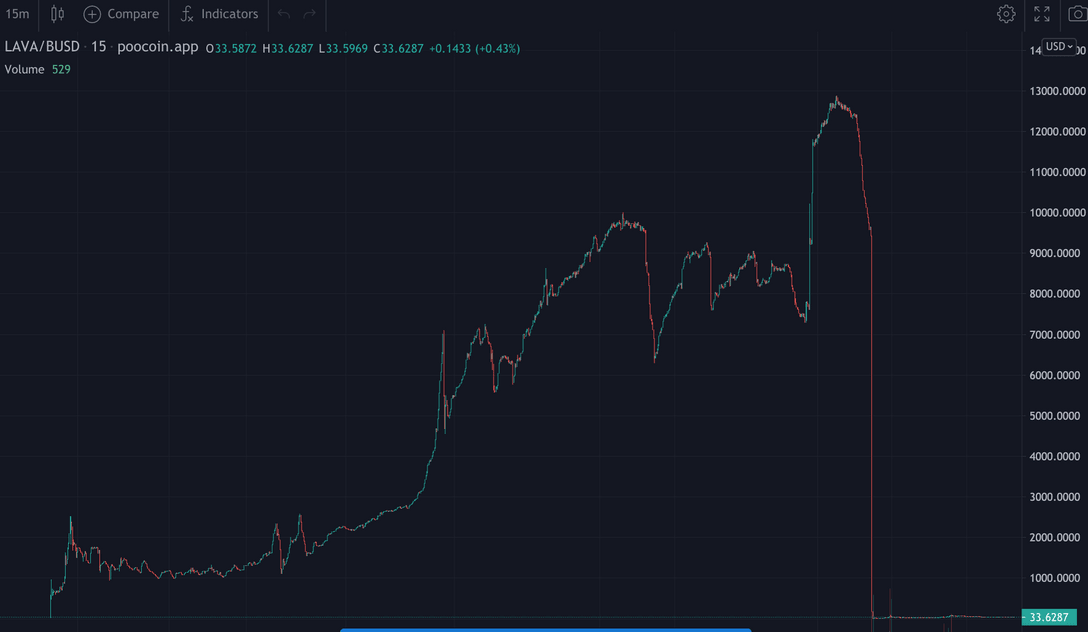

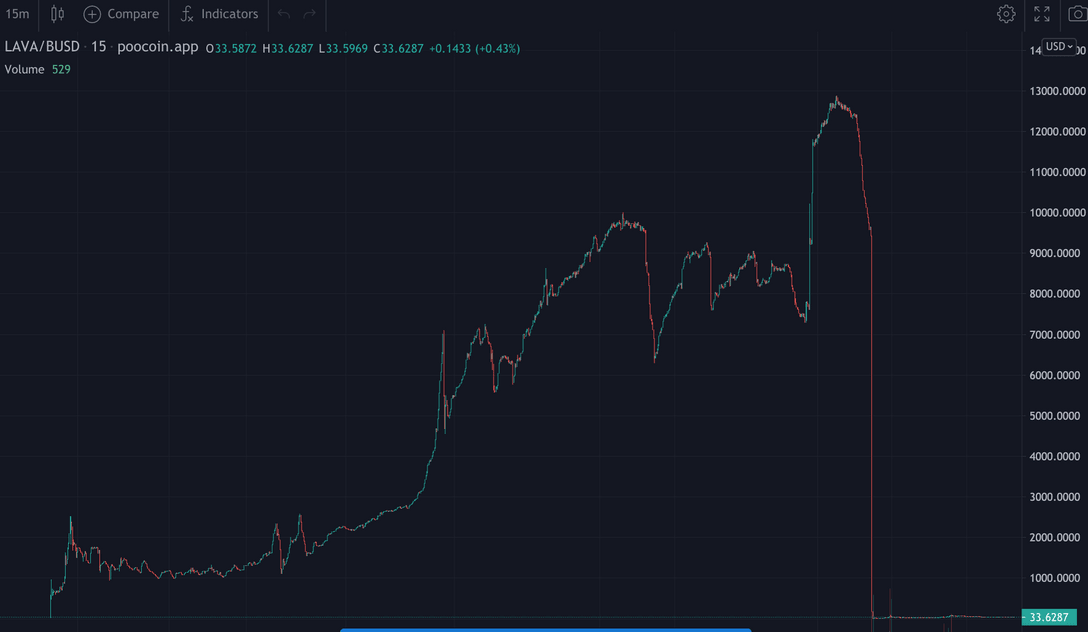

LAVA token drops 99.8% leaving investors empty-handed

Binance Smart Chain has suffered a price dump this week. Serving further warnings to the DeFi community to stay vigilant amidst increasing competition for eyeballs.

Editorial update (22 June 2021): We removed the term ‘rugpull’, as the developers are still active on LavaCake. However, we do warn readers about the risks involved, as the developers are free to dump their own tokens.

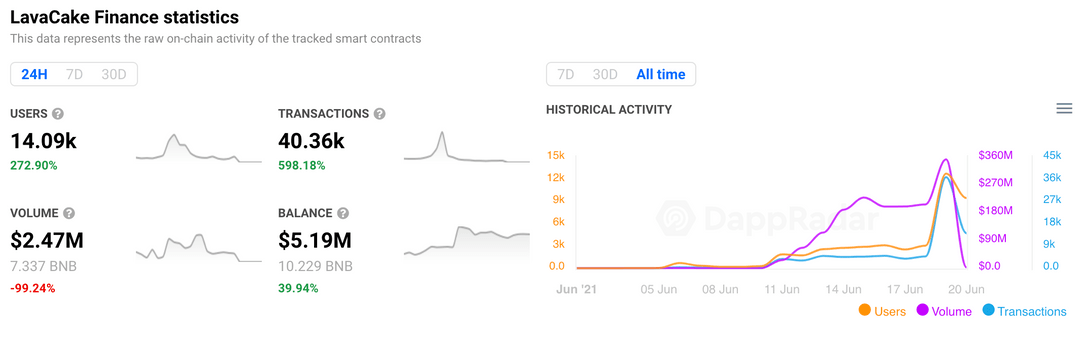

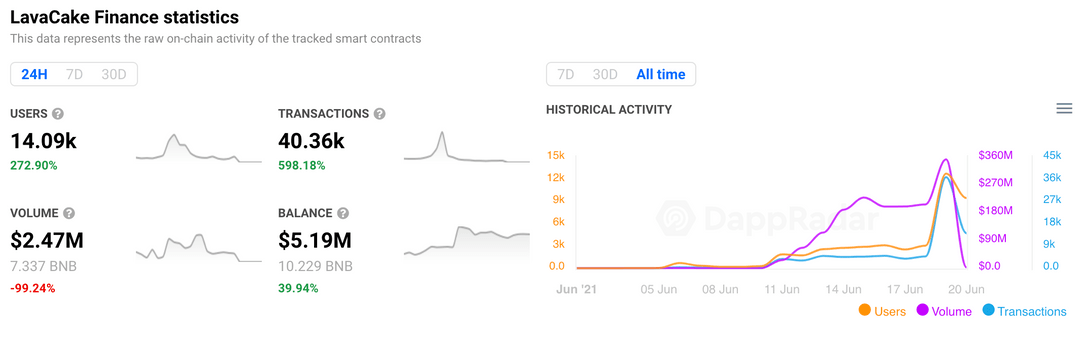

LavaCake, a one-month-old yield farming and automated market maker DeFi application on Binance Smart Chain, has caused yet another sensation this week. According to DappRadar data, a surge in unique active wallets took the relatively new DeFi application to 10th position in the overall dapp rankings. Interestingly, LavaCake outperformed Uniswap v3 on Ethereum, Polycat Finance, and Sushi on the Polygon network in the last 24 hours when considering the number of active wallets. Although impressive, it started to set off alarm bells.

Despite recent articles warning of recent exploits on new finance apps. In the last 7 days, LavaCake finance attracted over 16,000 unique active wallets to its platform. Most interesting though is that just over 14,000 arrived in the last 24 hours. The reason for the surge is that the platform’s lock-up feature came to an end on Sunday 20th June. After that time users would have to wait a further 28 days to unlock rewards again.

What is LavaCake?

LavaCake Finance is a yield farming platform on Binance Smart Chain. Here users can participate in staking liquidity pools in order to earn the LAVA token. Importantly, the platform claimed to have anti-whale measures and a harvest lockup. Most traders worry about whale activity, which usually affects token price whenever they sell large amounts.

In LavaCake, the developers claim that they put in place a system that will reject any transaction that is more than 0.01% of the total supply. This eliminates any heavy dumping that might occur. Now, in case there was an attack on the front-end, the devs put in place an emergency withdrawal system, that allows users to withdraw their tokens by direct integration with the MasterChef contract. On the other hand, this immediately removes all the rewards earned.

Check the code

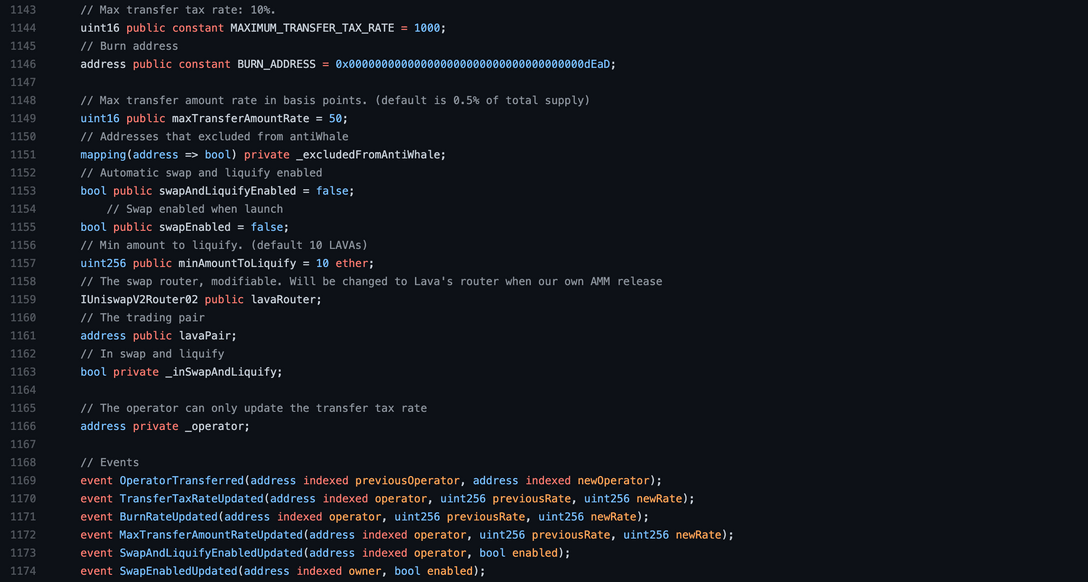

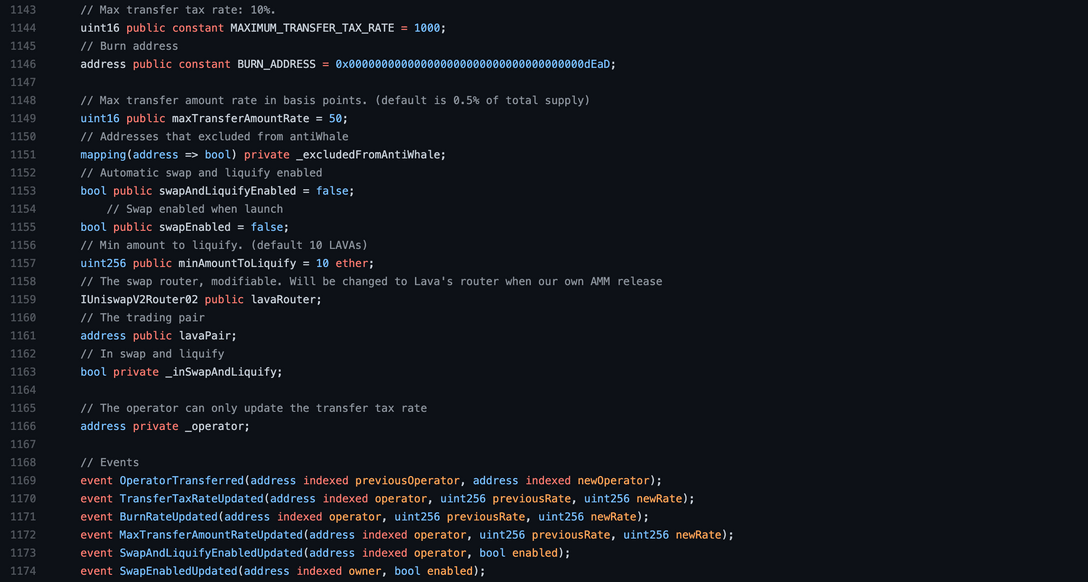

In the LAVACAKE contract code on Github, there appears to be an exception for the anti-whale system. As mentioned, the anti-whale prevents any user from dumping more than 0.01% of the token total supply. On the other hand, there is an exception for certain wallet addresses from the anti-whale restriction. So the company gave an exclusion for certain wallets to be able to dump more than “normal people”. This fundamentally renders the anti-whale system useless and means that ultimate control still lay in the hands of the owners.

Community reaction

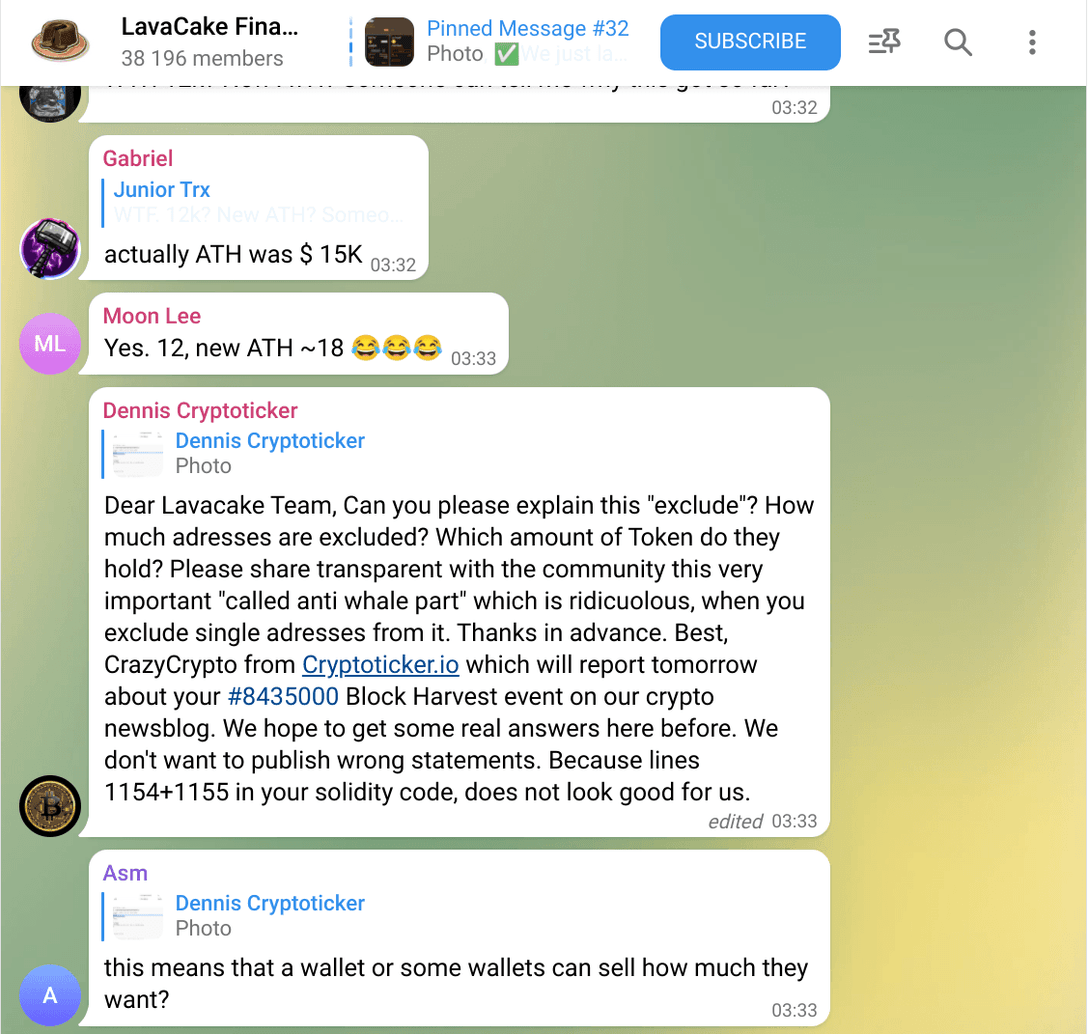

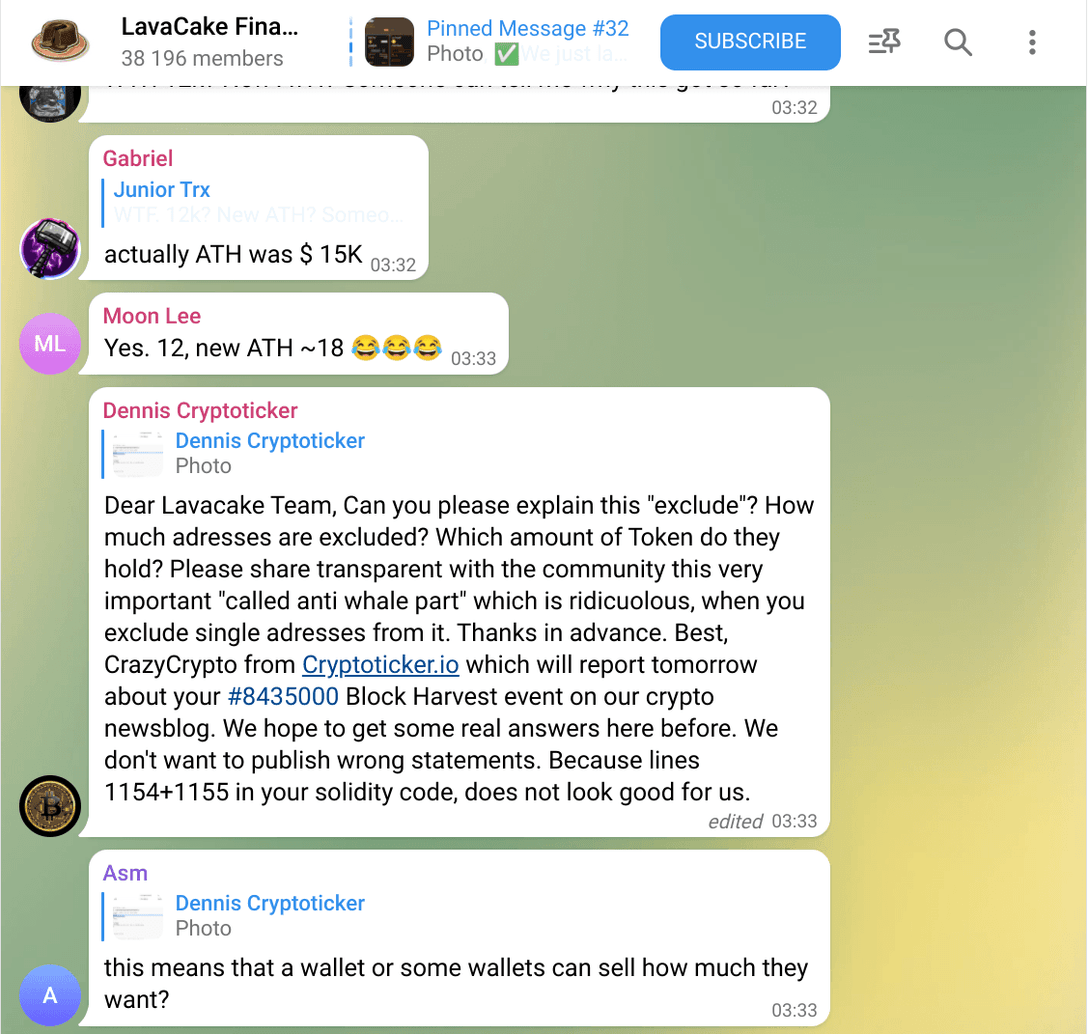

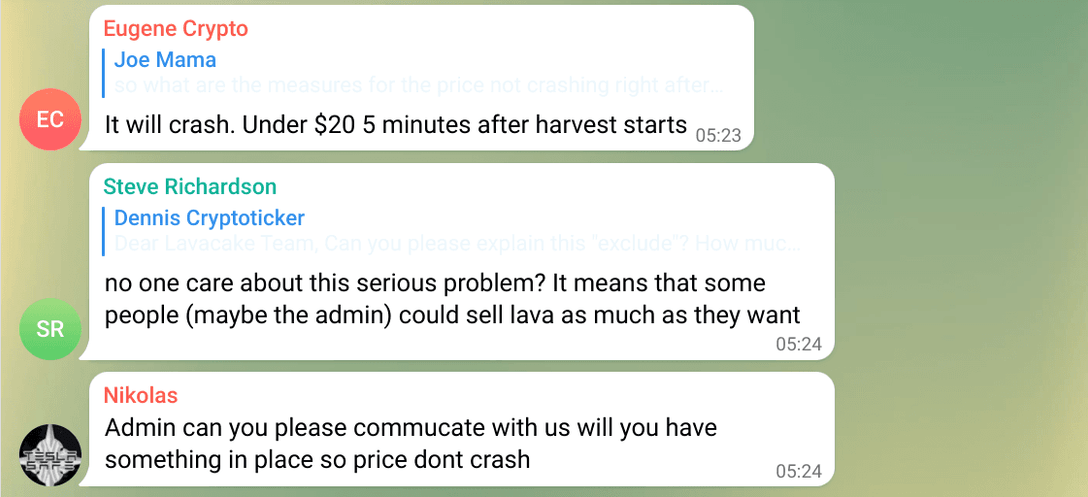

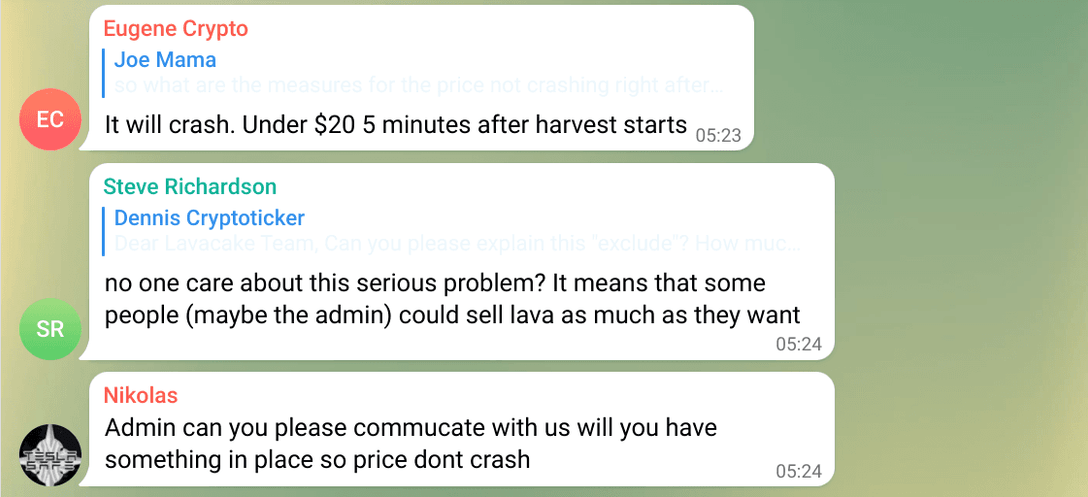

LavaCake has a Telegram group with almost 40,000 community members. When asked about the above exception to the anti-whale system, no one was able to answer the question for a long period of time. In the end, savvier community members started to theorize the outcome. The most on-point comment being. “In the event of dumping on harvest day DOES happen, the price of LAVA can fall from the current price of $10K all the way to $50 or even less, as seen in other projects.”

After addressing the issue on the Telegram group, the person was suspiciously blocked by the admins, until the CMO then unblocked him and answered the question. LavaCake admins claimed that the excluded wallets were the devs wallet, Masterchef wallet, and fees wallet.

- Dev address: 0xAc395eD94ddf317c8Bb9Ca966B1eb3ee98AF87eB

- MasterChef address: 0xfbfae2D489Bb649C7f33d9812b2Dcf17E9bb279C

- Fees address: 0x77931e5E5F89f9164D9100329A9b2656b0ACD63B

The Inevitable Happened

The first harvest took place on Sunday 20th June. Hence the influx of unique active wallets to the platform seen through DappRadar. Almost immediately after the harvest went live, the LAVA token which was priced around $13,000 pre-harvest fell all the way to $0.40.

Mass dumping on reward day would indicate the platform knew exactly what they were doing and this was in fact an orchestrated event as opposed to an exploit. On the other hand, the fact the website is still running and that Twitter continues to push out messages feels odd. The Telegram channel appears to have continued onwards but overall it’s safe to assume that the project is dead.

This recent case, although still developing, is a word to the wise. If something looks too good to be true then it probably is. The sheer number of copy-and-paste DeFi dapps arriving on Ethereum rival blockchains lately is alarming. It can of course be very difficult to pick the good from the bad. Due diligence is always important and even doing quick scans across sites and social channels can indicate a lot. However, more alarming is the rash nature of some investors who seem to be willing to chase the yield at all costs.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet