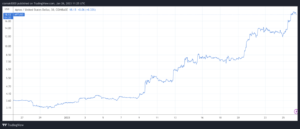

Shares of the Nasdaq-listed cryptocurrency trading platform Coinbase ($COIN) jumped as much as 45% in the early trading hours of the day after the platform announced a partnership with BlackRock to allow its institutional clients to buy Bitcoin.

According to available market data, COIN shares are currently up around 18% on the announcement, which will see the company’s Prime offering become available to clients of BlckRock’s portfolio management platform for institutional investor Aladdin, short for “Asset, Liability, Debt and Derivative Investment Network”

The Nasdaq-listed cryptocurrency exchange will provide cryptocurrency trading, custody, prime brokerage, and reporting capabilities. BlackRock is notably the world’s largest asset manager with over $10 trillion in assets under management.

Coinbase’s ticker, according to CNBC, became one of the most mentioned names on Reddit’s WallStreetBets after the announcement, which will allow BlackRock’s clients to “manage their bitcoin exposures directly in their existing portfolio management and trading workflows.”

Joseph Chalom, global head of strategic ecosystem partnerships at BlackRock, said:

Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets,

Coinbase’s shares have been surging over the last few days. COIN jumped over 20% on Wednesday and has kept on rising this Thursday, presumably because investors who were shorting COIN had to cover their short positions on a short squeeze.

Peer available data, 22% of Coinbase’s shares available for trading are sold short, which means that as COIN moved up short sellers may have had to buy more stock to cover their losses

Notably, news that BlackRock was preparing a cryptocurrency trading service for its investor clients started circulating in February, when people familiar with the matter said it was looking to provide the offering through Aladdin.

BlackRock’s intentions were shown as early as June when it started hiring a blockchain strategy lead for Aladdin. The firm has sent some positive signals to the market regarding crypto, including trading CME bitcoin futures and owning 16.3% of MicroStrategy, whose CEO, Michael Saylor, is one of the most popular bitcoin proponents out there.

Image Credit

Featured image via Unsplash

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- CryptoGlobe

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet