A reckoning in the digital asset industry that started in June after the collapse of improperly collateralized investment assets gained new urgency in November. Following the professional and possibly legal improprieties that led to bankruptcy and chaos at the FTX cryptocurrency exchange, the industry is regrouping and putting distance between legitimate market participants and the grifters.

In June, I attended Crypto Connection 2022 and in September Digital Asset Summit 2022 New York and the Trading Show 2022 Chicago. Speakers and exhibitors at these shows serve the needs of institutional investors, including hedge funds, private equity groups, family offices, pension funds, and endowments. Narratives that emerged over the summer:

- differentiated cryptocurrency and blockchain technology,

- indicated that the bad actors failed,

- called for increased regulatory clarity,

- focused on protocols that worked, and

- pointed toward future innovation in digital assets.

Industry leaders, especially those seeking institutional legitimacy, are calling on market participants and regulators to set and comply with principles of sound financial management. I expect that U.S. regulators and Congress will redouble their efforts. They also received their share of criticism over the summer for not providing the digital asset industry with the rules of the new road.

Marketers face their own challenges. My technical communications firm will make the distinction between cryptocurrencies and digital-asset technologies clearer and more accurate. Meanwhile, digital asset innovation continues with a focus on blockchain technology, central bank digital currencies, and decentralized finance protocols.

This overview of the Crypto Crash of 2022 and the industry’s current state is written for interested but not crypto-obsessed financial professionals.

Blockchain is not crypto.

It’s commonly assumed that digital assets, blockchain technologies, and cryptocurrencies are one and the same. Marketers of systems, products, and investments that rely on blockchain technologies routinely explain that their products are not bitcoin, are not ether, are not meme coins, are not scams. Fairly or not, crypto has a dodgy reputation and has from the start.

Simply put, cryptocurrencies exchange value and have grown into a tradable asset class. Blockchain technologies manage data about value and mark its changes in its ownership.

The underlying blockchain technologies are expected to make it more timely, secure, and certain to record who owns what and show how ownership is transferred using public and private networks. One notable use case is the representation of physical assets and commodities by digital code or tokens so that the assets can more easily be traded in smaller amounts to a wider range of investors.

“Blockchain will revolutionize trade settlement and payments reconciliation. It’s here to stay and already proven as a means of transferring ownership for assets,” said Chris Giancarlo, former chairman of the U.S. Commodities Futures Trading Commission (CFTC) and author of CryptoDad: The Fight for the Future of Money. He spoke at Crypto Connection.

The primary idea here is to gain “operational efficiencies through a mutualized workflow,” as Arijit Das put it. He heads digital asset technology at the Northern Trust Company and spoke at the Trading Show Chicago 2022. “It’s the standardization of data and workflows that are the main problem we’re solving, not the technology. That’s where digital assets are reinventing part of the traditional financial world and workflow.”

Companies are pointing out their blockchain credentials over their crypto credentials. “Our focus is on blockchain, not crypto,” said Neil Chopra, director of business solutions and strategy at Fireblocks, a provider of secure digital asset infrastructure for institutions, at Crypto Connection. “We are taking what people are doing today and mapping it to blockchain.”

Underscoring differentiation between crypto and blockchain since the summer, the digital-assets payments firm Circle started running the advertising campaign “Benjamin Meet Blockchain” in mid-October 2022. I love it and used photographs of its street ads in Chicago to illustrate this article, another in a series of posts I have published on payments and cryptocurrency advertising.

Circle issues the USDC stablecoin, which “serves as a digital dollar currency” and is backed one-to-one by U.S. dollars. The firm is committed to “the tokenization of all things,” a reference to the use case of digitally representing physical assets like real estate with digital asset tokens. Stablecoins like USDC provide an immediate means of exchange in trading digital assets, bringing increasing regulatory scrutiny.

I’ve learned about other blockchain-based systems over the years, including BanQu. The platform tracks the provenance of all the materials that go into manufactured goods, whether industrial or agricultural. Brands can trade raw materials, and the farmers and laborers, many unbanked, that produce raw materials get credit.

It seems ironic that it’s covered in an article I wrote titled ICOs and BTC. The controversy of the week in December 2017 concerned the by-then dodgy reputation of initial coin offerings and the need for U.S. securities regulators to step in, which they did. The event was the launch of bitcoin futures on the Chicago Mercantile Exchange.

The bad actors are getting weeded out.

Financial markets go through crises. It’s a familiar story involving illiquidity, insolvency, or both. Bloomberg’s Matt Levin explains the mess in relation to the latest crisis in the cryptocurrency investment market—the FTX exchange run and bankruptcy—in one of several columns he’s written on FTX.

The 2022 crypto-investment crash started in mid-May when Terra Luna, a stablecoin that was not backed by national currencies on a one-to-one ratio, collapsed. So did Celsius, a lender of cryptocurrencies that promised high returns to investors. Others followed.

These events were generally referred to as crypto’s “dot-com moment,” where the fluffy business cases, the cons, and the scams collapsed, leaving the real businesses to regroup and thrive. That happened with the initial build-out of today’s tech giants, and now it’s happening in the initial build-out of internet-native value-transfer businesses. Conference speakers used references like “the events of the last week,” “what’s been happening,” and “what happened last week.” In September, it was “the recent sequence of events,” “3AC,” a reference to the misdeeds of Three Arrows Capital.

Like many people in the industry, I thought this would be it: just another seasonal downturn. Then in the first week of November, we saw the drama of FTX and Sam Bankman-Fried, one of the summer’s heroes. As it turned out, FTX held $1 billion in liquid assets against $9 billion in liabilities, reports the Financial Times. Sam Bankman-Fried, his inner circle, or both authorized transfers of client money from the exchange into a “sister company” that made risky bets and invested in undercollateralized assets, namely the collapsed stablecoin Luna.

Coindesk all but predicted the coming crash. A run on the exchange engendered a liquidity crisis that quickly showed itself as an insolvency. As with many financial excesses, the signs were there but ignored.

The FTX chaos was initially referred to as the market’s Lehman moment, the event that purportedly led to the Great Recession. By the end of the first week, it’s more appropriately referred to as its Enron moment. As I was preparing to publish this article, the new FTX CEO, who supervised the Enron liquidation, called the mismanagement the worst he’s seen in his 40-year career.

“Crypto summer,” an early term for the downturn, seems quaint now. The Crypto Crash of 2022 is more apt.

Market participants who followed the rules are angry. Even in September, one Digital Asset Summit speaker gave a blunt assessment of the uncollateralized lending that led to failed firms in May and June. “It was a good thing to have them fail. What happened to them, they deserved.”

Let’s pause for some perspective.

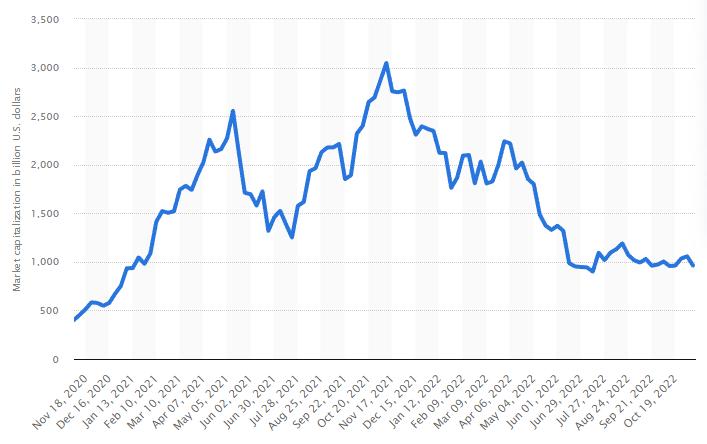

To put it in perspective, however, this is not a systemic financial crisis, though it’s tough for those institutions and traders that had significant exposure to FTX. The total market for crypto at the beginning of November 2022 was about $1 trillion, down $2 trillion from its November 2021 high. The U.S. stock market alone was worth more than $46 trillion at the end of September 2022. Crypto is a rounding error, as people like to say.

Crypto Market Capitalization November 2020-22

Source: Statista

Estimates of the losses from FTX are hard to come by. Initial reports suggested that as much as $2 billion in client funds were at risk. Paper losses industry-wide will be much larger, especially if you start counting in May. Bloomberg put that figure at $96 billion for the crypto billionaires. Enron shareholders lost $74 billion.

It’s also an eventful time. Elon Musk’s Twitter drama tops the most-read article list at Bloomberg, followed by the Republican party taking the House of Representatives and investigations into Taylor Swift ticket sales. FTX is second at the Financial Times, topped only by the worsening economic outlook in the UK.

Regulatory certainty is critical.

The FTX bankruptcy and its fallout is further evidence for the other theme of the summer digital asset conferences: the need for regulatory clarity for institutional investors to adopt digital assets as a serious alternative asset class.

“When you start trading at scale, investors want to know the rules,” Northern Trust’s Das said at the Trading Show Chicago. “You have to have well-thought-out, effective regulations so real money can come into the market, and it can reach its potential.”

In that regard, the Global Digital Asset and Cryptocurrency Association is calling for industry leaders to agree on principles for compliance and governance. “The Global DCA believes that this dark moment presents an enormous opportunity for firms to come together and agree on a certain set of fundamental core principles,” states the self-regulatory organization’s open letter to the industry.

After FTX, U.S. Treasury Secretary Janet Yellen stated that the debacle shows the need for crypto regulation, Bloomberg reported. The Block wrote that Senator Pat Toomey, Republican from Pennsylvania and ranking member of the Financial Institutions and Consumer Protections committee, slammed Congress for failure to produce crypto regulation in a timely fashion.

A Digital Asset Summit panelist also pointed to Congress. “Congress has to step up,” she said. A speaker at Crypto Connection told attendees to expect state and federal agencies to start moving quickly on regulation in the industry. Then again, I wrote that more than four years ago in The State and Cryptocurrency.

At Crypto Connection, CFTC Commissioner Kristen N. Johnson made the nuances of regulation interesting. She suggested an approach that described the legal and regulatory nuances required to produce thoughtful regulation and explained the “complementary jurisdiction” between the CFTC and SEC. She characterized the CFTC’s approach as “responsible innovation combined with appropriate enforcement.”

At the same time, U.S. regulation alone is insufficient. As conference speakers often pointed out, digital asset trading markets are global and don’t close at 5 p.m. like traditional markets. Cryptocurrency markets also settle trades immediately, rather than two days after the trade. That requires secure, global infrastructure and regulation designed for digital assets.

Crypto investors, whether they trade for hedge funds, invest for venture capital firms or are individual retailer investors trying to get rich, need to know that regulators will not save them.

“With digital assets, one hundred percent of your transaction is at risk. Every single time, every transaction or trade,” said Chuck Lugay at Digital Asset Summit. He heads execution services at sFox, which provides a cryptocurrency trading platform. “There is no recourse. The usual investor protections do not exist.”

Code is reliable, people are not.

The losses and bankruptcies in during the crisis stemmed largely from firms where executives acting on their own made decisions contrary to the practices of sound risk and financial management. Celsius, the digital asset lender that collapsed in June, and FTX are examples of such centralized finance (CeFi) firms.

Decentralized finance (DeFi) protocols, where code rules, worked. CeFi exchanges and firms, where executives made the final calls did not, and they collapsed. That’s another redemptive narrative for the digital asset industry and its developing technology. I heard it throughout the summer.

DeFi protocols are built with code that limits risk by design. Positions in cryptocurrencies and other cryptotoken-based investments are automatically liquidated when risk thresholds are exceeded, whether by individual investors or borrowers or the platform as a whole. It’s coded in, and the code executes the correcting transaction automatically.

“DeFi performed as expected and avoided the losses,” said Dan Morehead, CEO at Paterna Capital, creator of the first U.S. blockchain hedge and VC funds. “The centralized lenders shafted customers. The DeFi protocols did what they said they would do.” He spoke at the Digital Asset Summit. Paterna’s response to FTX focuses on the importance of DeFi.

Even so, investors in DeFi protocols are betting on teams creating projects. You do need to know who those teams are, what their experience is, what they intend their projects to do, and what problems they are solving. In other words, investors need to perform due diligence before they invest funds. It seems pretty clear that due diligence got short shrift in the 2021 frenzy for high-yield crypto investments.

The other difficulty, in the long run, is that regulated investors and financial institutions are unlikely to play an important role in DeFi. Institutional money—the big money that can grow markets—will not move into unregulated markets. The institutional investors that made crypto investments are likely to be held up as cautionary tales for some time.

At the same time, regulation is not likely to catch up with the latest technologies soon. I heard one talking about the unfairness of automated liquidation for consumers, that the time frames were too short. That sounds like a good thing now.

It’s still early, early days!

One thing I haven’t heard is that phrase to avoid responsibility: “mistakes were made.” During several presentations, speakers talked about how the industry got ahead of itself during the summer of 2021. Demand for “product” was high. Investors expected increasingly high yields, and one vendor or another was glad to offer it in any way they could.

Several speakers and exhibitors at the Digital Asset Summit took a high degree of responsibility, essentially saying, “We had a hard time keeping pace with demand. We knew that if we didn’t fill it, one of our competitors would. We took some shortcuts in our development.”

The best excuses are true. The best one I heard during the summer: “It’s early days. Early, early days. We’re in the early days.”

Now it’s time to build.

Despite the Crypto Crash of 2022, digital asset innovation shows little sign of stopping. Investment money is no longer gushing into crypto and blockchain firms as it did in 2021, but the spigot tightened for technology in general.

Exhibitors at Digital Asset Summit told me that the downturn in crypto investments is providing a well-needed breather, conference exhibitors said. I heard things like, “We have time to go back and correct some of the problems we know our products have.” Security and risk management topped their lists.

In the middle of November, as the FTX situation unravels, digital asset innovation looks more robust than fixing existing systems. Companies are announcing new initiatives across digital asset market segments. Here are a few I saw posted on LinkedIn:

To temper the optimism, the Australian Securities Exchange canceled its blockchain-based clearing system in mid-November. The exchange wrote off some $170 million USD.

I still believe that it’s a technological inevitability that a new financial system will be built using the technologies of cryptography, immutable and shared blockchains, and the public internet or private alternatives. The case for fractional ownership of hard assets and commodities is compelling. So is the ability to track asset ownership in more efficient and transparent ways. So is the opportunity to open investment asset classes to investors who could not afford the high price of entry while having knowledge of the risks they are taking and the rewards they can gain.

“There certainly will be a new financial system built on the back of new technology,” one Digital Asset Summit exhibitor said. “It takes time and money and effort. That’s why we’re all here.”

Disclosures

My firm is a member of the Global Digital Asset and Cryptocurrency Association.

Northern Trust is one of our clients.

I have investments in various cryptocurrencies and DeFi protocols: not enough to get rich but not enough to become poor either.

A colleague criticized me this week for not setting up self-custody of my digital assets, relying instead on crypto exchanges for digital-asset protection. Own your keys, own your crypto, as the adage goes.

- ant financial

- blockchain

- blockchain conference fintech

- blockchain technology

- chime fintech

- coinbase

- coingenius

- crypto conference fintech

- cryptocurrency

- Cryptofinance

- Digital Assets

- fintech

- fintech app

- fintech innovation

- FinTech investment

- fintech regulation

- Fintech Rising

- Future of Money

- Global Digital Asset and Cryptocurrency Association

- Innovation

- OpenSea

- payments

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stablecoin

- stripe

- tencent fintech

- xero

- zephyrnet