As January slips by, we will shortly be staring at June 30th 2023 when USD LIBOR will finally cease publication.

Whilst all signs suggest that LIBOR transition in USD markets will be just as smooth as in GBP, JPY and CHF last year, it is worth just pausing and noting how large the USD LIBOR market remained in 2022.

Once we are in H2 2023, will those volumes transition to SOFR, will they disappear or will we see a concerted adoption of Term SOFR among end users? Time, and our data, will tell.

2022 in Review

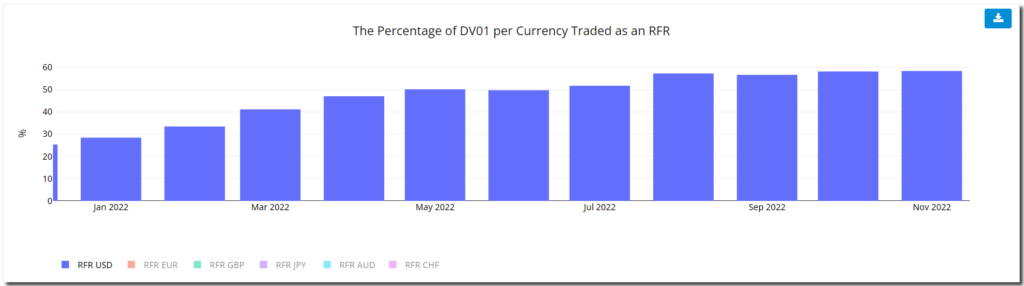

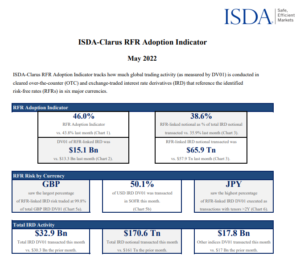

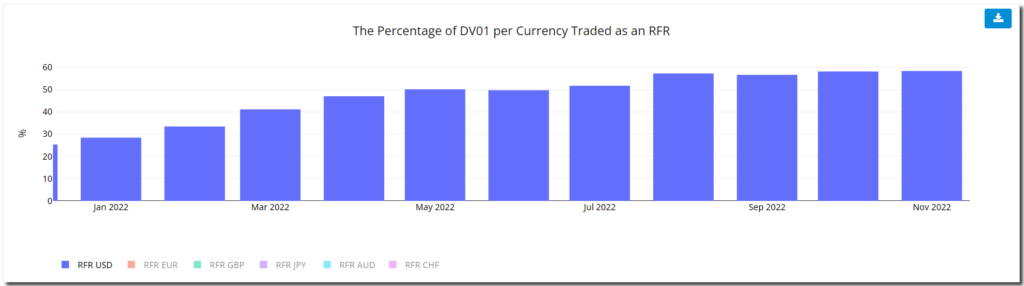

Trading conditions were far from “normal” in 2022. Event risk caused elevated volumes pretty much throughout the year. Despite trading being anything but normal, it didn’t stop SOFR adoption increasing from 28% to 58% (and even higher in December) as measured by the ISDA-Clarus RFR Adoption Indicator:

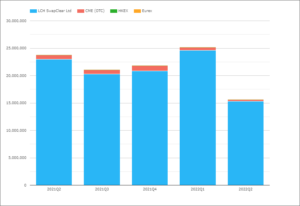

And this increased volume of RFR trading in USD markets came amidst some astoundingly large notional volumes overall.

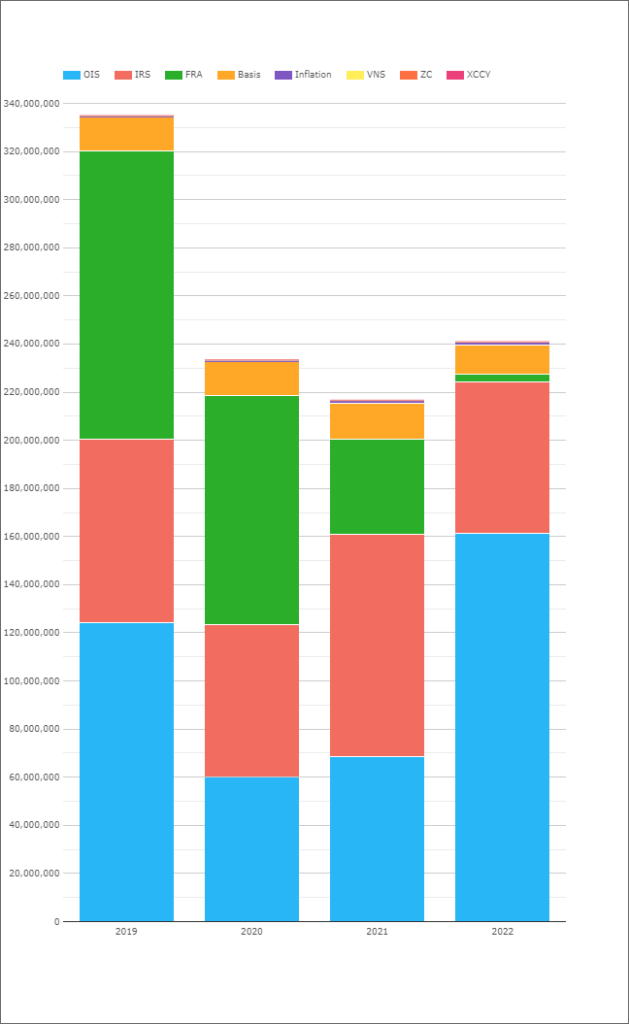

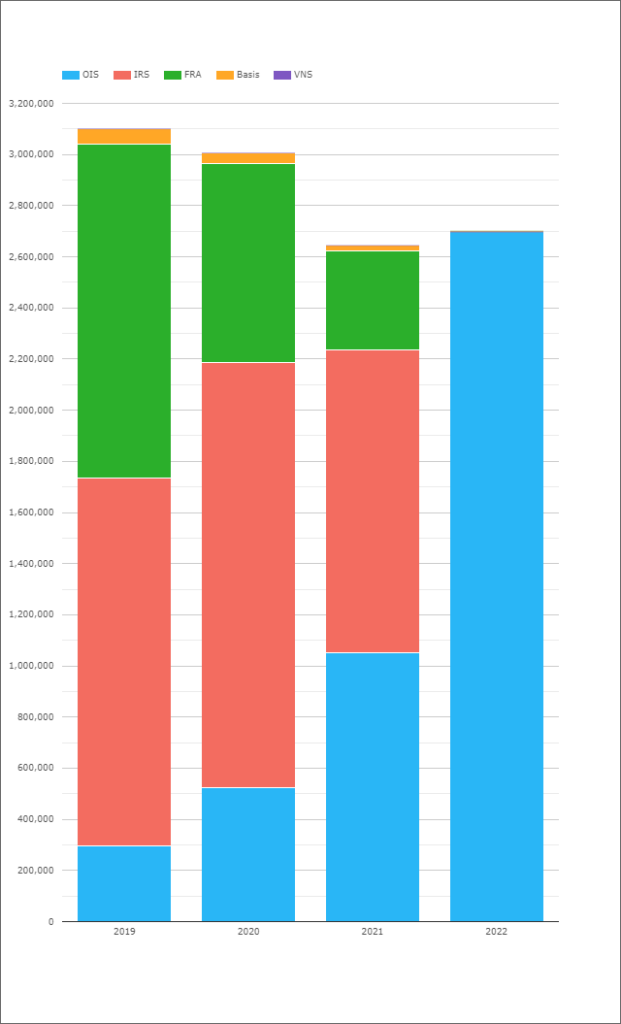

Showing;

- Annual volumes of USD OTC cleared derivatives since 2019 from CCPView.

- Remember 2020? That crazy year of elevated trading volumes related to the Pandemic as central banks slashed rates? Well, 2022 volumes were higher than even that.

- As the chart highlights, FRA volumes have almost disappeared as trading transitioned to SPS. That somewhat inflates the size of the IRS red bar in 2022.

- In fact, given that OIS trading is pretty much identical to the size of IRS+OIS trading in 2021, this is likely the most representative measure of “risk transfer” activity that we saw. Much of the IRS activity in 2022 was likely linked to either SPS or portfolio maintenance.

- It is equally striking that volumes have been relatively stable from 2020 to 2022.

- At least $62.7Trn of notional was written versus USD LIBOR in 2022. $62Trn!!

Will 2023 be the year in which $62Trn of notional is just no longer traded in markets? Or will that whole $62Trn transition into SOFR swaps?

The truth is likely to be somewhere in the middle, but I thought it was a worthwhile exercise to 1) highlight the sheer size of that business and 2) look into other currencies to see if we can get some clues for USD market size in 2023.

Guesses for 2023?

It is really intriguing to think about the final state of the USD market in 2023. Will trading activity in everything that is not “OIS” in 2023 simply disappear? i.e. will we see an overall reduction in volumes of about one third, from $240Trn to $160Trn?

It is tempting to think that GBP markets may be a good guide as to what might happen in USD markets. The UK had a very active FRA market before LIBOR cessation, and lots of basis trading as a result of the swaps market choosing GBP LIBOR 6M as the benchmark.

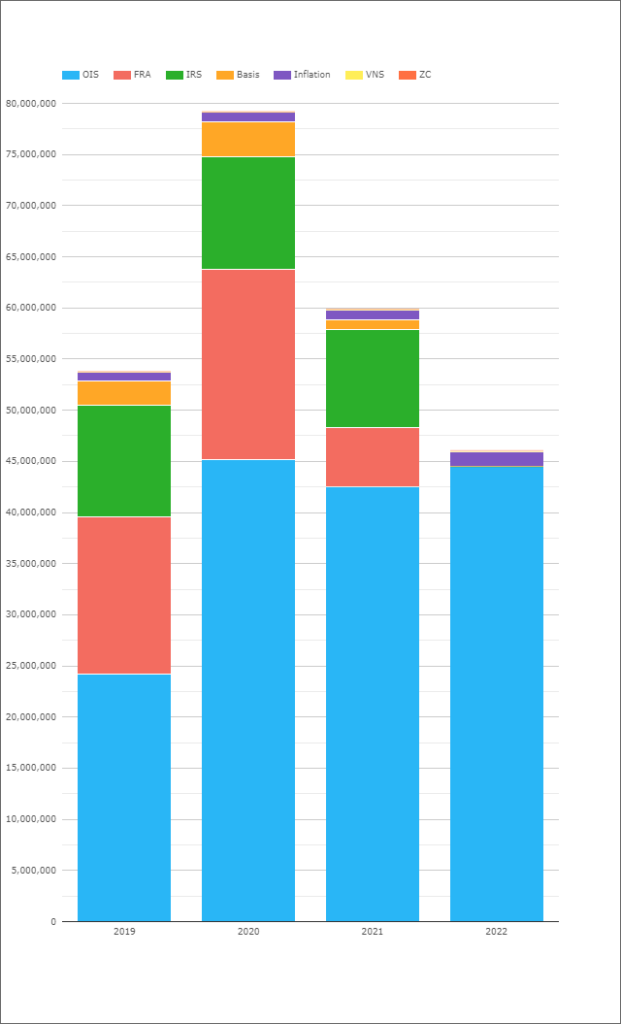

What has happened to GBP volumes in 2022?

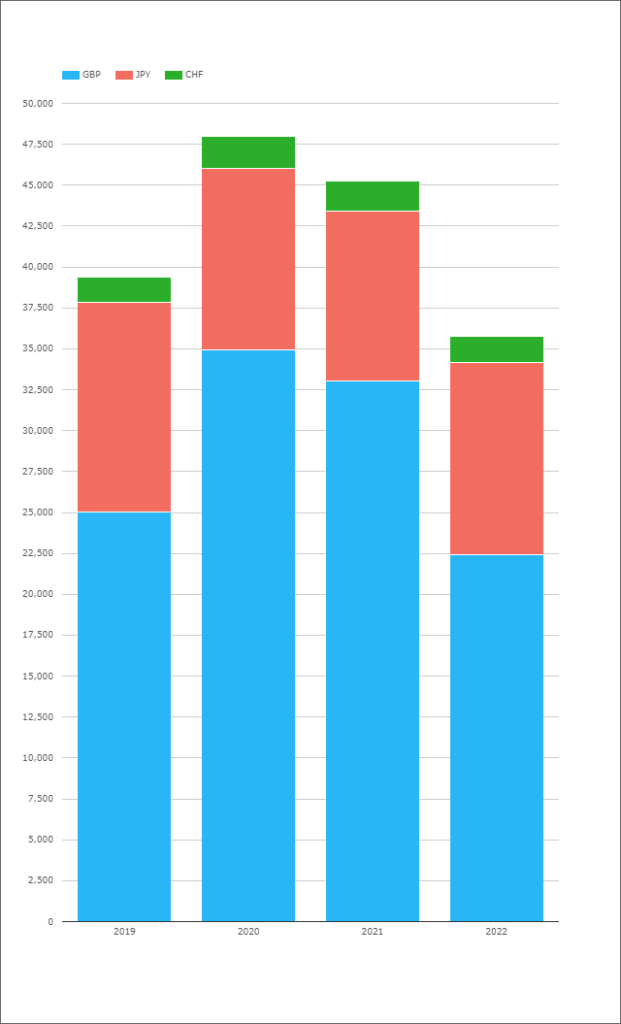

Showing;

- Annual volumes of GBP OTC cleared derivatives products since 2019. This is in GBP terms, so we can forget about any GBP depreciation effect.

- Volumes in 2022 were 25% lower than in 2021.

- They were a huge 42% lower in 2022 than 2020!

- Given the huge volatility we saw in UK financial markets this year, the reduction in volumes can only be as a result of trading moving to the simpler and easier to risk manage SONIA RFR.

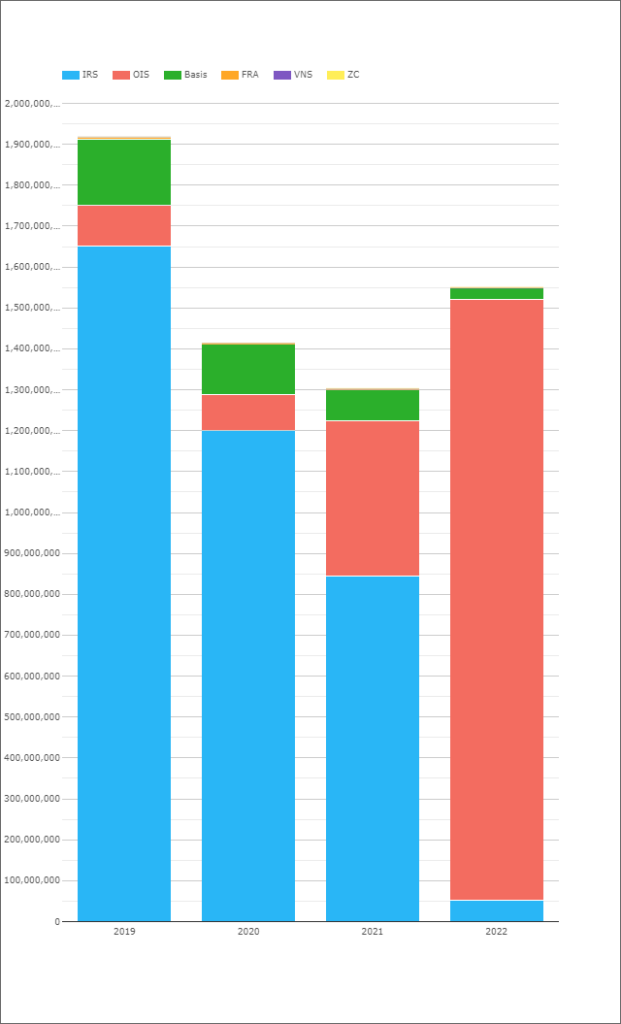

However, are GBP markets any better guide for USD markets than JPY? Just look at what happened in JPY trading in 2022:

- 2022 saw the highest amount of JPY notional traded since 2019 (in JPY terms, again ignoring any FX effects).

- JPY markets always saw FRA risk traded as single period swaps, but it was never hugely active due to JPY rates being far from volatile at the short-end.

- The uptick in activity is well note-worthy.

And what about the third currency that saw a LIBOR cessation event – CHF (“Swissy”)?

CHF volumes were in-line with 2021 (in CHF terms), but some 10% lower than in 2020.

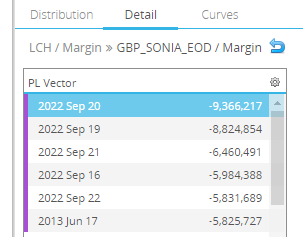

And Risk?

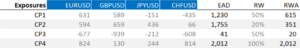

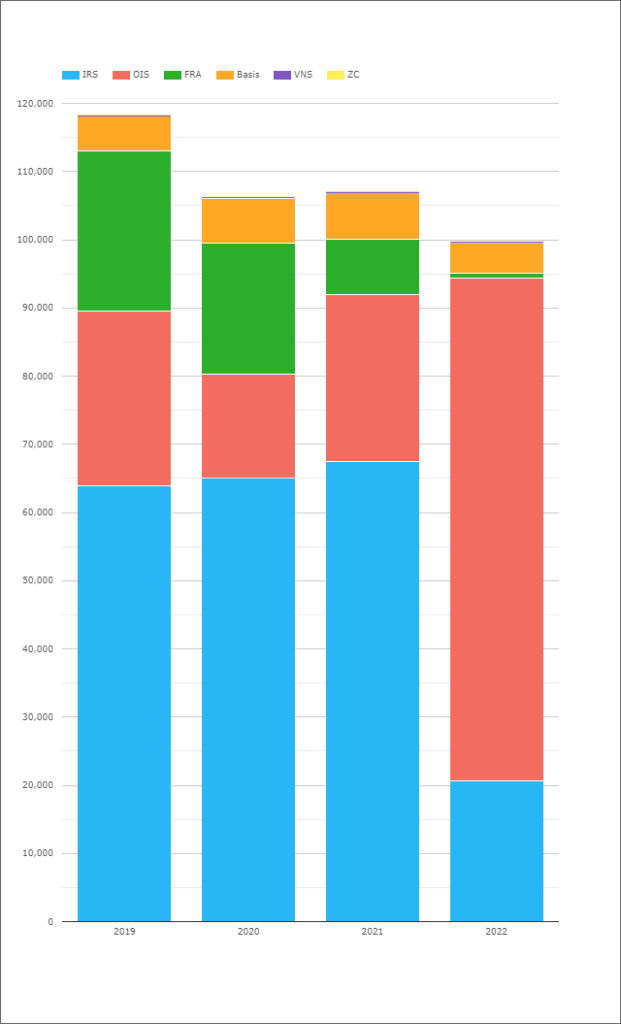

Looking at the DV01 traded in the three currencies, the story is replicated. GBP saw a significant drop in the amount of risk traded last year, whilst JPY and CHF markets did not:

And whilst USD markets posted some impressive looking notional figures in 2022, in truth it looks like a lot of this was in short-end trading. The amount of risk that moved through the market in 2022 was actually 10% lower than in previous years:

This is a key reason why we continue to monitor and analyse the DV01 traded in markets.

In Summary

What 2023 has in store for us is anyone’s guess. Even putting a number on the impact of USD LIBOR cessation on volumes is a lottery – it could be anywhere from down 33% to up 10% based on the numbers above!

The markets need transparency and they need accurate volume numbers so that market participants can continue to have confidence in markets.

That is why Clarus continue to analyse and publicise (yes, and sell!) data in OTC derivatives.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.clarusft.com/can-62trn-really-be-about-to-simply-disappear/?utm_source=rss&utm_medium=rss&utm_campaign=can-62trn-really-be-about-to-simply-disappear

- 1

- 2019

- 2020

- 2021

- 2022

- 2023

- 7

- a

- About

- accurate

- active

- activity

- actually

- Adoption

- All

- always

- amidst

- among

- amount

- analyse

- and

- anywhere

- Banks

- bar

- based

- basis

- before

- being

- Benchmark

- Better

- business

- Can Get

- central

- Central Banks

- Chart

- chf

- choosing

- Clarus

- concerted

- conditions

- confidence

- continue

- could

- currencies

- Currency

- data

- December

- Derivatives

- Despite

- DID

- disappear

- down

- Drop

- dv01

- easier

- effect

- effects

- either

- equally

- Even

- Event

- everything

- Exercise

- Figures

- final

- Finally

- financial

- Free

- from

- FX

- GBP

- get

- given

- good

- guide

- happen

- happened

- higher

- highest

- Highlight

- highlights

- HTTPS

- huge

- Hugely

- identical

- image

- Impact

- impressive

- in

- increased

- increasing

- informed

- IRS

- IT

- January

- JPY

- Key

- large

- Last

- likely

- linked

- longer

- Look

- looking

- LOOKS

- Lot

- lottery

- maintenance

- manage

- Market

- Markets

- max-width

- measure

- Middle

- might

- Monitor

- most

- moving

- Need

- Newsletter

- normal

- Notional

- number

- numbers

- ONE

- OTC

- Other

- overall

- participants

- period

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- posted

- pretty

- previous

- Products

- Putting

- Rates

- reason

- Red

- related

- relatively

- remained

- replicated

- representative

- result

- Risk

- Shortly

- significant

- Signs

- simply

- since

- Size

- So

- some

- somewhat

- somewhere

- stable

- State

- Stop

- store

- Story

- subscribe

- Swaps

- terms

- The

- the UK

- Third

- thought

- three

- Through

- throughout

- time

- to

- traded

- Trading

- trading volumes

- transition

- Uk

- URL

- us

- USD

- users

- Versus

- volatile

- Volatility

- volume

- volumes

- What

- which

- Whilst

- will

- worth

- worthwhile

- written

- year

- years

- zephyrnet