In early October we wrote about How Kwasi Kwarteng has increased your Inital Margin, given that so much has happened in the past month, I wanted to update the GBP Swaps initial margin figures in that article.

Before we start, two general points, very nicely illustrated by two The Economist covers.

On the left, “Reasons to be cheerful (part 3)”, commenting on Rishi Sunak’s promise of stability and a return to fiscal competence.

On the right, “Welcome to Britaly”, with the tag-line, “a country of political instability, low growth and subordination to bond markets”.

So while the market instability in UK Gilts looks to be over, the consequences of policy mistakes remain.

Higher, Lower or the Same from the 65% IM increase?

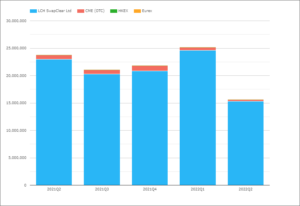

In that recent article, we noted that IM for received fixed GBP Swaps had increased by 65% over the 2-month period from that start of August to early October.

Allow me to pose a question, do you think given the events of the past month and where we are now, this 65% increase since August 1, 2022 will be higher, lower or the same?

A casual, non-considered answer would suggest that as the market volatility is over and rates are back down towards where they were prior to the mini-budget (allowing for the recent BOE rate rise), that the correct answer is lower.

But that ignores the nature of the IM calculation and the fact that what has happened in recent history cannot be forgotton.

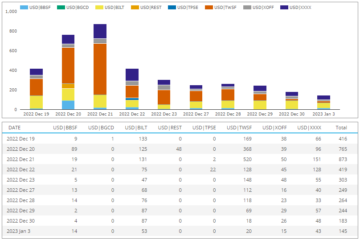

Let’s run the margin analytics in CHARM to find out.

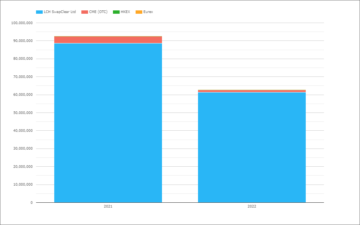

LCH SwapClear IM

On Oct 5th, we noted that the IM for a GBP 100m 10Y received fixed SONIA Swap at LCH (for a house/clearing member) was £7.2m.

The same trade now has an IM of £7.7m, so an increase of 14%.

Or to answer our question from the preceeding section, the 65% increase from 1-Aug, is now 76%, surprising indeed!

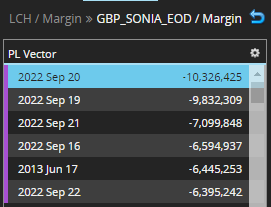

Let’s delve into the LCH IM model, which is a Historical simulation Value-at-Risk model, to look at the PL vector of worst moves:

- These are the same worst dates that we noted in the Oct 5th blog

- Except that the amounts are a touch higher for each, and

- The order is the same except that 2013 Jun 17, is up to 5th from 6th.

- The IM is an average of these 6 PLs.

- Looking for the reason for the higher PLs, requires a deep dive into the weeds

- Drill-down on the above and comparing with the earlier date, we identity two main causes

- Firstly Sonia 10Y Swap rates are now lower at 3.82% compared to 4.17% used in the Oct 5th blog, so as we have used the same 4.17% par swap rate today, our DV01 is higher at £86k compared to £84k; higher risk resulting in higher PLs and higher IM.

- Secondly the 5-day historical shifts in the IM model are subject to volatility scaling (increases in times of volatility) and closer inspection shows that these shifts are now also higher, with 10Y at +122 bps compared to +116 bps. Higher shifts resulting in higher PLs and higher IM.

- To get an idea of the effect of volataility scaling, the 2013 Jun 17 date had a 5-day shift for 10Y of +50 bps, but the same dates volatility scaled shift is now +77 bps, up 54%

- Let’s stop deep diving into the weeds…

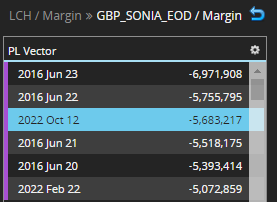

For pay fixed 10Y SONIA swaps, it is interesting to note that worst PL vectors now include an Oct22 date, resulting from the drop in Gilt Yields as the BOE committed to buying to restore market stability.

2022 Oct 12, showing up as the 3rd worst loss, resulting from a 5-day scaled shift for 10Y of -65 bps.

The assymetry between receivers and payers that we noted in the earlier blog, with receivers being 35% more expensive, is now a touch lower at 31%.

Pension Funds and LDI

A few points on a topic that had has a lot of press (e.g. LDI: where’s the exposure).

- LDI strategies utilise receive fixed Sonia Swaps

- As Sonia rates jumped, these Swaps mark-to-markets turned increasingly negative

- Resulting in large variation margin cash calls from LCH SwapClear

- Requiring some pension funds to sell gilts to raise cash to meet these calls

- Contributing further to the drop in gilt prices and rise in yields

- ….

- Not a good loop to be in

- …..

- With the BOE action and Jeremy Hunt as the new chancellor, Gilt prices were back up

- Meaning that much of the cash VM paid by pension fund clients will have been returned

- However prnsion funds are now on notice that Sonia swaps require more liquidity to meet possible variation margin calls than they did in the past

- And the initial margin required for their Swaps has increased, resulting in higher funding cost and less leverage

In addition we should note that IM for a client cleared swap attracts higher margin than house member swaps, as the LCH SwapClear model utilises a 7-day margin period of risk (MPOR) as compared to 5-day, meaning that IM is sqrt(7/5) or 18% higher.

So a GBP 100m Sonia 10Y receive fixed par swap now requires client IM of £9m, as compared to a par swap on 1-Aug requiring £4.5m, when 10Y Sonia Swap rates were 1.98%, as compared to 3.8% now.

While a 10Y pay fixed par swap now requires £6.9m compared to £4.8m then.

Higher IM, higher sterling interest rates, resulting in a higher cost of Swaps.

In Summary

- GBP Swaps IM is much higher than in the past

- This is to be expected given the sharp rate increases in October 2022

- Which will remain in the historical lookback period of the margin model

- Higher recent volatlity also increases IM (an effect which will fade over time)

- Funding cost of IM is significantly up (higher IM and higher interest rates)

- Receiving fixed currently requires 30% more IM than paying fixed

- 2022 has been an incredibly volatile year for GBP rates

- Inflation, rising rates and fiscal policy mean volatility is like to remain high

- There are of course reasons to be cheerful (however low the bar)

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- Clarus

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- Margin/Risk

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet