- The ISDA-Clarus RFR Adoption Indicator has now climbed above 50% for the first time.

- In August 2022 it hit a new all-time high at 51.1%.

- SOFR adoption increased to a new all-time high, at 57.2%.

- GBP and CHF continue to see nearly 100% of risk traded as RFRs.

- €STR trading slipped (again) to 19.3%, the second month of consecutive decline.

- Overall trading activity was 40% higher than last August, but still below August 2019.

The ISDA-Clarus RFR Adoption Indicator for August 2022 has now been published.

Showing;

- RFR adoption increased to a new record at 51.1%.

- SOFR hit a new high at 57.2% of total traded USD risk.

- GBP and CHF continue to see nearly 100% of risk traded as RFRs.

- 19.3% of EUR risk was versus €STR.

- August 2022 saw $31.8Bn of DV01 traded across all Rates products, 8% higher than last month and over 40% larger than August 2021.

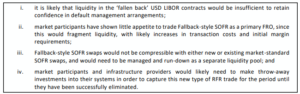

The Chart Blitz

With such a strong showing in RFR trading this month, this blog pretty much writes itself. Key take-aways include:

- The headline indicator hit a new all-time high above 50% for the first time.

- It jumped nearly 5% higher since last month.

- This is only the second time that the RFR Indicator has ever increased by such a large amount in a single month.

- Previously, RFR adoption increased from 26.3% to 31.7% between November and December 2021, just as 3 LIBOR indices were about to cease.

With the headlines covered, the underlying data is pretty interesting too!

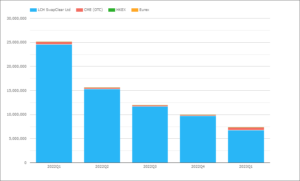

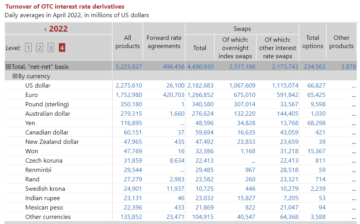

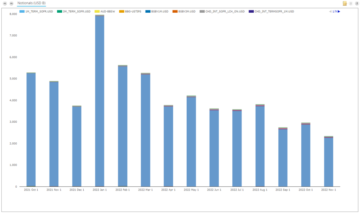

- This chart looks at notional amounts traded rather than DV01 (risk).

- At 44% of total IRD notional traded, this was another new record for RFR Adoption.

- In fact, August 2022 saw the second largest ever amount of RFR-linked notional transacted. That is pretty incredible for a “quiet” Summer month (although I’m not sure I would necessarily characterise August 2022 as a quiet month!).

- $81.2Trn of RFR linked notional was transacted across all Derivatives in the six currencies – covering both OTC and Futures markets.

- The second chart looks at only SOFR adoption. All charts are available at rfr.clarusft.com.

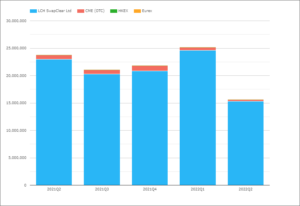

- As we highlighted previously, USD Rates are so big that the overall Indicator is very sensitive to the amount of SOFR trading.

- In a record breaking month for RFR Adoption it is therefore no surprise to see SOFR adoption also hit a new high.

- SOFR adoption jumped by over 5% last month, increasing from 51.7% to 57.2%.

- For comparison, it wasn’t until April 2021 that GBP SONIA broke the 50% barrier.

- This chart looks at the maturities traded in SOFR.

- The share of long-dated risk in SOFR reduced last month.

- It has nonetheless been pretty steady since June at 45-46% of total SOFR risk.

- This shows that activity in short-dated SOFR trading, including SOFR futures, are still increasing.

- Whilst much of the initial transition story was focused on long-dated OTC markets, we now see a more even spread of SOFR activity across the curve.

The charts in this blog therefore show that more SOFR notional traded and that there was relatively more short-dated trading. There was also a larger percentage of total USD risk that was SOFR-linked than ever before.

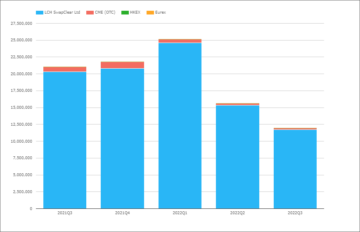

All of this leaves us with one final chart, highlighting in CCPView that last August 2022 saw the largest amount of SOFR-linked notional ever traded, breaking $60Trn for the first time – $10Trn higher than even last month!

The data is clear – it is onwards and upwards for SOFR adoption!

Remember that all of the data is available at ccpview.clarusft.com (subscription required) and the charts are available for free at rfr.clarusft.com.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- Clarus

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- IBOR/RFR

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet