The dapp industry registered more than 1.4 million daily unique users during July alone

UPDATE @ 3pm, 04.08.21: NFT July Sales Volume Figure Amended to $1.2B From Incorrect $2.5 Figure

July 2021 has demonstrated once again the exciting and rapid pace of the decentralized application industry. The surge of play-to-earn games, along with the establishment of high-value Non-Fungible token (NFT) collections, boosted the entire industry. Whereas the Decentralized Finance (DeFi) race continues to heat up, mostly in part due to the multichain paradigm.

The blockchain industry appears to be recovering from the downside trend experienced since the crypto crash in May. Bitcoin and Ethers prices have increased by 18% and 17% respectively since the start of the month. The scenario translated into the dapp industry, where more than 1.4 million daily unique users were engaged during July alone. This represents a 23.72% increase from June.

Last year, we saw thousands of users dabble into the DeFi space in the so-called Summer of DeFi. Several individuals started their blockchain journey experiencing the benefits of enhanced decentralized finance that included attractive yield farms and innovative products like Aave’s flash loans. This year, it is NFTs and games that are drawing the headlines.

Play-to-earn games have shocked the industry and are quickly becoming a trend across several circles. With low transaction fees and high scalability, chains like Ronin, WAX, and BSC are home to some of the most used dapps in the entire world. Furthermore, success stories like Axie Infinity’s economic boost in the Philippines may be the missing piece towards mass adoption.

On the other hand, NFT collectibles are not left behind. Blue-chip avatar collections like CryptoPunks and Bored Ape Yacht Club (BAYC) have become established referents of the NFT movement. The trend in floor prices has only signaled that avatar NFTs are becoming units of value for the near future. Moreover, the added utility granted by some of these collections is engaging communities in manners never seen before.

Finally, the DeFi space is becoming more consolidated. The competition continues to heat up across several protocols. The multichain paradigm is in full swing with dapps like Aave and Sushi extending their features beyond Ethereum. With newer projects like Polygon’s QuickSwap becoming rapidly adopted, there is no surprise to see the organic growth within this space.

Table of Contents

Key Takeaways

- The dapp industry registered more than 1.4 million daily unique users during July alone; a 23.72% increase from the previous month.

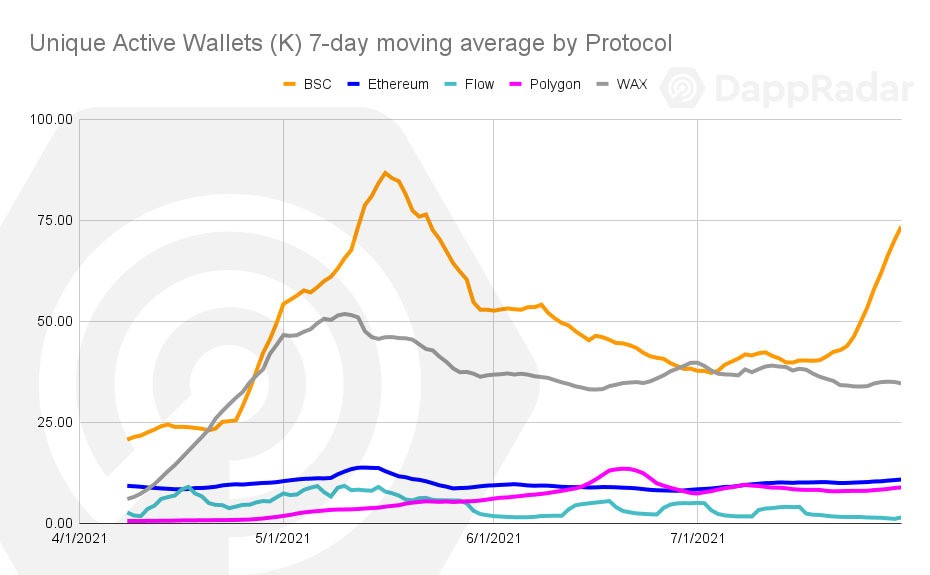

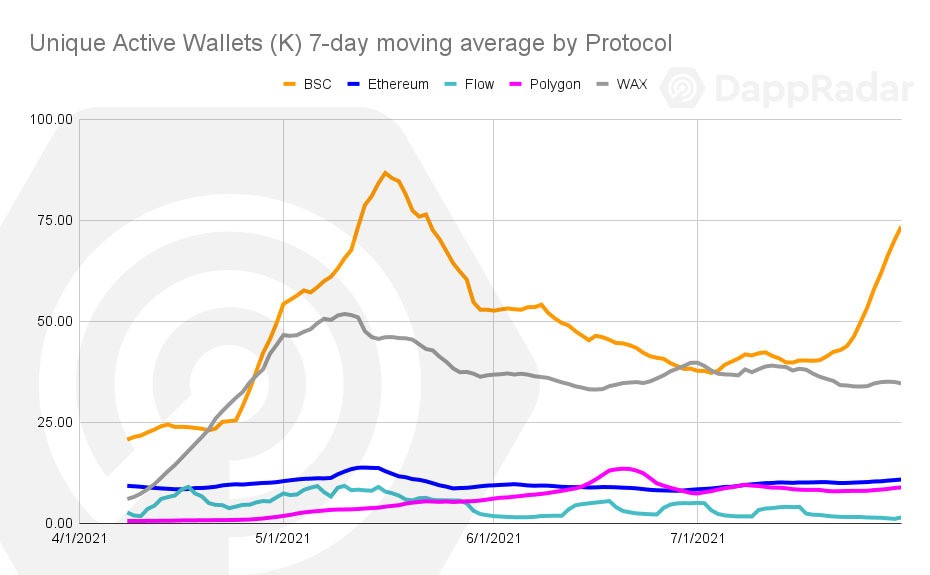

- BSC is the most used blockchain with more than 658,000 unique users in July; WAX comes second with 336,000 and Ethereum is now third with 105,000.

- Axie became the most valuable NFT collection ever with more than $830 million in trading volume; $600 million happened during July alone.

- Play-to-earn games arrived on BSC; Cryptoblades onboard more than 316,000 unique users whilst generating more than $4.3 million in transaction volume.

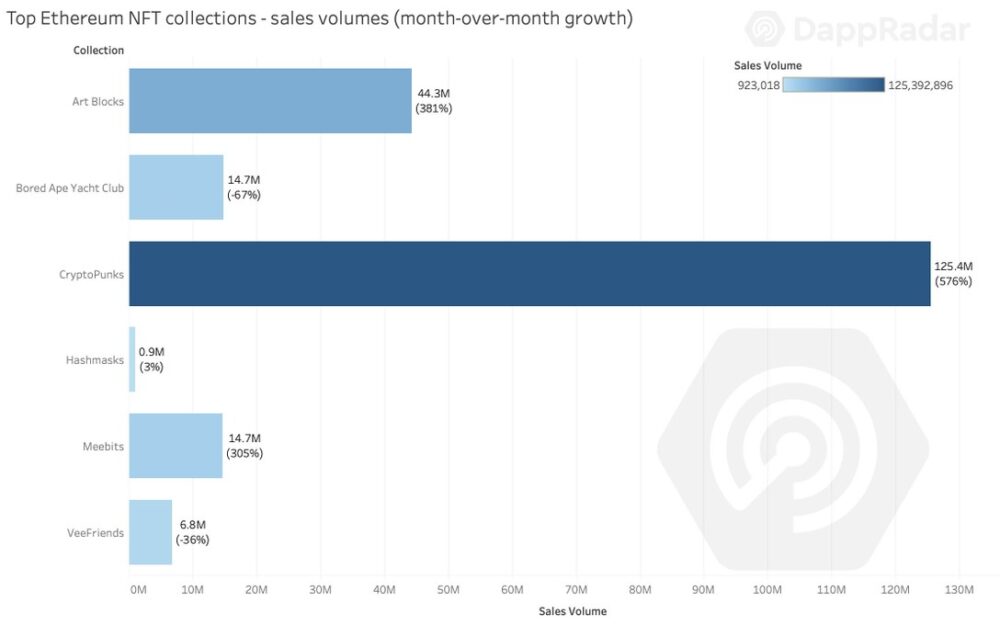

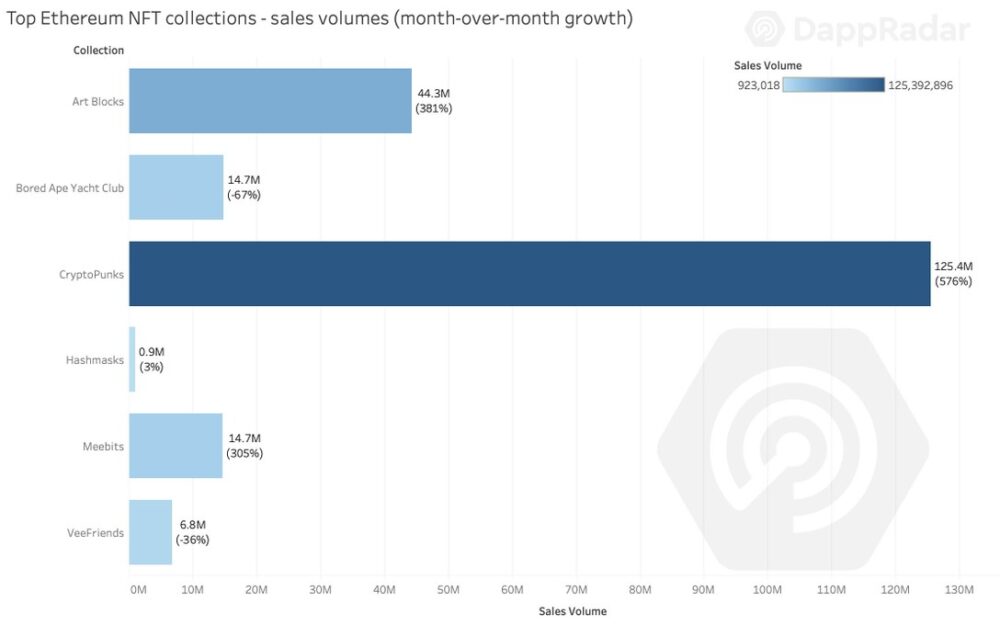

- Top Ethereum NFT collections (CryptoPunks, Meebits, VeeFriends, and Bored Apes) are still on the rise; volumes increased collectively by 250% approximately.

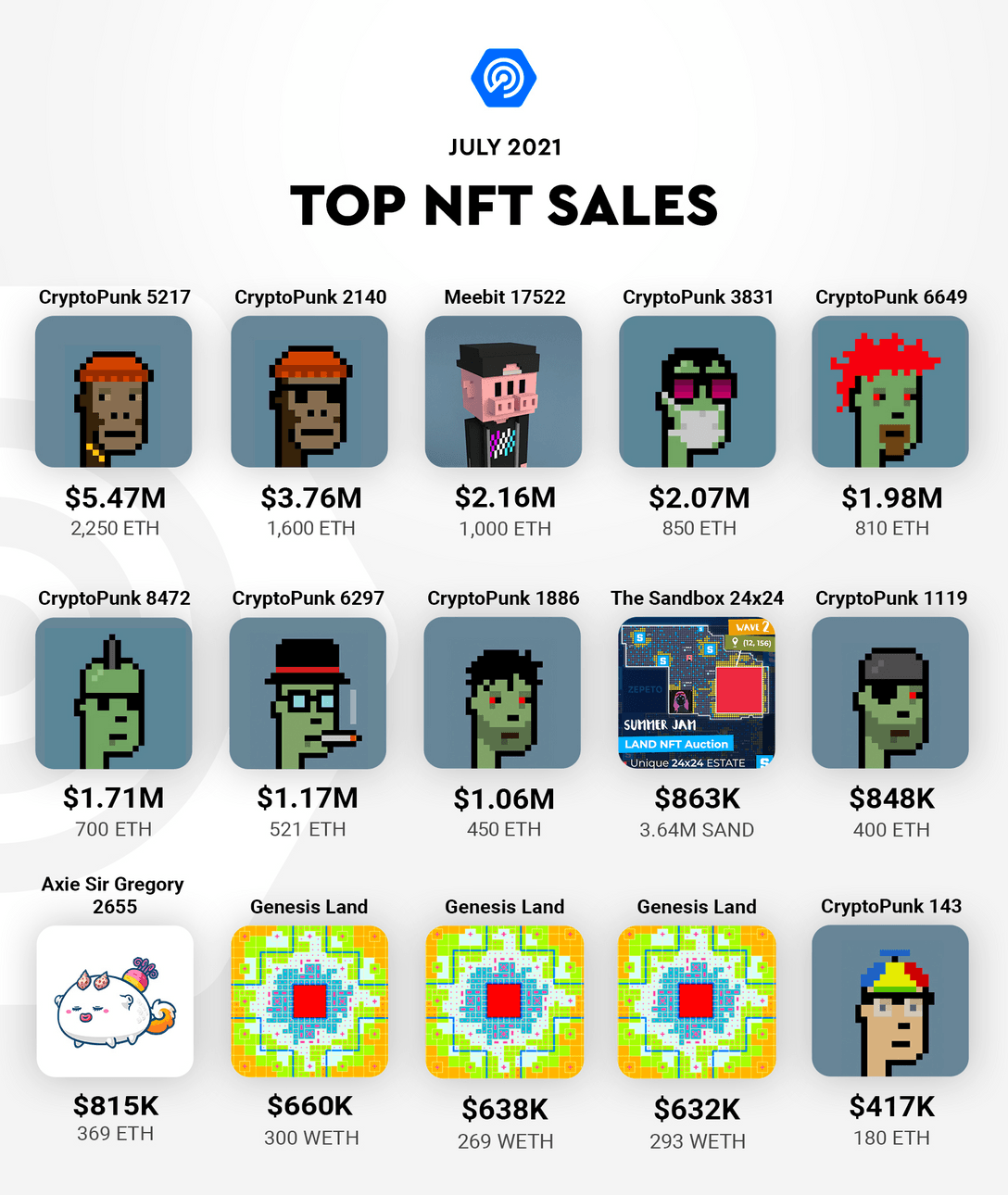

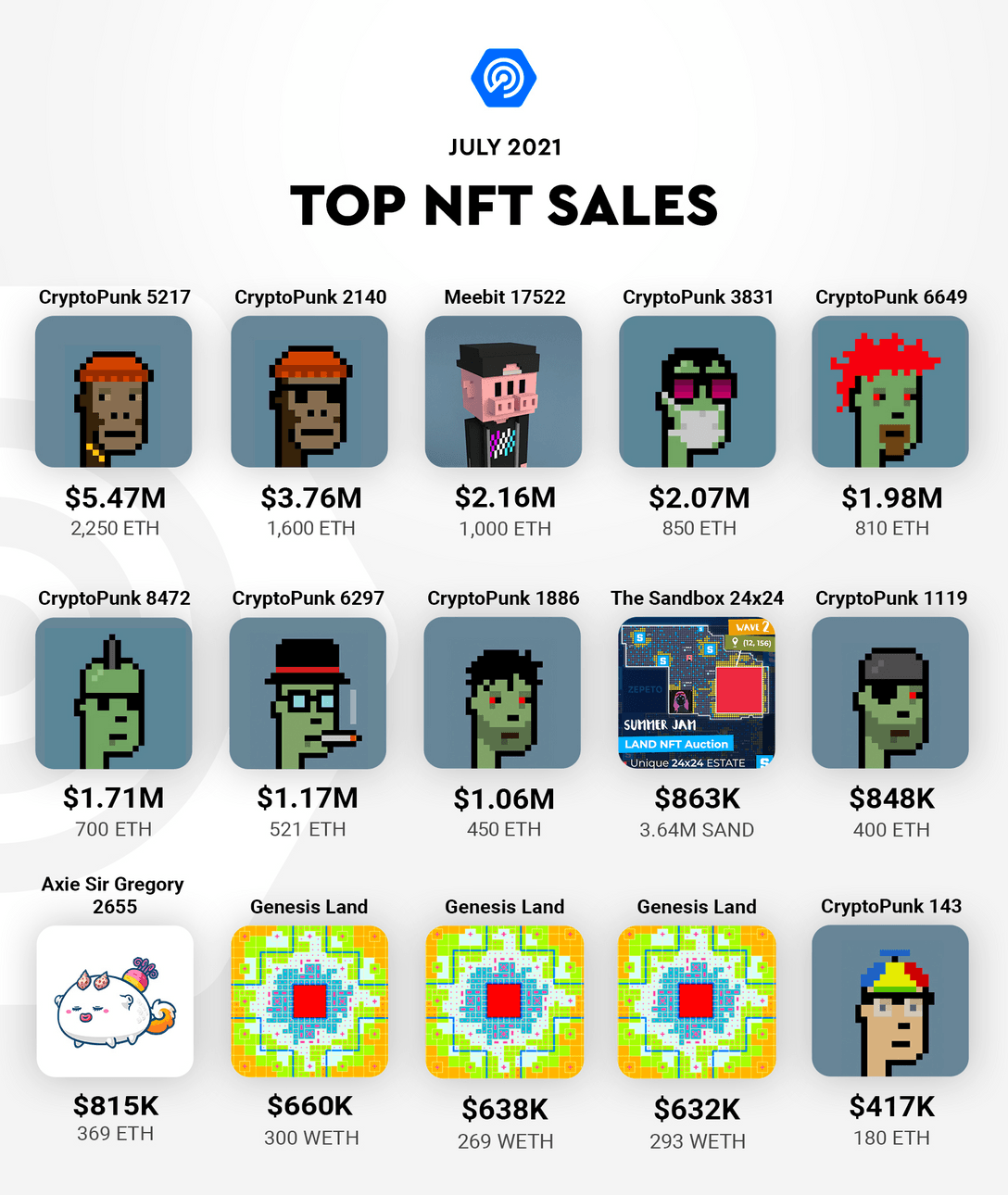

- Virtual lands among different metaverses increased their value; A Sandbox land lot sold for $863,000 while several Axie lands are trading above $500,000.

- One step forward towards mass adoption; OpenSea marketplace gets a $1.5 billion valuation, whilst Coca-Cola partners with Decentraland.

- Ethereum maintains the lead in the DeFi race with more than $80 billion in TVL, an increase of 23% from the previous month.

- PancakeSwap is still the most used dapp across all protocols with more than 2 million users in July that generated $22 billion in transaction volume; more than 1 million Twitter followers reached.

- QuickSwap is the most used dapp on Polygon, the DEX lured 135,000 unique users whilst generating more than $5 billion in volume.

High-Level Industry Overview

The blockchain industry keeps showing signs of increased demand. High activity in the most important sectors is becoming recurrent. The NFT space is thrashing past critics on its future with record sales volumes and a constantly increasing number of NFT holders. The DeFi sector is also showing signs of growth. The most representative DeFi dapps are organically increasing their TVL, a key metric to understand this space.

However, the most encouraging insights come from the gaming space, where play-to-earn dapps are providing the industry with a big boost. It appears that we are currently undergoing a shift in the traditional gaming paradigm. Players around the globe are realizing the benefits afforded by the in-game mechanics that blockchain games offer.

Either through DeFi, NFTs, or gaming, the industry is growing exponentially whilst massively increasing its usage. It appears imminent that the whole industry is heading towards mass adoption.

Play-to-Earn Revolution

Play-to-earn games are creating micro-economies on their own. In the last month, we issued a special report to highlight the massive success that Axie was already enjoying. Despite facing several technical issues that left thousands of players without access to the gaming platform, the game not only maintained its huge usage but it increased significantly.

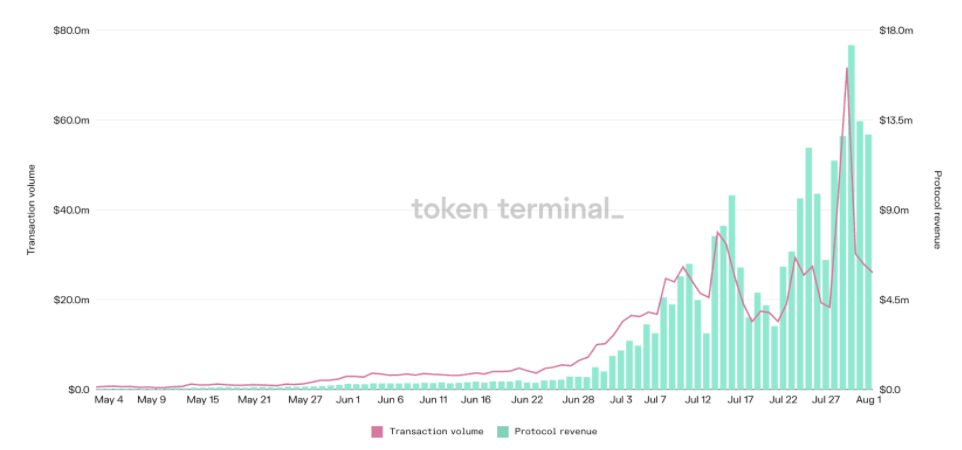

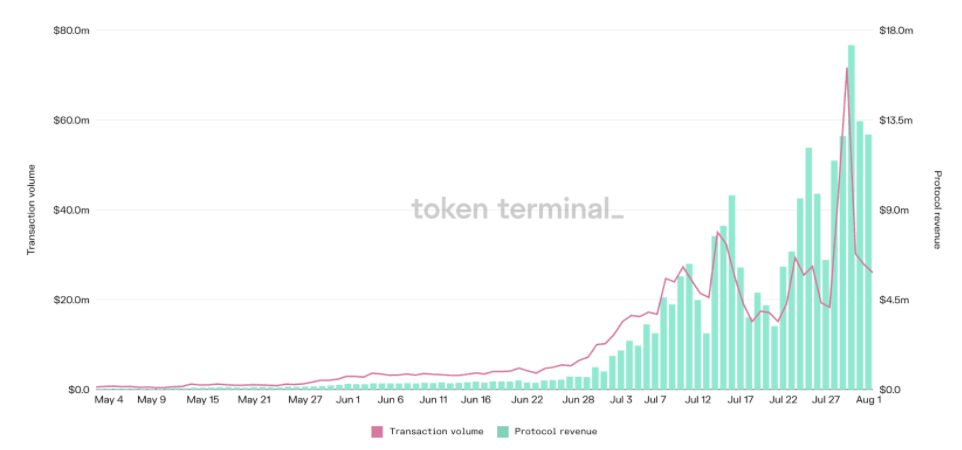

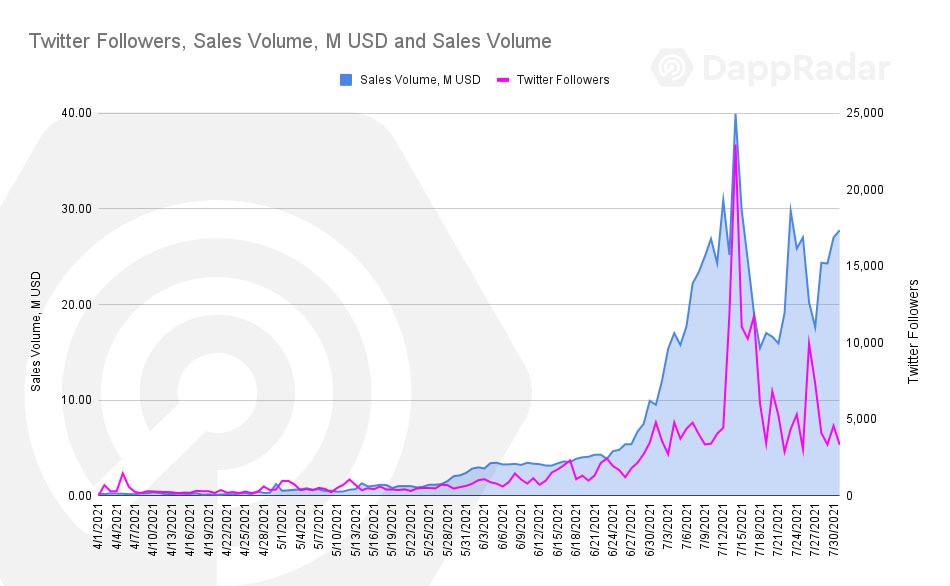

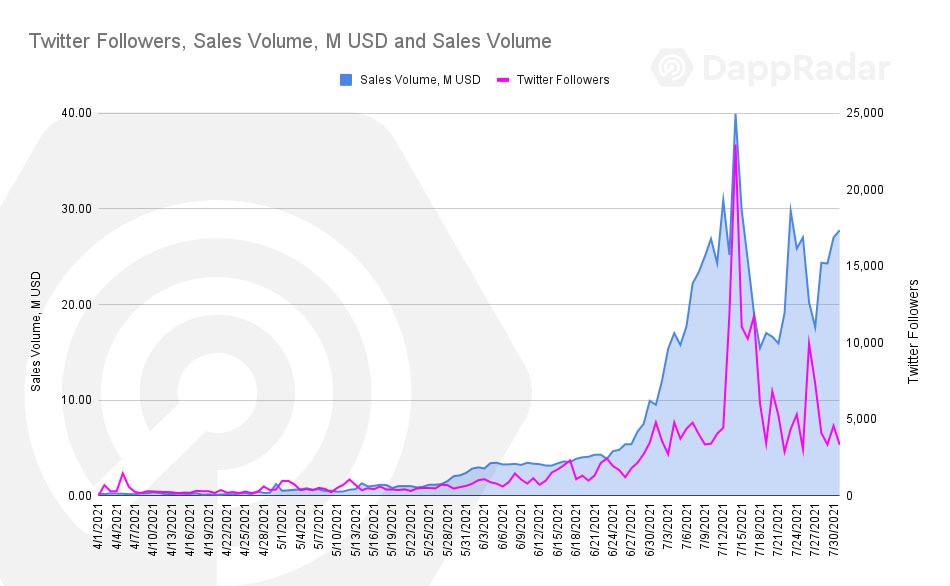

In July, Axie became the most valuable NFT collection ever, reaching more than $830 million in trading volume. The Ronin-based game achieved new highs in July, generating more than $600 million in volume. This represents an impressive 453% increase from an already robust June.

The massive volumes go in accordance with their rapid growth in social media channels as well. In the last month, the positive trend continued as the game reached more than 700,000 followers on Twitter and Discord respectively. Furthermore, according to Token Terminal, the AXS governance token helped Axie generate more revenue during July than the whole Ethereum, BSC, and Bitcoin blockchains respectively.

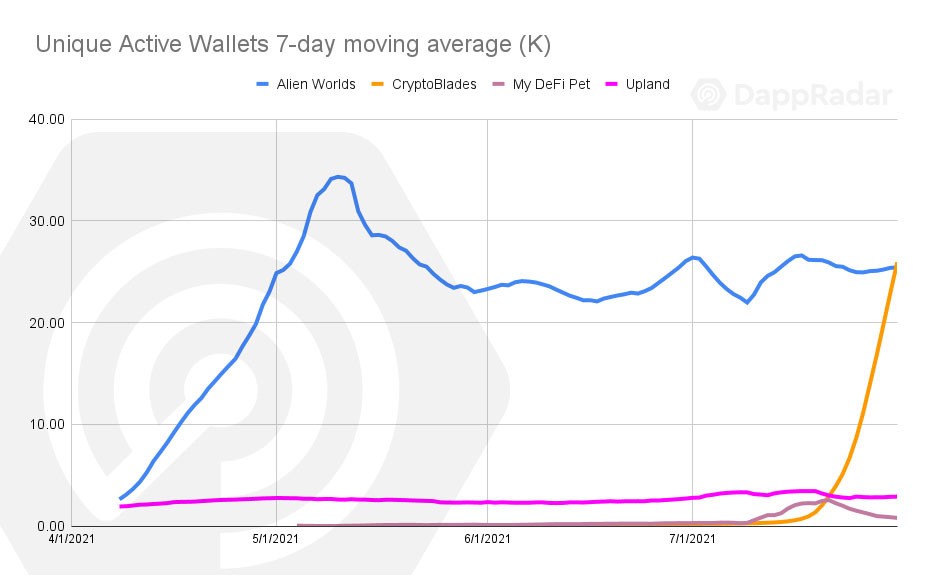

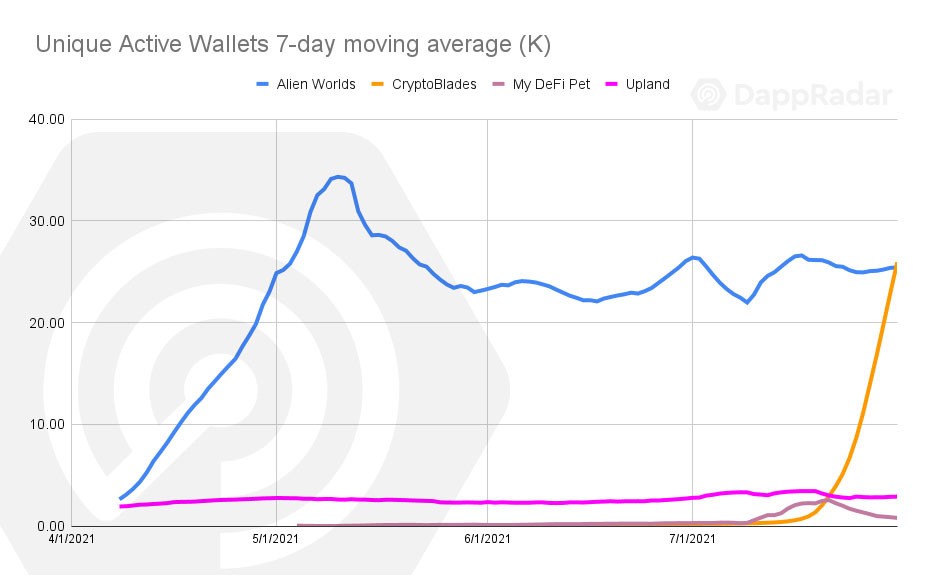

While Axie’s colossal success is getting most of the headlines, the numbers registered by other play-to-earn dapps cannot be overlooked. For instance, Alien Worlds and Upland, whose usage is increasing as well. During July, the WAX-based game reached 904,000 unique wallets, increasing this metric by 32.06%. As for Upland, the usage is increasing as well. The EOS game registered 151,000 unique wallets, a 17% increase from June.

Games, where players can yield higher rewards, are becoming mainstream, especially in emerging economies. The play-to-earn trend is shifting the way we know gaming. Players are moving from paying small amounts to unlock special features, to receiving daily rewards for their in-game actions. As blockchains are constantly evolving in search of a better user experience, mass adoption may be closer than ever.

BSC Doubles Up on Gaming

During this year, BSC has established itself as one of the top blockchains in the industry. The Binance Smart Chain network is the most used protocol in the industry with more than 750,000 daily unique users on average during July.

BSC has relied mainly on DeFi dapps and NFTs to some extent to achieve its current level of success, yet it is gaming that has made the bigger strides in recent weeks. During this month a couple of BSC games have reached important milestones in important metrics.

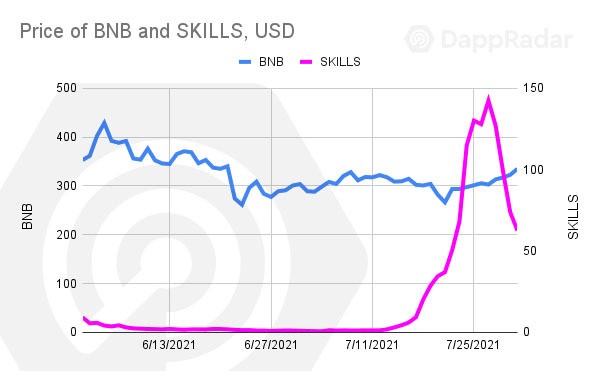

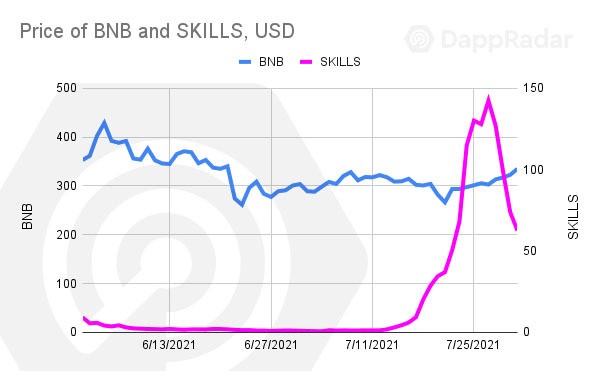

CryptoBlades, a play-to-earn game has now become the second most used dapp behind PancakeSwap. The battle game lured 580,000 unique users in its first days of existence whilst generating more than $92 million in more than 50 million transactions. The usage represents a 12,000% increase from the previous month. The game enables traditional battle mechanics where players can improve their warriors by spending SKILL, CryptoBlades’ native token. Furthermore, SKILL reached an all-time high of $187.07 on July 24. During this month, SKILL increased its value by 6,900% approximately.

Another play-to-earn dapp outperforming expectations is MyDeFiPet. The virtual pet game increased its daily unique users month-over-month by 660%. It combines DeFi collectibles with breeding skills to improve the pet’s overall conditions in order to earn higher rewards. MyDefiPet lured 172,000 unique users during the last 30 days generating more than $54 million in volume in the process.

As the play-to-earn narrative continues, it is necessary to keep monitoring the aforementioned dapps. Taking advantage of low fees and high scalability, BSC looks to replicate the success obtained in DeFi.

NFTs Are More Relevant Than Ever

At some point during the previous months, several people and media were calling for an imminent downside of the NFT space. Not only did that negative trend never come but it became exactly the opposite. The NFT phenomenon has reached heights that were unthinkable just a few months ago.

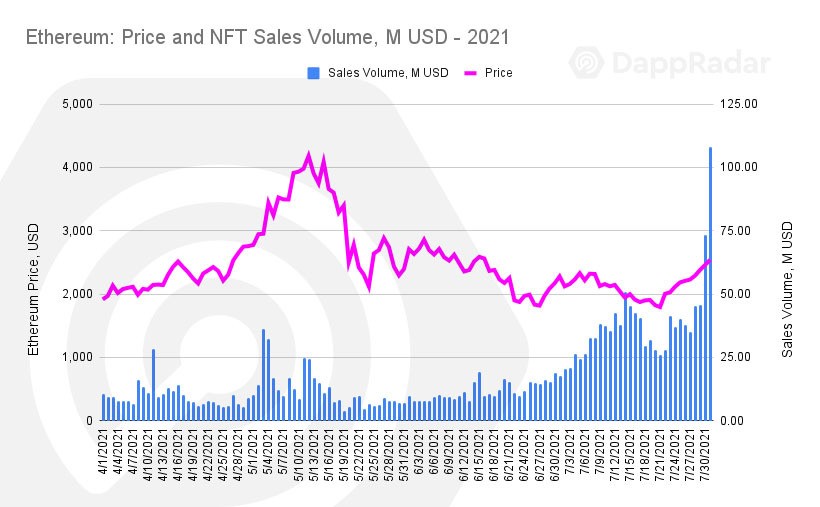

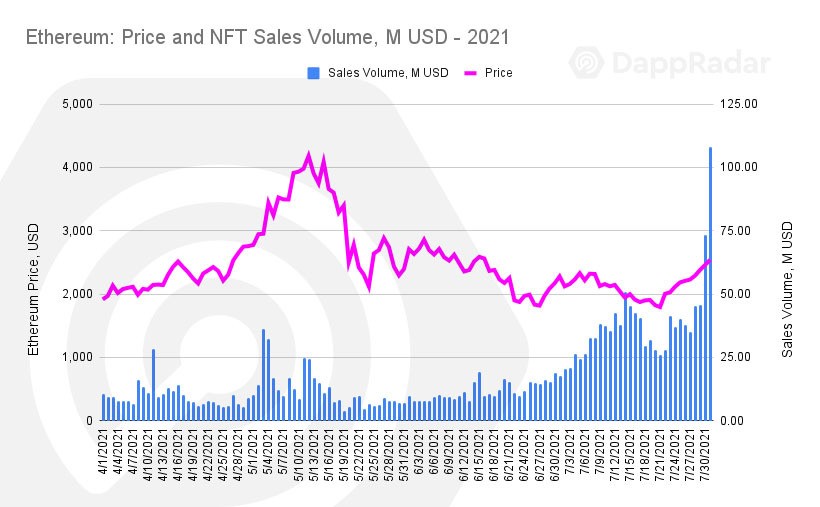

As a whole, the NFT space has amassed over $1.2 billion in sales volume during July alone. Besides Axie Infinity, approximately 80% of it comes from Ethereum’s primary and secondary markets. While FLOW’s NBA Top Shot and WAX’s Alien Worlds are two of the most traded projects, the lion’s share of the volume is definitely happening on Ethereum.

Established projects like CryptoPunks, Meebits, and BAYC continue to yield high upside for holders. The floor price of those continues to rise as the demand for their limited supply pieces increases significantly.

CryptoPunks and Meebits both saw their trading volumes increase in impressive fashion. The Punks collection generated $125.4 million in sales volume, an astonishing 576% increase from June’s numbers. Meebits generated $14.7 million in volume which also represents a 305% increase from June. Even though both collections appeared to be cooling down, the market’s appetite shows otherwise.

On one hand, celebrities from different industries were amongst the latest buyers of both Punks and Apes, adding an intriguing value to an already solid community. But perhaps more importantly, during the last weekend, we saw probably the first big-scale investment on NFTs, when Three Arrows Capital bought thousands of Ether (Ξ) mostly in Punks and Art Blocks, another Ethereum-based collection.

And while the established projects continue to thrive, investors are trying to get their hands on the next upside project. Either by minting new items or buying in secondary markets, there is an upside trend in Ethereum projects. Collections like the Royal Society of Players and Stoner Cats are being sold out in minutes. The latter, for instance, attracted so much audience that the whole Ethereum network collapsed due to a war in gas prices in the mining process. Mila Kunis’ Stoner Cats were launched on July 23 selling out in a few minutes leaving thousands of Ether lost in transaction fees.

With dozens of collections launching each month, it is wholly important to learn as much as possible about a project. Along with the art itself, the team, community, and added utility are normally the factors that can make a project successful in the long run.

Blockchain-powered virtual worlds where players can build, own and monetize their gaming experiences are also trending upwards. As shown in the month’s top NFT sales, digital lands are being sold for considerable amounts.

The Sandbox has become the virtual home of several projects within the blockchain industry. Certain parcels near recognized dapps or individuals will be key when creating digital experiences, therefore an appreciation in these lots is expected.

While The Sandbox, Decentraland, and Upland lead the way in the blockchain-powered virtual worlds, several other projects aim to integrate digital lands in the near future. For instance, Axie Infinity. Axie will incorporate in-game mining rewards as part of the in-game mechanics. Thus, virtual lands in the Genesis parcels are becoming increasingly appreciated.

With more metaverse collaborations looming in the near future, and more projects like Aavegotch enabling features that benefit from owning pieces of virtual lands, expect the digital real estate to maintain their value atop NFT trading markets.

Two Flashes in the Search for Mass Adoption

NFTs have slowly become one of the main industry drivers in recent months. In July alone, Ethereum’s leading NFT marketplace OpenSea generated $167.5 million in sales volume, an important 101% increase from previous months. The secondary market can be used in different manners, from securely trading blue-chip avatar projects to minting personal creations.

As the demand for NFTs increased significantly, the latest market valuations appear to agree with that trend. OpenSea raised $100 million at a $1.5 billion valuation two weeks ago. With the integration of other blockchains like Polygon and Binance, that figure may easily go up.

On another note, Coca-Cola, one of the most collectible brands in the world, announced the launch of its first NFT collection. The red brand’s NFT was auctioned on OpenSea gathering 217 Ξ or $543,750 in the process. The bundle piece contains various Coca-Cola-inspired collectibles including a unique customized wearable that can be donned inside Decentraland.

A Deeper Look at the DeFi Race

It is true that during July, the industry was mainly driven by the NFTs and gaming spheres. However, there is no reason to overlook the impressive performance sustained by the DeFi space.

Overall, DeFi saw another month of organic growth within its most important projects. Despite the natural limitations of high gas fees and low scalability, the dapps and their underlying protocols are finding methods to provide users with better products to improve their experience. This has resulted in higher usage eventually leading to improved metrics.

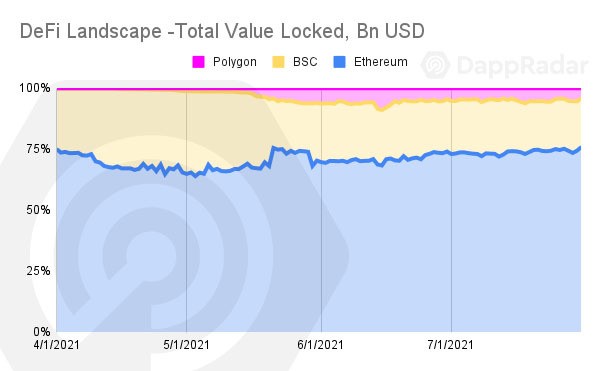

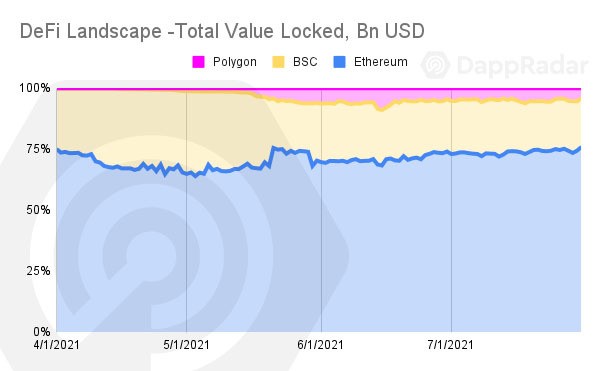

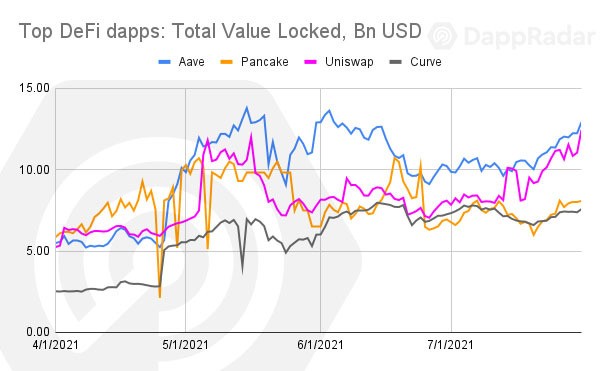

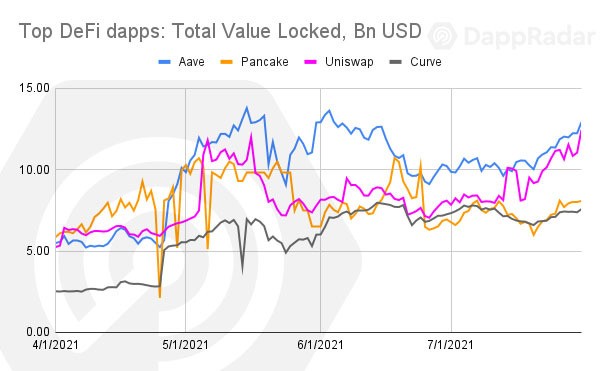

Ethereum is still the leading protocol in terms of TVL. Mostly due to Uniswap, Aave, Compound, and Curve, which dominate 44.16% of the network’s TVL. Ethereum currently has $83.6 billion in TVL, more than 70% of the whole industry’s metric. Compared to the previous month, the chain has increased the metric by 23%. The TVL numbers achieved by Ethereum are strengthened when compared to Ether’s price. ETH’s has also trended upwards during July, increasing by 17%. Thus, we can assume that the chain’s TVL organically grew by 6% approximately.

BSC is the second network in terms of TVL. The Binance blockchain surpassed $21 billion in TVL, increasing 7.63% from the previous month. Most of its value is driven by the PancakeSwap DEX. PancakeSwap maintains the lead as the most used dapp across all protocols with more than 2 million unique users in July alone. The dapp achieved $8.08 billion in TVL, an 16.28% increase from the previous month. Furthermore, PancakeSwap has reached more than 1 million users on Twitter, whilst surpassing 4 million users of social engagement according to LunarCrash.

PancakeSwap’s TVL dominance saw a slight decrease from previous periods. The dapp now represents almost 38% of BSC’s TVL. On the other hand, Venus and Alpaca Finance made big strides in terms of TVL representation. Venus now accounts for almost 15% of BSC’s TVL with more than $3.15 billion in TVL, a 25% increase month-over-month. Whilst Alpaca Finance is now responsible for 7.25% of the network’s TVL with $1.58 billion.

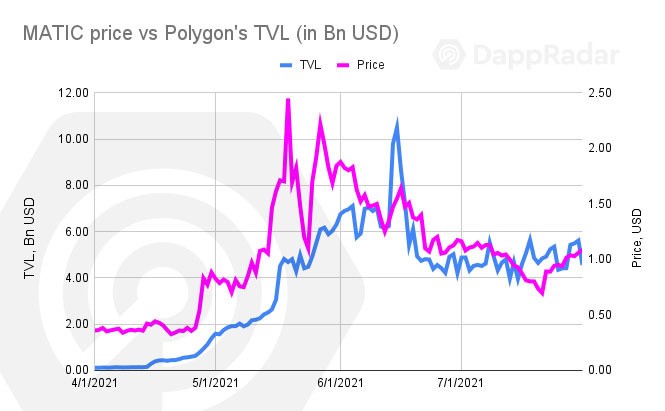

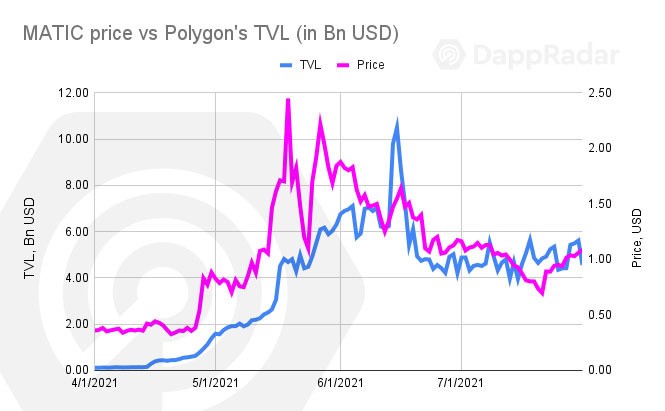

Polygon comes in third place. The sidechain netted $4.55 billion in TVL, an 8.38% increase when compared to June. More than 65% of Polygon’s TVL comes from Aave, Curve, and Sushi, taking full advantage of the multichain paradigm. On the other hand, Polygon’s native QuickSwap is the most used dapp in the network. The DEX attracted more than 161,000 unique users during July, an 11.83% increase month-over-month. Furthermore, QuickSwap generated $4.53 billion in transaction volume.

Most interestingly for Polygon is the fact that the price of Matic decreased by 9% when compared to the previous month. The chain saw its usage grow 24% from June, supporting the organic growth of 17% in the network.

The DeFi industry is undergoing an important evolution. Ethereum’s structure somehow limits the potential capabilities of a fully scalable space. With blockchains like Tezos and Terra’s invasion into the world of DeFi, more users and a better experience will benefit the whole industry.

Furthermore, DeFi is finding a way to reach traditional finance. Recognized financial institutions are creating exposure into the DeFi world through ETFs. While regulations are still a big hurdle in the way, the DeFi sector is preparing to explode into a massive adoption.

Multichain Analysis

Whilst the current DeFi landscape appears to be organically increasing, there are mixed drivers behind the inherent growth. One of them is the multichain paradigm which enables the same features in less expensive and more scalable networks.

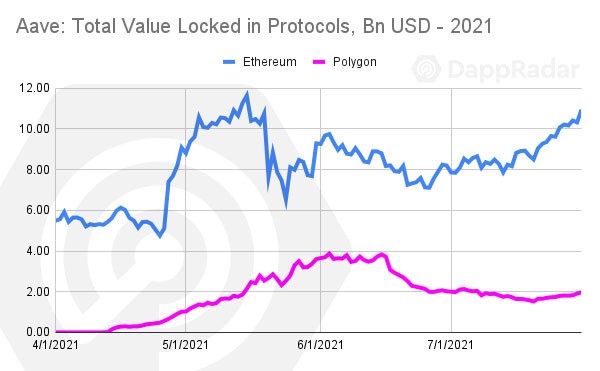

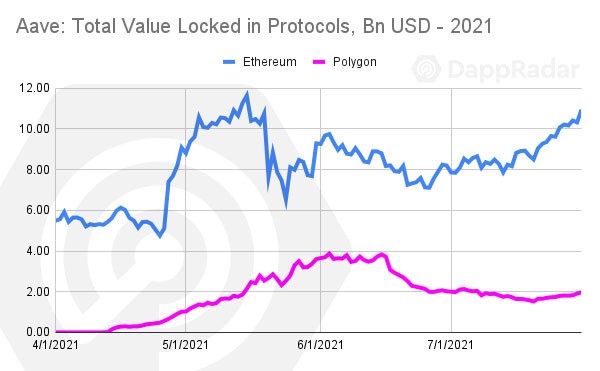

For instance, Aave, the leading DeFi dapp in terms of TVL, has reached $12.92 billion. The ghost dapp’s TVL increased $2.7 from the previous month. While 85% of the metric is locked in Ethereum, Aave’s TVL grew 43.2% in Polygon, compared to 33.5% in Ethereum’s chain.

Another established dapp that benefits from transacting on more than one chain is Curve. The Automated Market Maker (AMM) surpassed $7.57 billion in TVL in both Ethereum and Polygon combined. As in the case of Aave, Curve saw its TVL increased by almost 11% month-over-month. Curve’s 93% is locked in Ethereum; however, its TVL in Polygon increased by 21.39% compared to a mere 3.2% in the former network.

The multichain paradigm appears to be gaining momentum. At first, it was natural seeing Ethereum hosted dapps extending their services to Polygon or BSC. However, more recently, dapps that are native to more DeFi friendly blockchains, like Apeswap and Paraswap, have decided to broaden into multiple chains. A more integrated ecosystem may pave the way for an enhanced DeFi sector in the upcoming months.

Conclusion

As previously stated, play-to-earn games are creating micro-economies of their own. The massive impact generated by Axie Infinity paved the way for play-to-earn games in other blockchains to excel. With excellent options on BSC and another array of enticing games in Polygon like Aavegotchi and MegaCryptoPolis, the play-to-earn narrative can now be considered as the third main foundation of the dapp ecosystem along with DeFi and NFTs.

Whilst play-to-earn stole the headlines, NFTs were not lagging behind. Blue-chip collections are maintaining their status as units of store value. The main avatar projects on Ethereum have kept their community-engaged and are even outperforming expectations in most cases. With new investment patterns emerging in the NFT space, such as the incursion of Venture Capitals and the fractional NFT buying on large-scale NFTs, it may seem that there is still plenty of room to grow for the NFT space. It will also be interesting to monitor how the sector reacts to a potential movement in the price of Ether.

Finally, the DeFi landscape looks in very good shape. Organic growth in the top 3 blockchains proves that although most of the space is getting along with NFT and games, there is still plenty of room for DeFi to grow. With important updates coming for Ethereum and other blockchains like Tron, trying to become more relevant, expect new opportunities for diversifying the products and perhaps new manners of generating passive income.

All in all, the industry looks as competitive as ever and shows signs of increased demand in its most important sectors. Several projects are creating positive experiences and new ways of investment across different verticals. As the blockchain industry continues to evolve, it certainly feels like we are getting one step closer to the goal of mass adoption.

About DappRadar

We want to make exploring, tracking & managing dapps, insightful, convenient, and rewarding for all. We started in 2018, bringing high-quality, accurate insights on decentralized applications to a global audience and rapidly became the go-to, trusted industry source. Today, we’re the starting point for dapp discovery – hosting more than 6000 dapps from over 20 protocols – offer comprehensive NFT valuation & portfolio management and lead the way in data-led, actionable industry reporting.

For all media inquiries and further commentary please contact: [email protected]

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet