in 2022 due to an uncertainty hovering around the interest rate rise and inflation concerns.

Marion Laboure and Galina Pozdnyakova’s study forecasts a more than 30% rise from the currency’s June 29th trading level, which is roughly $20,000. However, even when that price level is considered, the King currency is trading downward by 50% from its November 2021 spike.

Right from the month of November 2021, cryptocurrencies have become highly connected with baselines such as the tech-heavy Nasdaq 100 and the S&P 500, according to Laboure and Pozdnyakova.

According to Bloomberg reports, The Deutsche bank’s experts expect that the S&P might rebound to January prices at the end of the year 2022, and Bitcoin might indeed join the party.

Digital Currencies Are More Like Diamonds

According to the Laboure and Pozdnyakova, virtual currency is something like diamonds, a heavily hyped asset, then gold which is also known as a reliable safe-haven medium of exchange.

Bitcoin has struggled to keep up with the promises made by analysts and market-watchers.’ The promise was that Bitcoin would be an investing haven, but the currency has declined by higher than 50% in the year.

Throughout the broader market collapse, digital currencies lagged equities, bonds, and commodities because central banks around the world removed surplus liquidity, doubling downward pressure on asset values. Besides this, Gold has fared far better.

Laboure and Pozdnyakova present the story of De Beers, a significant participant in the diamond industry that was effective in influencing public opinion of diamonds through marketing.

The analysts are of the opinion that De Beers was able to form a solid foundation for the $72 billion-a-year diamond industry by marketing an idea rather than a product. The experts also claim that what holds valid for diamonds also holds true for many other products and services, including Bitcoins.

Researchers also refer to a few of the ongoing issues in the crypto market, such as instability into certain digital-asset hedge funds and financiers.

Laboure and Pozdnyakova conclude their analysis by asserting that It is difficult to stabilize token values since there are no uniform valuation methodologies, which are often used in the public equity scheme.

The experts also feel that the cryptocurrency industry is tremendously decentralized and say that due to the overall program’s complexities, the crypto collapse might persist.

- "

- &

- 000

- 100

- 2021

- 2022

- a

- According

- analysis

- appeared

- around

- asset

- Bank

- Banks

- because

- become

- before

- Better

- Bitcoin

- Bitcoin Price

- Block

- Bloomberg

- Bonds

- central

- Central Banks

- certain

- claim

- claims

- Commodities

- complexities

- connected

- crypto

- Crypto Market

- cryptocurrencies

- cryptocurrency

- currencies

- Currency

- decentralized

- Deutsche Bank

- difficult

- digital

- digital currencies

- Display

- doubling

- Drop

- Effective

- equity

- exchange

- expect

- experts

- fintech

- First

- form

- Foundation

- from

- funds

- Gold

- heavily

- Hedge Funds

- higher

- highly

- holds

- How

- However

- HTTPS

- idea

- Including

- industry

- inflation

- influencing

- interest

- investing

- issues

- IT

- January

- join

- Keep

- King

- known

- Level

- Liquidity

- made

- Market

- Marketing

- Markets

- massive

- medium

- methodologies

- might

- Month

- more

- Nasdaq

- news

- ongoing

- Opinion

- Other

- overall

- party

- present

- pressure

- price

- Product

- Products

- promise

- public

- reliable

- research

- S&P 500

- scheme

- Services

- significant

- since

- solid

- something

- Story

- Study

- The

- the world

- Through

- token

- Trading

- Uncertainty

- us

- Valuation

- Virtual

- virtual currency

- What

- world

- would

- year