One thing to start: Manchester United’s US owners are considering selling the English football club, potentially making it the latest prestigious team in the lucrative Premier League to go on the market in recent months.

In today’s newsletter:

-

Babylon’s Spac-tacular fail

-

FTX’s courtroom drama unfolds

-

The power move by SocGen’s future boss

The healthcare start-up with a nasty case of Spac fever

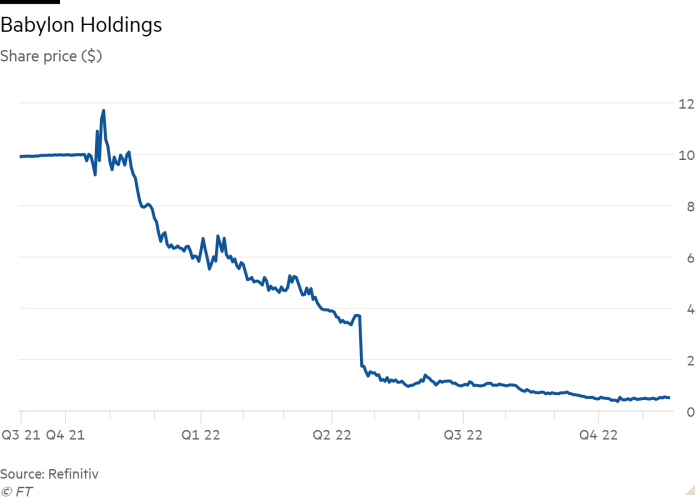

In the summer of 2021, the healthcare start-up Babylon had an enterprise value of $3.6bn , a clutch of prestigious partnerships with the UK’s NHS, backing from the US big data company Palantir and an expected $575mn windfall from an upcoming merger with a blank-cheque vehicle.

It has all been downhill from there, reports the FT’s Cristina Criddle in an interview with Babylon’s regret-filled chief executive Ali Parsa, who dubbed the company’s performance since the listing an “unbelievable, unmitigated disaster”.

An early sign of trouble came with the vote on its merger with a Nasdaq-listed special purpose acquisition company, Alkuri Global. About 90 per cent of shareholders asked to redeem their shares despite approving the deal.

That left Babylon with only $275mn of the expected $575mn. Most came from a so-called “private investment in public equity” or “pipe” agreement from investors such as Palantir, which has also been trying to cement itself in the UK and US healthcare sector, and Swedbank Robur.

Like so many companies that jumped on the Spac bandwagon in the boom times, Babylon couldn’t always turn its technology into profits.

“We still lose money on every patient” that uses the company’s mobile app, GP at Hand, which allows UK patients to see NHS doctors virtually, said Parsa. The British-Iranian entrepreneur and former banker founded the healthcare platform in 2013.

Babylon’s share price has tanked 90 per cent since its stock market debut in October last year. It risks being kicked off the New York Stock Exchange for trading under $1 for 30 days, though it has issued a reverse stock split to consolidate shares into fewer, higher-priced ones to avoid that.

(Side note: the GP at Hand service was publicly championed by the then-health secretary Matt Hancock, who is known for being covered in slime on a reality TV show, breaking Covid-19 guidance by kissing his adviser in his office, and championing cryptocurrency.)

Now it has its eyes set on the US, which accounts for more than 90 per cent of its revenues through contracts with Medicare and Medicaid health insurance schemes. But the US healthcare system remains notoriously immune to disruption, Lex notes.

Parsa says the disaster that has befallen him is “super simple to understand”, with hindsight.

To him, the problem stems from going public through the blank-cheque vehicle. “We learnt a big lesson, which is we should have done a lot more thinking through Spacs.”

Inside the ‘fiefdom’ of Sam Bankman-Fried

Sullivan & Cromwell partner James Bromley did not mince his words during FTX’s bankruptcy hearing on Tuesday.

“We have witnessed one of the most abrupt and difficult collapses in the history of corporate America,” he said, adding that bankruptcy proceedings had “allowed everyone for the first time to see under the covers and recognise the emperor had no clothes”.

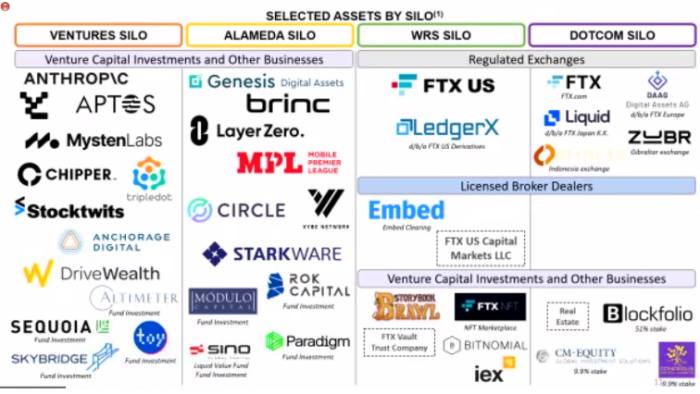

Though much of the FTX empire had gone up in smoke, its founder Sam Bankman-Fried did accumulate a massive trove of real estate.

The team of lawyers tasked with winding down FTX is attempting to untangle a complex web of assets in order to repay creditors, including $300mn of property in the Bahamas that were “homes and vacation properties used by the senior executives” of FTX”, according to Bromley.

Among them are a $40mn penthouse in an upscale gated community called Albany where SBF lived with other FTX executives, and a $16.4mn vacation home listed under the names of his Stanford law professor parents, according to Reuters.

Tracking down other assets to repay FTX’s thousands of creditors won’t be as easy as locating the negative $8bn entry described as “hidden, poorly internally labelled ‘fiat@’ account” on FTX’s balance sheet.

Under restructuring expert John Ray III, FTX’s new management has tracked down $1.24bn in the scramble to survey its assets ahead of the bankruptcy case. (For those in need of a refresher, a FTX special edition of DD broke down the saga last week.)

SBF ran the cryptocurrency exchange as his “personal fiefdom” before its implosion, Bromley attested, transferring “substantial funds” from crypto hedge fund Alameda Research to fund the property purchases and other things “not related to the business”.

Alameda also appeared to have used FTX funds to make billions in venture investments in funds such as Sequoia Capital and companies including Elon Musk’s SpaceX and Boring Company, Bromley said.

There are other reasons the bankruptcy case may set a new bar for complexity. Hedge funds have found themselves locked out of billions of dollars after trading through the failed crypto exchange. It could take years for investors to claw back the funds, if at all.

Bromley wasn’t the only person to take a sartorial jab at SBF on Tuesday.

A “horrifying” outcome of the crypto wunderkind’s collapse is that his shabby attire wasn’t in fact a power play, notes the FT’s financial attire guru Rob Armstrong.

“How unpleasant to discern that Bankman-Fried actually was a failure-to-launch video-game addict, just one who somehow got hold of a lot of other people’s money,” he wrote.

Unfortunately, getting the billions back won’t be so easy.

SocGen’s incoming chief makes a deal with the Americans

Before Frédéric Oudéa announced in May his intentions to step down as CEO of Société Générale, the head of the French lender’s investment bank Slawomir Krupa was already working on a plan that may have helped him solidify his new role.

The Polish-French national, set to become group chief executive in May next year, has been formulating a strategy to merge SocGen’s equities research and cash equities businesses with that of US investment company AllianceBernstein’s for more than a year now, he told the FT’s Owen Walker. That proposal is now coming to fruition.

The joint venture idea couldn’t have hurt his case as the board evaluated him for the top job against Sébastien Proto, the former Rothschild banker who ran SocGen’s retail bank and was widely considered to be a formidable candidate.

It was Krupa’s markets experience — a key area SocGen is trying to fix as it looks to de-risk and reverse its falling share price — that ultimately helped seal the deal. He previously ran SocGen’s US business before taking over the investment bank a few years ago.

The equities merger, which has been discussed since last year by Krupa and AllianceBernstein’s chief Seth Bernstein, will create a global player in equities services that SocGen will have the option of buying outright five years after it launches. The deal is expected to close late next year.

It’s a clear way to make up for lost ground against its larger domestic rival BNP Paribas, which bought out its equities joint venture Exane last year.

Oudéa, under whom SocGen’s share price has plummeted, isn’t the toughest act to follow. But boosting the group’s shares is going to take a lot more than one good deal.

Job moves

-

Carlyle has announced 32 new partners and 39 new managing directors.

-

Vodafone chief commercial officer Alex Froment-Curtil is leaving the group “to return to France with his family for an external opportunity in another industry” at the end of the year.

-

Squire Patton Boggs has hired private equity and M&A lawyer Carlos Blanco Morillo as a partner in Madrid. He arrives from Spanish firm Roca Junyent.

-

UK communications and advisory firm Nepean has appointed former Teneo chief operating officer Peter Fitch as a partner.

Smart reads

Loyal to a fault? Coinbase boss Brian Armstrong is “just as bullish on crypto as ever” in the wake of the FTX crash, he tells Hannah Murphy over Lunch with the FT. His self-proclaimed zero-politics policy must now reckon with the politics of crypto.

The Taylor effect The newest anti-monopoly activists are Taylor Swift fans, who’ve become enraged after TicketMaster’s botched sales for the singer’s upcoming tour. “Swifties” and US lawmakers are mobilising, Bloomberg reports.

Problematic policy The cancelled takeover saga of Welsh semiconductor group Newport Wafer Fab highlights the shortcomings of the UK’s attempts at industrial policy, writes the FT’s Helen Thomas.

News round-up

Disney do-over: can Bob Iger pick up where he left off? (FT)

Trump Spac’s shareholders give it more time to clinch a deal (FT)

Elon Musk postpones Twitter Blue relaunch (FT)

Enel seeks to slash debt with €21bn asset sale (FT)

Exonerated trader sues Deutsche Bank over Libor rigging allegations (FT)

Tiger Global’s now-worthless FTX bet had Bain’s due diligence (Bloomberg)

L&G defends risk management and blames mini-Budget for LDI crisis (FT)

US credit markets: autumn thaw gives LBO lenders some relief (FT)

#mailpoet_form_1 .mailpoet_form { }

#mailpoet_form_1 form { margin-bottom: 0; }

#mailpoet_form_1 .mailpoet_column_with_background { padding: 0px; }

#mailpoet_form_1 .wp-block-column:first-child, #mailpoet_form_1 .mailpoet_form_column:first-child { padding: 0 20px; }

#mailpoet_form_1 .mailpoet_form_column:not(:first-child) { margin-left: 0; }

#mailpoet_form_1 h2.mailpoet-heading { margin: 0 0 12px 0; }

#mailpoet_form_1 .mailpoet_paragraph { line-height: 20px; margin-bottom: 20px; }

#mailpoet_form_1 .mailpoet_segment_label, #mailpoet_form_1 .mailpoet_text_label, #mailpoet_form_1 .mailpoet_textarea_label, #mailpoet_form_1 .mailpoet_select_label, #mailpoet_form_1 .mailpoet_radio_label, #mailpoet_form_1 .mailpoet_checkbox_label, #mailpoet_form_1 .mailpoet_list_label, #mailpoet_form_1 .mailpoet_date_label { display: block; font-weight: normal; }

#mailpoet_form_1 .mailpoet_text, #mailpoet_form_1 .mailpoet_textarea, #mailpoet_form_1 .mailpoet_select, #mailpoet_form_1 .mailpoet_date_month, #mailpoet_form_1 .mailpoet_date_day, #mailpoet_form_1 .mailpoet_date_year, #mailpoet_form_1 .mailpoet_date { display: block; }

#mailpoet_form_1 .mailpoet_text, #mailpoet_form_1 .mailpoet_textarea { width: 200px; }

#mailpoet_form_1 .mailpoet_checkbox { }

#mailpoet_form_1 .mailpoet_submit { }

#mailpoet_form_1 .mailpoet_divider { }

#mailpoet_form_1 .mailpoet_message { }

#mailpoet_form_1 .mailpoet_form_loading { width: 30px; text-align: center; line-height: normal; }

#mailpoet_form_1 .mailpoet_form_loading > span { width: 5px; height: 5px; background-color: #5b5b5b; }#mailpoet_form_1{border-radius: 3px;background: #27282e;color: #ffffff;text-align: left;}#mailpoet_form_1 form.mailpoet_form {padding: 0px;}#mailpoet_form_1{width: 100%;}#mailpoet_form_1 .mailpoet_message {margin: 0; padding: 0 20px;}

#mailpoet_form_1 .mailpoet_validate_success {color: #00d084}

#mailpoet_form_1 input.parsley-success {color: #00d084}

#mailpoet_form_1 select.parsley-success {color: #00d084}

#mailpoet_form_1 textarea.parsley-success {color: #00d084}

#mailpoet_form_1 .mailpoet_validate_error {color: #cf2e2e}

#mailpoet_form_1 input.parsley-error {color: #cf2e2e}

#mailpoet_form_1 select.parsley-error {color: #cf2e2e}

#mailpoet_form_1 textarea.textarea.parsley-error {color: #cf2e2e}

#mailpoet_form_1 .parsley-errors-list {color: #cf2e2e}

#mailpoet_form_1 .parsley-required {color: #cf2e2e}

#mailpoet_form_1 .parsley-custom-error-message {color: #cf2e2e}

#mailpoet_form_1 .mailpoet_paragraph.last {margin-bottom: 0} @media (max-width: 500px) {#mailpoet_form_1 {background: #27282e;}} @media (min-width: 500px) {#mailpoet_form_1 .last .mailpoet_paragraph:last-child {margin-bottom: 0}} @media (max-width: 500px) {#mailpoet_form_1 .mailpoet_form_column:last-child .mailpoet_paragraph:last-child {margin-bottom: 0}}

Regrets from a Spac disaster Republished from Source https://www.ft.com/content/9f641e7d-7225-4f24-a1b5-76768bad625e via https://www.ft.com/companies/technology?format=rss

<!–

–>

- Bitcoin

- bizbuildermike

- blockchain

- blockchain compliance

- blockchain conference

- Blockchain Consultants

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet