The price of Ethereum ($ETH), the second-largest cryptocurrency by market capitalization, has managed to remain above the $1,800 mark after the U.S. Securities and Exchange Commission cleared the path for spot Ether exchange-traded funds last month, with ETH whale accumulation intensifying since then.

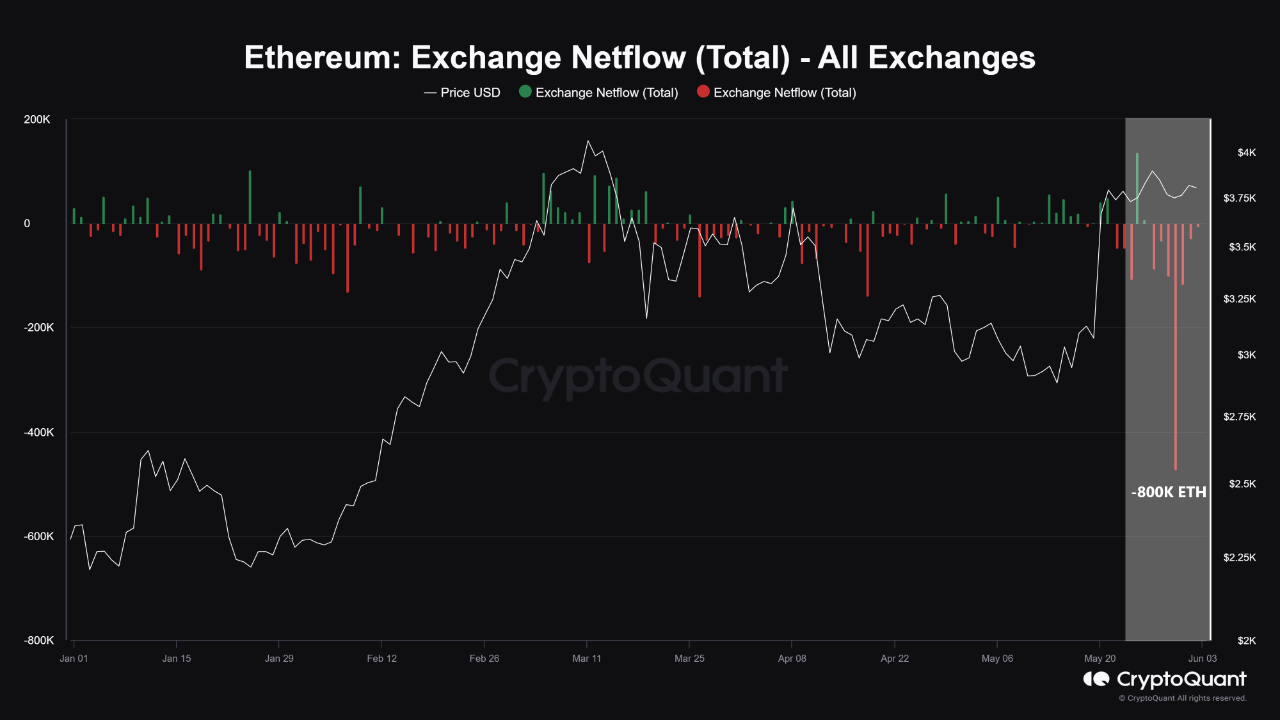

According to an analyst from cryptocurrency analytics firm CryptoQuant, over 800,000 ETH worth around $3 billion has moved off of centralized cryptocurrency exchanges in little over a week.

The analyst noted that institutions preparing for a spot Ethereum ETF to start trading in the United States could be behind the centralized exchange outflows in a bid to meet the potential demand from investors for such a fund.

The data comes as the first leveraged Ether ETF was launched in the United States, with the Volatility Shares 2x Ether ETF (ETHU), set to start trading on June 4 after securing approval from the U.S. Securities and Exchange Commission.

Notably IntoTheBlock, a cryptocurrency intelligence firm, has noted that whale accumulation has recently intensified, with 41% of the supply of the second-largest cryptocurrency now being held by addresses with more than 1% of its total circulating supply, up from 36% at the beginning of the year.

<!–

–>

Per the firm, the trend highlights the increasing confidence in ETH among large holders.

As CryptoGlobe reported, last month data revealed that then umber of smaller Ethereum investors, those holding 10 ETH or less, recently climbed to a new all-time high while larger investors were seemingly still lagging behind after divesting most of their funds over the last few months.

Before any trading can begin, issuers of spot Ether ETFs must receive the go-ahead on their S-1 registration statements, with the SEC having no set deadline to review these filings.

The SEC’s ongoing investigation into Ether has intensified over the last few months, especially after the network’s transition to a Proof-of-Stake protocol.

Should Ether be classified as a security, it could provide the SEC with a basis to deny the applications for spot Ether ETFs. Nevertheless, the surge led to the spike in small ETH holders while seeing the cryptocurrency’s trading volume explode.

Featured image via Unsplash.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2024/06/ethereum-whale-accumulation-intensifie-as-over-3-billion-worth-of-eth-leaves-exchanges/

- :has

- :is

- :not

- $3

- $UP

- 000

- 10

- 31

- 7

- 800

- 9

- a

- above

- accumulation

- addresses

- Ads

- After

- All

- alt

- among

- an

- analyst

- analytics

- and

- any

- applications

- approval

- around

- AS

- At

- basis

- BE

- begin

- Beginning

- behind

- being

- bid

- Billion

- by

- CAN

- capitalization

- centralized

- centralized cryptocurrency

- centralized exchange

- circulating

- classified

- Climbed

- comes

- commission

- confidence

- could

- cryptocurrency

- CryptoGlobe

- cryptoquant

- data

- deadline

- Demand

- especially

- ETF

- ETFs

- ETH

- eth whale

- eth worth

- Ether

- ethereum

- ethereum whale

- exchange

- exchange-traded

- exchange-traded funds

- Exchanges

- few

- filings

- Firm

- First

- For

- from

- fund

- funds

- having

- Held

- highlights

- holders

- holding

- HTTPS

- image

- in

- increasing

- institutions

- Intelligence

- intensified

- intensifying

- into

- intotheblock

- investigation

- Investors

- issuers

- IT

- ITS

- jpg

- june

- lagging

- large

- larger

- Last

- launched

- Led

- less

- leveraged

- little

- managed

- mark

- Market

- Market Capitalization

- max-width

- Meet

- Month

- months

- more

- most

- must

- Nevertheless

- New

- no

- noted

- now

- of

- off

- on

- ongoing

- or

- outflows

- over

- path

- plato

- Plato Data Intelligence

- PlatoData

- potential

- preparing

- price

- Proof-of-Stake

- protocol

- provide

- receive

- recently

- Registration

- remain

- Reported

- Revealed

- review

- s

- Screen

- screens

- SEC

- second-largest

- securing

- Securities

- Securities and Exchange Commission

- security

- seeing

- seemingly

- set

- Shares

- since

- sizes

- small

- smaller

- spike

- Spot

- start

- statements

- States

- Still

- such

- supply

- surge

- than

- that

- The

- their

- then

- These

- this

- those

- to

- Total

- Trading

- trading volume

- transition

- Trend

- true

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- United

- United States

- use

- Volatility

- volume

- was

- week

- were

- Whale

- Whale Accumulation

- while

- with

- worth

- year

- zephyrnet