Not all investors are born equal. That’s a sad but true fact in the global investment market. If you were a regular individual investor, the market only provides limited options to you, and you will never be able to trade and invest like an accredited/institutional investor or venture capitalist.

Rules like this exist because financial regulators believe that individual investors can’t handle “risky investment” very well, such as investing in a startup. To many, however, this is arguably not the best approach for risk management and making plenty of investment opportunities out of reach for individual investors.

Besides regulations, some of the asset classes’ entry barriers could be substantially higher than others, making them inaccessible to the mass public.

Decentralized finance, or DeFi, is set to change all these. It is open, not controlled by a central source, and global. These qualities remove hurdles limiting early-stage investing to only a handful of investors and allows anyone to participate. Protocols like Convergence could be a gateway for individual investors to tap into the private investment market. So, let’s look at what private investment opportunities Convergence Finance can unlock for the public.

Fractionalized NFT

NFT accompanied much fanfare recently after Christie’s auctioned Beeple’s “Everydays: The First 5000 Days” for $69 million in March, making him among the top three most valuable living artists globally. The NFT market has been expanding exponentially long before Beeple’s piece went to auction. Data from NonFungible.com shows that NFT sales surged to over $2 billion in 1Q21, over 20 times more than the previous quarter. The number doesn’t include Beeple’s $69 million piece and the sales from NBA Top Shots, a platform that sells NBA highlights as NFTs.

Figure 1: Beeple’s “Everydays: The First 5000 Days”

Figure 2: Highlight of New Orleans Pelicans’ Zion WIlliamson

Even though the NFT market is flourishing, investors can potentially find meaningful investment opportunities there; however, many investment-grade NFTs often come with a hefty price tag, which not everyone can afford comfortably. That’s why breaking down the NFT investment could become a new trend for the digital collectible market.

Fractionalized high-priced NFT artwork allows investors to participate in the higher end of the market, bringing a more significant upside than those in the lower end of the spectrum.

This is where Convergence Finance comes in. Convergence can fractionalize a high-priced NFT and present them as wrapped tokens, making them tradeable on ConvX, Convergence’s AMM. The built-in smart contract pre-set a time frame that the NFT will be held in the system. When it expires, the system will sell the NFT in the market, investors who have the NFT-represented wrapped tokens will be able to share the profit according to their shares.

This is how Convergence could break into the fractionalized NFT market.

Private-Sale Tokens

Leveraging ConvX infrastructure, Convergence can also provide private-sale tokens of new crypto projects, a field that has been exclusively for private investors and crypto VCs.

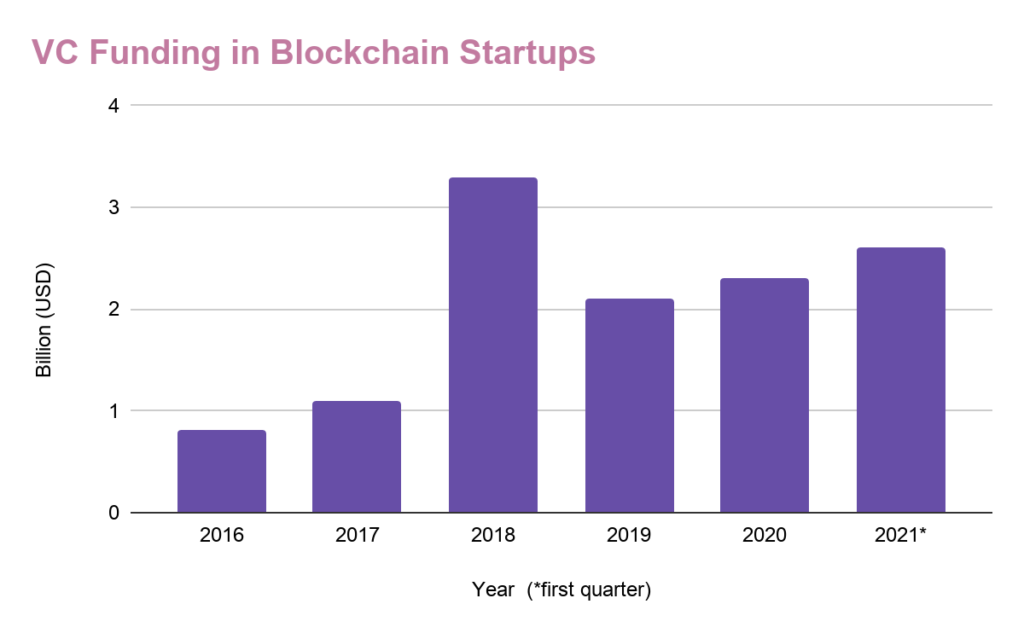

Early-stage investing in crypto projects may not be familiar to regular individual investors. Still, the swiftly growing appetite of crypto VCs on blockchain startups and crypto projects is quite notable.

Reports from Bloomberg show that crypto VCs and private investors have poured a record $2.6 billion in the first quarter of 2021, which is more than all in 2020. Those investments have spread across 129 crypto and blockchain firms.

Although crypto VC’s desire to invest in new crypto projects is high, they are also subjected to certain limitations. For example, when a private equity firm is an early-round investor of a crypto project, the firm usually would receive a block of private-sale tokens. These private-sale tokens are often bounded by a Simple Agreement for Future Tokens agreement or SAFT. These pre-sale tokens are also subjected to a lockup period. The only way they can sell these tokens before it is publicly listed is to go through the OTC market, which is relatively untransparent.

Convergence could be the way out. Private investors could take advantage of Convergence’s ConvX by wrapping their private-sale tokens and put them into a liquidity pool on Convergence. Such a move allows private investors to exit their positions earlier. At the same time, DeFi users can purchase pre-listing tokens at a discounted price and enable them to have a private-sale exposure through Convergence.

Shares of Private Companies

Convergence allows shares of pre-IPO companies to be traded by any DeFi users using the same token wrapping mechanism.

Like early-stage crypto projects, private company investment has primarily remained a game for a small group of investors. They are mostly VC firms or other institutional investors. Retail investors are hardly able to get into this market.

Imagine how great it would be if a DeFi user can buy shares of private companies like SpaceX on Convergence using crypto. This could be a game-changer for the early investors who bet on startup companies because they can take profit with the help of the liquidity in the DeFi space. For retail investors, this could be the first time they can purchase private companies’ shares using cryptos.

Conclusion

The world of DeFi is an ever-changing place. Blockchain technology and emerging web 3.0 applications are changing the way we invest in real assets. Convergence is set to push the limit further and demoralize assets previously unavailable to the mass public. That’s not only limited to NFTs, pre-sale tokens, and shares of private companies. There could be unlimited possibilities with Convergence, and the sky is the limit.

Guest post by Oscar Yeung from Convergence Finance

Oscar Yeung is the Co-Founder of Convergence Finance. He brings his expertise in tokenization to the world of DeFi. He is also the COO of Liquefy, a leading crypto firm in Asia. Prior to his ventures in the blockchain space, he worked as a Global Markets Analyst at Deutsche Bank.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.

Source: https://cryptoslate.com/exploring-fractionalized-nft-and-private-sale-tokens/

- 2020

- ADvantage

- Agreement

- All

- among

- analyst

- appetite

- applications

- article

- Artists

- asia

- asset

- Assets

- Auction

- Bank

- barriers

- BEST

- Billion

- blockchain

- blockchain technology

- Bloomberg

- buy

- change

- CNBC

- Co-founder

- Companies

- company

- contract

- coo

- crypto

- data

- DeFi

- Deutsche Bank

- digital

- Early

- equity

- Exit

- expanding

- finance

- financial

- Firm

- First

- first time

- fund

- future

- game

- Global

- great

- Group

- Growing

- High

- Highlight

- How

- HTTPS

- Hurdles

- index

- Infrastructure

- insights

- Institutional

- institutional investors

- investing

- investment

- Investments

- investor

- Investors

- IT

- join

- leading

- LEARN

- Limited

- Liquidity

- Long

- Making

- management

- March

- Market

- Markets

- million

- move

- NBA

- New Orleans

- NFT

- NFTs

- open

- Options

- OTC

- Other

- platform

- Plenty

- pool

- present

- price

- private

- Private Equity

- Profit

- project

- projects

- public

- purchase

- regulations

- Regulators

- retail

- Retail Investors

- Risk

- risk management

- sales

- sell

- set

- Share

- Shares

- Simple

- small

- smart

- smart contract

- So

- Space

- SpaceX

- spread

- startup

- Startups

- system

- Tap

- Technology

- time

- token

- Tokenization

- Tokens

- top

- trade

- Updates

- users

- VC

- VCs

- venture

- Ventures

- Wealth

- web

- WHO

- world