Set up a wallet and start earning a passive income

Yield farming and DeFi are often seen as the ignition for a new blockchain project, and that’s why we will take a look at Raydium and its unique approach to yield farming. Solana has seen an uptick in user activity over the past weeks, and with it, a variety of dapps found an audience. Reasons enough to dive deeper into Raydium, and earn that passive income.

Blockchains and the applications they run (dapps) are evolving. A truly multichain paradigm is embedding itself. As such, yield farming is no longer reserved for those investors choosing to use Ethereum-based services. The simple act of staking your held crypto assets into a platform to earn more tokens has become extremely popular on other blockchains such as Binance Smart Chain, Polygon, and more recently Solana.

With a total value locked of just over $3.3 billion, Solana’s DeFi dapps are still some way behind those on BSC or Ethereum. Nonetheless, the Solana ecosystem is growing steadily, with projects such as Raydium and Serum bringing unprecedented attention to the fast and cheap blockchain network.

Moreover, the Solana ecosystem can be trickier for newcomers to navigate and connect to. Although the lightning-fast speed and low transaction fees are very appealing to veterans and retail investors, it is not as simple as just switching networks on Metamask, and newbies may be put off by the large change in the overall user experience. The purpose of this guide is to get you set up with a compatible Solana blockchain wallet and lead you to your first staking experience on Solana through Raydium.

Getting a Solana Wallet

Unlike most other mainstream blockchains that can be accessed using a Metamask account or hardware wallet such as Ledger, there are various wallets available that can be used for storing funds on Solana. Among these wallets are Sollet, Solong, and MathWallet.

These wallets are all non-custodial, meaning that you are in charge of your funds, and they can be used to receive and send SOL or any other Solana Program Library (SPL) token. Although all of them can be used with little to no issue, we would recommend using the Sollet wallet built by the Project Serum team since it is highly compatible with most, if not all of the projects that are currently live on Solana. We already covered setting up a Sollet wallet here.

Making Transactions Using SOL

Now you have set up your wallet you’re ready to start farming on Solana. Like the majority of dapps, you need to connect with them using a supported wallet. Similarly, performing and approving transactions is mostly the same as you would normally do on Ethereum or Binance Smart Chain. You will receive a prompt to conduct the transaction, which would require the payment of transaction fees in the form of SOL, the native token of the Solana blockchain. But fret not, as the transaction fees are extremely low, sometimes costing less than a cent. Nonetheless, it’s vital to hold a small amount of SOL in your wallet in order to make any transactions.

Yield Farming with Raydium on Solana

Recently, we dug deeper into the Solana DeFi ecosystem to uncover the most active dapps in regards to their total value locked (TVL). Below are the TVL figures of some of the projects that have gone live. As a project with over a third of the total TVL locked of the entire ecosystem in its smart contracts we will be taking a look at the Raydium platform. Here users can start staking assets to earn a yield right away.

For those familiar with Ethereum decentralized exchanges such as Uniswap and SushiSwap, Raydium would feel very familiar. It is an Automated Market Maker (AMM) built for Serum, a decentralized exchange on Solana. The two protocols have a tight relationship, where Raydium will provide on-chain liquidity to the central limit order book of Serum, allowing the liquidity providers (LPs) to receive full access to the volume and liquidity of Serum. On the flip side, Raydium users can also access liquidity via the central order book, allowing for almost instant trades.

Using RaydiumSwap, any Solana-based token can be quickly swapped into another, thanks to liquidity from two main sources Firstly of course Raydium’s liquidity pools and in addition the Serum order book. Each exchange transaction will incur a 0.25% trading fee, of which 88% of that fee will be redeposited in the liquidity pool to reward liquidity providers. At the same time, the remainder will be sent as yield to RAY stakers. To use the Swap function follow the steps below:

- Click on the SWAP button at the top of the website.

- Connect your wallet by clicking on CONNECT WALLET in the top right of the page.

- From the drop-down list, select the token you want to Swap in the first column and choose the one you wish to receive in the second column.

- Enter the number of tokens that you wish to exchange in the first column.

- In column 2, it will automatically show you the estimated amount of tokens that you receive.

- Finally, click SWAP to exchange.

- Click “Approve” in your wallet to confirm the transaction.

- Soon after the completion of the transaction, you can view your tokens in your SPL wallet. Make sure to add the token to view it in the wallet.

Providing Liquidity

Anyone with a Sollet wallet can provide liquidity to Radiyum’s liquidity pool. You can view the complete list of pools by navigating the Pools tab on the website. Follow the below steps to provide liquidity:

- Go to the pools section and scroll down to select your preferred pool pair to provide liquidity.

- Click on it, and it will redirect you to the LIQUIDITY TAB of the website.

- Enter the number of assets to provide liquidity. Make sure to enter them in the ratio of 1:1.

- Click to ADD LIQUIDITY

- Confirm both of the transactions in your wallet to provide liquidity.

- Once done, you can view the received LP tokens in your wallet that you get as a proportion to provide liquidity to the pool.

- You can withdraw your assets at any time by clicking on the REMOVE LIQUIDITY button against your preferred pool pair.

Staking Single Assets

Besides the core functions of swapping and providing liquidity. Staking single assets or various LP tokens in Raydium’s Farms or Fusion Pools can earn users RAY tokens, the platform’s native governance token. Additionally, RAY can be staked on the platform for further yield. Currently, the annual percentage return for staking RAY is 19.19%.

The process is very straightforward and once you have connected your Sollet wallet with Raydium you simply approve the transaction, deposit your RAY and start earning. Rewards can be collected at intervals based on accrued value by approving another transaction. At which point your original staked amount of RAY, plus any given rewards will be deposited back to your Sollet wallet. Follow the below steps to stake RAY:

- To stake RAY, go to the STAKING TAB at the Raydium website.

- Enter the amount of RAY you want to stake and click STAKE, followed by confirming the transaction in the SPL wallet.

- Once staked, your RAY token will grow based on the mentioned APR against the RAY vault.

- You can harvest your RAY rewards by clicking on the harvest button under the RAY vault, but only when it reaches a specific value.

- You can also end all this with one click. Simply click UNSTAKE to receive your RAY tokens back.

Farms & Fusion Pools

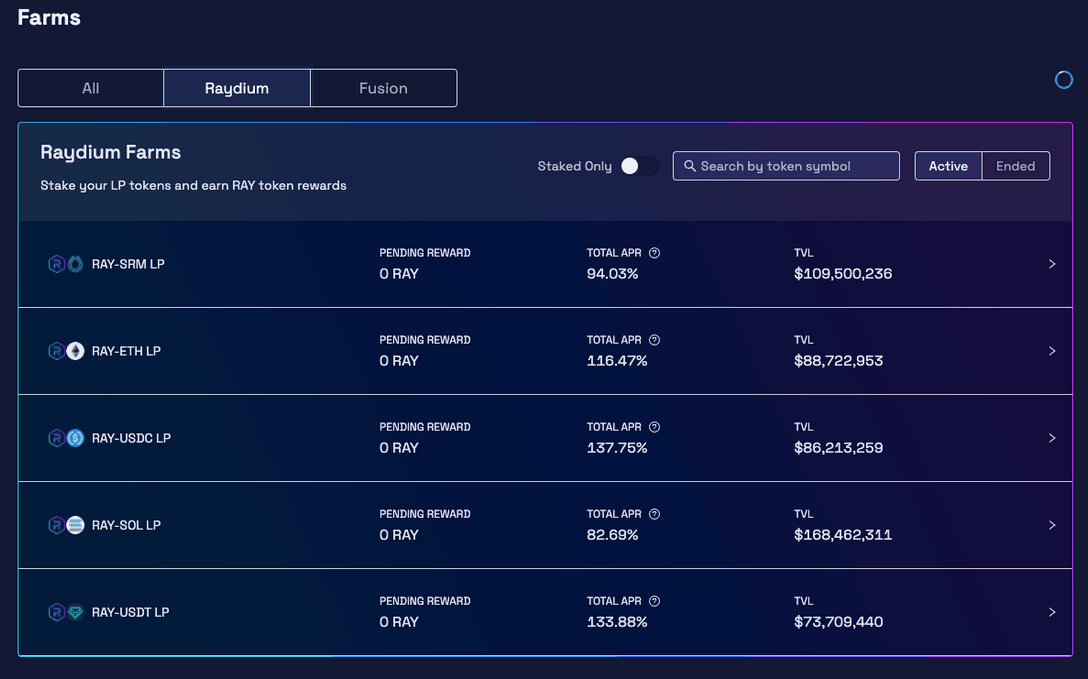

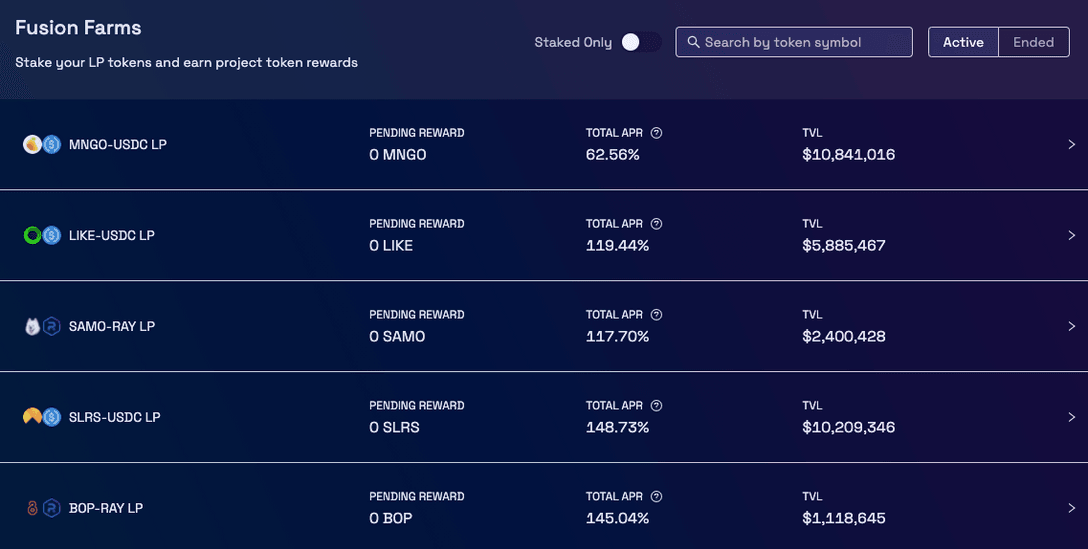

Raydium Farms are basically liquidity pools on the Raydium platform. They allow liquidity providers to earn RAY tokens on top of the trading fees from their provided liquidity pair. Fusion Pools are a new form of liquidity mining created in collaboration with several projects. The main objective of these liquidity pools is to work together with other Solana projects to expand liquidity within the Solana DeFi ecosystem. With the eventual aim of promoting growth for both the participating projects and Raydium. At the time of writing, we see rewards up to 134% when depositing both RAY and USDT LP tokens.

Projects that have received enough attention are included in the Fusion Farms section. At the time of writing, the Fusion Pools offer very attractive yields, such as 145% APR for the BOP-RAY pair.

Raydium farms function like any other farm in the De-Fi space. Users can earn RAY tokens as farming rewards to provide liquidity to the pools. It is a process to generate more crypto from your existing crypto securely and efficiently. Users can stake the LP tokens they receive after providing liquidity to the pool and can earn RAY. Follow the steps below to generate RAY as farming rewards:

- Go to https://Raydium.io/farms/

- Select your preferred farming pool to generate RAY tokens.

- Click to ADD LIQUIDITY on the left-hand side under the pool pair name.

- Follow the steps described above to add liquidity and receive LP tokens.

- Once you receive LP tokens, you can stake them in the farming pool to earn RAY.

- To Stake LP tokens, CLICK STAKE under the pool you wish to farm.

- Enter the number of tokens you would like to stake or hit MAX to stake all LP tokens.

- Click Confirm.

- Approve the transactions in your SPL wallet to successfully stake the tokens.

- Your asset will grow based on the mentioned APR against it, and you will also receive RAY tokens as farming rewards.

Wrap Up

The Solana ecosystem is still very young and as such arguably relatively untapped. As more projects are introduced and go live there is real potential for hungry investors in liquidity mining and yield farming. Moreover, these DeFi services don’t experience any restrictions from the now-standard high fees and slow settlement times on the Ethereum blockchain.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, NIOX, AGIX, MATIC, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, OMI, GO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet