Southeast Asia’s payment ecosystem is undergoing a profound transformation, fueled by rapid adoption of digital payments, modernization initiatives by governments and a burgeoning consumer base of mobile-first young adults with new habits and expectations, a new blog post by payment company Currencycloud and Australian super-app Bano says.

The region’s millennials and Generation Z demographics, which refer to those born between 1980 and 2012, are reshaping the payment landscape, forcing industry players to adjust to this audience’s expectations of speed, personalization, contextuality and transparency, the post says.

These generations are digital-first; at ease with new technologies; and are avid users of super-apps, the report notes.

They are also keen to trying out new digital solutions, having shown strong interest in alternative payment methods including buy now, pay later (BNPL), cryptocurrencies and QR code payments, it says. But perhaps more importantly, millennials and Gen Z consumers want payments to be more instant, frictionless and embedded within their customer journeys.

Industry stakeholders must pay attention to these changing needs, the report says, especially considering that millennials and Gen Zs are fast-growing demographics which are expected to make up half of Asia-Pacific (APAC)’s population by 2025.

The rise of BNPL

Demand for embedded payments among Southeast Asian millennials and Gen Zs is reflected by the traction buy now, pay later (BNPL) arrangements have received among these demographics in the region.

According to market researcher PayNXT360, APAC’s BNPL payment industry has recorded strong growth over the past year, owing to increased e-commerce penetration caused by the COVID-19 pandemic outbreak. In 2022, it estimates BNPL payments reached US$201.9 billion in APAC, growing by 45.3% that year.

This growth is showing no signs of slowing down with BNPL payment adoption set to increase by 25.3% annually between 2022 and 2028. By 2028, the firm expects BNPL gross merchandise value in APAC to reach US$782.9 billion, compared to just US$139 billion in 2021.

BNPL arrangements have increased in popularity over the past years. These microloans, which are offered right at the point of sale, allow users to split a purchase into multiple equal payments to be paid back over time, typically with little to no interest.

According to PYMNTS’ Buy Now, Pay Later Tracker, Gen Z and millennial consumers are the top users of these services.

QR code payments

QR code payments are another payment method that has risen in popularity across Southeast Asia, a trend that’s emerging on the back of soaring mobile payment usage.

In the Philippines, leading mobile wallet GCash claimed 55 million registered users at the end of 2021, a figure that represented 70% of the adult population. And Grab, a leading super-app across Southeast Asia, says its ecosystem counts over 25 million monthly transacting users.

According to the Currencycloud/Bano post, QR code payments are especially popular among Singapore millennials and Gen Z consumers who enjoy the speed and convenience of this payment method.

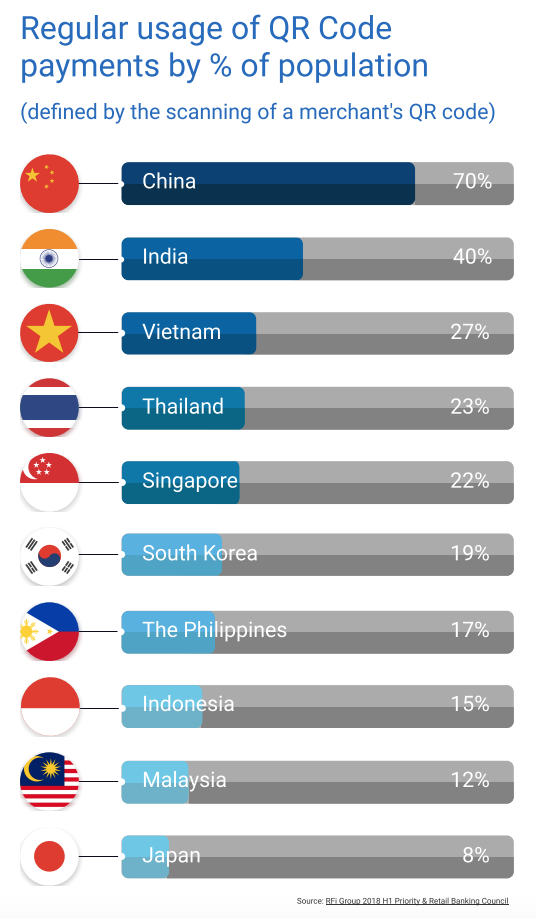

This is evidenced by data compiled by Swiss technology provider Scantrust which show that APAC was the biggest adopter of QR code payments in 2019, with a penetration rate of 15%.

A closer look at Asian nations reveals that China topped the ranking with 70% of the population utilizing QR code payments on a regular basis. China is followed by India at 40%, Vietnam at 27%, Thailand at 23% and Singapore at 22%.

Regular usage of QR code payments by percentage of the population, Source: QR Code Usage Around the World, Scantrust

In Southeast Asia, usage of QR code payments is only expected to grow as governments across ASEAN are working on linking their payment systems. Malaysia, Indonesia and Thailand already have their QR code payment systems connected, while Singapore is linked to Thailand and is seeking to add more countries, including Indonesia.

Southeast Asian millennials and Gen Z consumers are also fond of reward programs, the Currencycloud/Bano post says. This observation is supported by findings of a 2022 study conducted by Adyen, an omnichannel payment processing company, which found that of the 1,000+ Singapore consumers polled, 65% said they would download a retailer’s app to receive better loyalty rewards.

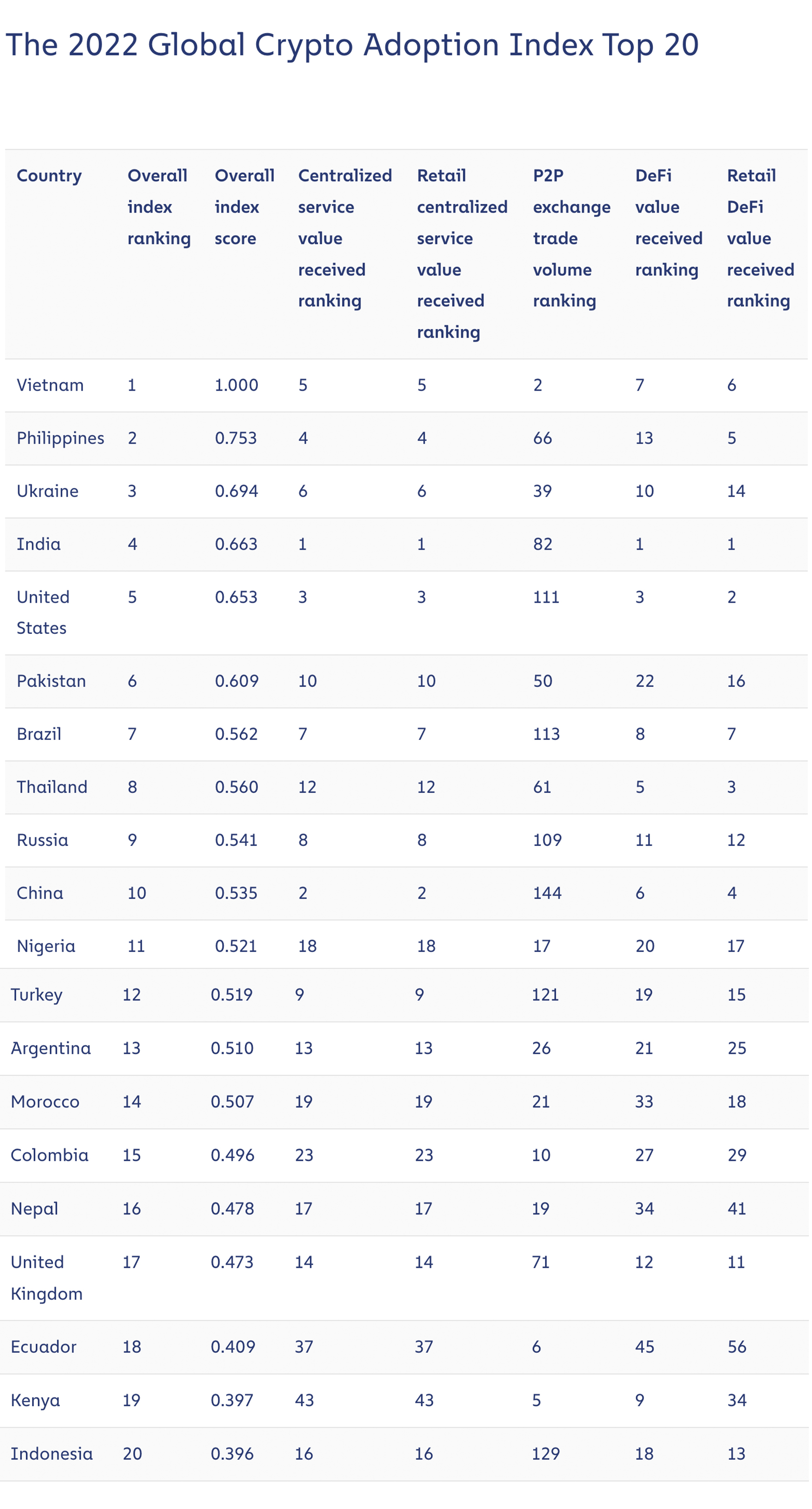

Cryptocurrency is another alternative payment method that’s gaining ground, the Currencycloud/Bano post notes, a trend that’s risen on the back of booming adoption of digital asset. According to Chainalysis’ 2022 Global Crypto Adoption Index, Vietnamese and Filipino consumers were the biggest adopters of crypto last year, recording the highest usage of crypto-related tools, products and services, compared to other nations.

Source: The 2022 Global Crypto Adoption Index, Chainalysis

Featured image credit: Edited from Freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/68454/payments/how-gen-zs-are-redefining-payments/

- 1

- 15%

- 2012

- 2019

- 2021

- 2022

- 7

- 9

- a

- across

- adopters

- Adoption

- Adult

- adults

- already

- alternative

- among

- and

- Annually

- Another

- APAC

- app

- around

- Asean

- asia

- Asia’s

- asian

- asset

- attention

- Australian

- back

- base

- basis

- Better

- between

- Biggest

- Billion

- Blog

- BNPL

- born

- buy

- caps

- caused

- chainalysis

- changing

- China

- closer

- code

- company

- compared

- connected

- considering

- consumer

- Consumers

- convenience

- countries

- COVID-19

- COVID-19 pandemic

- credit

- crypto

- Crypto adoption

- cryptocurrencies

- customer

- data

- Demographics

- digital

- Digital Asset

- Digital Payments

- down

- download

- e-commerce

- ecosystem

- embedded

- emerging

- enjoy

- especially

- estimates

- expectations

- expected

- expects

- Figure

- Filipino

- Firm

- followed

- found

- frictionless

- friendly

- from

- gaining

- Gcash

- Gen

- Gen Z

- generation

- generation Z

- generations

- Global

- Global Crypto

- Go

- Governments

- grab

- gross

- Ground

- Grow

- Growing

- Growth

- Half

- having

- highest

- How

- HTTPS

- HubSpot

- image

- in

- Including

- Increase

- increased

- index

- india

- Indonesia

- industry

- initiatives

- instant

- interest

- IT

- Journeys

- Keen

- landscape

- Last

- Last Year

- leading

- linked

- linking

- little

- Look

- Loyalty

- make

- Malaysia

- Market

- max-width

- McKinsey

- merchandise

- method

- methods

- microloans

- Millennial

- Millennials

- million

- Mobile

- Mobile Wallet

- monthly

- more

- multiple

- Nations

- needs

- New

- New technologies

- Notes

- offered

- omnichannel

- Other

- outbreak

- paid

- pandemic

- past

- Pay

- payment

- payment method

- payment methods

- payment processing

- Payment Systems

- payments

- percentage

- perhaps

- personalization

- Philippines

- plato

- Plato Data Intelligence

- PlatoData

- players

- Point

- Popular

- popularity

- population

- Post

- processing

- Products

- Programs

- provider

- purchase

- QR code

- QR code payments

- Ranking

- rapid

- Rate

- reach

- reached

- receive

- received

- recorded

- recording

- Redefining

- reflected

- region

- registered

- regular

- report

- represented

- researcher

- return

- Reveals

- Reward

- Rewards

- Rise

- Risen

- Said

- sale

- seeking

- Services

- set

- show

- shown

- Signs

- Singapore

- Slowing

- soaring

- Solutions

- Source

- Southeast Asia

- speed

- split

- stakeholders

- strong

- Study

- Super-app

- Supported

- Swiss

- Systems

- Technologies

- Technology

- Thailand

- The

- The Philippines

- the world

- their

- time

- to

- tools

- top

- topped

- traction

- transacting

- Transformation

- Transparency

- Trend

- typically

- Usage

- users

- Utilizing

- value

- Vietnam

- vietnamese

- Wallet

- which

- while

- WHO

- within

- working

- world

- would

- year

- years

- young

- zephyrnet