With the way our society is moving, it is time for new money transfer apps to take over. The old-school methods of payment are outdated and leave a lot to be desired. It has been said that there will be three types of mobile banking users: those who don’t use any form of digital payments at all, those who just pay with cash or debit/credit card without using their phone’s app, and third, clients who do use some form of digital payment. The future of money transfer apps looks bright, with society moving in the cash-free direction.

Why building a money transfer app is a viable idea

Great demand

$1.89 trillion – this is the valuation of the global P2P payment market as of 2021 according to the Precedent Research report. It is expected to reach around $9.87 trillion by 2030, making the money transfer apps market a lucrative niche to tap into.

With over 2.5 billion active users, mobile payments are becoming more popular than ever. Quick peer-to-peer money transfers offer a convenient and social way to send and receive money almost instantly. Although in 2022 the money transfer volume decreased due to the crisis caused by the Russian aggression in Ukraine, the high demand for quick digital payments that soared during the pandemic isn’t going away anytime soon.

Financial inclusion

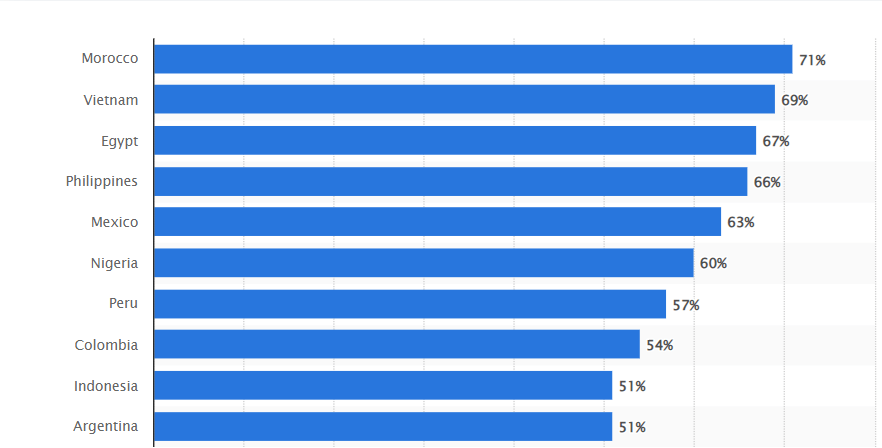

Demand is not the only reason building a money transfer app looks really promising. In fact, it might be the only way for the unbanked to receive access to financial services that are otherwise unavailable in certain countries and regions. According to Statista, 5 countries top the list of those with the largest percentage of the unbanked population: Morocco, Vietnam, Egypt, the Philippines, and Mexico.

Source: Statista.com

The list of countries where financial inclusion is insufficient is much longer, with about 1,7 billion people in total as of 2017, according to the World Bank. Therefore, it would be safe to assume peer-to-peer payment applications might be in demand, provided the population has access to smartphones and the Internet.

Cloud-based money transfer service platform

Explore the software to build your payment app faster and without hefty investments

What is a money transfer app and how does it work?

A money transfer or a p2p payment app is a type of app that allows users to make payments to other people without having to use a bank or credit card. It also enables users to perform banking transactions via cashless payment methods and exchange currency.

How do payments apps work?

Although pretty straightforward for end-users, money transfer apps are complicated “under the hood”.

Most P2P payment apps contain a digital wallet so that consumers can deposit their funds that will be later used for payments and transfers.

In case both parties use the same payment app, they can transfer money to each other by simply identifying a recipient via their email or mobile number. The amount transferred is deducted from the sender’s wallet and credited to the recipient’s one.

In case the transfer involves bank accounts or credit cards, the process will include sending encrypted information to the payment processor, credit card issuers, or banks to confirm the necessary amount is available at the sender’s account and then add the sum to the recipient’s balance.

Now, once it is clear why to build money transfer apps and how they work, let’s see how to do it right.

What are the must-have features of a money transfer app?

Money transfer apps provide a variety of features that can be helpful for businesses and consumers.

These apps allow people to send money to friends, family, or other contacts quickly and easily.

They also offer the ability to pay bills, buy airtime, or make in-app purchases – everything to spare the users the necessity to use cash in their everyday lives or spend hours paying their bills in person. The essential ones are as listed below.

Ewallets

As mentioned above, an ewallet is the means for users to store their funds and bank data within the payment app, plus perform transactions.

Design your own digital wallet solution

Cloud platform to implement your ewallet service features

Bill payments

Another feature of a customer-centric money transfer application is the ability to handle phone top-ups, utility bill payments etc online in a few taps. Adding invoice scanning to this feature will make your application even more attractive to customers and help you gain a competitive advantage.

Expense tracking

This feature adds value by helping users manage their finances more effectively. Basically, it means visualizing all transactions and grouping them by volume, status, location etc. This way, your customers get better UX and the chance to optimize their spending.

International remittance

Remove the boundaries for your users and let them transfer money abroad or receive international money transfers in minutes, without delays and huge fees.

Currency exchange

This feature will allow your potential users to send and receive different currencies, plus exchange currency between their accounts.

Online ID checks

Online ID checks are a common feature on money transfer apps because they protect both the sender and receiver. The sender can be sure that their information is being sent securely, and the recipient can avoid scams or fraudulent transactions. Money transfer apps with online ID checks also offer convenience for both parties – no need to meet in person or exchange phone numbers.

Multilingual interface

For startups, a single language interface might be enough, but at later stages, it is worth considering adding multiple languages to speed up product growth and expand worldwide.

Customer support

A decent customer support system typically includes live chat, email, or phone call support features. However, online chats are often the most frequent choice enabling customers to get the fastest support by asking a question in the in-app chat.

API-driven ledger layer software for your payment product

Build a new finance business or scale your existing one with SDK.finance

How to create a money transfer app? Essential steps

Once you’ve decided the money transfer app is your way to go and defined its market and type (i.e. a standalone P2P payment app, like PayPal or Zelle, a bank-centric app, which allows the bank’s customers access certain bank services 24/7), it’s time to move on to actually developing the app.

Draw up product concept and key features

Above, we talked about the must-have features of a payment app, but these are pretty generic. Your product will have its own feature set, stemming from its market needs, goals, available budget and team resources, etc.

So, creating a kind of PRD (product requirements document) for your app, specifying the necessary and nice-to-have features will make your further development steps much easier and more structured.

2. Create UI/UX concept

At this stage, your designers can start working on the app’s interface concept, making sure it’s intuitive and user-friendly, plus ensuring compatibility with a variety of devices – like smartphones, tablets, and desktops.

3. Choose a development approach

Once you understand the key functionality of your peer-to-peer transfers app, time to think about its implementation and development. We aren’t going to discuss the methodologies or tech stack here, but rather give you an idea of the key options for a remittance app development.

In-house development

If you have a strong team of developers with decent fintech experience, they can implement your product concept from scratch. Taking into account the complexity of compiling a team of 20+ professionals for a fintech project, it will be safe to assume this option is most viable for enterprise-level companies and hard to reach for smaller businesses.

Software development outsourcing

For businesses lacking enough talent to develop a money transfer system in-house, there’s an option to outsource development to companies specializing in fintech development. In this case, a discovery phase results in a clear vision of the product in terms of its technological implementation, which the development team proceeds to bring to life. It is far from being a cheap option, and usually no less time-consuming than in-house development.

Using a cloud-based SaaS fintech solution

Vendors like SDK.finance aim to bridge the gap between an initial product concept and a live application both in terms of budget and development time by providing a cloud-based API-driven transactional core to build finance products on. It comes with a bunch of benefits that help it stand out of the crowd and make it a viable alternative to more traditional solutions listed above.

What SDK.finance cloud SaaS payment platform has to offer?

- Release acceleration – SDK.finance platform acts as the development shortcut, so the customers’ teams don’t have to start from the ground up but rather can use the software as a backend platform for a payment app. This not only seriously saves the time for development, but also lets the team focus on tailoring its functionality, adding the necessary integrations and building extra features via API.

- Affordable price – the subscription-based payment model doesn’t require upfront investments in the infrastructure and opens the way for startup companies working on their MVPs, apart from SMBs and enterprises.

- No commitment – a hybrid cloud SaaS fintech platform by SDK.finance means a customer’s team doesn’t handle the app maintenance and can cancel the subscription anytime (or purchase the source code and go on-premise).

SDK.finance money transfer app end-user features

Below, you can find a table matching the must-have features for a remittance app and their availability via SDK.finance platform.

| Feature | SDK.finance fintech platform |

| Two-factor authorization (2FA) | Yes |

| Online ID check (KYC) | APIs for manual approval and for integration with third-party KYC services are available |

| E-wallets | Yes, multiple wallets in different currencies can be created |

| Bill payments | Available through integrations with the vendors via API |

| Expense tracking | Yes, spending by categories, transactions on the map |

| Transaction notifications | Email and SMS notifications APIs |

| P2P transfers | Available out of the box |

| International remittance | APIs for integration available |

| Currency exchange | Available between a user’s accounts |

| Multilingual interface | APIs for integration available |

| Support | APIs for integration available |

| Integrations | The product is integration-ready with 400+ APIs, but no out-of-the-box integrations available |

How much time does it take to develop a money transfer app?

The main factors that affect the time it takes to develop a money transfer app are: the platform you use, the development tools, how much customization you require, whether you have an in-house team etc.

Even if you choose a payment platform from a vendor like SDK.finance, which will cut down the time-to-launch, there’s no way one can estimate the approximate development time without knowing your specific product requirements and pre-requisites.

Platform to build your own neobank

SaaS solution to offer bill payments, transfers, currency exchange, card payments etc.

Important things to consider before developing a money transfer app

Aside from the development hurdles, there are a range of other factors you need to take care of when working (or entering) in the fintech industry.

Regulatory compliance

Although a remittance app is not a banking institution (unless it’s a mobile banking app), it still is subject to certain regulations related to dealing with people’s finances. Moreover, the regulations vary between jurisdictions, so an app should match all fintech standards in every location it is going to operate.

How does the SDK.finance platform handle compliance issues?

SDK.finance platform complies with any potential regulations since it serves as a layer within a customer’s system and its usage can be customized according to the respective license. Besides, no data is stored within the system and the database is on the customer’s server, SDK.finance providing only backend app available at one of the cloud providers.

Security

Money transfer applications not only transfer funds but also report on transactions performed, so security is of primary importance for any application in the fintech niche. It is best to use strong data protection methods to maximize your customer’s money and data protection and prevent fraud.

Some of the recommended security measures include:

- Two-factor authentication

- Password change on a schedule.

- PCI DSS compliance (if you deal with cards)

- Use third-party identity verification services for anti-money laundering (AML) and “Know Your Customer” (KYC) procedures.

- Implement data encryption, session time limits, backups, and alerts.

Wrapping up

Once you’ve decided on your app’s needs, you can weigh all the pros and cons of different development possibilities and choose software vendors or outsourcing partners who will help you build a project roadmap that will take you from concept to launch.

P.S. Get in touch with us for expert consultation on how your project can be implemented on SDK.finance platform.