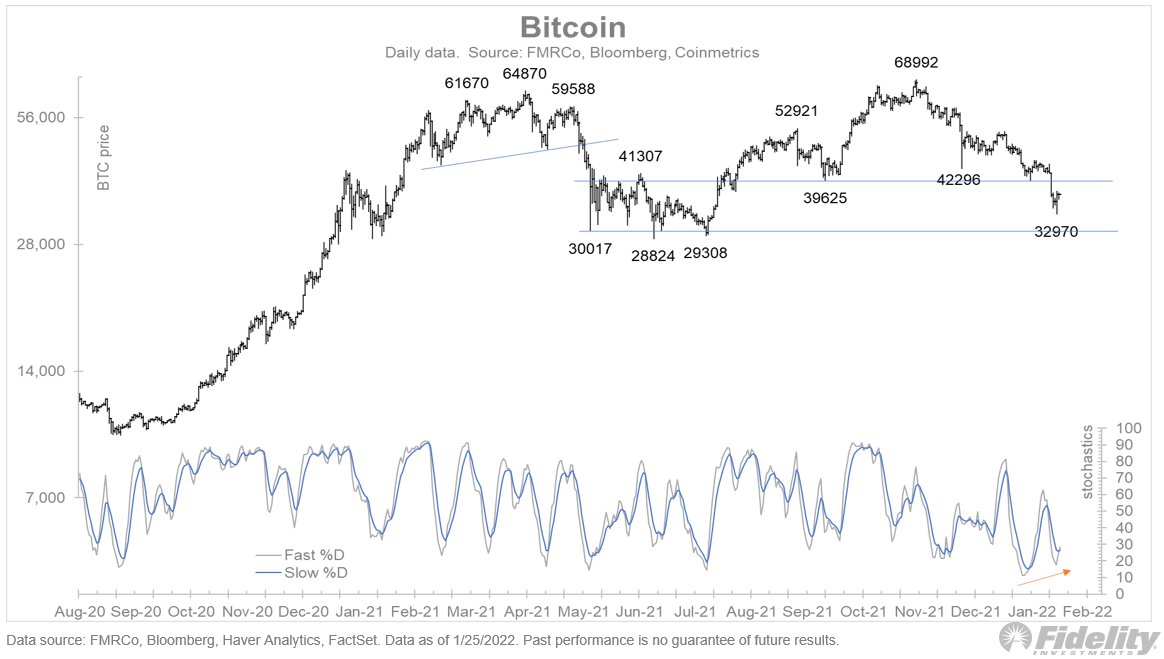

Jurrien Timmer, a macro strategist at financial giant Fidelity, is revising his outlook for Bitcoin (BTC) after the leading cryptocurrency dipped below a key price level.

In a thread to his 86,700 Twitter followers, Timmer says that he was surprised to see Bitcoin not hold the line at $40,000 after falling steadily from its November all-time high above $69,000.

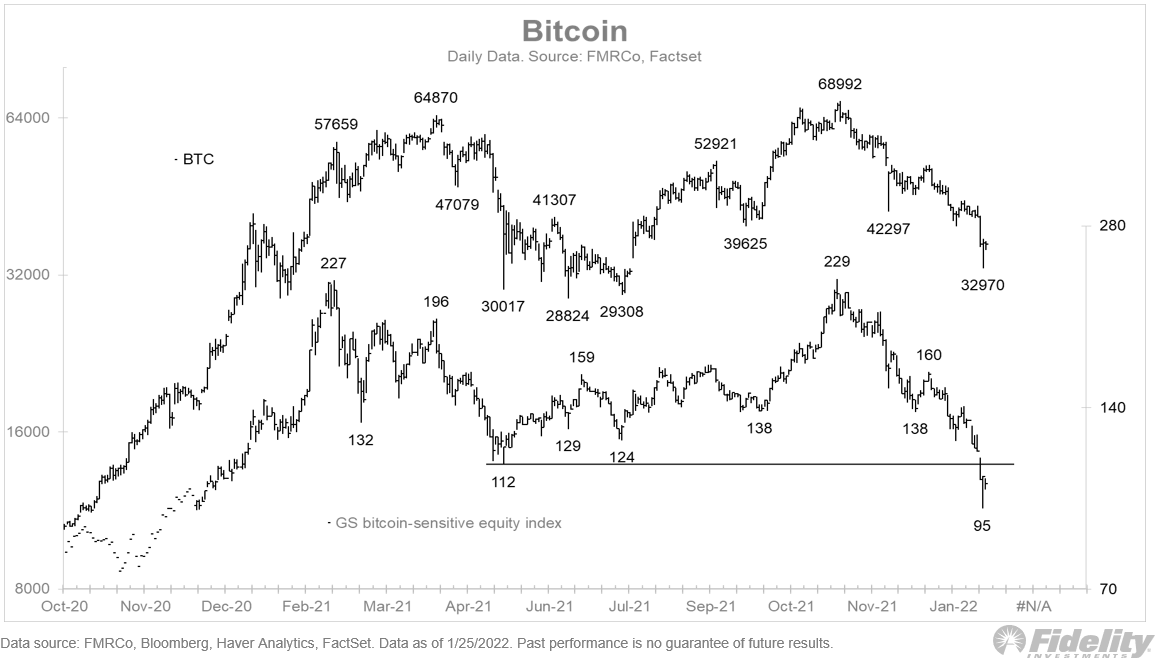

“It has been a bad trip for crypto. The GS [Glassnode] Bitcoin-sensitive equity basket already took out its 2021 lows – not a great sign.

I thought $40k would be a bottom, based on my demand model and on-chain dynamics (via the dormancy flow indicator), but here we are at $35k.”

Next citing past trends of weak hands capitulating to strong hands, Timmer does see the potential for Bitcoin to reverse course and rise once again.

“Bitcoin often overshoots the upside and downside, though, so maybe that’s all that is happening here.

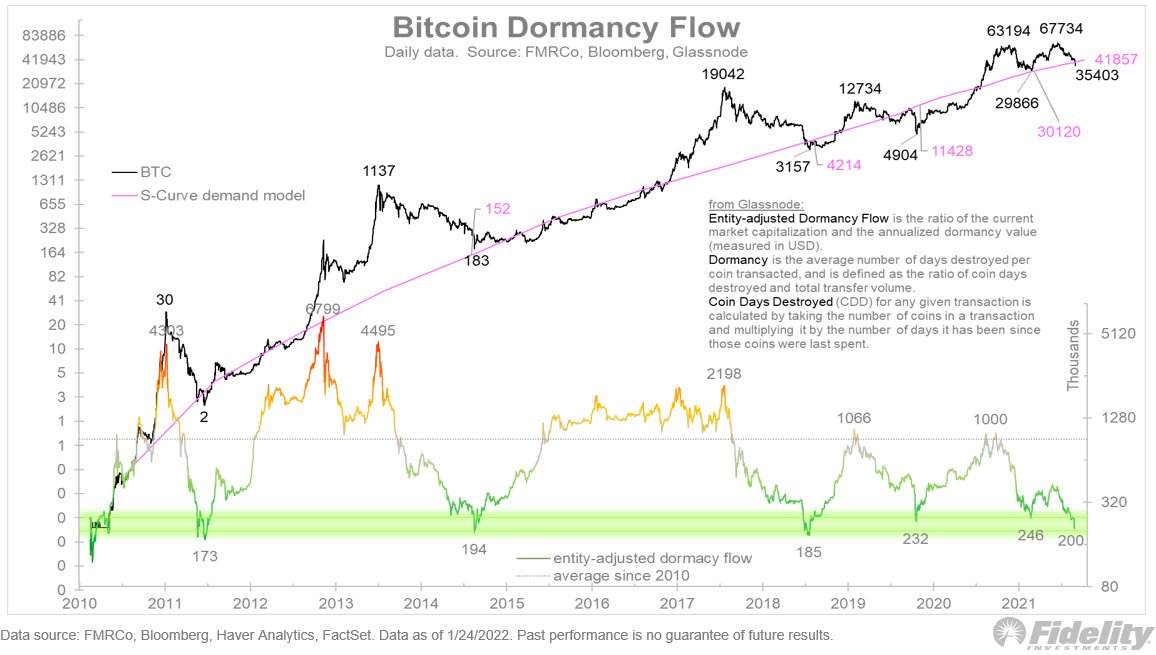

Here is the ‘entity-adjusted dormancy flow,’ which measures the transfer from weak hands to strong hands. It is in the range that has stopped every previous decline.”

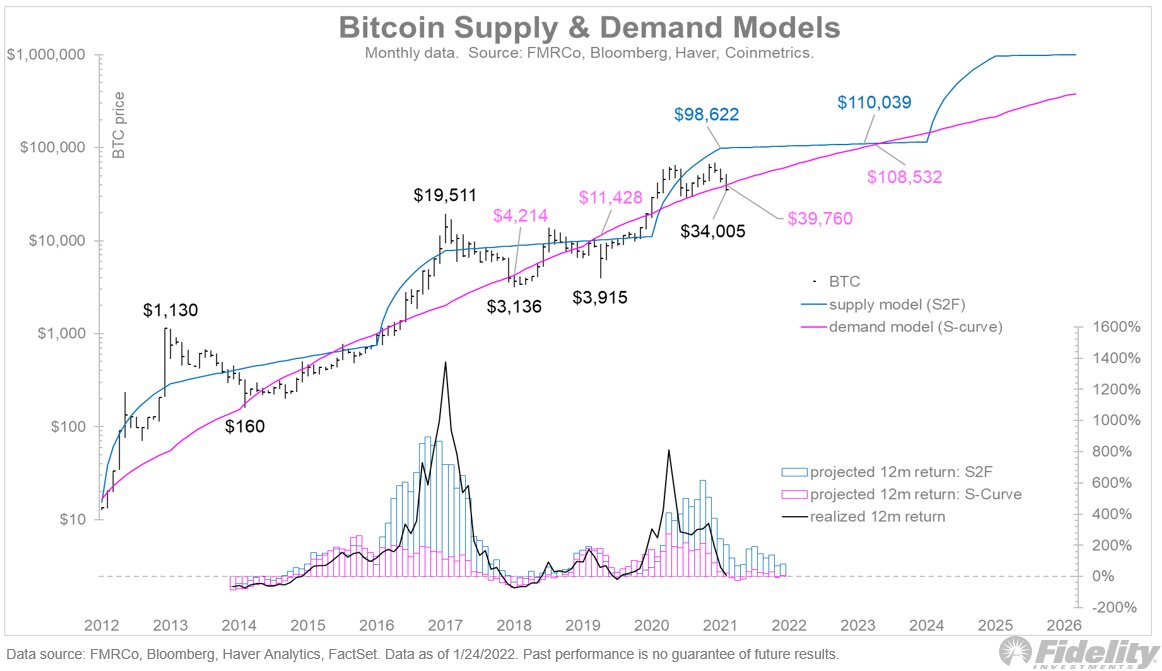

Regarding Bitcoin supply and demand, the analyst says,

“The lower Bitcoin falls, the more undervalued it will become on a fundamental basis.”

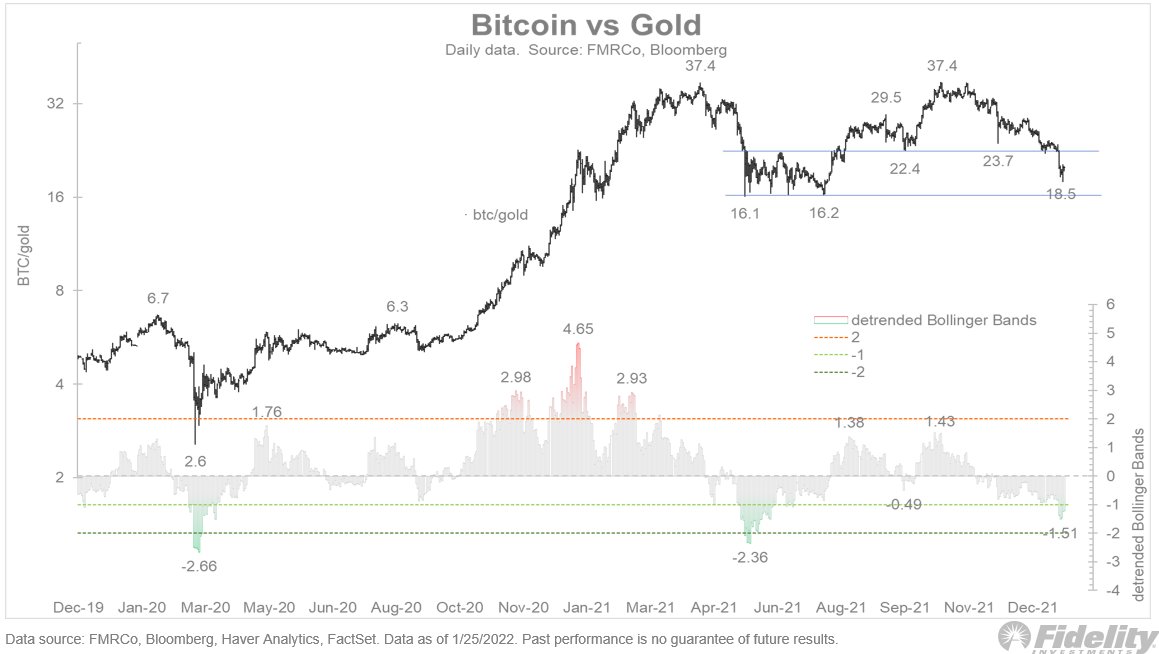

Timmer also highlights that the Bitcoin-to-gold ratio is “back in the support zone and is 1.51 standard deviations from its trendline.”

The strategist shares his final chart as an indicator that “short-term momentum is now sporting a bullish divergence.”

Timmer concludes his analysis by saying that although Bitcoin has suffered a rough ride that also saw speculative stocks crumble, BTC’s strong fundamentals remain intact.

“Bitcoin clearly got caught in the liquidity storm that is now sweeping the more-speculative side of the stock market.

But unlike non-profitable tech stocks, Bitcoin has a fundamental underpinning that will likely get more compelling over time.

Now that the liquidity tide is going back out, the fundamentals should matter more than ever in 2022.”

At time of writing, Bitcoin is trading sideways at $36,899. It began the year valued at $47,292, marking a 22% decline since.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Jamo Images

The post Here’s What Will Matter More Than Ever for Bitcoin in 2022, According to Fidelity Macro Strategist appeared first on The Daily Hodl.

- "

- 000

- 2022

- 3d

- According

- advice

- advisor

- Affiliate

- affiliate marketing

- All

- already

- Although

- analysis

- analyst

- Assets

- basis

- Bitcoin

- BTC

- Bullish

- Buying

- cartoon

- caught

- Children

- compelling

- copyright

- crypto

- cryptocurrencies

- cryptocurrency

- Demand

- digital

- Digital Assets

- diligence

- Display

- equity

- featured

- fidelity

- financial

- First

- flow

- Fundamentals

- Glassnode

- going

- great

- here

- High

- high-risk

- HODL

- hold

- HTTPS

- image

- investment

- Investments

- Investors

- IT

- Key

- latest

- Latest News

- leading

- Level

- Line

- Liquidity

- Macro

- Making

- Market

- Marketing

- Matter

- model

- Momentum

- Moon

- news

- Opinions

- Outlook

- price

- range

- reverse

- Risk

- So

- Space

- Space Travel

- stock

- stock market

- Stocks

- Storm

- strong

- supply

- support

- tech

- Tide

- time

- trades

- Trading

- travel

- Trends

- us

- valued

- What

- without

- writing

- year