Oil falls as demand eases

Oil prices softened after softer economic data in the US and Europe confirmed fears that crude demand destruction is happening. The oil market however remains very tight and declining production should prevent prices from falling below the USD 100 a barrel level. Libya’s oil production is falling as disruptions continue from political protests.

Oil CEOs and energy secretary Granholm are meeting in what is basically grandstanding to show an effort is being made to provide Americans some relief at the pump.

Crude prices may remain heavy until Wall Street is done fully pricing in an economic slowdown that will bring this economy on the verge of a recession.

Gold

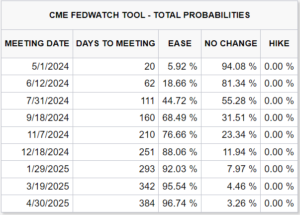

Gold was unable to hold onto earlier gains as another round of hawkish talk and rising recession fears weakened demand for most commodities. Gold will stabilize once Wall Street is confident they have a handle on how high the Fed will take interest rates.

Gold could be vulnerable to further selling as it has broken below the 200-day simple moving average (SMA). Gold should find support around the USD 1800 level as rising recession risks will weigh on Treasury yields. Gold will eventually emerge as an attractive asset as investors look to diversify away from bonds.

- 100

- a

- Americans

- Another

- around

- asset

- average

- Basically

- being

- below

- Bonds

- bring

- Commodities

- confident

- continue

- could

- data

- Demand

- Economic

- economy

- effort

- energy

- Europe

- eventually

- fears

- Fed

- from

- further

- Gold

- handle

- High

- hold

- How

- How High

- However

- HTTPS

- interest

- Interest Rates

- Investors

- IT

- Level

- Look

- made

- Market

- meeting

- most

- moving

- Oil

- political

- pricing

- Production

- Protests

- provide

- pump

- Rates

- recession

- relief

- remain

- remains

- rising

- risks

- round

- Selling

- show

- Simple

- some

- street

- support

- Talk

- Technical

- The

- us

- USD

- Vulnerable

- Wall Street

- weigh

- What

- What is