The Securities and Exchange Commission has released a public advisory vs Lodicoins for illegal investment scheme and operating an investment undertaking without the necessary licenses to do so.

From the SEC: According to information gathered by the Commission, LodiTech has been using several social media platforms such as Facebook, Twitter, Instagram and Discord in enticing people to invest their hard-earned money in LODICOIN, a virtual currency created and operated by Lodi Technologies Incorporated through lodicoins.com, the official website of the virtual currency.

Per its website, Lodicoin represents that:

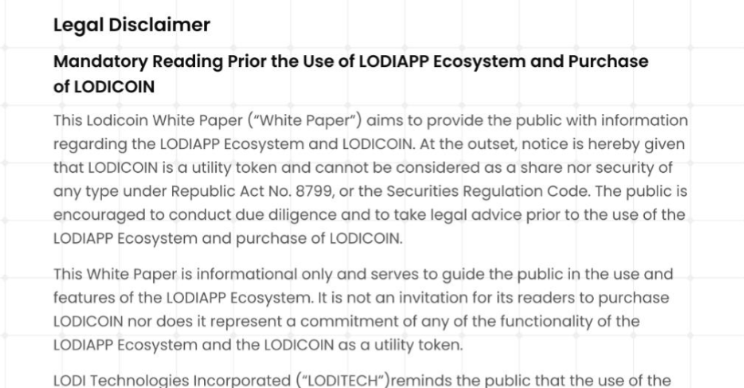

In its “whitepaper,” LodiTech put up a disclaimer that LodiCoins cannot and should not be considered as a share or security of any type.

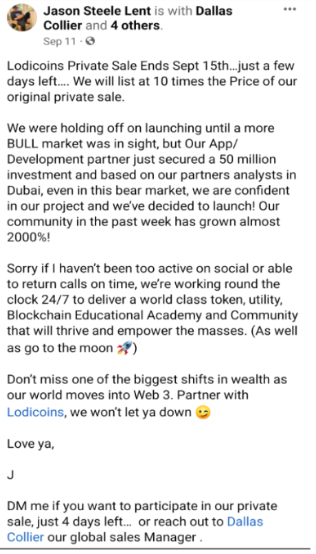

However, LodiCoins and Lodi Technologies Incorporated’s CEO/co-founder hyped or shilled

on Facebook that Lodicoin would be listed at ten times the pre-sale or original private price, making it appear that those who will purchase the coin in the ICO will earn at least 1000% in profits.

Further, several posts in its official Facebook page states that investing in Lodicoin will give the investor an opportunity to earn through the virtual currency.

Apparently, Lodicoin promises earnings for investors by acquiring Lodicoins on pre-sale and purchasing $LODI beforehand through an Initial Coin Offering (ICO) at a significantly low price on the pretext that it will considerably increase in value once $LODI is officially launched by listing on public exchanges.

Further, Lodicoins offers packages with inclusions such as 54% commission, as follows:

As mentioned in our SEC Advisory on Initial Coin Offerings and Virtual Currency posted 08 January 2018, an ICO is the first sale and issuance of a new virtual currency to the public usually for the purpose of raising capital for start-up companies or funding independent projects.

The US SEC in its investigative report in “The DAO” case said that “securities law may apply to various activities, including distributed ledger technology, depending on particular facts and circumstances, without regard to the form of the organization or technology used to effectuate a particular offer or sale.”

Thus, depending on the facts and circumstances surrounding their issuance, some of these new virtual currencies partake of the nature of a security in the form of an investment contract, whereby a person invests money in a common enterprise and is led to expect profits primarily from the efforts of others.

The same goes for LODICOIN where Lodi Technologies Incorporated seeks to use the money it gathered from the public to fund its purported project on the promise of profits.

Applying the Howey Test, the investment-taking scheme employed by Lodi Technologies Incorporated is an investment contract as it involves the offering and sale of securities to the public where their investors need not exert any effort other than to invest or place money in its scheme with the expectation of profits.

Hence, no matter how LODICOIN portrays itself as “utility token,” clearly, $LODI is being offered for its potential for price appreciation, not to mention profit opportunities through commissions, bonuses and other incentives. In this case, the sales materials and literature describe LODICOIN as having profit potential (in the words of the CEO-“we will list at ten times more than the pre-sale price”), and therefore, it is offered in such a way that the investor “expects profits,” as to ultimately, consider it as a security.

In other words, merely calling a token a “utility” token or structuring it to provide some utility does not prevent the token from being a security. Tokens and offering that incorporates features and marketing efforts that emphasize the potential for profits based on the entrepreneurial or managerial efforts of others contain the hallmarks of a security.

Accordingly, these virtual currencies and assets cannot be masked and presented as currencies when it is essentially a security in character which must be subject to registration in order to protect the investing public.

Therefore, said entities or individuals must be duly registered with the Commission and that any person or entity intending to offer and sell its investment contract are required to secure the necessary registration and/or license from the Commission as well.

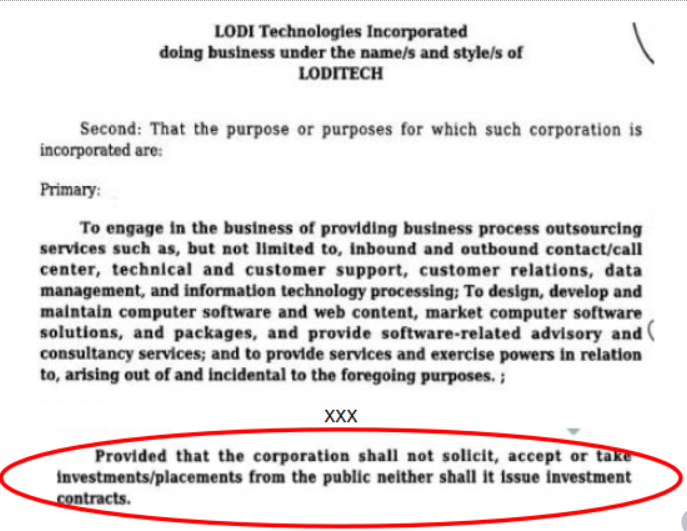

Based on the records of the Commission, while Lodi Technologies Incorporated doing business under the name and style/s of LODITECH had been REGISTERED as a corporation with the Commission on August 2, 2021, HOWEVER, IT OPERATES WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

In fact, Lodi Technologies’ primary purpose is that of being a BPO service provider which is inconsistent with its actual business model, quoted as follows:

Thus the SEC said it is advising the public against Lodicoin and encourages the public to report to the Commission.

This is a developing story.

This article is published on BitPinas: SEC Issues Public Advisory Against LODICOIN

- Bitcoin

- BitPinas

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Lodicoin

- Lodicoins

- Lodicoins Philippines

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Slide

- W3

- zephyrnet