The crypto markets have been punished recently, but tokens associated with Andre Cronje have taken an extra beating in the wake of news he is quitting DeFi.

While the star DeFi developer has previously published knee-jerk pronouncements of retirement, a March 6 Twitter thread from Anton Nell of the Fantom Foundation suggests the pair are now resolute in their desire to walk away.

Nell announced that he and Cronje will “close” their respective “chapter[s] of contributing to the DeFi/crypto space,” noting they will hand over all existing responsibilities with roughly 25 projects by April 3. He added that their decision “has been coming for a while now.”

Future of the Project

The pair will now cease working on several major DeFi protocols, including Yearn Finance, Multichain, and Solidly, among others.

Yearn (YFI) developer Banteg also took to social media to address concerns about the future of the project. “People burying YFI, you do realize Andre hasn’t worked on it for over a year? And even if he did, there are 50 full-time people and 140 part-time contributors to back things up,” he tweeted.

YFI has shed roughly 10% since the news broke. But it is showing strong signs of recovery, having reboundedy 5% from its local low over the past 24 hours. Its total value locked (TVL) is also down 6% overall since Cronje’s departure was announced, although its Fantom deployment has lost more than 46% in one week.

The Fantom (FTM) team also responded to the news by emphasizing that the network “isn’t and never was a one man team.” It added that there are currently more than 40 people working on Fantom. Regardless, the price of gas on Fantom surged to more than 10,000 gwei as users raced to reduce exposure to protocols associated with Cronje.

Despite the team’s best efforts at placating fears in the market FTM is down 22% since Fell’s tweet went live. Its TVL has also plummeted 41% in the past five days, currently sitting at $7.15B from $12.1B since March 3.

Multichain, a popular cross-chain bridge that recently rebranded from Anyswap, has suffered a less violent draw-down than other tokens associated with Cronje. The MULTI token has shed 20% since March 6. However, TVL appears largely unscathed, dropping 6.6% to $6.94B from $7.43B over the same period.

But smaller-cap coins have fared much worse.

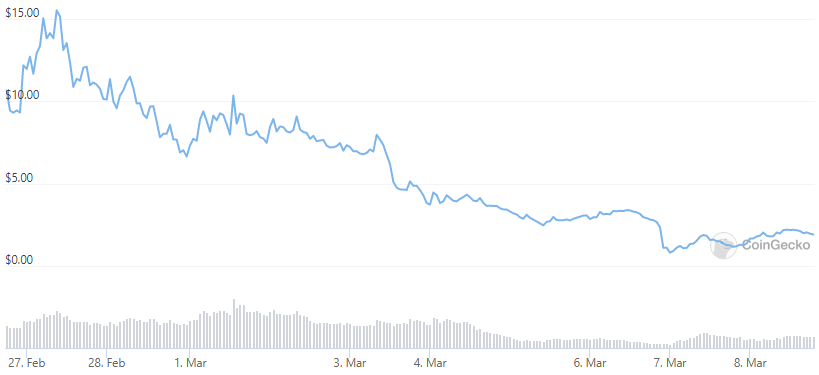

Cronje’s freshly launched DEX Solidly shed 76% of its value down to $0.80 within a day of the news breaking. SOLID has since rebounded to $1.99, a 41.5% draw-down from its local high. Its TVL has also plummeted, sitting at $735.6M from $1.25B on March 6.

Solidex (SEX), a yield optimizer built on top of Solidly, has also crashed 44.5% since March 6, and its TVL is down by two-thirds since March 2.

Keep3r (KP3R), a decentralized devops network launched by Cronje in late October 2020, has tanked by 42.3% since the news broke.

The news was the catalyst for another leg down in Bribe’s prolonged down-trend, with BRIBE drooping 23.4% from March 6. Bribe has now crashed 91.5% in roughly six weeks.

Iron Bank (IB) is also down 24% since news of Cronje’s departure went viral, with the IB token shedding 61.6% since posting an all-time high six days ago.

Many of the leading tokens of the Fantom network that aren’t associated with Cronje have also suffered significant losses since Nell’s departure was announced. Each of the network’s 20 largest protocols has posted significant losses for the past seven days, 18 of which saw double-figure drawdowns.

The network’s second-largest protocol, Spookyswap (BOO), has lost 21.2% since March 2. Tomb (TOMB) is down 25.3%, and has become decorrelated from its peg to FTM.

Read the original post on The Defiant

- "

- 000

- 2020

- About

- address

- All

- Although

- among

- announced

- Another

- April

- background

- Bank

- become

- BEST

- border

- BRIDGE

- CoinGecko

- Coins

- coming

- confidence

- Cross-Chain

- crypto

- Crypto Markets

- day

- decentralized

- DeFi

- deployment

- Developer

- Dex

- DID

- down

- Exit

- fears

- finance

- Foundation

- future

- GAS

- having

- head

- High

- history

- HTTPS

- Including

- IT

- leading

- local

- locked

- major

- man

- March

- Market

- Markets

- Media

- network

- news

- Other

- People

- Popular

- price

- project

- projects

- protocol

- protocols

- recovery

- reduce

- Sex

- significant

- Signs

- SIX

- Social

- social media

- Space

- strong

- team

- token

- Tokens

- top

- tweet

- users

- value

- week

- within

- worked

- working

- Yahoo

- year

- Yield

- youtube