USD 100 oil delayed as Ukraine tensions ease

Oil prices have pulled back from yesterday’s highs and are off more than 3% on the day as invasion fears recede. Brent and WTI had been on the march to USD 100 but the removal of troops has reduced the likelihood of conflict and, in turn, the risk premium. We could quickly see that change over the coming days if the situation deteriorates but if not, we could see a further decline in the price.

There’s been so much talk of triple-figure crude and the threat of war in Ukraine clearly accelerated that. We could still see oil hit USD 100 even without an invasion but it will take a little longer. The market is still extremely tight, which is why we’re seeing the prospect of an invasion drive up prices so much. In the absence of some unilateral action from Saudi Arabia, or a nuclear deal between the US and Iran, it may still not be too far away.

Gold appeal wanes on Ukraine de-escalation

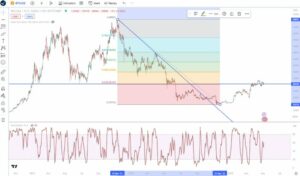

Soaring demand for gold in recent days has cooled after Russia confirmed the planned withdrawal of some troops; the first sign of de-escalation on the Ukrainian border amid warnings of an invasion. The yellow metal was boosted by a combination of its safe-haven reputation and its inflation hedge qualities as oil and gas prices spiked.

It peaked earlier today around USD 1,880 but now finds itself testing USD 1,850, a level that prior to the invasion warnings on Friday had been a notable level of resistance. Should gold erase its invasion premium, we could see it move back towards USD 1,830 where it had stabilised around the middle of last week.

For a look at all of today’s economic events, check out our economic calendar: www.marketpulse.com/economic-events/

- 100

- Action

- All

- appeal

- around

- Boosted

- border

- Calendar

- change

- combination

- coming

- conflict

- could

- crisis

- day

- deal

- Demand

- Economic

- events

- fears

- finds

- First

- Friday

- GAS

- Gold

- HTTPS

- inflation

- Iran

- IT

- Level

- little

- March

- Market

- metal

- move

- Oil

- Premium

- price

- quickly

- RE

- Risk

- Russia

- Saudi Arabia

- So

- Talk

- Testing

- today

- today’s

- Ukraine

- us

- USD

- war

- week

- without