Finding the right crypto exchange that caters to your specific trading needs can be a task. That’s why, Coinbureau makes it a point to deliver comprehensive, structured and easy-to-read articles that breaks down exactly what you can expect from a particular crypto exchange. Today, we’re taking a look at Bybit, a popular derivatives exchange that has recently been making moves in the industry with its partnerships and trading competitions.

We break down exactly what you can expect from Bybit, such as its trading fees, range of products, how it compares to other exchanges etc.

Page Contents 👉

Bybit Summary

| HEADQUARTERS: | Dubai |

| YEAR ESTABLISHED: | 2018 |

| REGULATION: | Granted an in-principal license as a Virtual Asset Service Provider in Dubai |

| SPOT CRYPTOCURRENCIES LISTED: | 100+ |

| NATIVE TOKEN: | The Bybit exchange does not have a native token.

However, it has launched the BIT token for BitDAO. |

| MAKER/TAKER FEES: | Spot Trading – 0.1% maker/0.1% taker

Perpetual and Futures Contract- 0.01% maker/ 0.06% taker fees Options- 0.03% Maker/ 0.03% Taker Users with VIP status unlock fee discounts |

| SECURITY: | 2FA, Cold Storage of Assets, Multi-Sig wallets, Insurance Fund |

| BEGINNER-FRIENDLY: | Yes |

| KYC/AML VERIFICATION: | Required if you wish to withdraw more than 2 BTC a day |

| FIAT CURRENCY SUPPORT: | 20+ Fiat currencies supported via P2P exchange

Direct Fiat on-ramp supports only Argentine Peso (ARS) and Brazilian Real (BRL) |

| DEPOSIT/WITHDRAW METHODS: | Bank Transfer, Credit/Debit Card, Crypto Transfer, Third-party Fiat On-ramps |

What is Bybit Exchange?

Bybit is a global P2P (peer-to-peer) cryptocurrency derivatives exchange that is headquartered in Dubai. The exchange was previously based in Singapore and operates under Bybit Fintech Limited, a company that is registered in Seychelles. The Bybit server is hosted via Amazon Web Services (AWS) Singapore.

Bybit’s team is comprised of professionals from investment banks, tech firms, the forex industry, and early adopters of blockchain. The development team also boasts of talents from Morgan Stanley, Baidu, Alibaba, and Tencent. Bybit’s founder and CEO, Ben Zhou, is formerly from XM, one of the world’s largest forex and CFD trading brokerage firms. Loads of talent there, but how does it translate into the user experience?

While the primary product offered on the exchange is perpetual futures products with 100:1 leverage, over the years it has expanded its range of services to allow both institutional and retail users access to spot trading, mining and staking products, NFT marketplace, Token Launchpad, Trading bots, API support and other derivative products.

The exchange is open to most traders around the world and the website has been translated into English, Simplified and Traditional Chinese, Korean, Japanese, Russian, Hindi and 10 other languages. It offers users true multilingual support, with the range of supported languages on the exchange constantly expanding.

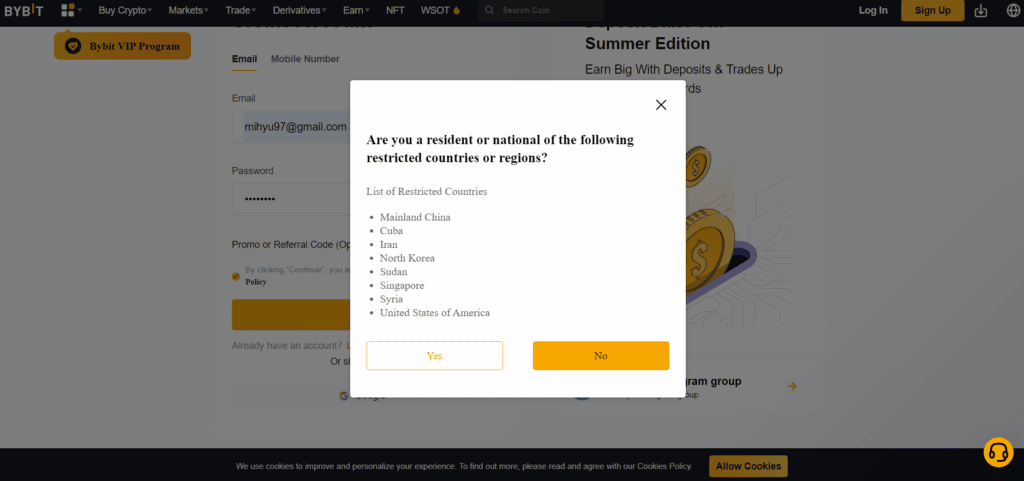

Restricted Countries via Bybit

However, it is also worth noting that Bybit is restricted in quite a number of jurisdictions such as the United States, mainland China, Singapore, Quebec (Canada), North Korea, Cuba, Iran, Crimea, Sevastopol, and Sudan.

Bybit Review: Key Features

The exchange offers users access to a range of services that can be broadly categorized into six key features-

- Trading

- Derivatives

- Earn Program

- Launchpad

- NFTs

- Testnet

Bybit Trading

Bybit offers users a robust trading experience thanks to its efficient market matching engine. There are four key trading services and features that Bybit offers users-

- Spot Trading

- Margin Trading

- Leveraged Tokens Trading; and

- Trading Bots

Spot Trading

Spot trading service refers to the standard buying and selling of cryptocurrencies at market price. Bybit supports the trading of over 100 tokens in its spot trading interface. Trading on the spot market does not require KYC.

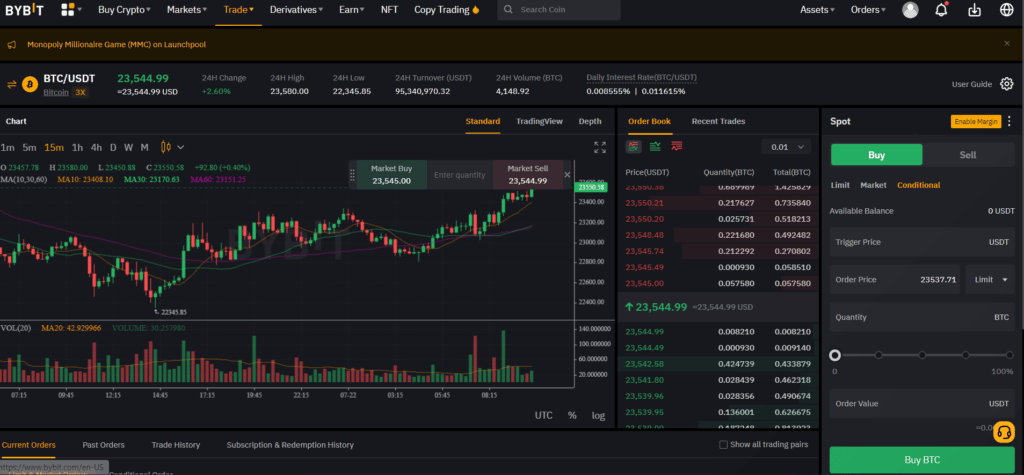

Spot trading interface via Bybit

Bybit’s spot trading interface features an order-book system where users can input buy and sell orders which are displayed in real-time under the market depth tab. Users can execute limit, market and conditional orders under the Spot market interface. Limit orders allow you to specify the price at which the order must be executed. Market orders execute your buy/sell orders instantly at the price of the lowest offer available for buy orders and the highest bid available for sell orders. Conditional orders allow traders to preset the placing of orders by choosing a trigger price at which the order is placed, the order may be executed at either market price or limit price depending upon the trader’s preference while placing the conditional order.

Spot Margin Trading

Bybit is a leveraged exchange, which means that they allow crypto margin trades. Margin trading allows users to borrow funds by using the assets in their Spot Account as collateral. This allows users to place buy/sell orders with more funds than available in their wallet balance. In Spot margin trading, users can borrow funds up to 3x the value of the assets (3x leverage) present in their spot accounts when margin trading on select spot assets such as BTC, ETH, SOL, XRP etc.,

Bybit supports cross margin mode, this means that all assets that support margin trading in your Spot Account will be used to prevent spot leveraged positions from being liquidated. When the risk level of the Spot Account hits the liquidation ratio, the system will automatically sell the margin assets to repay the borrowings in your Spot Account.

To place margin trades on Bybit, users are required to complete at least level 1 KYC on the exchange. Bybit’s level 1 KYC requires users to upload a file of their valid government-issued identity proof along with a selfie photo verification.

Bybit Leveraged Tokens

Bybit offers a special derivatives product with no margin or liquidation risks called “Leveraged Tokens”. Each Leveraged Token represents a basket of Perpetual Contract positions. It provides users with leveraged exposure to the underlying asset and is suitable for short-term investments in a one-sided market.

Essentially, these tokens amplify the price movement of the underlying asset by the proposed leverage of the token. For example, leverage tokens for BTC called BTC3L and BTC3S refer to the position it takes and the proposed leverage. BTC3L stands for a long position on BTCUSDT Perpetual Contracts with 3x leverage. BTC3S stands for a short position on BTCUSDT Perpetual Contracts with 3x leverage. Therefore, for every 1% price increase in BTC, the net asset value (NAV) of BTC3L increases by 3%, and the NAV of BTC3S decreases by 3%.

Bybit Leveraged Token Fees via Bybit

Leverage tokens allow users to gain exposure to amplified price movements without worrying about margin or liquidation risks. Leverage tokens can either be traded or redeemed for the underlying asset. They are tradable on the spot markets. Redemption of leverage tokens is currently available only to API users. Leveraged Tokens are suitable for investors who believe that the market will move in a one-sided fashion, or those who want to avoid the risk of liquidation.

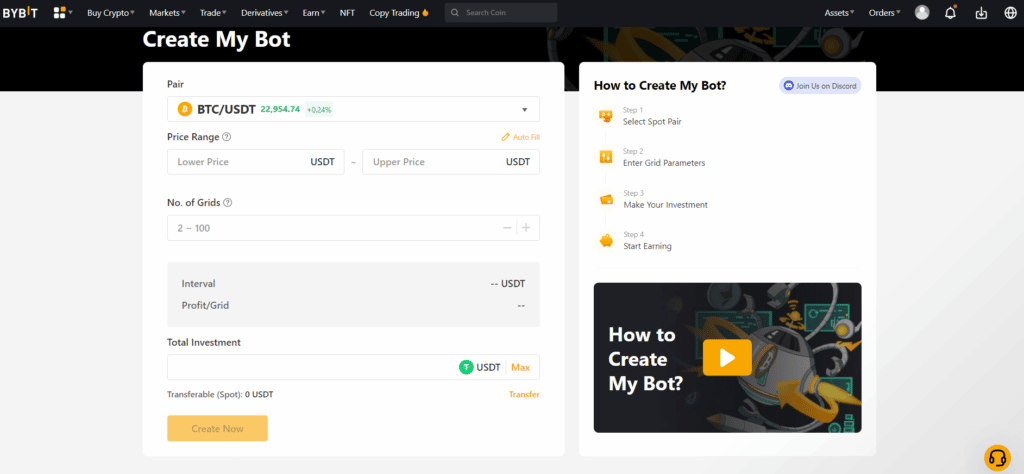

Bybit Trading Bots

Bybit also offers its users “grid trading bots” as a service. Grid bots are essentially automated trading strategies that users can set. They’re designed to place buy and sell orders at regular intervals within a predefined price range. Grid bots perform best in volatile markets as they seek to capitalize on price fluctuations. Grid trading is available in the spot market for both desktop platforms and app versions.

Users can create their own grid trading bot strategy, by specifying the upper and lower price bands and setting up the total number of grids and investment amount. To give an illustration, consider that trader A sets their grid strategy with an upper price band of $24,000 and a lower price band of $21,000 USD. They then proceed to specify the number of grids between the range and its corresponding interval. Trader A sets a total of 3 grids with an interval of $1000. Now that their strategy parameters have been set, the trading bot kicks into action by placing either buy or sell orders between every $500 interval within the range.

Grid Trading via Bybit

For example, if the price of the asset hits $24,000, the sell order will be executed, and a buy order at $23,000 will be placed above the next grid. When the price falls to $23,000, the buy order will be executed, and a sell order will be placed at $24,000. This creates a grid-like strategy.

In the event that the price moves outside the specified price bands, the grid trading strategy will be paused. At this point, the user can choose to either close the grid trading strategy to get the most out of their funds or wait for the price to return to the range they’ve set, at which time the strategy will resume.

Profits made from grid trading will be auto-credited to the user’s ‘BOT Account’. Once the grid trading strategy is completed, the funds will be automatically transferred from the user’s BOT Account to their Bybit Spot Account.

Bybit Exchange Derivatives

Bybit is primarily preferred by traders for its derivatives products and deep liquidity. The exchange offers three main derivatives products on its derivatives portal.

- Perpetuals Contracts

- Inverse Contracts

- Options

Perpetuals Contracts

There are two categories of perpetual contracts offered on the exchange- USDT Perpetuals and USDC Perpetuals. Both USDT and USDC Perpetuals are linear contracts, with the only difference being the margin used i.e., USDT and USDC respectively. You can think of this as analogous to a contract that has USD as a base currency (given that USDT and USDC are stablecoins). So, the dollar value of your collateral will remain the same.

Another difference between USDT Perps and USDC perps is the number of contracts available on the platform. USDT perpetual has a significantly higher number of contracts, while Bybit’s USDC perpetual is restricted to offering only a BTC-PERP contract.

Bybit allows its perpetual contract traders to take up to 100x leverage on its BTCUSDT and ETHUSDT perpetual contracts. Other perpetual contracts on the exchange are capped at 50x and 25x leverage. However, leverage on Bybit is dynamic and freely adjustable. Freely adjustable means that it can be changed even after opening a position, which is something that cannot be done on other exchanges.

Dynamic leverage, on the other hand, is a mechanism that protects the exchange from the risk posed by large positions. This means that if you are a large trader and are entering sizable positions then they will bring down the leverage that you can achieve on your contract. You can refer to the USDT perp risk limits and USDC perp risk limit before you decide to use the exchange.

Leveraged trading is an easy way to lose your funds via liquidation if you don’t know what you are doing. Thankfully, Bybit has a number of tools that will help traders avoid or minimise the impact of liquidation. These include the following:

Dual Price Mechanism: In order to prevent the risk of market manipulation on the exchange, Bybit will use a dual price mechanism as the contract reference price. This is composed of the “Mark Price” which triggers liquidation and the “Last Traded Price” which is used to calculate the price at which the position is closed. The former is a global Bitcoin price whereas the latter is the current Bybit market price. Using external pricing inputs reduces singular exchange manipulation.

Auto Margin Replenishment: If you want to make sure that your position will always have adequate levels of margin then you can set it to auto-replenish. This means that whenever your margin is close to being depleted, it will draw on your funds to keep your position open

Stop Loss: When trading with leverage, stop losses are essential. There are 3 different ways in which you can set up a stop-loss on ByBit. These are covered in detail on this page. Having effective stop losses on your positions will ensure that it never gets down to the liquidation level.

Isolated/Cross Margin: Bybit also allows users to toggle between isolated margin and cross margin. When traders select an isolated margin, the maximum loss of an isolated position is its initial margin and extra margin (if any), no additional margin will be drawn to the position during liquidation. The margin that you have on the trade is applicable to only that position. It does not take into account the equity levels and positions PnL that you have on other orders for the same trading pair.

However, when traders select ‘cross margin’ it means that all available balances will be combined in order to prevent liquidation. So, if you have other positions that are open for the corresponding trading pair then these will be included in a calculation of margin levels before liquidation occurs.

Bybit’s Inverse Contracts

Inverse contracts are a form of derivative contracts that use the underlying cryptocurrency itself for margin, instead of using stablecoins like USDT or USDC for collateral. For example, if you wish to trade BTC/ETH/EOS/XRP inverse contracts, then the base currency for your margin will be BTC/ETH/EOS/XRP respectively. This means that ETHUSD inverse contracts will have ETH as the margin.

Compared to the USDT perpetual contracts, inverse contracts are slightly riskier. This is because you will be exposed to value volatility in your underlying collateral in addition to your exposure to the market as a whole. For example, if you are long Ethereum and the price drops, not only will your position worsen, but you will also witness a decline in the USD value of your collateral.

To trade inverse contracts, you will have to make sure that you already have the coin in question for collateral. It is also crucial to keep in mind that even while the required margin is in the relevant coin, it is still quoted in USD. The value of each inverse perpetual contract is one dollar. You may swap contracts for as little as 1 USD, which is a fairly cool feature. This is in contrast to USDT contracts that are quoted as one token of the respective asset, i.e., 1 BTC for BTCUSDT contracts, 1 SOL for SOLUSDT contracts etc.

Inverse contracts on Bybit are of two types – Inverse Perpetual contracts and Inverse Futures contracts.

Inverse Perpetual contracts are similar to USDT perpetual with the only difference being the asset used for margin. Perpetual contracts are similar to futures, with the difference being that perpetual contracts do not have an expiration or settlement date. Perpetual contract mimics a margin-based spot market. The trading price is anchored to the reference index price by the funding mechanism.

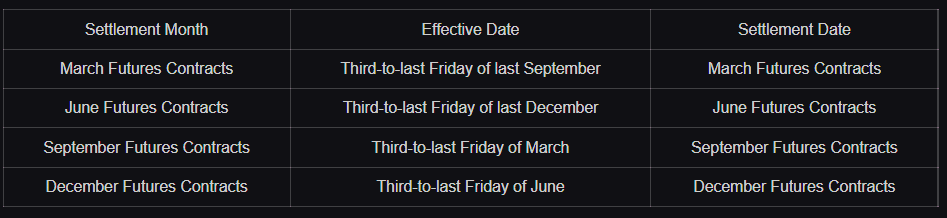

Inverse futures contracts on Bybit are quarterly futures. The contracts are delivered at 8:00:00 UTC on the settlement date. You can check out the projected settlement dates for different futures contracts in the picture below.

Bybit Futures Settlement Dates

When a futures contract expires, all outstanding positions will be settled at the 30-min Time Weighted Average Price (TWAP) of the corresponding index price. Bybit currently offers inverse futures for BTC and ETH only.

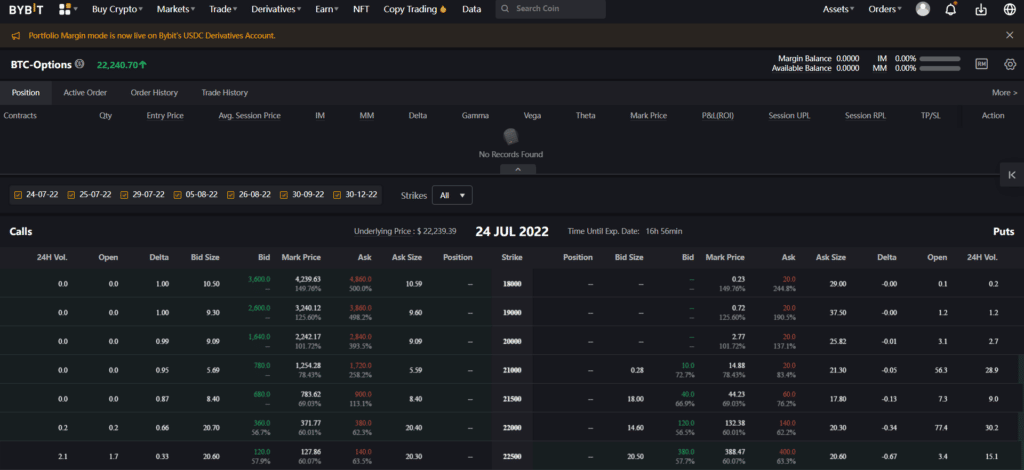

Bybit Options

The last time we covered Bybit in 2021, we mentioned the lack of options contracts on the platform. Well, it seems like Bybit listened, because the exchange now allows users to trade USDC options for BTC on the platform.

Bybit Options Interface

Options are a type of derivatives contract that allows the buyer the option to buy or sell an underlying asset at a specified price and date. Buyers must pay a premium to acquire the call or put option in order to have this right. Call options provide the buyer with the right to buy the underlying asset from the seller of the option, whereas ‘put options’ provide the buyer with the right to sell the underlying asset to the seller of the option. Option sellers receive a premium from the option buyer for the contract.

Bybit offers European-style cash-settled options. European style options can be exercised only at expiration and there is no actual physical delivery of the underlying asset required. Bybit’s European options will automatically be exercised when an option expires. The options are settled in USDC.

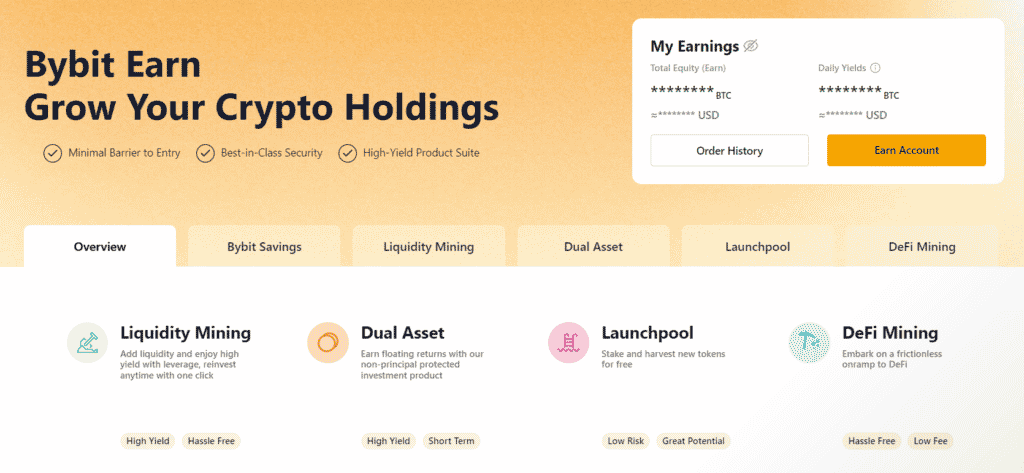

Bybit’s Earn Program

Bybit Earn Overview

Bybit allows its users to earn passive income on their idle assets through a variety of products available on its “Earn” program. However, do note that users need to complete at least level 1 KYC on the exchange to use the ‘Bybit earn’ program. The products available on its ‘Earn’ program are-

Bybit Savings – Bybit’s savings program allows users to lock up their assets on the platform for a period of time to earn interest on the asset. There are two types of savings programs available- flexible and fixed term. Flexible term savings offer lower rates of interest on locked-up assets but allow the user to withdraw them at any time. Fixed term savings, on the other hand, offer relatively higher rates of interest but mandate the user to lock the assets for a fixed number of days, commonly 30 days or 60 days.

Bybit Liquidity Mining – Bybit’s liquidity mining program allows users to provide liquidity to AMM pools, where the liquidity provider earns swap fees from users swapping assets in the pool. Liquidity mining generally offers a higher rate of return in comparison to the savings program. Users can also add leverage to increase their share of the pool and maximize their yield. However, adding leverage exposes the user to liquidation risks.

Bybit Dual Asset – Users of the Dual Asset program have the chance to profit from better returns in low-volatility markets. In order to achieve this, users must forecast the movement of a specific cryptocurrency asset, like BTC or ETH, within a predetermined timeframe and deposit their preferred cryptocurrency to lock in the higher yield. Depending on how the settlement price compares to the benchmark price, the user will receive one of the two assets in the asset pair at maturity.

Bybit Launchpool – The Bybit launchpool allows users to earn free tokens from partnered projects by staking the exchange’s native BIT token during the event. These tokens can be unstaked at any time.

Bybit Defi Mining – Bybit’s Defi mining program allows users to earn yield from various Defi platforms such as Curve by staking the assets via Bybit. This allows users to participate in Defi without worrying about wallet management. Bybit’s Defi mining programs are generally for a period of 7 days.

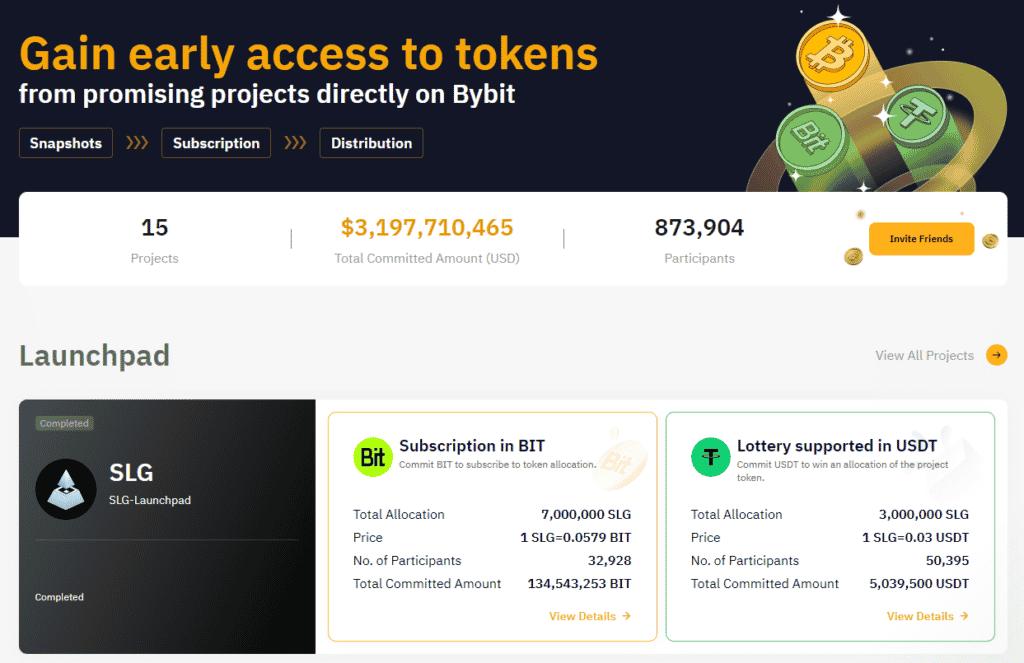

Bybit Launchpad

The Bybit launchpad is a token launch platform that enables users to gain early access to pre-listing coins by enabling them to purchase these tokens at an attractive introductory price.

Bybit Launchpad

To participate in Bybit’s launchpad, users are mandated to complete at least level 1 KYC verification on the platform and maintain a daily average wallet balance of 50 BIT or 100 USDT in their spot wallet for five consecutive days before the subscription period.

Once all these eligibility conditions are satisfied, there are typically two ways in which users can purchase launchpad tokens. The first would be to stake your BIT tokens in the BIT pool and gain an allocation in line with the weight of your BIT stake in the pool. This method guarantees an allocation for participants.

The second way in which users can gain an allocation would be to stake USDT and gain an entry into a lottery for the allocation. Users can gain 1 lottery ticket for every 100 USDT that they commit. The USDT pool typically offers a chance to purchase the tokens at a lower price than the BIT pool.

Bybit NFTs

Bybit NFT Marketplace

Like most top centralized crypto exchanges, Bybit has ventured into the NFT space by launching its own NFT marketplace. Bybit’s NFT marketplace often partners with GameFi NFT projects and individual artists to launch an exclusive sale, users can purchase these assets via the marketplace. Currently, NFTs can only be listed for a fixed price, but an auction mechanism is expected to be released soon. Payments on the marketplace can be made in either ETH, USDT, XTZ or BIT, depending on which token the listing mandates the payment be made in.

Bybit Testnet

For those traders that would like to try the platform out in demo mode, they can make use of the Bybit testnet. Demo accounts are a great way to get a sense of how the orders work before depositing funds.

You can access their testnet on testnet.bybit.com. If you’re accessing their testnet for the first time, your account should have testnet funds of 50,000 USDT and 0.2 BTC. In order to fund your account further, users have to click on the “request testnet coins” button on the Asset overview tab. Users can receive 10,000 USDT and 1 BTC test coin every 24 hours through this method.

Bybit Fees

Trading fees are an important criterion for us because of obvious reasons. This is especially true when it comes to paying fees on a derivatives exchange where your positions are much larger than your margin.

Bybit offers a variety of products that all have their own fee structure. Most of them follow a “maker-taker” fee model. This means that the exchange charges traders a fee for creating and taking liquidity off their order books.

Bybit used to offer rebates to all traders creating maker orders, but rebates have since been restricted for certain high volume marker makers and BIT holders. VIP traders refer to high volume traders on the exchange. Being a VIP trader allows you to unlock exclusive fee discounts via the VIP program offered by the exchange.

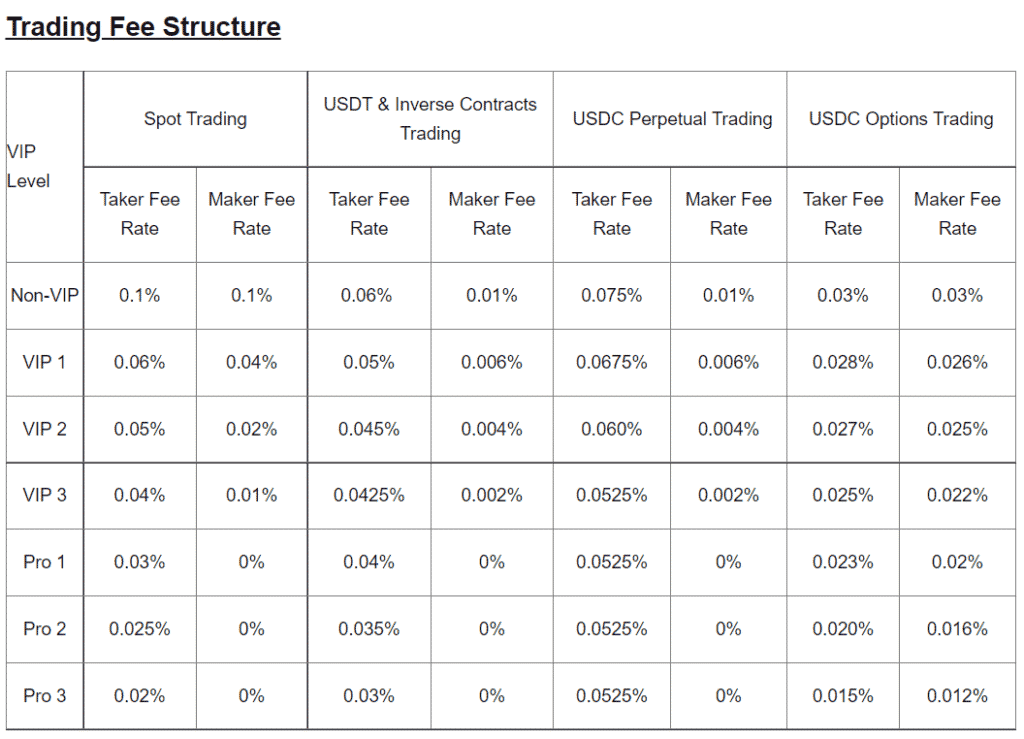

You can find the fee structure for Spot and derivative trading products along with the associated fee discounts for different VIP and Pro users in the picture below

Bybit Fee Structure

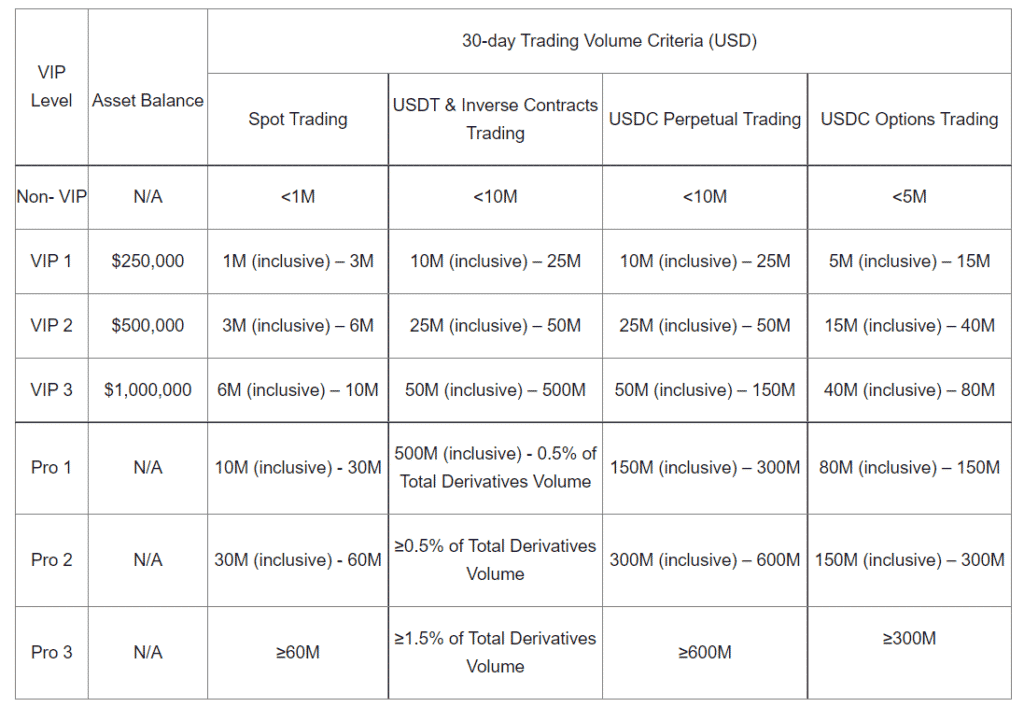

A user’s VIP or PRO level is determined by their 30-day trading volume on the exchange. You can see the different eligibility requirements in the image below.

Bybit VIP Criteria

We spoke about how certain high-volume marker makers receive fee rebates for creating maker orders, you can find the eligibility criteria and the associated rebate below

Bybit Maker Rebates for high frequency traders

Bybit also offers maker fee rebates for BIT holders when trading derivatives (not spot market orders). You can find the rebates for the associated BIT holdings in the picture below.

Rebates for Bybit Holders

Bybit KYC and Account Verification

Bybit has a comprehensive KYC and AML process that divides users into three categories-

- Users without KYC

Bybit allows customers to use the platform, albeit with limited functionality, even without passing any KYC checks. Users without KYC lose access to a variety of products on the exchange such as margin trading, earn program, launchpad, etc. They are also limited to a $1000 transaction limit on P2P markets.

- Users who have completed Level 1 KYC

To pass level 1 KYC on the exchange, users are required to submit valid identity proof and a selfie. Users who clear level 1 KYC unlock unlimited P2P trading, fiat top-up limit of $100,000 per day and a withdrawal limit of 50 BTC a day. Users also unlock most of the restricted features on the exchange.

- Users who have completed Level 2 KYC

This is the final KYC check on the platform. To pass level 2 KYC on the exchange, users are required to submit a valid proof of address. This unlocks unlimited P2P trading and fiat top-ups, along with increasing the withdrawal limit to 100 BTC a day.

Bybit Security

One of the most important features in every crypto product is the level of security it offers. Therefore, it’s no surprise that Bybit seems to have introduced as many security and safety features for its users. Let us look into all that Bybit offers, such as the safety of the exchange in terms of coin management, user security tools and of course risk management.

Exchange Security

To counter the threat posed by hackers, Bybit operates a secure cold storage solution. This means that they store the bulk of their crypto reserves, and all of the clients’ funds, in offline wallets that are stored in a secure “air-gapped” location.

There is only a small portion of their own coins that are kept in their “hot wallets” in order to service the needs of traders when it comes to withdrawals. Moreover, if they ever need to move funds from cold storage, they need to use a multi-signature address scheme.

Multi-signature means that the exchange will need more than one key in order to sign a transaction from one wallet to another. This prevents the risk posed by having a single individual manage all the funds on the exchange.

Encrypted Communication

In order to prevent the risk posed by online snoops and phishing attacks, the Bybit website has full SSL encryption. This means that all passwords and address information that you send them will be encrypted.

This is also helpful in order to spot a phishing site. If you are on a website that looks like it could be that of Bybit but it does not have a secure padlock in the browser, it is an immediate indication that you are on a phishing site and you should leave immediately.

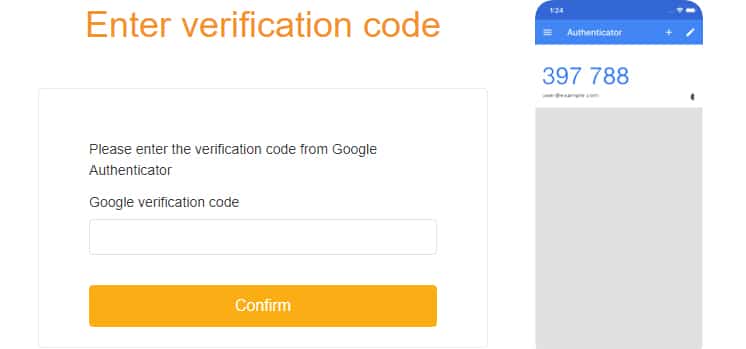

Two Factor Authentication

While exchange side protection is one thing, in most cases the biggest threat to a trader’s security is themselves. That is why Bybit has included a number of tools that will help protect your account from a hacker with your password.

Two Factor Authentication

One of the most important tools that they have included is two-factor authentication. This means that you will have to use your phone in order to authenticate into your account or send transactions. You have to enable google authenticator before you are allowed to withdraw any coins.

Insurance Fund

In order to manage the risk posed by shortfalls in a futures contract settlement, Bybit operates what they call their “insurance fund”. Essentially, this fund will be used in the case that a trader gets liquidated at a level that is below their “bankruptcy price”. This means that the fund acts as an insurance policy that will protect traders in the case that Bybit is not able to liquidate the position at bankruptcy price or better.

Without the fund, there would be a shortfall whereby the counterparty to the trade would not be made whole. The insurance fund is replenished when there is residual margin resulting from trades in which Bybit closes the liquidated position at a better value than the bankruptcy price.

If the insurance fund is insufficient to cover the loss, Auto-Deleverage (ADL) will be triggered. Auto-deleveraging is a risk management mechanism that will automatically deleverage the opposing position from the trader with the highest ranking at the bankruptcy price of the liquidated order. Bybit uses the insurance fund to prevent traders from auto-deleveraging. All USDT Contracts share the same insurance fund to prevent the unnecessary ADL of less liquid contracts.

Cryptocurrencies Available on Bybit

Bybit Assets

Bybit has more than 100 assets listed on its spot trading interface and more than 150 contracts listed on its derivatives interface. The number of assets supported on Bybit is constantly expanding with new listings every other week.

Bybit Exchange Platform Design and Usability

One of the most important things for a margin trader is to have an effective trading platform with advanced technology. This is especially true when you are trading with a great degree of leverage.

Bybit’s trading platform seems to meet this requirement with its easy-to-use interface and wide range of services. It also provides users with a range of languages such as English, Simplified and Traditional Chinese, Korean, Japanese, Russian, Hindi and 10 others.

Bybit dropdown menu on web interface

When it comes to the web home page, the interface features the list of services along with your account information on the top bar. Users can hover the mouse button over a particular service to access the drop-down menu with further details.

Bybit Trading Interface

When it comes to Bybit’s trading interface, you have the chart and market depth on the left (you can toggle between). Then in the middle you have the order book and the last trades. On the right, you have the order forms as well as the contract details.

Scrolling down from the main interface you have other important trading information. This includes things such as the current market activity and your assets. Something that we really liked about their interface is that it is customizable and modular. You can detach some of the modules, resize them, and move them around such that they are in your chosen position.

For those seasoned traders among you, you will have noticed that Bybit uses Tradingview charting technology. This third-party charting package is well known in the industry for having the most functionality and features.

With tradingview charts, the budding technical analysts among you can easily lay your studies and follow the important trendlines. It is also in use on a number of other platforms so it is relatively easy for you to adapt if you do move somewhere else.

You will also notice that in your current position/order bar, you have the “ADL ranking” indicator. This will show you where you currently are positioned for potential deleveraging in the case that the ADL is triggered. As mentioned above, this is done to manage risk.

Something that Bybit appears to be quite proud of is their order matching engine. They claim that this trading engine is able to execute a total of 100,000 transactions per second per contract. So, for every new asset they add, their matching engine will have a dedicated 100,000 transactions per second for that asset only. This faster order execution ensures that the risk of slippage and trading errors is greatly reduced.

Order Functionality

Bybit appears to have pretty advanced order functionality on the platform. This is great as it allows you to not only customise your entry levels but it also allows you to manage your risk on the exit levels.

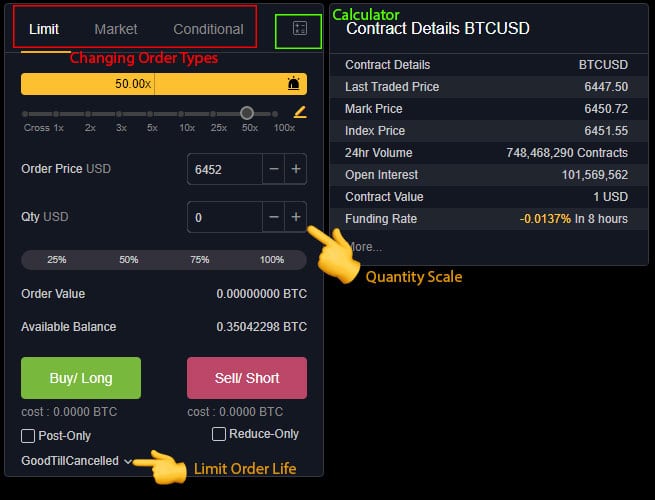

Bybit Order Functionality

When you are placing your order, you will see the following order form. At the top of the form, you can switch between the order types such as Market order, limit order and conditional order which we explained when we spoke about Bybit’s spot trading product. Below that you adjust the leverage, price and quantity. There is also information on the contract specifics.

As mentioned, with the Limit order and the Conditional limit order, the order will have a certain order life. This is for how long the order will remain open until it is “killed”. There are three order life options at Bybit:

Good-Till-Cancelled (GTC): This is an order that will remain open until you decide to close it.

Immediate-or-Cancel (IOC): This order is designed to be filled immediately and at the best price. If there are any portions that are unfilled then this portion will be cancelled. This means that this order type allows for partial order execution.

Fill or Kill (FOK): This order is designed to be filled at the best price in entirety or not at all. This is quite similar to the IOC order except that it does not allow the execution of any partial orders.

On top of all these orders, you also have some optionality around how these orders are executed. For example, with your Limit and Conditional orders, you can set them as a “Post Only”. This will ensure that when your order is placed it will be done as a “market maker” and you will receive the maker fee rebates if eligible.

On top of this, you have the option of making your limit order a “Reduce Only” order. This basically means that the order will only execute if it was going to reduce your position. If the order were to increase the position, it would be amended or cancelled.

You also have a similar order parameter on the Conditional order. This is called “Close on Trigger” and it can be used in conjunction with your conditional stop losses. It will ensure your stops reduce your position and don’t increase it.

One more handy tool that you may want to check out is their position calculator. This lets you calculate your Profit/Loss and ROE on target levels. It can also be used to determine your liquidation levels.

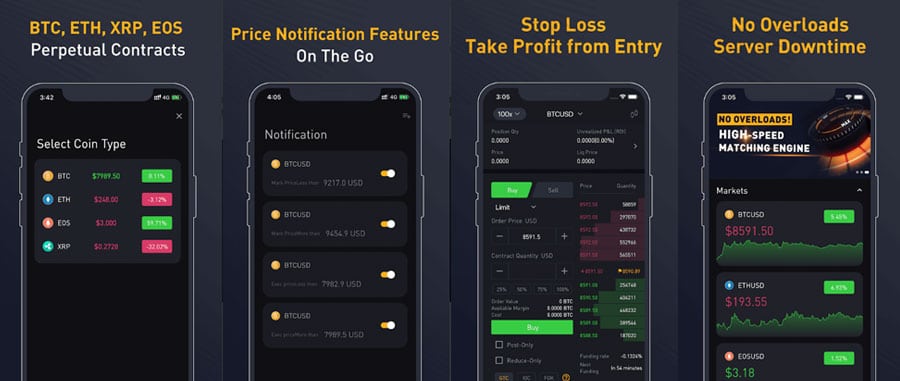

Bybit Mobile Application

Bybit Mobile Application

Bybit also features a mobile application available on both Android and iOS. The mobile application offers all of the functionality of the web browser with the added benefit of being instantly accessible even during travels. However, traders might find charting and reading charts on the mobile interface a little inconvenient due to the relatively smaller screen size.

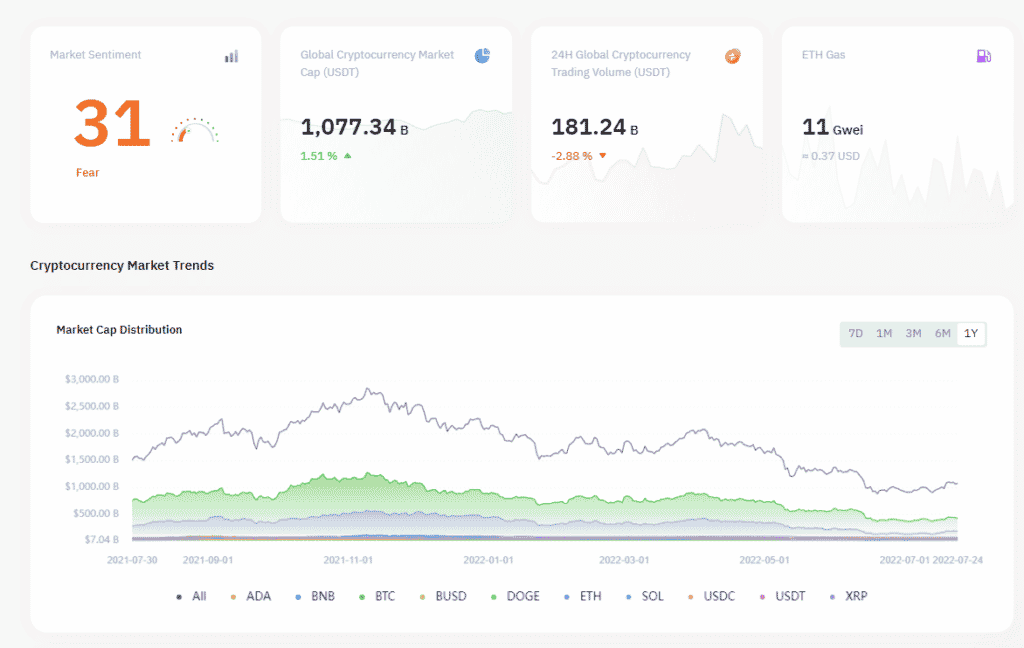

Market Analytics Interface

General Market Data via Bybit

Another great tool that we found pretty neat was their market data and overview section. It contains some really handy graphs and charts along with social metrics that could help inform your trading. The charts show data related to crypto exchanges as well as the general crypto market. You can also pull up some of these charts and download the data. This could either be as an image, vector file or as CSV.

Market Data of Exchanges via Bybit

Some of the metrics on display in relation to crypto exchanges are inflow volume, outflow volume and ownership time metrics. Some of the metrics on display in relation to the general crypto market are market sentiment, global trading volume, rankings, sector-related crypto data, social media metrics etc.

Deposits and Withdrawals at Bybit

ByBit is a crypto-only exchange. This means that you cannot fund your account in fiat currency. While this may be annoying for some, Bybit has fiat onramp partnerships with third-parties that allow you to purchase crypto with select fiat currencies such as the Argentine Pesos, Brazilian Real, and Russian Rouble. The supported fiat currencies may differ depending on the part of the world you access the exchange from. Users can also purchase crypto with other fiat currencies via the P2P exchange on the website.

In order to deposit crypto, you will need to generate a wallet address and initiate a transaction into the wallet. However, before you make any crypto deposits, ensure that the coin you wish to deposit is supported by the exchange. Once confirmed, head over to your “Assets” section in the header. This will present your wallet balances where you will select “deposit” and it will bring up the relevant crypto asset wallet address.

Generating your wallet deposit address

Once you have the address, you can initiate the transaction. It will not be instantaneous as the transaction still has to be propagated through the network and confirmed by the Miners. However, ByBit is quite unique among exchanges in that they require only 1 blockchain confirmation to credit your account.

Withdrawals are just as easy, as long as you’re planning to withdraw the crypto to a private wallet. All you need to do is hit the withdrawal button on the applicable asset. It will ask for your wallet address as well as confirmation of the transaction through 2FA. You will also be given information on the miner fee that will be applied to the transaction. Withdrawal of funds directly to banks, on the other hand, is not currently supported. Users have to sell their assets via P2P to be able to receive cash directly in their bank accounts.

In order to make sure that they always have funds available on their hot wallet, Bybit also has a daily withdrawal limit on the exchange. These are set to 100BTC and 10,000ETH. If this limit is reached, you will have to wait for Bybit to reset the limit and replenish the funds from their cold wallet the next day.

BitDAO Token (BIT): Uses and Performance

Bybit does not have a native platform token. However, the exchange did launch an investment DAO called ‘BitDAO’ in August 2021. BitDAO is a DAO that endeavours to support the growth of decentralised finance and develop decentralised, tokenized economies. BitDAO has a token called ‘BIT’ and is backed by many heavy-weight investors which include Peter Thiel, Bybit, Pantera, Spartan Fund, Sushiswap, Polygon, and Dragonfly Capital.

Utility

The BIT token acts as both a governance and utility token for BitDAO. The Bybit exchange has a special incentive program called the BitDAO (BIT) Holders Incentive Program. This program was launched in order to provide additional utility to the token and encourage holding.

Holders of the BIT token gain various perks on Bybit such as

- Guaranteed allocation in Bybit’s token launchpad

- Fast-tracked VIP status

- Exclusive Maker Fee rebates

- Higher interest rates on Bybit Earn

- Voting priority on Byvotes

- And exclusive perks on the Bybit NFT marketplace

Token Supply and Distribution

The ‘BIT’ governance token was launched through a Dutch Auction on MISO, a launchpad for new projects on SushiSwap. It has a fixed supply of 10 billion BIT tokens that was distributed in the following manner

- 60% reserved for Bybit (split into 15% for Bybit Flexible, and 45% for Bybit Locked)

- 30% for the BitDAO treasury,

- 5% for launch partners, and

- 5% allocated through a private sale

BIT Emission Schedule via Messari

Sushiswap’s DAO was the first to partner with BitDAO and provided technical support for governance and treasury operations and in turn, they were allocated 2.6% of the supply. Bybit’s token emission schedule estimates all the tokens to be vested and unlocked by August 2024.

Price History

BIT Price History via Coinmarketcap

The BIT token was first launched in August 2021 and began trading immediately at $1.60, gradually rising in price to hit its all-time high of $3.64 in November of 2021. Since then, it has steadily been trending downwards and is currently trading between 0.40 to 0.55 for the past month. Most of this downward price action can be attributed to the general crypto bear market.

Where to buy BIT?

BIT can currently be bought on both centralized and decentralized exchanges. The available markets are listed below

Centralized Exchanges- FTX, Gate.io and Bybit

Decentralized Exchanges- SushiSwap and Uniswap

Can I stake BIT?

Yes, BIT tokens can be staked on Bybit to earn interest on them via the Bybit Earn program. Depending on the product, the interest rate varies between 2% to 322% annually.

BIT tokens can also be committed on Bybit’s launchpad to win a guaranteed allocation in the purchase of a new token. BIT tokens are also staked to participate in governance of the BitDAO.

Bybit Customer Support

Bybit has a 24/7 customer support chat function on their website. It can be accessed by clicking on the yellow headphone button at the bottom right corner of the website. Their live chat support is automated and covers a range of queries and topics. In the event the bot is unable to help you with a query, it offers to connect you with a human agent. The wait time is hardly a minute and the agents are responsive and attempt to help you the best way possible.

Bybit Customer Support Chat Interface

You can also reach out to them via email on support@bybit.com for customer support or it@bybit.com if your query is more technical in nature. Unfortunately, there is no phone support or direct telephone line into the exchange.

However, if you’re in the world of crypto, social media activity is equally important. On that note, Bybit’s discord channel is fairly unmoderated and users’ questions or queries sometimes go unanswered. Their telegram channel in comparison is much more active and queries never go unanswered.

Bybit also has a comprehensive FAQ resources section as well as other helpful guides that could help you with answering general queries or questions.

Bybit Top Benefits Reviewed

Bybit is an excellent exchange for non-US customers looking to trade in derivatives. It offers one of the best derivatives trading experience in the industry. Some of the top benefits Bybit offers are:

Wide Range of Assets and Services – Since 2018, Bybit has grown into one of the top exchanges that provides users with access to a wide range of assets as well as services. Bybit has over a 100+ assets in the spot market and 150+ contracts in the derivatives market. It also offers users services such as trading bots, spot markets, derivatives such as option, perpetuals and futures, and more.

High Leverage and Risk Management – The exchange allows users to trade with up to 100x leverage on select assets, but it also has a variety of tools that ensure risk is properly contained. Some of the tools include Bybit’s insurance fund, auto deleveraging, cross and isolated margin accounts, a range of order options, etc.

Good Customer Support – Bybit has 24/7 customer service available for users to get any issues addressed.

Testnet Available – Bybit offers users a testnet environment to make test trades and familiarise themselves with the products offered by the exchange sans risk.

What can be Improved

The last time we covered Bybit, we mentioned that the exchange lacked sufficient trading pairs and derivative products such as options. We also spoke about how acquiring testnet tokens was cumbersome.

Well, maybe Bybit read our piece! Because currently, Bybit offers all of the features that they lacked. If we absolutely had to speak on one area of improvement, it would be the social media response of the platform. Bybit’s discord channel is relatively inactive and users’ queries sometimes go unanswered.

Bybit Review Conclusion

In our opinion, Bybit seems to be a user-friendly exchange with strong technology, reasonable fees and a relatively intuitive user interface. While leverage trading is extremely risky, Bybit enables users to manage the risk to an extent by offering various risk management tools. The exchange has also developed quite a bit in a short span of time and seems to have captured a spot among the top exchanges for derivative products

Bybit Review FAQs

Is Bybit Legit?

Bybit is a fairly trusted exchange and has been around since 2018. It has various security features built into the platform to ensure users’ asset safety. It also has an insurance fund that ensures that the exchange and traders do not suffer any shortfall during liquidations.

Can U.S. Citizens use Bybit?

Unfortunately, US citizens cannot use the exchange as the exchange does not have the required licenses for it.

Is Bybit better than Coinbase?

Bybit (founded in 2018) is a relatively new exchange in comparison to Coinbase which was founded in 2012. Coinbase is arguably a much bigger exchange than Bybit, but it only caters to spot markets. Bybit is preferrable for traders interested in trading derivatives. It also has lower trading fees than Coinbase

Is Bybit better than Binance?

Binance is one of the biggest exchanges in the industry and is very similar to Bybit in the features it offers. It also has a better trading fee structure than Bybit. However, Bybit scores higher in the number of promotional offers and trading competitions conducted for users to participate in.

Is Bybit better than FTX?

FTX is one of the heavyweight exchanges in derivatives trading. Moreover, it has a trading platform available for US customers called FTX.US. Bybit does not offer services for US customers.

Pros

Up to 100x leverage on crypto

Offers both web and mobile app-based platforms

Insurance fund to cover losses

Provides frequent traders with trading fee discounts via its VIP program

Exportable trading data and history

Educational resources

Cons

Not available in the U.S.

Need to do KYC to access most features

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- Bybit

- Bybit exchange

- Bybit review

- bybit trading

- Coin Bureau

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Derivatives

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- review

- Trading Bots

- W3

- zephyrnet