Following several months of headwinds for the crypto space, the crypto market trended lower in September. ETH fell significantly more than BTC as Ethereum transitioned from proof-of-work (PoW) to proof-of-stake (PoS) via The Merge. ETH sold off sharply post-Merge in classic “buy the rumor, sell the news” price action.

The downtrending crypto market and bleak macroeconomic environment continued to weigh on stocks, crypto and beyond, making it difficult to anticipate what lies ahead. However, on-chain data can help identify the signal amid the noise by providing evidence of trends in network usage and demand. In Kraken Intelligence’s latest on-chain digest, Honeymoon Phase Is Over, the team investigates what went down in September.

Dominance shift

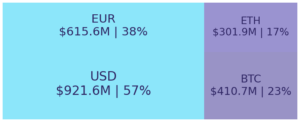

BTC dominance fell as it became the second-worst-performing cryptoasset of the cohort year-to-date (YTD) as ETH was preparing to execute The Merge. Meanwhile, ETH outperformed the cohort in several on-chain metrics, including dominance growth, in anticipation of the historic event.

However, the honeymoon phase is over now, as ETH dominance dropped -1.9 percentage points (pp) in September to become the worst-performing cryptoasset of the group MoM and YTD. On the other hand, BTC flipped from the second-worst performer YTD in August to the second-best performer YTD in September after outperforming the cohort for the month. The rest of the altcoins within the group, except for AVAX, also saw dominance growth MoM. Despite this MoM growth in dominance, total crypto market capitalization fell -4% in September from $1.03 trillion to $989 billion.

On-chain fundamentals

Our findings suggest that after ETH interest faltered following The Merge, BTC absorbed much of the attention this month, as evidenced by its increases in dominance, transaction count, on-chain volume and transaction fees. ALGO also took the spotlight as it rose in all tracked metrics, including transaction count, active addresses, volume and dominance.

DOGE on-chain activity slowed for the second month, falling in terms of fees, transaction count, volume and active addresses. In late September, ADA underwent a major hard fork, known as Vasil, that reduced costs and introduced improvements to smart contract capabilities and the chain’s throughput. This catalyst ostensibly caused an increase in on-chain demand as the cryptoasset saw dominance, transaction count and active addresses rise in September, though on-chain volume ticked down. In sum, the trend is little changed MoM, but the latest on-chain data suggests the overall mix of on-chain activity pivoted to the positive side.

Want to learn more about on-chain activity in September and what’s ahead? Read the Kraken Intelligence report, Honeymoon Phase Is Over, in which the team explores the crypto fundamentals and on-chain data that shaped the market in September.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell or hold any cryptoasset or to engage in any specific trading strategy. Some crypto products and markets are unregulated, and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptoasset markets can lead to loss of funds. Tax may be payable on any return and/or on any increase in the value of your cryptoassets and you should seek independent advice on your taxation position.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Kraken Blog

- Kraken Intelligence

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet