This is a weekly tutorial on the most compelling opportunities in yield farming, written by our friend DeFi Dad, an advisor to The Defiant and Head of Portfolio Support at Fourth Revolution Capital (4RC).

Background on Protocol:

One of the biggest windfalls in DeFi portfolios is an airdrop.

It’s “Uptober” and aside from green candles, we’re seeing Ethereum L2s just beginning to take off with the recent anticipated Arbitrum launch in September. With L2s, we also see a demand for fast and reliable bridges. Hop Protocol has been one of the few new leaders to step up in this surge of DeFi interoperability.

Hop provides a scalable rollup-to-rollup general token bridge, allowing users to send tokens from one rollup (ie Optimism, Arbitrum) or sidechain to another almost immediately without having to wait for the network’s challenge period. Why’s that such a big deal? Because the average DeFi user is not going to wait 7 days to withdraw assets from Optimism or 4.5 hours from Arbitrum to get back to Ethereum L1. Even more promising is Hop’s bridge between L2s, which shows us a future where we avoid the congestion and high fees on Ethereum L1.

In order for Hop to work, the protocol requires market makers, called Bonders, who front the liquidity at the destination chain in exchange for a small fee. This credit is extended by the Bonder in the form of hTokens, which are then swapped for their corresponding native token in an AMM.

For example, if I were to withdraw USDC from Arbitrum to Ethereum, Hop allows me to transfer my liquidity from Arbitrum thanks to liquidity providers holding USDC and hUSDC on Arbitrum. Bridging requires fees when you either move between L2 <> L2 or L2 <> L1.

L2 <> L2 = 0.08% swap fee (two swaps)

L2 <> L1 = 0.04% (only one swap)

As of this writing there is no announce or confirmed Hop governance token. There is also no Arbitrum governance token. However, I am speculating both Hop and Arbitrum will eventually release their own tokens in the future in order for Hop and Arbitrum to operate and grow long term as decentralized, community-owned solutions.

Opportunity: In light of the newly launched Arbitrum and growing utility of Hop Protocol, I will show how I can become an hUSDC-USDC LP (Bonder on Hop) for Arbitrum to earning trading fees via Hop bridge, but also simultaneously, speculate on a future airdrop from Hop and/or Arbitrum.

Time to Complete: 15 minutes if paying the recommended FAST gas price or higher on gasnow.org.

Estimated Length of Rewards Program: There’s no start or end date to this opportunity, but the sooner the better since I’m unsure if/when Hop or Arbitrum may launch tokens.

Gas + Protocol Fees: Based on gas prices between 50-100 Gwei on Ethereum, it should cost $25-$50 to participate.

Fees: There is no fee to convert USDC into Hop tokens (hUSDC) and become an LP other than the gas network fees.

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

- Smart contract risk in Hop and Arbitrum

- Oracle failure

- Liquidity crisis

- Systemic risk in DeFi

- Pegged assets like stablecoins can de-peg

Tutorial:

- First, I go to the Hop protocol app and connect my Ethereum wallet in the top right.

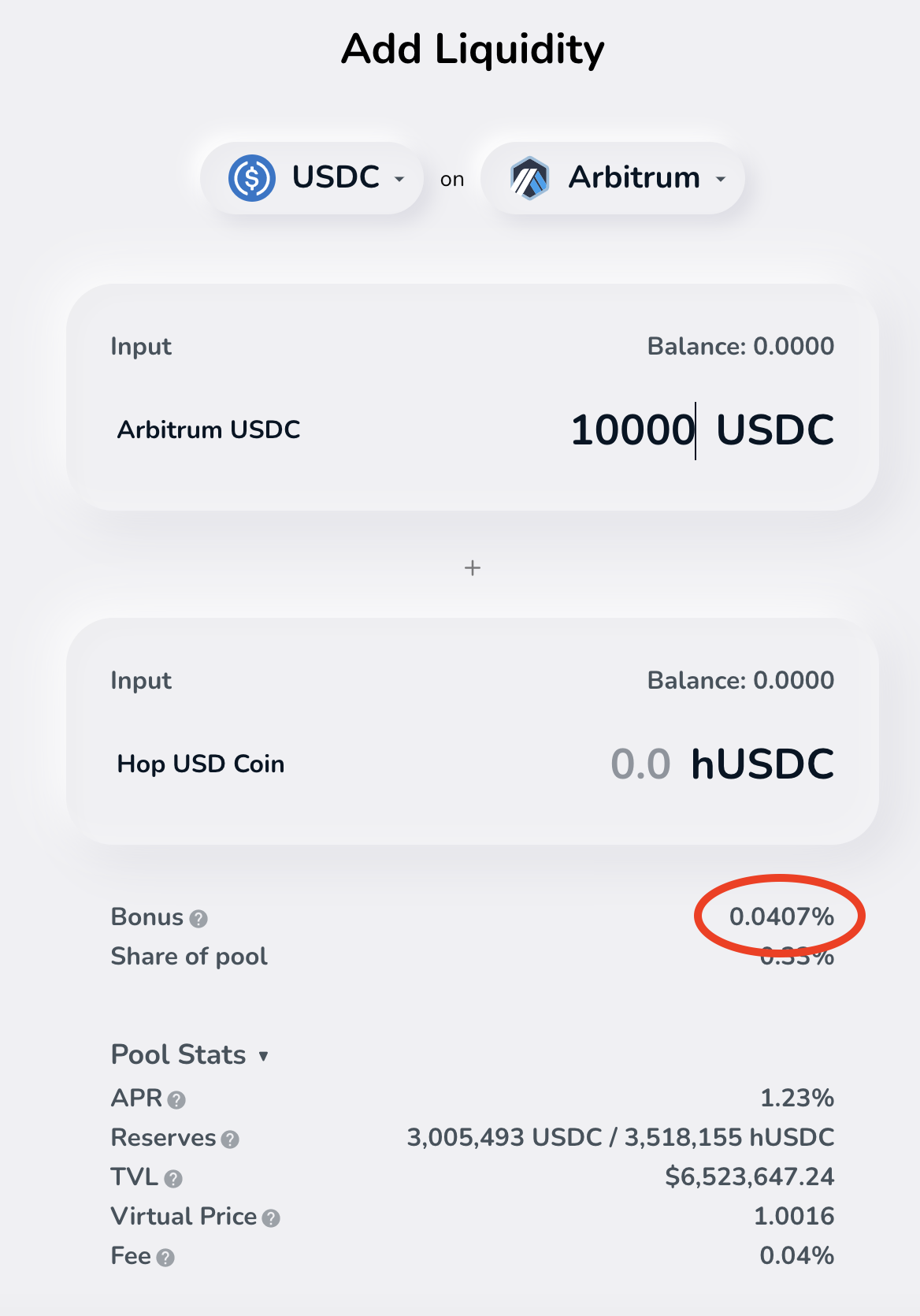

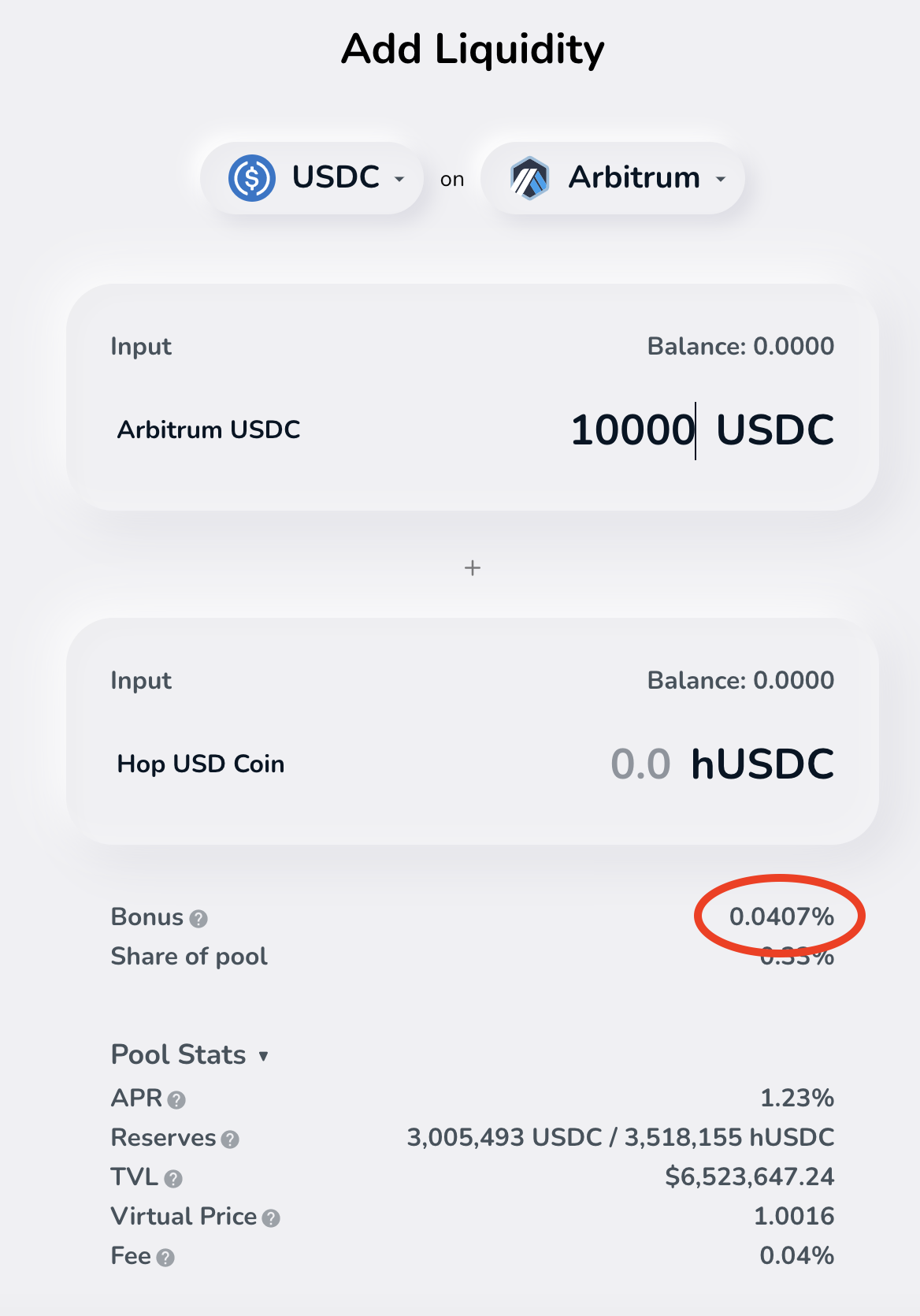

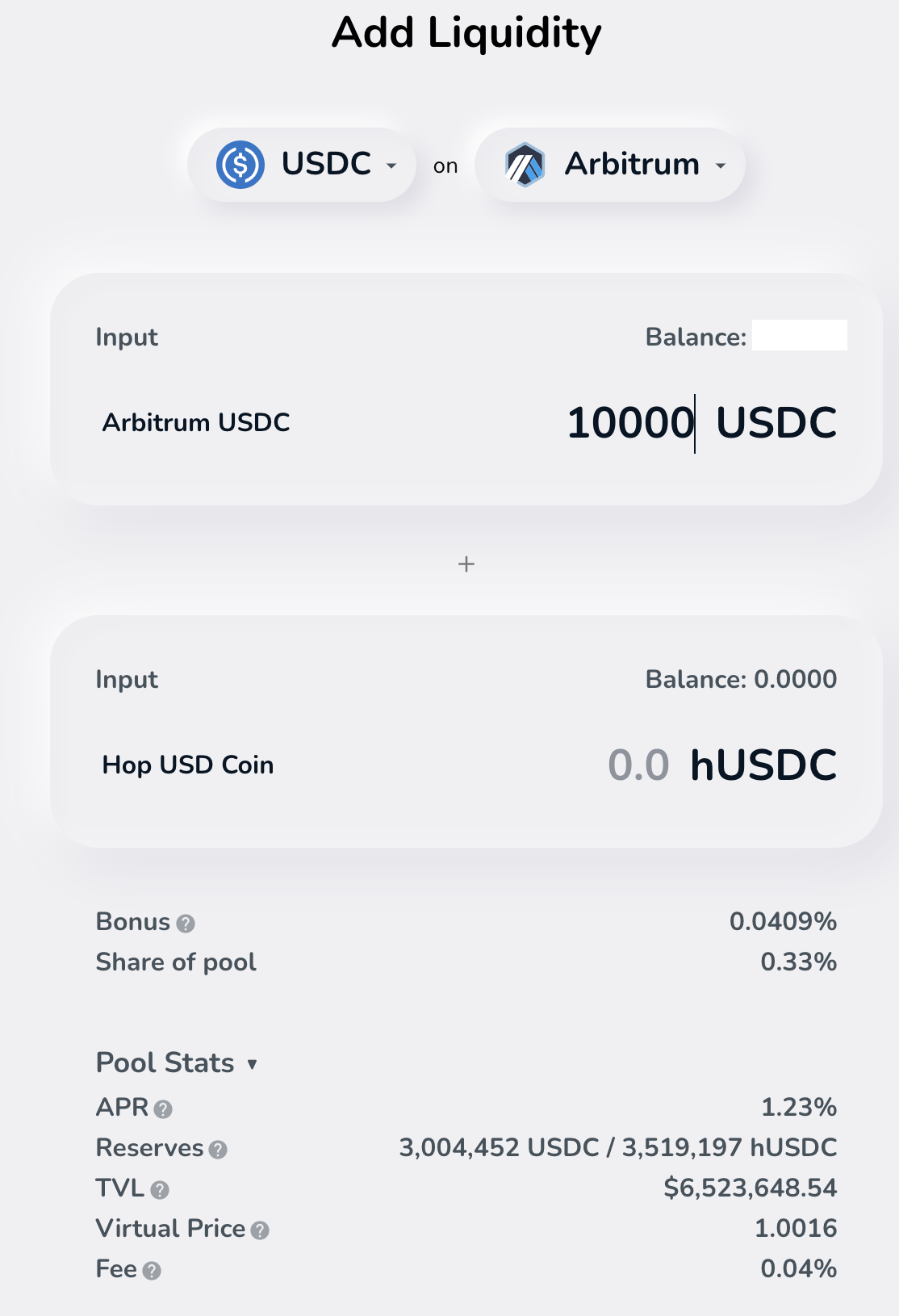

- Under the Pool tab, I can choose Arbitrum and USDC from the dropdown menus to see whether I can get positive slippage (aka a bonus) to deposit Hop tokens (hUSDC) vs depositing Arbitrum USDC (USD Coin Arb1).

- I can test entering any amount of USDC and see if the Bonus is positive or negative. Below you see an example where I would earn a larger share of the pool and hence more trading fees by depositing Arbitrum’s version of USDC (USD Coin Arb1).

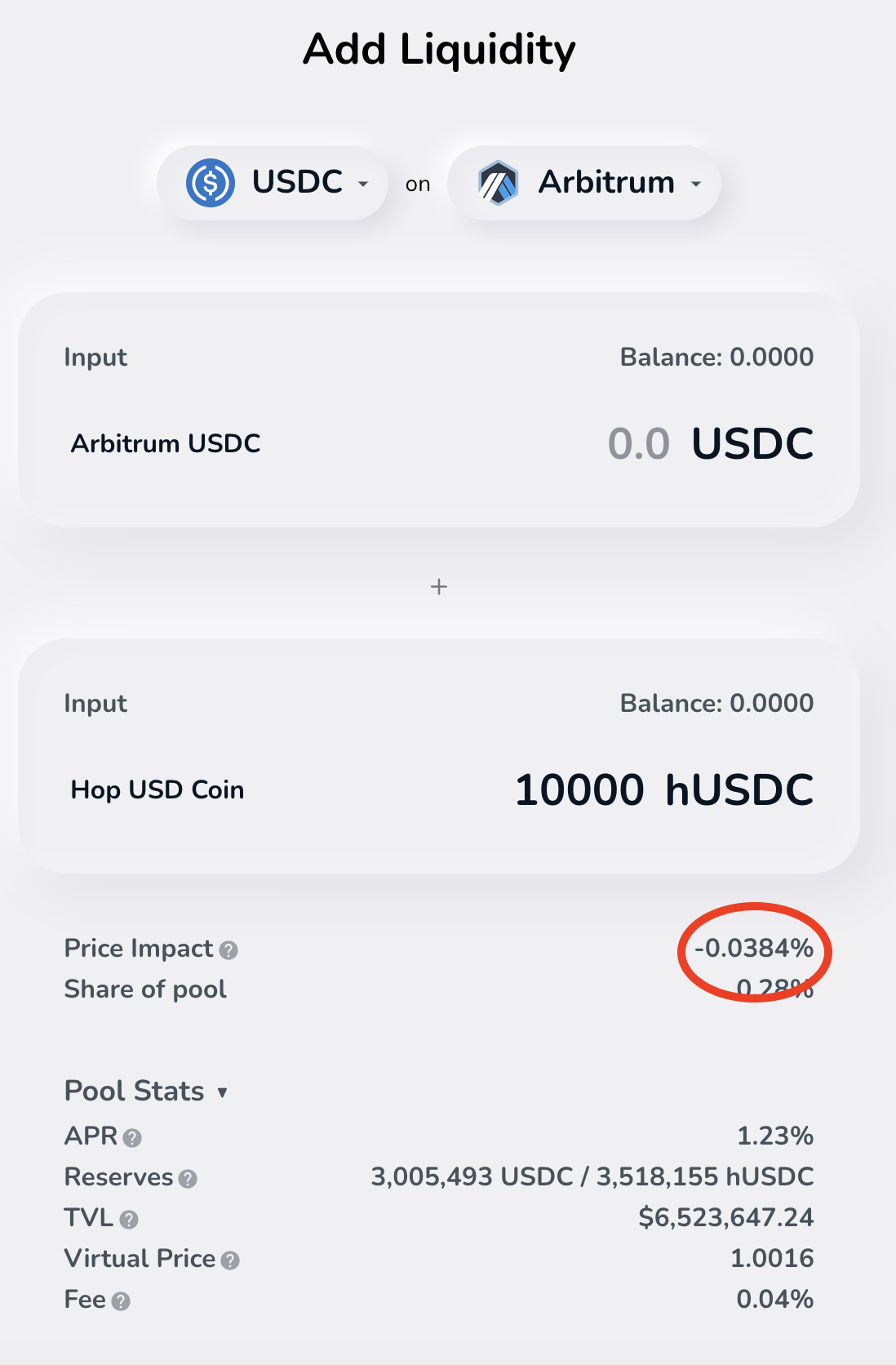

- However, if I enter more hUSDC, I get negative slippage, indicating there’s more hUSDC in the pool than what’s needed at the moment.

- Depending on whether I discover I will get a “Bonus” for depositing more USDC on Arbitrum or hUSDC, I will follow one of 2 paths below to acquire either token (hUSDC or USDC on Arbitrum) before I deposit it into the pool to maximize my yield.

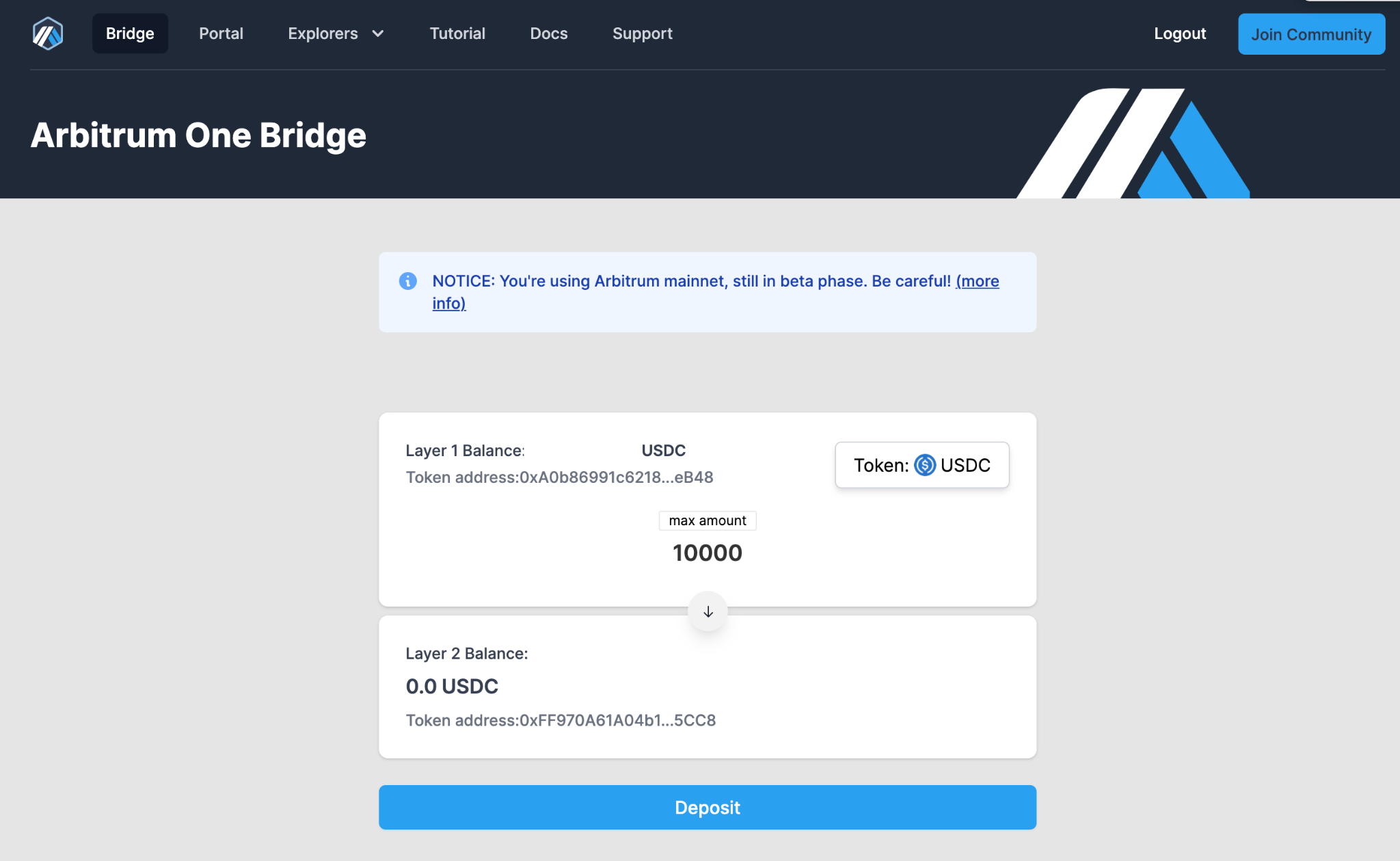

- If there’s a bonus for depositing USDC (USD Coin Arb1) on Arbitrum: I need to go through the Arbitrum bridge to transfer USDC from Ethereum to Arbitrum so I connect my Ethereum wallet and choose USD Coin Arb1 for Layer 1 to send to Layer 2. I specify how much USDC to transfer and follow the instructions after hitting Deposit, which requires 2 transactions and once done, in 10-15 mins I’ll have my USDC (on Arbitrum L2).

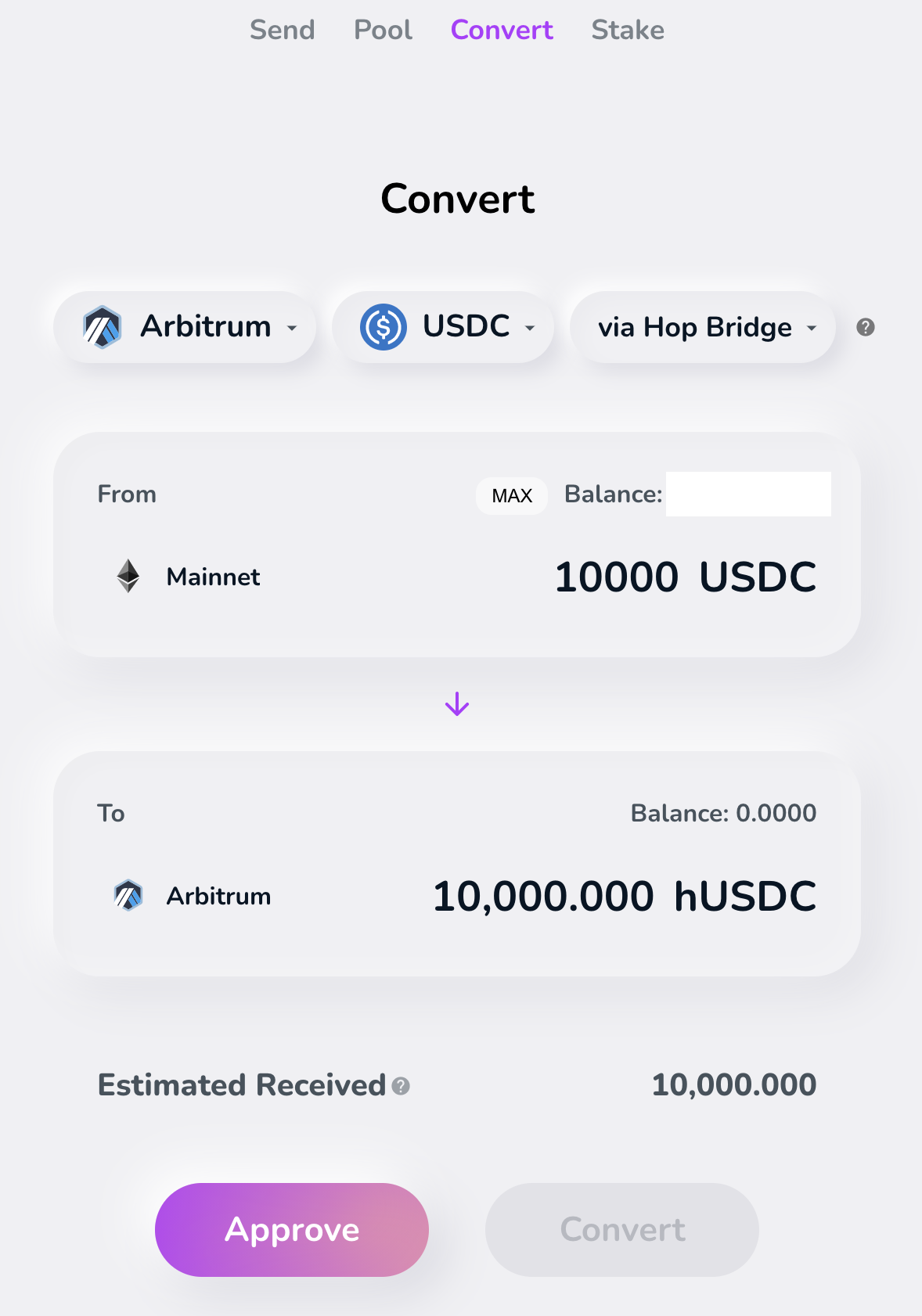

- If there’s a bonus for depositing hUSDC on Arbitrum: I would instead jump to the Convert tab here on the Hop app and choose the via Hop Bridge and Arbitrum and then specify how much USDC on Ethereum to convert 1:1 to hUSDC on Arbitrum. I follow the prompts to Approve and then Convert with 2 MetaMask transactions which will get my USDC on Ethereum converted to hUSDC on Arbitrum.

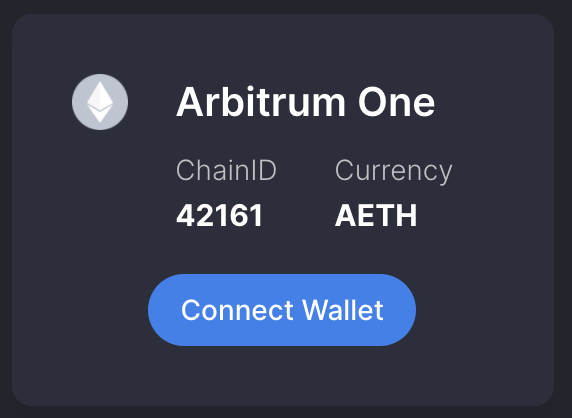

- Regardless of whether I deposit hUSDC or USD Coin Arb1 on Arbitrum to get a bonus, I can now switch my wallet to Arbitrum One settings, which are available to add to MetaMask by going to chainlist.org and search Arbitrum One and clicking Connect Wallet.

- I’m now on Arbitrum and ready to deposit either hUSDC or USD Coin Arb1 (USDC) on the Hop app under the Pool tab. I can specify depositing either hUSDC or USDC or both and follow the prompts to Approve and Deposit my tokens on Arbitrum L2.

- I’m done! Now, I can track my position under the Pool tab when I choose Arbitrum. All my earnings will accrue to my share of the Hop protocol pool of hUSDC/USDC on Arbitrum.

Disclaimer: All opinions expressed by DeFi Dad are solely his own and do not reflect the opinion of 4RC. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

About Author: DeFi Dad is a DeFi super-user, educator and investor. He and his team at 4RC (Fourth Revolution Capital) invest in teams building the next great protocol or application in DeFi, NFTs, and Web3. You can subscribe to his YouTube channel at defidad.com and follow him on Twitter.

- 7

- advice

- advisor

- airdrop

- All

- Allowing

- app

- Application

- Assets

- Biggest

- BRIDGE

- Building

- capital

- challenge

- Coin

- contract

- credit

- deal

- decentralized

- DeFi

- Demand

- Earnings

- ethereum

- exchange

- farm

- farming

- FAST

- Fees

- financial

- follow

- form

- future

- GAS

- General

- governance

- great

- Green

- Grow

- Growing

- head

- High

- How

- How To

- HTTPS

- Interoperability

- investment

- investor

- IT

- jump

- launch

- light

- Liquidity

- liquidity providers

- Long

- LP

- Market

- MetaMask

- move

- network

- NFTs

- Opinion

- Opinions

- opportunities

- Opportunity

- order

- Other

- pool

- portfolio

- price

- Program

- protocol

- research

- Rewards

- Risk

- Search

- Share

- sidechain

- small

- So

- Solutions

- Stablecoins

- start

- Strategy

- support

- surge

- Switch

- test

- token

- Tokens

- top

- track

- Trading

- Transactions

- us

- USD

- USD Coin

- USDC

- users

- utility

- wait

- Wallet

- Web3

- weekly

- WHO

- Work

- writing

- Yield

- youtube