Discover new ways to analyze the crypto space

Blockchain applications or decentralized apps could very well help you invest in certain crypto tokens. These so-called dapps provide unique metrics, and in this report, we will show how crypto investors can use these metrics to their advantage.

Technical analysis of cryptocurrency token prices is the standardized way to predict future price movement. But, there are more and more metrics becoming widely available that may give a better impression of what’s actually happening on the blockchain right now. Of course, utilized in tandem with other metrics. In this article, I will explore the idea of using the unique active wallet data available for free on DappRadar as a guide to the future success of a blockchain application and its underlying native token.

In fact, a vast amount of people do not realize that many popular tokens actually represent dapps. Tokens such as UNI, CAKE, and SKILL are all tied to dapps. Moreover, they all have utility within dapps. If the service tied to the token is thriving and being utilized then we can assume the token price will follow suit.

First Things First

Growth is of course an important metric. But in the blockchain world, we are measuring growth through the interaction of blockchain wallets with dapps. It is important to note that a wallet or unique active wallet (UAW), is not a single person. In fact, 10 wallets can be controlled by one person. It is also important to note that certain dapps will require more transactions than others.

A DeFi dapp such as Uniswap for example, where a user comes to simply swap tokens, generates two transactions usually. One transaction is needed to approve a token (if new or not previously used) and another transaction happens to actually swap the tokens. That’s two transactions from one user.

In a blockchain game where the player is exploring a 2D world packed with items to be discovered, people to talk to, and other interactions. Far more transactions would be racked up as every interaction may require a transaction of some kind between the blockchain wallet and the platform. Here a player may rack up to a hypothetical 50 transactions in a 1-hour playing session. The Wax dapp Alien Worlds provides an excellent example of this activity.

Nonetheless, unique active wallet interactions give us a strong indication of the activity within a dapp. Furthermore through the close analysis of growth in this metric certain conclusions can be drawn as to the strength of the project, its team, and most importantly for investors, it’s token.

User Growth

Now you are aware of the above we can progress into the idea of using Unique Active Wallets (UAWs) growth as an indicator of success. As mentioned, alongside traditional metrics such as token price. To make the article clearer I have hand-picked a few dapps with native tokens that I know have already shown signs of success. We will look at the user data and token price over time and look for correlations. The theory can then be applied to more projects at different stages in their life cycle.

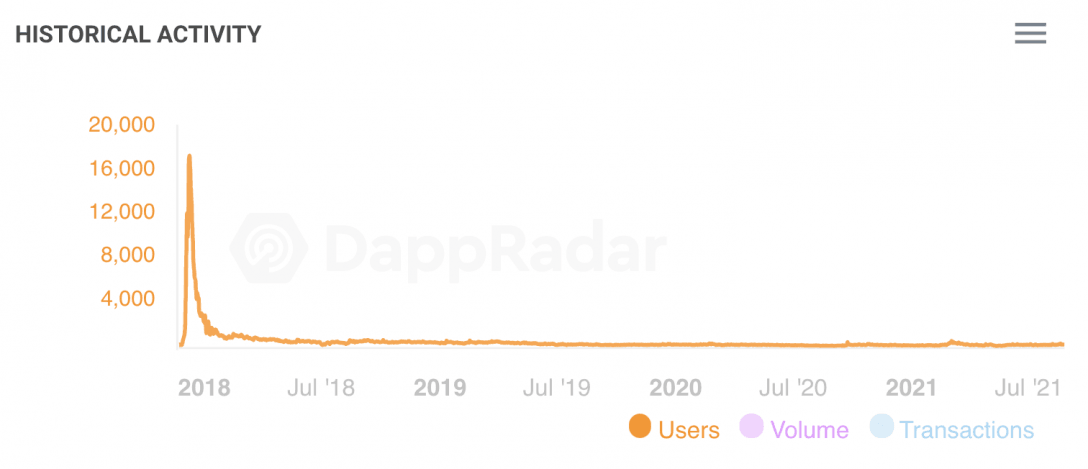

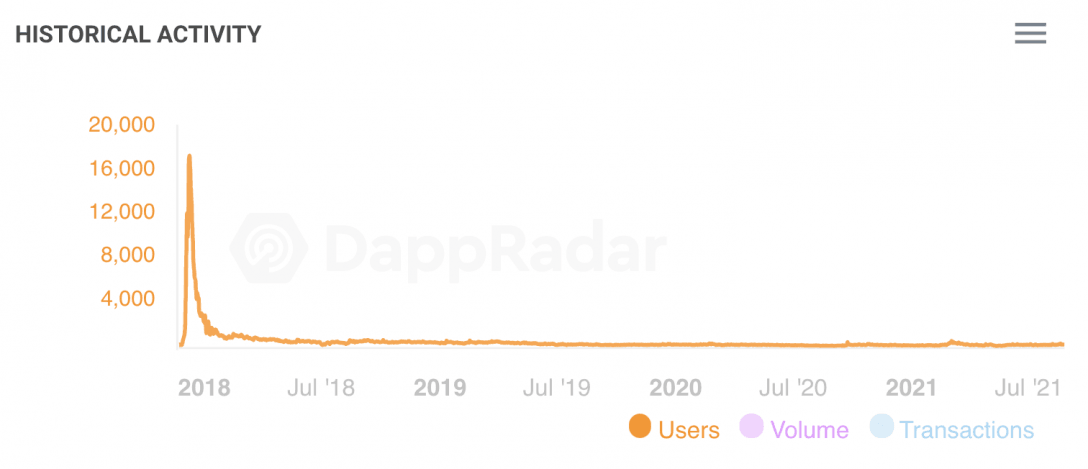

Importantly, and like crypto prices, volatility is present. A dapp can run a staking campaign for example and attract thousands of wallets in a small amount of time only to then dip off until another campaign pops up to entice users. Furthermore, some dapps require users to only visit once, providing no reason to come back after making a transaction or purchase. CryptoKitties provides an example of this as users rushed into mint the NFTs then were given no reasons to return. It doesn’t mean the dapp and NFTs are dead – just that the activity is now finished through that particular platform or smart contract.

Additionally, some dapps operate through centralized entities such as Binance and have the ability to tap into mass marketing and huge ready-made communities. Whilst these peaks and troughs do represent user activity, we are looking for more sustained activity over time that can indicate adoption. Importantly, and as mentioned, judging a dapp on UAW data means knowing if that is a useful metric, to begin with. As we see above – it would not be in the case of CryptoKitties strictly speaking.

As you can see, it’s a complex world we are about to enter. With time you too can come to understand the dynamics of dapps in more detail and use DappRadar to your advantage.

Axie Infinity

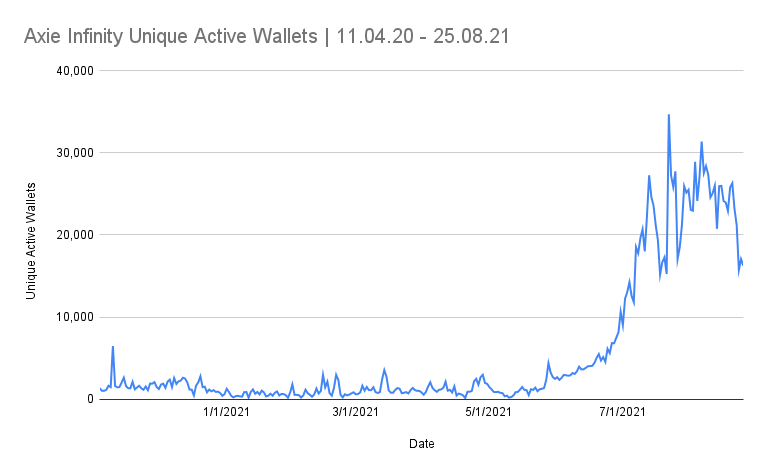

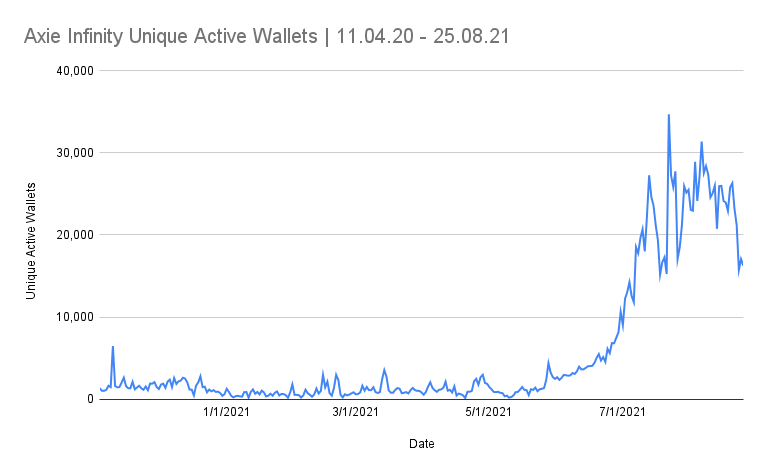

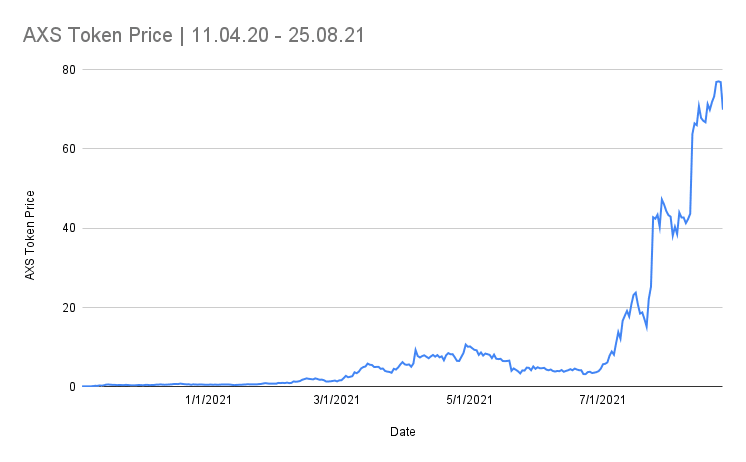

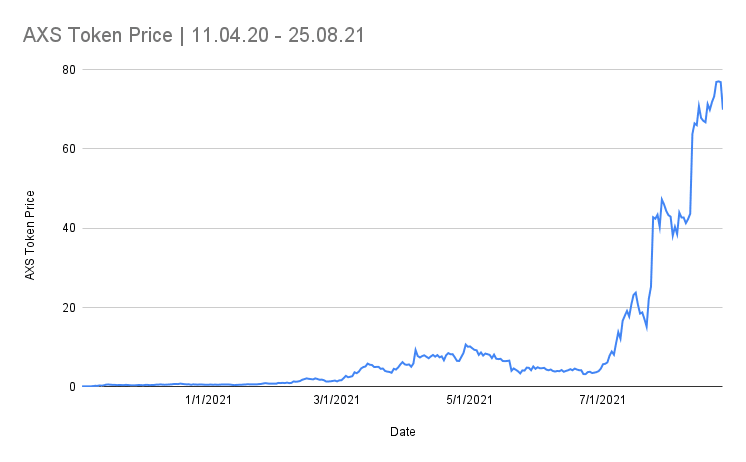

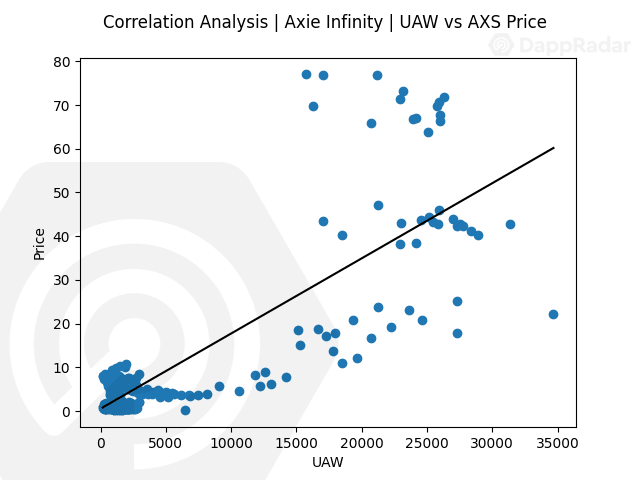

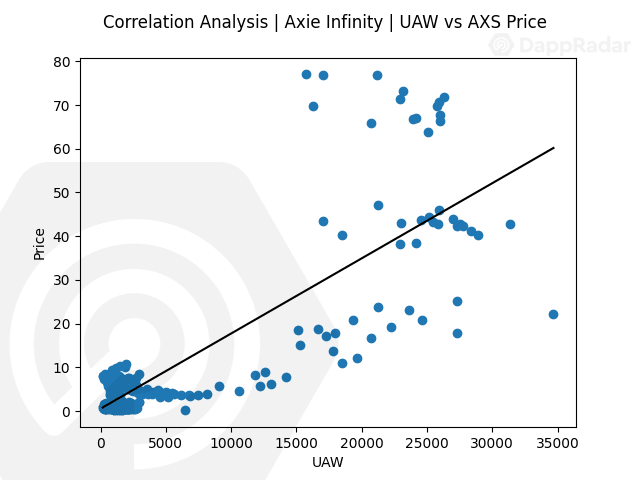

As the leading play-to-earn blockchain game with its own token economy and secondary marketplace, Axie Infinity can provide an excellent case study. We want to know how tight the correlation is between the number of unique active wallets and the token price of AXS over time. In the case of Axie, its AXS token dropped on the 4th of November 2020 so we can begin analysis from that point.

Without running any complex correlation analysis we instantly see the correlation. AXS price followed the pattern of unique active wallets rising with the same drops witnessed in May as the entire industry. The real turning point for Axie UAW arrived once they moved operations over to their Ronin custom chain and customers started benefitting from very cheap transaction fees.

Moreover, through keeping a close watch on Axie Infinity UAW data through DappRadar, investors could have seen that turning point emerging at the end of June 2021. A snowball effect coupled with increased media mentions (due to rising UAW and volume metrics) appears to have pushed the game to new highs. Again, whilst not easily detectable, the point of this article is to identify the triggers to watch for.

In the case of Axie up until the end of June, they had been steadily rising to around 10k UAW per day. On the 7th of July, they hit 18k UAW and never looked back. That is what can be called an inflection point, or the moment the scales tipped in Axie’s favor. From that date, moving forward, the number of UAW has steadily risen to its new daily figure of around 20,000. At the same time, the price of AXS has risen over 76% in the last 30 days alone.

It is clear that in the case of Axie Infinity the number of unique active wallets interacting with its smart contracts and utilizing the game and marketplace had a direct impact on the token price of AXS. Moreover, there were clear signs that a savvy investor could have noticed.

In the Axie chart, it is obvious that we could draw a straight line, starting near the left-most dot and upwards as we move to the right amongst the plotted data points. The line looks like a good match to the points. A positive correlation line would have a positive slope, and the plotted data points would all lie on or very close to that drawn line. For Axie the correlation between the number of UAWs and the AXS token is strong.

SushiSwap

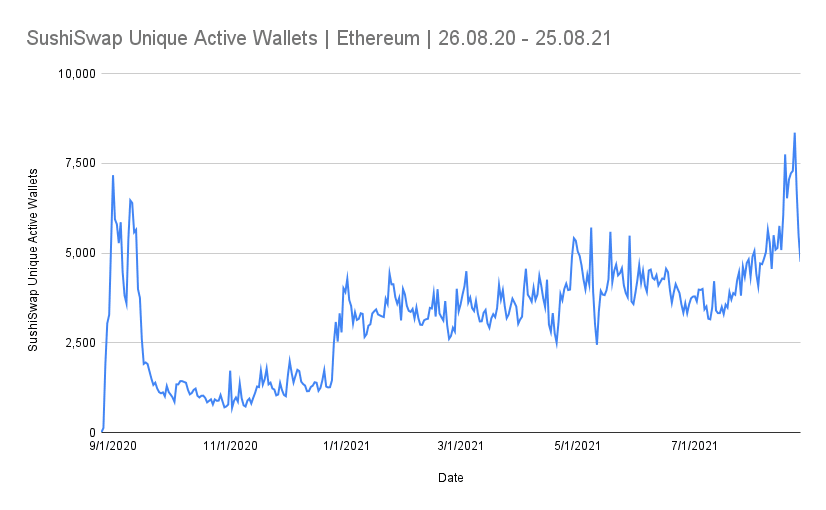

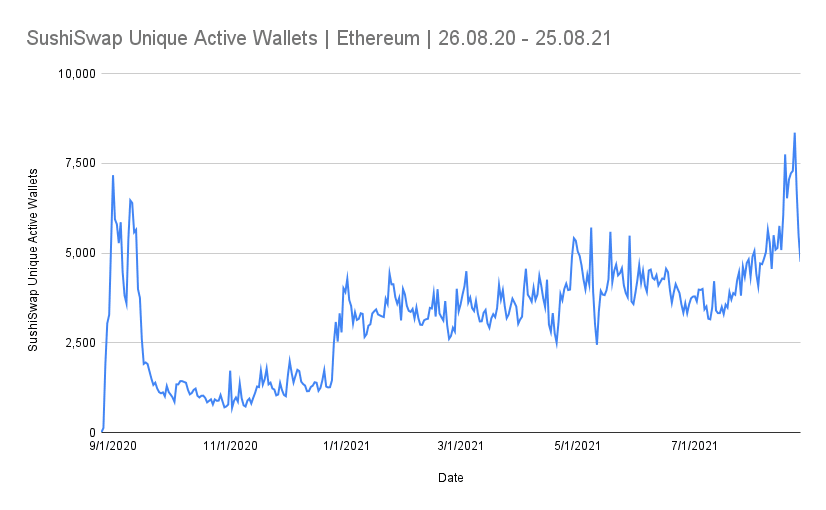

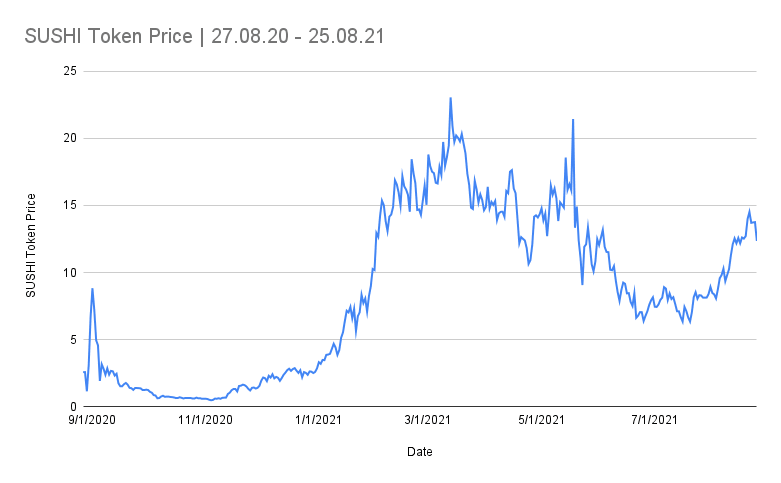

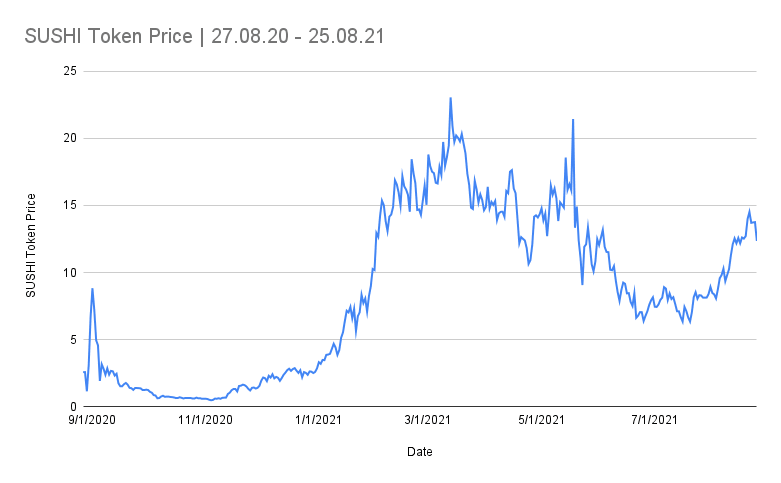

The last case in point focussed on a play-to-earn blockchain game. In order to diversify this analysis, we will now look at a correlation in the DeFi world. Between the leading decentralized exchange SushiSwap, and its native token SUSHI. SushiSwap is active on a wide variety of blockchains, including Ethereum, Polygon, Binance Smart Chain, and Avalanche. In addition, it covers Fantom, HECO, OKex, Harmony, and a couple of others. However, we will primarily look at the activity on Ethereum.

Launched on August 26th, 2020, SushiSwap is both a cryptocurrency token and a decentralized exchange. The exchange offers a platform for anyone to swap cryptocurrency. As previously mentioned transactions on DEXs can be numerous. Ranging from a simple token swap to staking, claiming rewards, or ending a stake. Nonetheless, multiple transactions will be carried out by a single wallet therefore only registering as one unique active wallet.

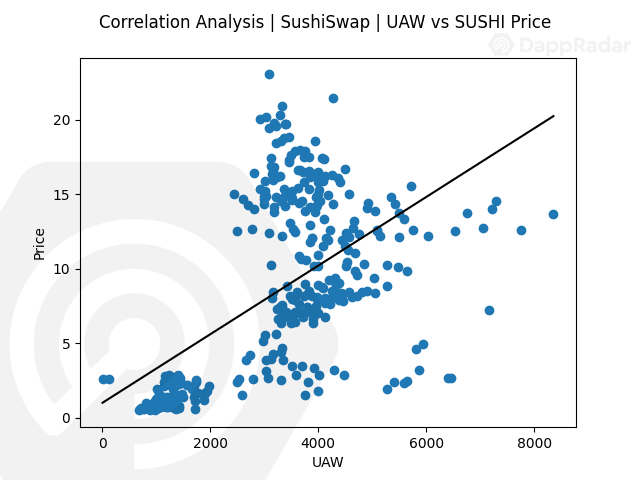

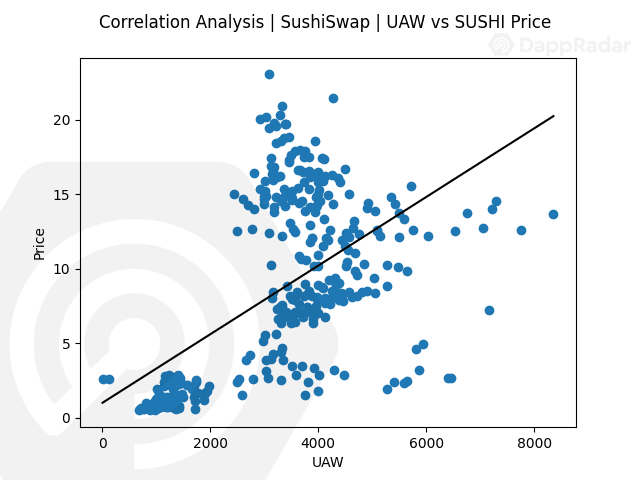

Unlike Axie, the correlation here is not clear to see from the get-go. We can certainly observe some similar trends but nothing conclusive. We see huge peaks and troughs for the exchange dapp as users seemingly come and go when they have a need or when a new campaign, percentage reward, or opportunity arises. In some cases, a peak can be caused by a stake period coming to an end bringing a surge in active wallets to end their respective stakes. These types of actions are not expected to directly impact the price as there are so many moving parts that the token really operates atop all of this noise. To see more clearly we need to run a deeper correlation analysis.

What we see is around a 40% correlation between the number of unique active wallets interacting with SushiSwap and the token price of SUSHI. The number of UAW is very variable for the reasons mentioned above so, I expected this result. Nonetheless, the price of SUSHI and the number of UAW on the platform have both steadily increased over the same time period. Showing that while the correlation isn’t concrete it is still an indicator worth paying attention to in the case of decentralized exchanges. Moreover, there doesn’t appear to be any trend to these data points and we cannot draw a line to justify the data points. It appears the DeFi token has its own standard tokenomics where the price increase and decrease are affected by other parameters. Therefore we cannot draw a positive correlation between UAWs and token price when it comes to SushiSwap.

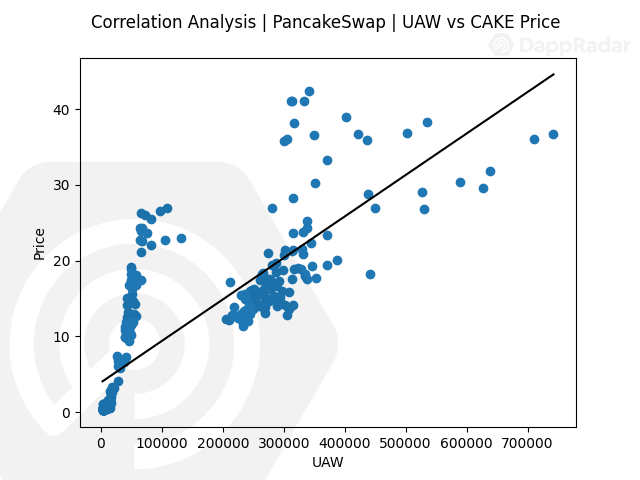

To further put this to the test we will now look at a decentralized exchange operating from a more centralized platform. PancakeSwap on Binance Smart Chain. What we are hoping to find is a much tighter correlation due to the influence of the centralized marketing efforts and the large community that surrounded the dapp from the point of arrival on BSC.

PancakeSwap

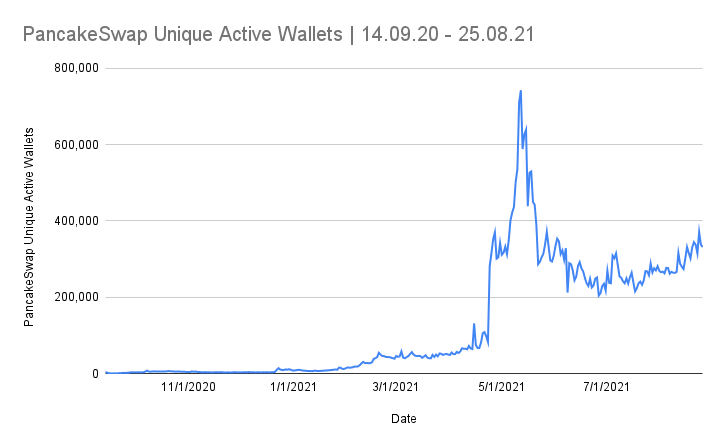

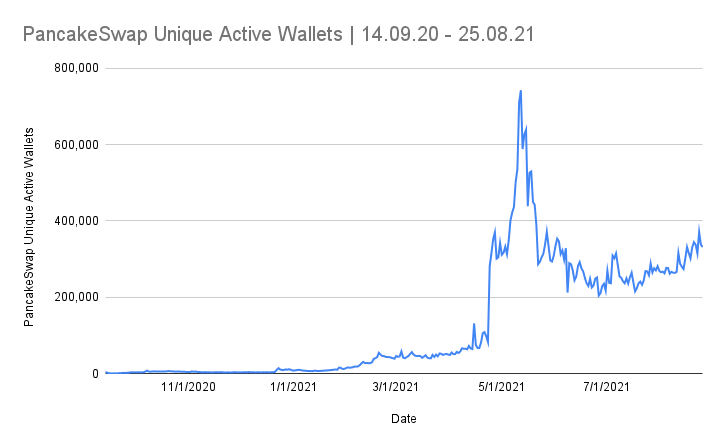

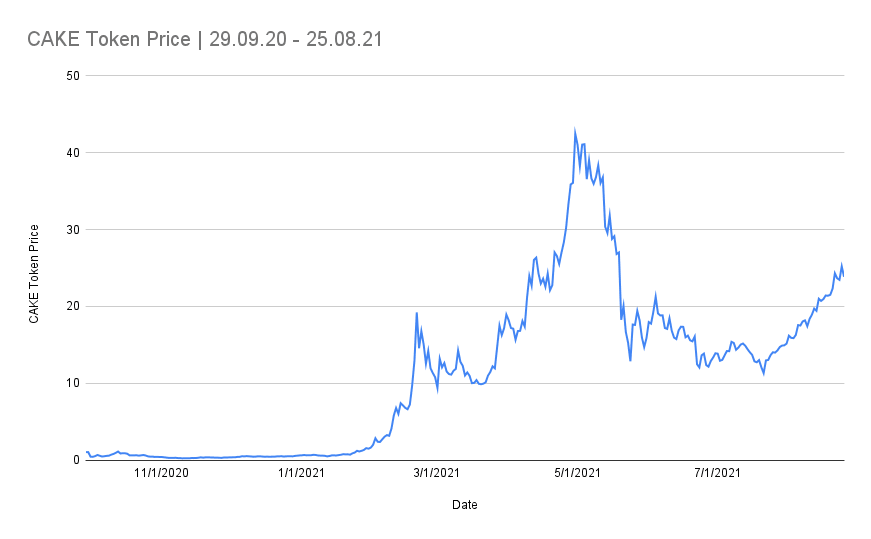

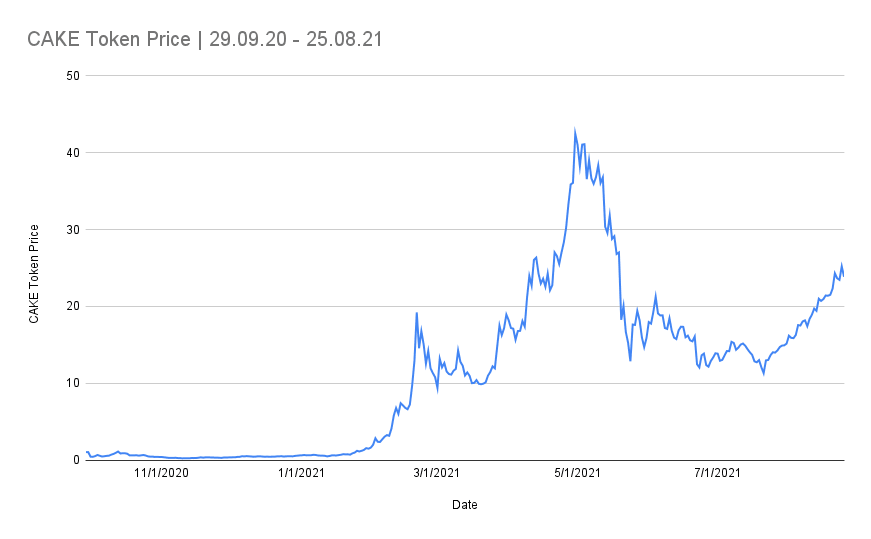

PancakeSwap is fundamentally SushiSwap on Binance. The platform has become extremely popular over the last 12 months due to several factors. Firstly escalating gas fees on Ethereum for transactions caused by high demand for its services led people to look elsewhere for the same services. Transaction fees on BSC are a fraction of what they are on Ethereum. Lastly, a rush of new blood entered the crypto space this year guided by the bull run. Those investors arguably came from traditional investment backgrounds where fast transactions and processing were the norms. Two things BSC and PancakeSwap offered in abundance. Moreover, the DEX is the leading exchange across all blockchains, with around 1 million UAW a week, therefore it makes for a great example.

The platform and its native token CAKE arrived in late September 2020. Looking at the raw data from both UAW’s and the token price since then, there is a very clear correlation already. So much so that the all-time high token price for CAKE goes almost hand in hand with its all-time high UAW figure.

Between the 9th and 12th of May 2020, the platform had its highest number of UAW per day to date. Notably surpassing half a million and then trending above that for around 10 days afterward. On those same days, CAKE hit a price just above $38, an all-time high.

One reason for this close correlation could be the fact that PancakeSwap operates from the centralized Binance platform. Being centralized it can in theory control the price through liquidity provision, marketing campaigns, airdrops, and more. Things an exchange on a completely decentralized network such as Ethereum cannot tap into so easily and in such a coordinated way. In a completely decentralized ecosystem, it’s every dapp for themselves.

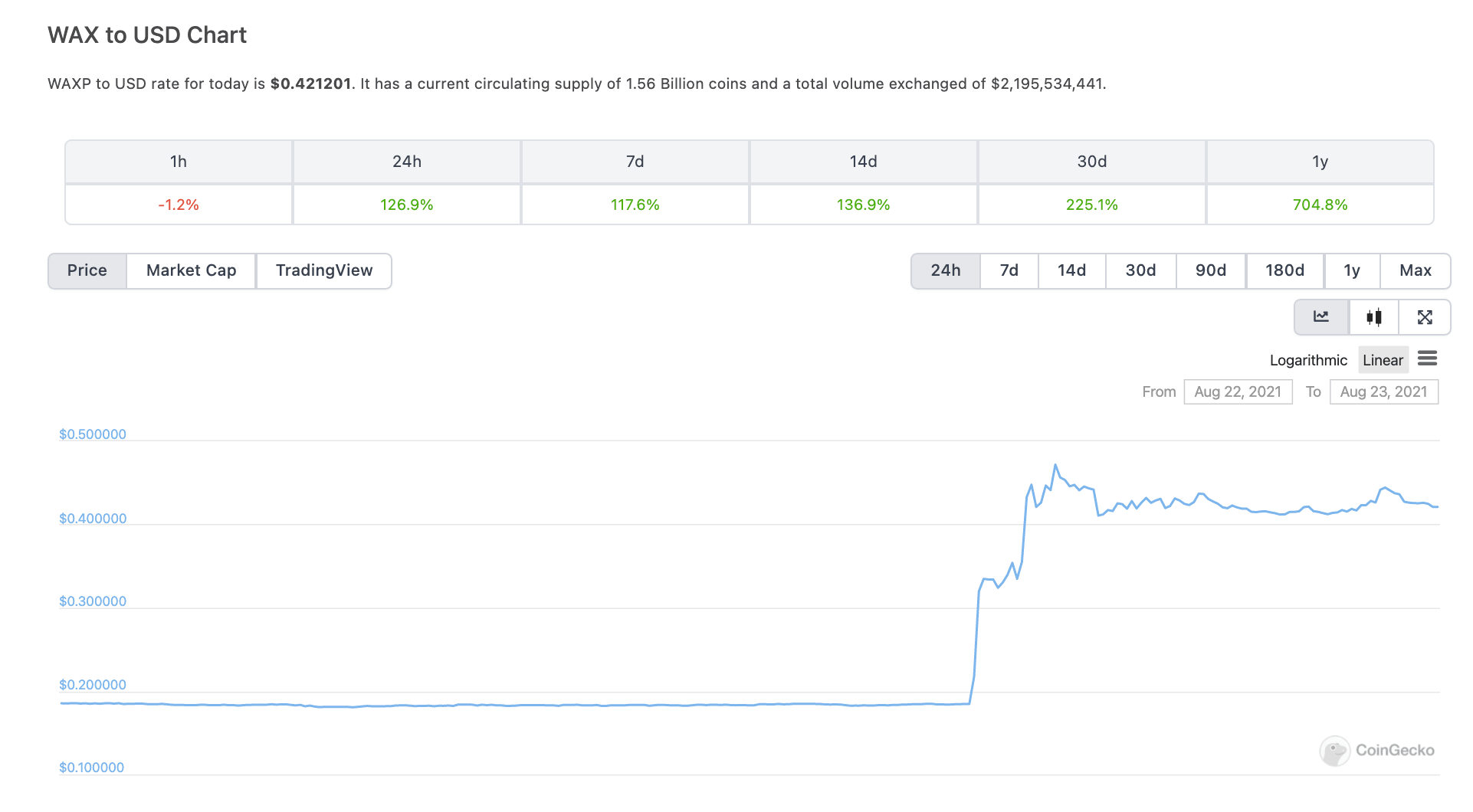

Marketing Power Matters

Recently, I believe a case in point arrived to push my theory into the realms of reality as Binance listed the Wax blockchain’s native token WAXP. The result is a 126% increase in the token price in the immediate 24 hours after the blog post and subsequent social media chatter started through the official Binance channels. A quick look at the Twitter post’s virality shows the impact more clearly with almost 600 shares and 1.8k likes just a few hours after being posted. There was demand and the community responded in turn. Which pushed the price up. At the time of writing it’s down almost 20% to around $0.33. Still, the token price is resting higher than ever before.

I believe the main point here is that the correlation of a decentralized exchange is very different from that of a centralized exchange when looking at token prices.

QuickSwap

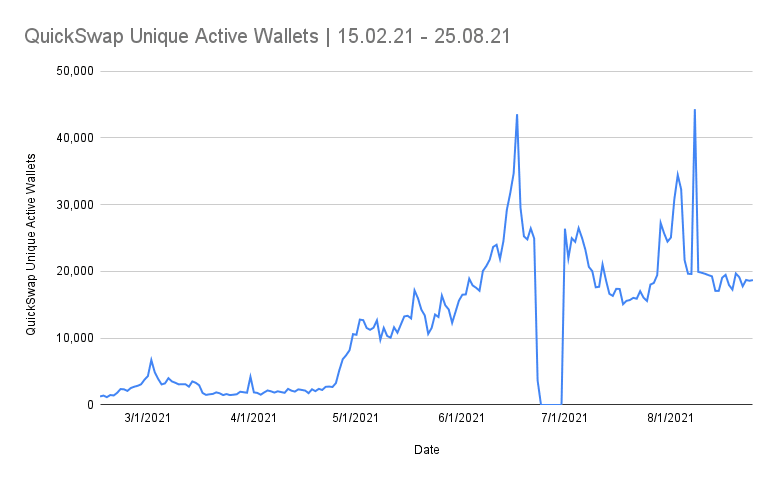

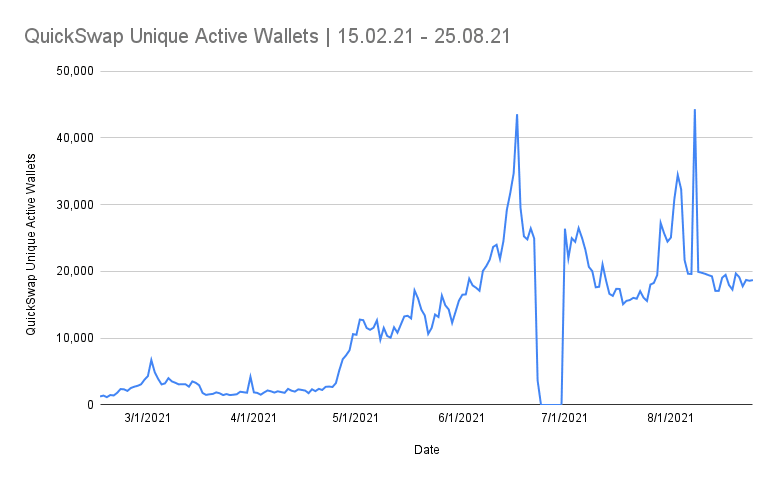

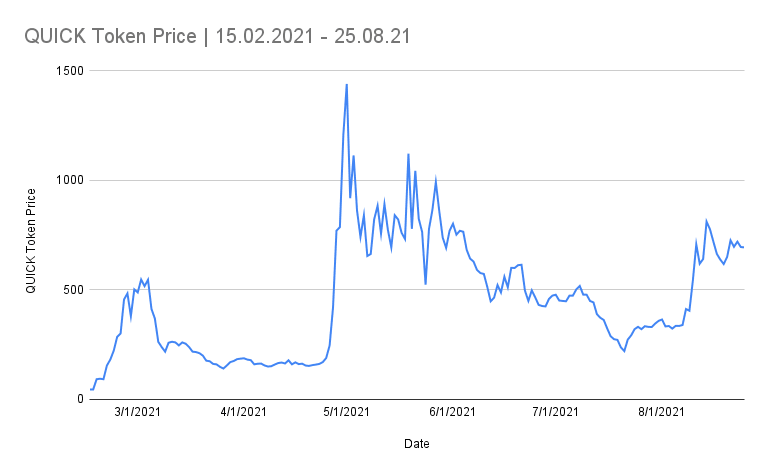

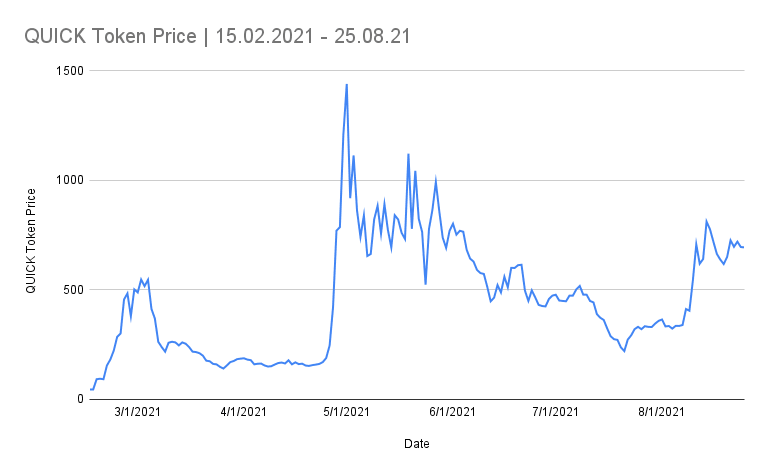

QuickSwap is a decentralized token swapping and staking platform on the Polygon Network. It’s a copy of the leading Ethereum DEX Uniswap and offers the same liquidity pool model. Users add pairs of tokens to liquidity pools and earn transaction fees from others who swap their tokens using the pools. QuickSwap’s native token is called QUICK.

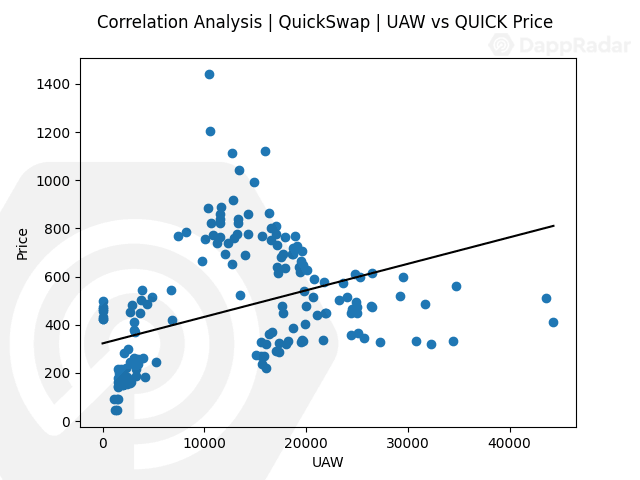

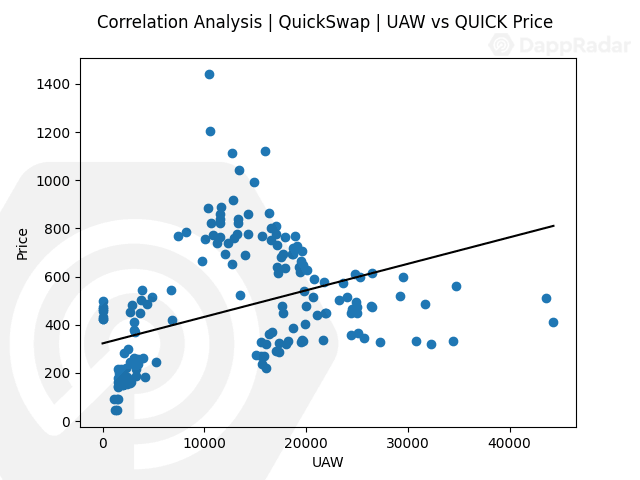

The main reason for including this protocol is twofold. The Polygon network has been flying throughout 2021 and has become home to many dapps. Nonetheless, QuickSwap is relatively new and we will be analyzing quite a short lifespan as the token arrived on the 15th of February 2021. As such it will be interesting to see if it’s too early to perform any correlation analysis, or if some initial trends can be seen.

Firstly, to address the big dip in the UAW chart. That represents a 1 week period when the platform was down for maintenance and updates. Looking at the raw data of both the UAW number and token price initially shows us some indicators that the correlation could be tight. On the 1st of May 2021, the price of Quick was at an all-time high of $1,439 which corresponds with the same moment the platform went past 10,000 UAWs.

Nonetheless, looking at the correlation analysis tells us that it’s too early to draw any conclusions. A clear line cannot be drawn, instead what we see is volatility. Price volatility occurred around the same time as the entire market crashed and UAW volatility resulted in some huge peaks. Moreover, I believe it’s too early to perform this analysis and that the dapp and its token need to weather the storm more in order for us to draw a clear picture.

Rarible

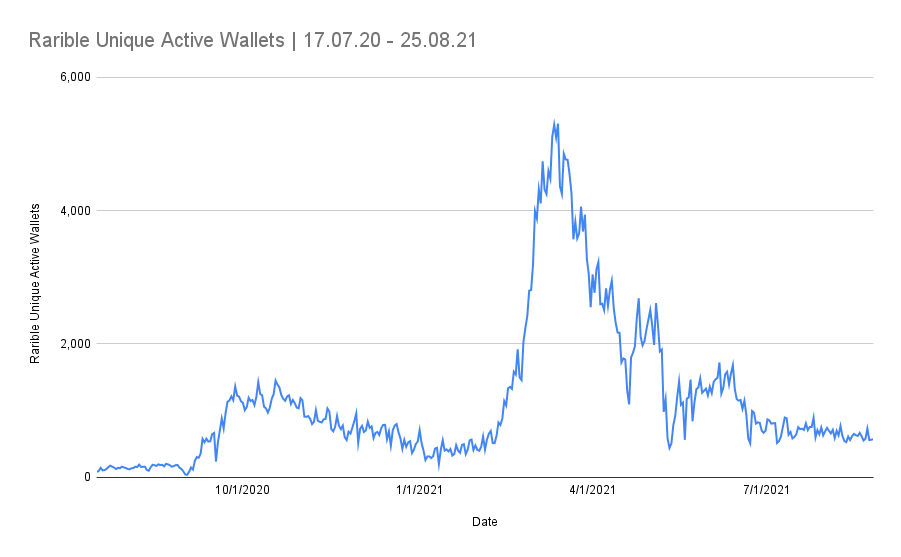

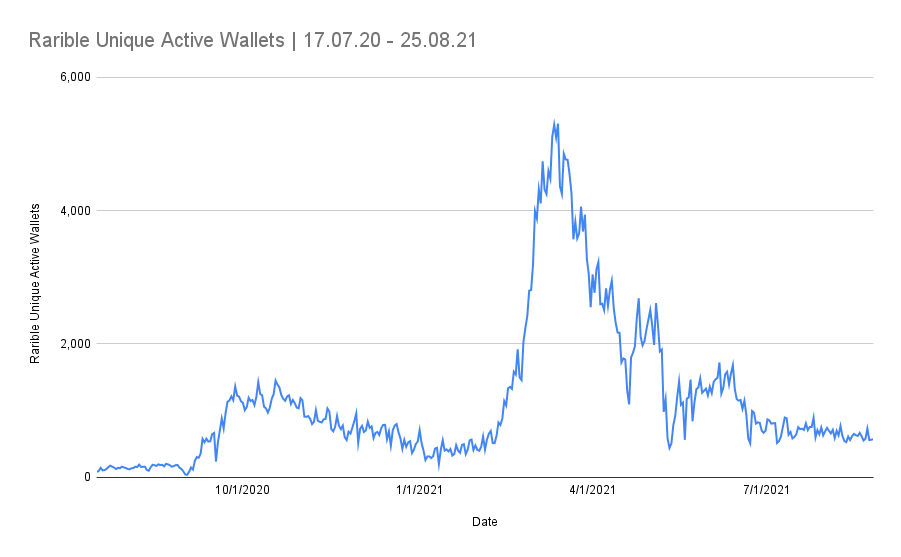

The growth of crypto art, NFTs, and digital collectibles is one of the most interesting trends of 2021 and shows no signs of slowing. NFT art marketplaces such as Rarible have boomed on Ethereum. In that context, it is perhaps fitting that Rarible made its reputation by employing one key technique from the Ethereum DeFi boom. Anyone selling or buying art on Rarible also earns some of the 75,000 RARI tokens which are distributed weekly to encourage activity. It was the first NFT platform to role out a governance token and it had a major affect.

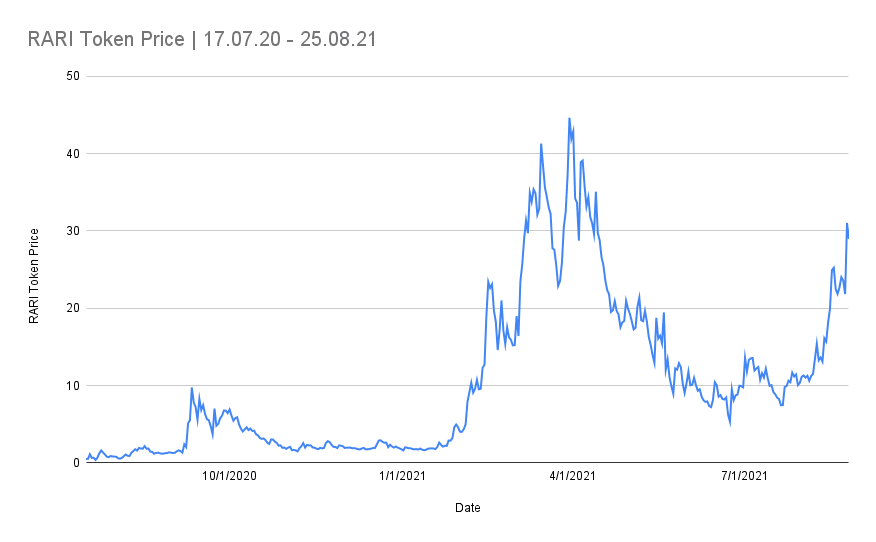

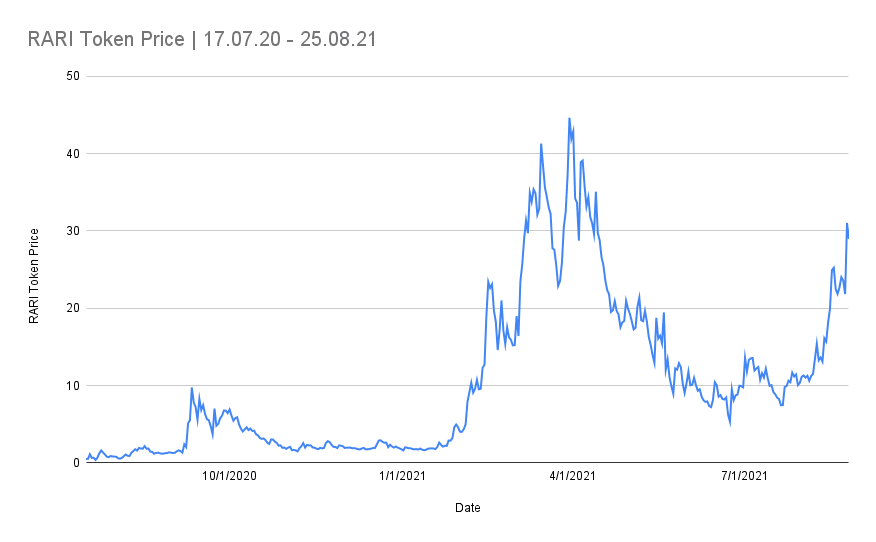

The introduction of the RARI token in mid-June 2020 catapulted the NFT marketplace platform to new heights from which it hasn’t returned. There was much excitement around the launch of RARI initially and the purpose of this analysis is to ascertain the correlation between token price and the number of UAW’s interacting with the platform in the NFT sector. With all eyes on the newest NFT projects and marketplaces – it’s vital to understand what affects the token price of such platforms.

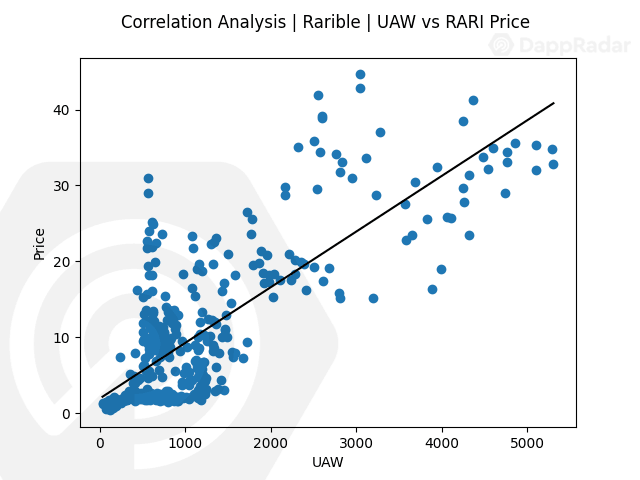

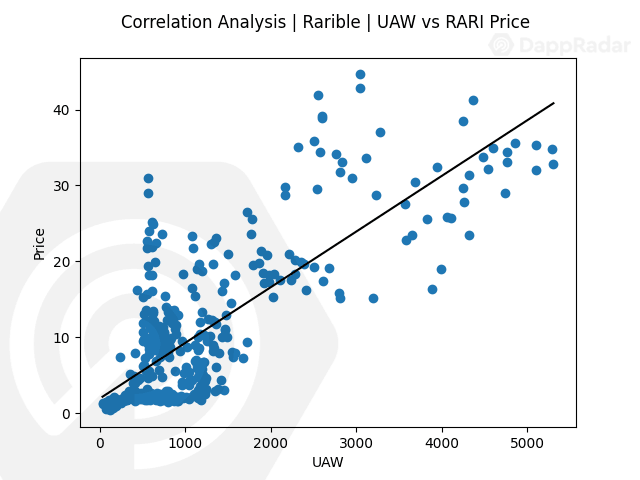

We see a very close correlation between the two metrics after observing the raw data. It is quite clear to see a boom of UAWs around the time the RARI token arrived. Presumably, a rush of new users that hoped to be able to cash in on some free RARI tokens joined. The platform did deal with that spike accordingly by adding further layers of authentication and profile building to ensure only users with good intentions ended up staying on the platform. This is visible through the flattened line occurring after the initial boom in November 2020. Following that initial boom, we then observe that the token price of RARI increased along with the number of UAWs.

Additionally, as with other analyzed protocols the token’s all-time high corresponds with an all-time high in UAWs. We see that as the number of UAWs interacting with the dapps smart contracts increased at the tail end of March into early April. The RARI token price shifted upwards, peaking at around $44 on the 30th of March. Interestingly, looking at the raw data, the token price of RARI has recovered from the huge drop across the sector in May. Meanwhile, the number of UAWs has not shown the same trend. This indicates that the price of RARI found its baseline during the recent bull-run and despite an increase or decrease in UAWs now, the token is performing well and looking to re-establish and move beyond the base.

Looking at the correlation analysis we see a very tight correlation at the start of the journey for Rarible and RARI. Moving closer to now, that correlation appears to be less with far more sporadic and lower levels of UAW activity. We could conclude that more data is needed to fully analyze the correlation in the long term but that a positive price movement is being caused by historical UAW activity.

In Summary

The purpose of this article is to expand upon how dapp metrics can lead us to understand the price movements of dapp native tokens. Unlike token prices which are unpredictable at the best of times, the number of unique active wallets gives us a more solid foundation on which to guide an investment decision.

When it comes to token prices, one day it can be increasing and look appealing to jump in. Only to check 24 hours later and be in the minus. There is literally no 100% accurate way to know what the token price will do. Of course, we have metrics, triggers, trend analysis, and social signals to utilize, but I prefer some good old-fashioned intuition coupled with more traditional metrics tied to growth.

Watching the number of active users of a platform, as discussed, in the context of how they come to attract them. Is surely a good way to understand the dapps popularity, awareness in the space, and therefore its appeal to potential users. If that platform has a token attached to it then as we have seen here the activity through wallets can impact that in certain instances.

We will continue this research at different periods of time moving forward and re-visit these dapps and look once more at the correlation between the number of unique active wallets interacting with a dapp and the impact on token price. In the hope of providing more tangible metrics to guide cryptocurrency investment decisions.

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, NIOX, AGIX, MATIC, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, OMI, GO, SHIBA INU, AND OCEAN.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet