Riot Platforms’ proposal to purchase all outstanding shares of Bitfarms comes a few weeks after former CEO of Bitfarms, Geoffrey Morphy, filed a lawsuit against Bitfarms for wrongful dismissal and aggravated damages.

Riot’s market cap stands at nearly $3.1 billion, while Bitfarms’ market cap sits at $846 million, per Yahoo Finance.

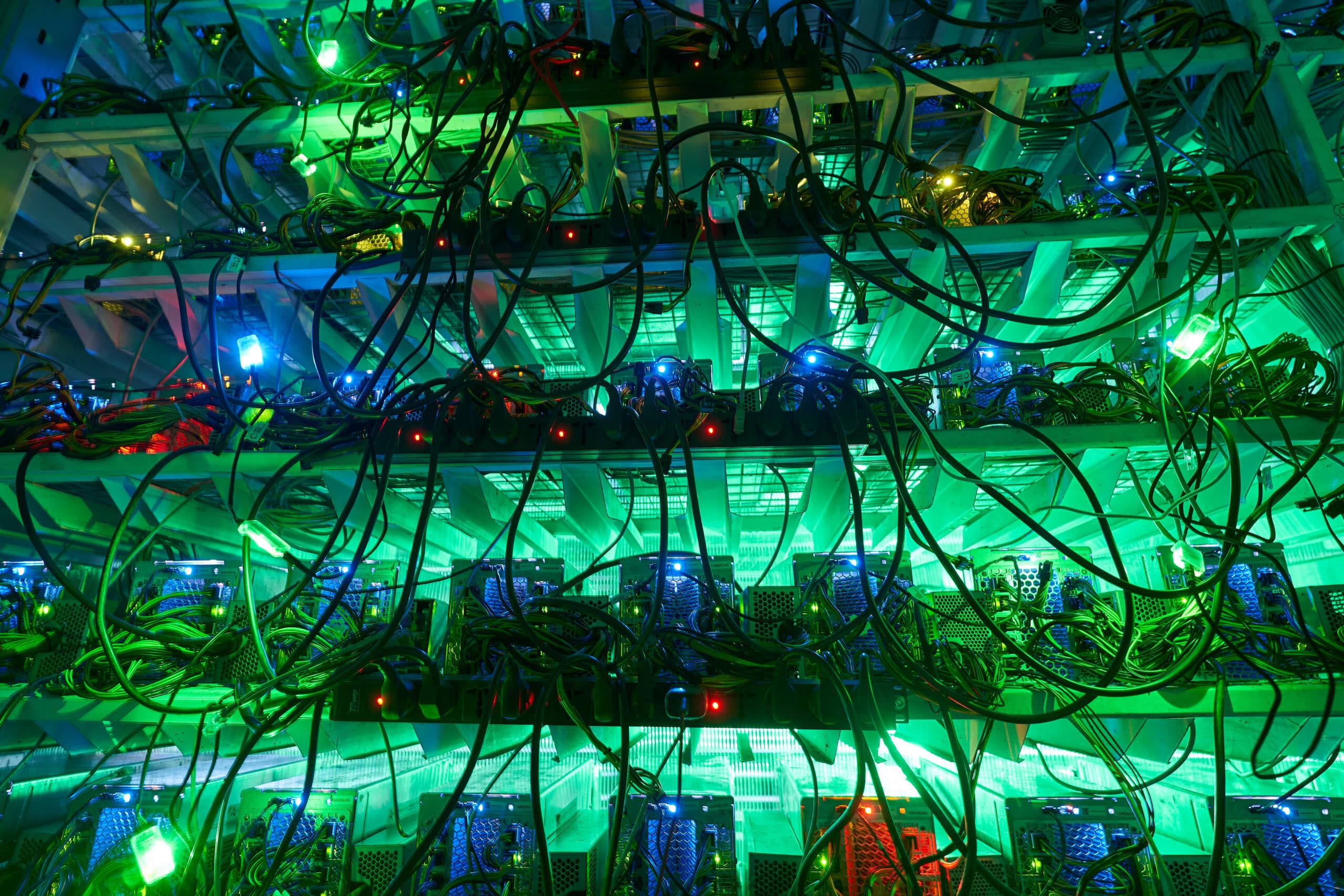

(Shutterstock/Artie Medvedev)

Posted May 28, 2024 at 11:14 am EST.

Shares of Bitfarms (BITF) have jumped on the news that Bitcoin miner Riot Platforms offered to acquire all outstanding shares of Bitfarms, which, if accepted, would create the largest Bitcoin miner company globally. BITF has risen 6.68% to $2.15 from its previous close of $2.02, data from Yahoo Finance shows.

According to a press release published by Riot Platforms on Tuesday, Riot proposed to the Bitfarms Board of Directors to acquire all outstanding shares of Bitfarms at a price of $2.30, a roughly 7% premium at presstime and 24% premium to Bitfarms’ one-month volume-weighted average share price as of May 24. The total equity value of the proposal stands at about $950 million.

Riot’s proposal includes cash and Riot common stock, which would give Bitfarms’ shareholders about 17% ownership of the combined company. The proposal is expected to provide geographic diversification for long-term growth as the combined company would have 15 facilities across the United States, Canada, Paraguay, and Argentina.

Read More: Bitcoin Miners Diversify Their Revenue Streams as Halving Nears

“While we have long respected Bitfarms’ business and management team, we are confident that Bitfarms’ shareholders will agree that this Proposal represents a significantly more attractive alternative for Bitfarms than its standalone trajectory,” said Benjamin Yi, the executive chairman of Riot, which is also Bitfarms’ largest shareholder with a stake of 9.25%.

Bitfarms’ Initial Rejection

Riot Platforms initially made the offer to acquire all outstanding shares of Bitfarms on April 22, but the Bitfarms Board of Directors “rejected it without engaging in substantive dialogue with Riot,” the press release said.

Riot had decided to publicly disclose its proposal to Bitfarms shareholders Tuesday in light of allegations stemming from a lawsuit filed by Bitfarms’ former CEO, Geoffrey Morphy who was immediately terminated earlier in the month.

Morphy on May 10 filed a lawsuit in the Superior Court of Ontario against Bitfarms “claiming damages for breach of contract, wrongful dismissal and aggravated and punitive damages in the amount of USD $27 million,” a Bitfarms press release stated.

“The abrupt termination of the Bitfarms CEO without a transition plan in place at a critical period of execution for Bitfarms and the industry, as well as the allegations, if accurate, regarding the actions of certain members of the Bitfarms Board set out in the lawsuit filed by that recently terminated CEO, raise serious governance questions,” said Jason Les, Chief Executive Officer of Riot.

Shares of Riot Platforms have increased roughly 3% from its previous close of $10.37 to trade at $10.43 at the time of writing, per Yahoo Finance. Riot’s market cap stands at nearly $3.1 billion, while Bitfarms’ market cap sits at $846 million.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/bitfarms-shares-jump-following-riots-950-million-proposal-to-acquire-bitfarms/

- :has

- :is

- $3

- 1

- 10

- 11

- 14

- 15%

- 2024

- 22

- 24

- 28

- 30

- 33

- 36

- 37

- 43

- 9

- a

- About

- accepted

- accurate

- acquire

- across

- actions

- After

- against

- All

- Allegations

- also

- alternative

- am

- amount

- and

- April

- ARE

- Argentina

- AS

- At

- attractive

- average

- Benjamin

- Billion

- Bitcoin

- Bitcoin Miner

- Bitcoin Miners

- Bitfarms

- board

- board of directors

- breach

- Bunch

- business

- but

- by

- Canada

- cap

- Cash

- ceo

- certain

- chairman

- chief

- Chief Executive

- chief executive officer

- Close

- combined

- comes

- Common

- common stock

- company

- confident

- contract

- Court

- create

- critical

- damages

- data

- decided

- dialogue

- Directors

- Disclose

- diversification

- diversify

- Earlier

- engaging

- equity

- execution

- executive

- Executive Officer

- expected

- facilities

- few

- filed

- finance

- following

- For

- Former

- former ceo

- from

- geographic

- Give

- Globally

- governance

- Growth

- had

- Halving

- Have

- High

- HTTPS

- if

- immediately

- in

- includes

- increased

- industry

- initial

- initially

- IT

- ITS

- jason

- jpg

- jump

- Jumped

- largest

- lawsuit

- light

- Long

- long-term

- made

- management

- Management Team

- Market

- Market Cap

- max-width

- May..

- Medvedev

- Members

- million

- miner

- Miners

- Month

- more

- nearly

- news

- of

- offer

- offered

- Officer

- on

- one-month

- Ontario

- out

- outstanding

- ownership

- Paraguay

- per

- period

- Place

- plan

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- posted

- Premium

- press

- Press Release

- previous

- price

- proposal

- proposed

- provide

- publicly

- published

- purchase

- Questions

- raise

- recently

- regarding

- release

- represents

- respected

- revenue

- Riot

- Risen

- roughly

- Said

- serious

- set

- Share

- shareholder

- Shareholders

- Shares

- significantly

- sits

- stake

- standalone

- stands

- States

- stock

- streams

- superior

- team

- than

- that

- The

- their

- this

- time

- to

- Total

- trade

- trajectory

- transition

- Tuesday

- Unchained

- United

- United States

- USD

- value

- was

- we

- Weeks

- WELL

- which

- while

- WHO

- will

- with

- without

- would

- would give

- writing

- Yahoo

- yahoo finance

- zephyrnet