The US dollar surges on Ukrainian nuclear fears

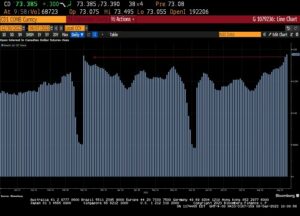

Notably, the US dollar did not experience any relief flows seen in energy and equity markets overnight in New York, as US yields held onto their gains of the previous session. The rising price of commodities increases demand for US dollar, as does Ukraine haven flows, and should continue to support the greenback into the weekend. The dollar index rose by 0.38% to 72.73 overnight, climbing another 0.20% to 97.925 as the headlines of a Ukrainian nuclear plant fire in Zaporizhzhia hit the wires this morning.

By contrast, the euro suffered overnight, EUR/USD sliding 0.50% to 1.1060 overnight, and falling another 0.30% to 1.1030 this morning. The single currency is guilty by geographic association now and the nuclear headlines today will not help its cause. Having fallen through 1.1100 overnight, EUR/USD’s next level of importance is a two-decade support line that lies at 1.0800. EUR/USD could still potentially see a relief rally if an Iranian nuclear agreement is announced but will struggle to recapture 1.1200.

GBP/USD fell by 0.45% to 1.3350 overnight, easing to 1.3345 this morning. It has double bottom support at 1.3275, failure of which signals deeper losses. Like EUR/USD, it has the potential to stage headline-driven relief rallies. Overall, even as the Zaporizhzhia situation eases, European currencies are likely to remain offered as yet another risk factor is introduced into the Ukraine conflict.

AUD/USD and NZD/USD both rose overnight and continued climbing today. I have been waiting for both to catch a commodity tailwind and it seems that that time is now upon us. Put simply, Australia, and to a lesser extent New Zealand, grow, pump or dig out of the ground, all the stuff that the world is desperate to by right now at seemingly any price.

USD/JPY is trading at 115.45 today, roughly midrange for the week. It is capped at 115.80 with support at 114.75 as the yen is bounced between domestic haven flows and yield differential outflows. Asian currencies are mixed with the Indian rupee and Korean won notable losers, while the Indonesian rupiah and Malaysian ringgits remain steady. That is probably an easy way to play the commodity price story at the moment from an Asian perspective. Currencies across the region are likely to remain soft into the weekend as investors hedge risk in US dollars.

- across

- Agreement

- All

- announced

- Another

- Association

- Australia

- Catch

- Cause

- Commodities

- commodity

- conflict

- continue

- could

- currencies

- Currency

- deeper

- Demand

- DID

- Dollar

- dollars

- double

- easing

- energy

- equity

- Euro

- European

- experience

- Failure

- Fire

- Grow

- having

- Headlines

- help

- HTTPS

- importance

- index

- Investors

- Iranian

- IT

- Korean

- Level

- Line

- Markets

- mixed

- New York

- New Zealand

- perspective

- Play

- price

- pump

- rally

- relief

- Risk

- Risk Factor

- Stage

- support

- the world

- Through

- time

- today

- Trading

- Ukraine

- us

- US Dollar

- week

- weekend

- world

- Yen

- Yield