How far will the crypto contagion spread?

DappRadar tracks dapps, so it is only fitting to approach this latest FTX crypto catastrophe from the perspective of how it will impact decentralized apps across all significant categories. With so much nuance and granular information to digest, DappRadar hopes to provide an overview of which dapps have a relationship with FTX and which are entirely unaffected.

This article serves as an introduction. On Thursday, November 17, DappRadar will publish a full-fledged research report on the impact of the FTX crypto crisis on the wider dapp industry.

FTX, through its FTX Ventures arm alongside Alameda Research, invested in countless Web3 projects. For some, they provided funding. Others had their entire treasury on the exchange.

Some projects are fast to show transparency, and they have no underlying reliance on FTX or Alameda Research in an attempt to calm the nerves of their investors and communities. Others are still looking at the situation to assess the full scale of the impact.

Across the wider dapp industry, there are all kinds of decentralized applications in various categories. Here we will list the dapps per category impacted by the crypto contagion from the FTX downfall. The categories we will tackle are:

NOTE: this article will continuously be updated as the story develops.

How can a dapp be affected?

The FTX crypto crisis can impact Dapps in various ways. These are the most common scenarios on how dapp developers and ecosystems can be hampered by the current situation:

- Dapps that received (a part of their) funding in FTT or other assets have plummeted in value.

- Dapps which kept its treasury on the FTX exchange, which has filed for bankruptcy and has now been drained by hackers.

- Dapps built their service on Solana, an ecosystem heavily impacted by the FTX downfall.

Games

Star Atlas

Star Atlas development company ATMTA had its treasury on FTX, and therefore they’ve been affected. In an email to DappRadar, they revealed that 50% of their treasury had been affected.

Co-founder Michael Wagner stated that the development team’s resolve was still firm. The group was committed to continuing to build with their remaining budget. Internal restructuring and raising additional capital for further development are both on the table. Wagner hinted at conversations already happening with existing VC partners.

Genopets

The mobile move-to-earn game Genopets has not been impacted directly by the issues surrounding FTX. However, the native GENE token was available on FTX, and therefore has seen a drop in price. In addition the game uses the Solana blockchain, meaning that the price drop of GENE has been quite severe with -42%.

Stepn

Stepn is another move-to-earn NFT-infused application that successfully rewards users for daily activities. Satoshi Lab, the company behind Stepn, has reassured the community that treasury funds are secure and they remain focused on building new products for the ecosystem.

DeFi

Serum

Serum is the main order book for liquidity providers to backstop liquidations of all significant lending protocols on Solana. In short, it’s the backbone of DeFi on Solana, so any impact here can have wide-reaching implications.

The Serum program update key was not controlled by the Serum DAO but by a private key connected to FTX. In an announcement on November 13th, Serum stated that no one can confirm who controls this key and that they also have the power to update the Serum program, possibly deploying malicious code.

Lending protocol Solend, Jupiter, automated market maker Raydium, stablecoin swap shop Mercurial Finance, Solana-based DeFi traders, and centralized entities, including Phantom wallet, limited their exposure to Serum. They disconnected price data oracles, shut down token trading pools, or ceased trading on its central limit order book.

Given the nature of Serum and its importance, a group of devs identified the last safely deployed version of Serum. A verified build of the same version has now been made and deployed with a new program id. Notably, this is an interim solution, with the Serum team stating the whole community should decide on the next steps. However, several key Solana DeFi projects agreed to work with the fork, including Jupiter Exchange and Mango Markets.

NFTs

Prices for Ethereum blue-chip NFTs have been falling. We’ve already seen Bored Ape Yacht Club losing lots of its value. At the same time, NFT trading on Solana is also in trouble, with significant collections such as DeGods, Solana Monkey Business, and y00ts all down around 70% at writing.

Despite the fall in floor prices, trading of top NFT collections remained buoyant as hungry speculators looked to secure high-profile NFTs at discount prices.

Magic Eden

The leading NFT marketplace on Solana, Magic Eden, stepped in to clarify their position as NFT holders started asking questions. Announcing that NFTs were safe and secure but that Serum was being used for Semi Fungible Token (SFT) trading, which may have been affected. To be safe, they temporarily disabled SFT listings & sales on Magic Eden.

Those with SFT listings on Magic Eden are advised to delist them immediately, as the platform can not do this on users’ behalf. More information on which Solana NFT collections contain SFTs can be found here.

Yuga Labs

One high-profile company caught up in the debacle is Yuga Labs, the creators of the blue-chip NFT collections Bored Ape Yacht Club and its derivatives. As reported by Wu Blockchain, Yuga Labs stored 18,000 ETH, or around 23 million dollars, in royalties on FTX.

The FTX-Blockfolio link depreciated the value of the assets, while traders may also have shifted focus to owning CryptoPunks rather than BAYC as the FUD set in. However, fears about BAYC being unable to reclaim its treasury and royalty are now resolved as Yuga Labs announced it was able to salvage the situation by transferring the assets to Coinbase.

In summary

The saga of FTX’s insolvency is unfolding, but the picture is becoming more apparent. The exchange lent out customer deposits to its sister company Alameda Research, a hedge fund that made poor discretionary bets with the assets.

Alameda’s collapse triggered FTX’s insolvency, creating a balance sheet hole to the tune of $10 billion and leading FTX to file for bankruptcy-court protection on Friday, Nov. 11. In the aftermath, we see reports of an exploited back door allowing those responsible for the platform to remove funds without recourse.

Don’t miss the report on Thursday, November 17. Make a DappRadar account.

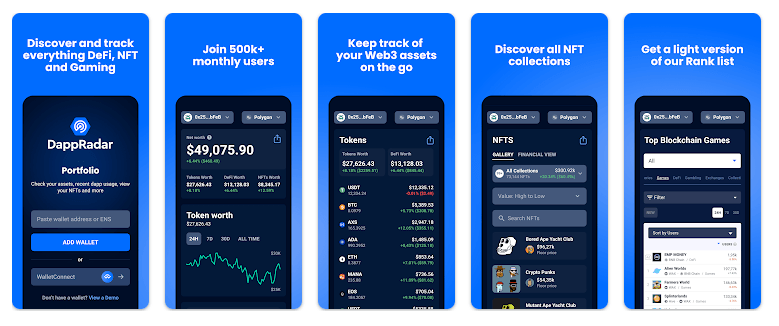

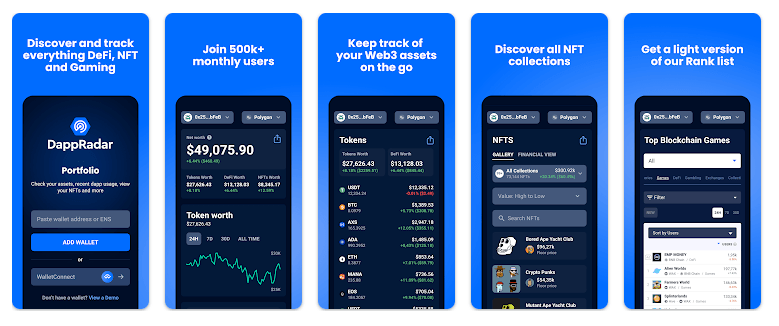

Carry your Web3 journey with you

With the DappRadar mobile app, never miss out on Web3 again. See the performance of the most popular dapps, and keep an eye on the NFTs in your portfolio. Your account on DappRadar syncs with our mobile app, giving you soon the option to receive alerts live as they happen.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet