Singapore’s wealthtech sector is growing at a fast pace. Amid soaring venture funding and booming adoption of robo-advisors, the city-state is on a path to becoming a leading wealthtech hub in Asia-Pacific (APAC), a new report by KPMG and Endowus, a local digital advisor, says.

The report, which looks at the progress of wealthtech developments, points to rising investment activity in the country, noting that over the past four years, venture funding to Singapore-based wealthtechs grew seven-fold from US$23 million in 2017 to US$161 million in 2021, drastically outpacing Asia’s two-fold growth from US$1.1 billion to US$2.2 billion.

In the same period, Singapore’s share of total Asian wealthtech venture funding tripled to 2% to 7%, indicating a positive trend of increased capital inflows directed to Singaporean wealthtech companies.

Asia and Singapore venture investments in wealthtech, 2017 and 2021, Source: KPMG; Endowus, 2022

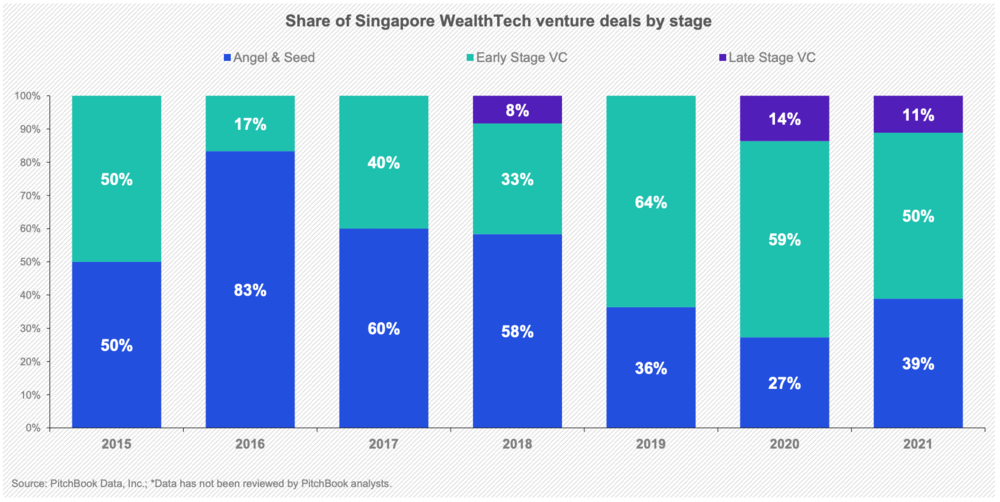

Singapore’s wealthtech companies still largely remain rather young and in the development phase, with one-third of local startups being founded only in the last three years, the report notes. However, venture deals have started moving from angel and seed to early stage, and venture sizes are increasing steadily, showcasing that the sector is maturing.

Angel and seed deals decreased from a 60% share of all deals in 2017 to 39% in 2021. Late-stage deals represented 11% of all wealthtech deals in 2021 while being non-existent in 2017 and prior.

Share of Singapore wealthtech venture deals by stage, Source: KPMG; Endowus, 2022

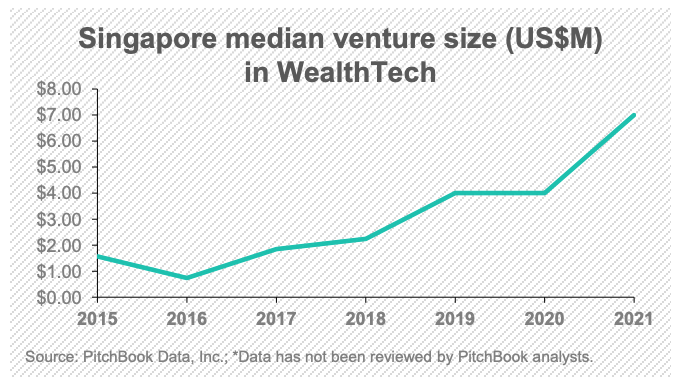

In the same period, median venture size increased steadily, rising from about US$2 million in 2017 to about US$7 million in 2021.

Singapore median venture size (US$M) in wealthtech, Source: KPMG; Endowus, 2022

Booming venture funding activity has been driven by growing adoption of robo-advisors in the city-state where at least three of Singapore’s largest robo-advisors have reported strong assets under management (AUM) figures since 2020, the report notes.

Endowus, for example, which spans both private wealth and public pension savings, said in August that it had witnessed an increase of 120% in its client pool over the past year, with AUM across S$2 billion.

StashAway, a robo-advisor that invests customers’ money in exchange traded funds (ETFs), reported AUM growth of more than 300% year-on-year (YoY) in 2020. Syfe, a robo-advisor providing fully-managed investment portfolios, echoed the same growth trajectory, with AUM quadrupling in the first-half of 2021.

Further growth is expected moving forward as Singaporean wealthtech startups start expanding overseas. Endowus is due to launch its wealth management service in Hong Kong later this year after receiving approval from the Securities and Futures Commission (SFC). Like Endowus, Syfe chose Hong Kong as its first market expansion. And StashAway already has operations across Malaysia, Hong Kong, the United Arab Emirates (UAE) and Thailand.

Asia drives wealth growth

APAC has witnessed massive wealth creation, driven by rapid economic growth in China and India. As of 2021, Asia financial wealth stood at US$52.3 trillion, taking approximately a 20% share of global wealth.

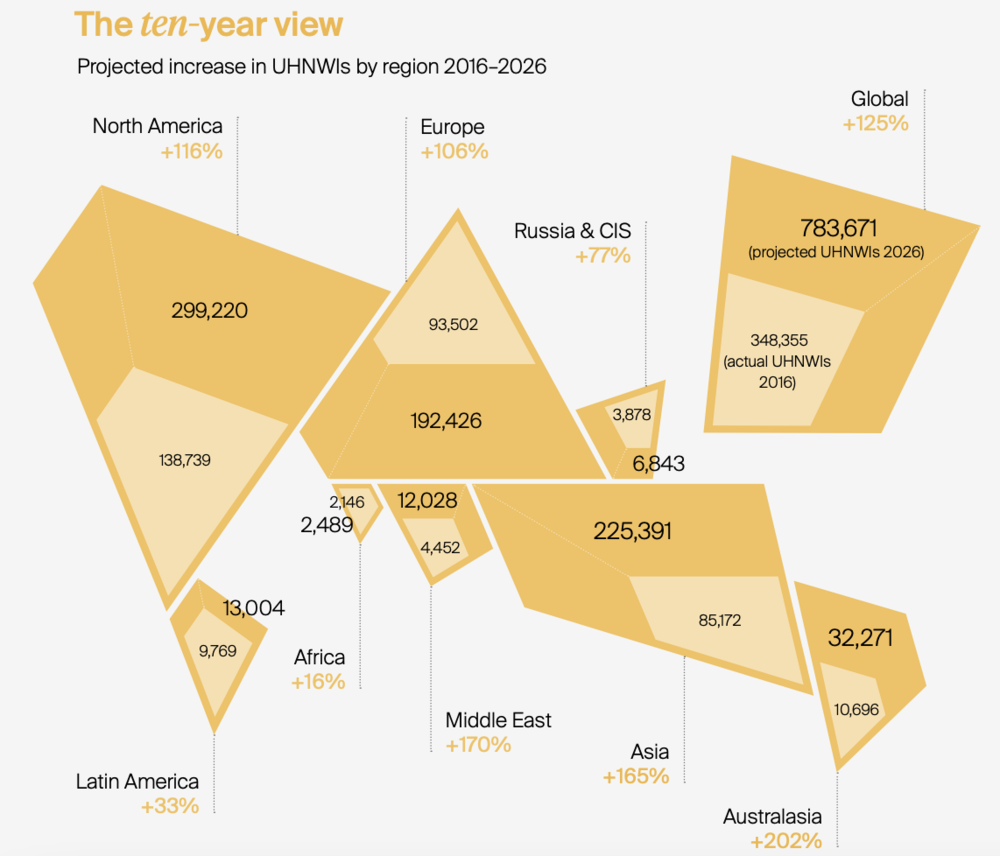

By 2026, the region is expected to surpass Europe as the second largest regional wealth hub, with both high-net-worth individuals (HNWI) and ultra-high-net-worth individuals (UHNWIs) set to grow among the quickest across all regions, according to Knight Frank, a real estate consultancy.

Between 2021 and 2026, Singapore is projected to witness a 268% growth in its UHNWI population to around 6,000.

Projected increase in UHNWIs by region 2016–2026, Source: Knight Frank, 2022

Singapore’s political stability, tax incentives and supportive regulatory environment have positioned the city-state as a leading wealth management hub both regionally and globally, the report says. And with its well-established information technology (IT) infrastructure and burgeoning startup scene, the nation is poised to become a top wealthtech hub.

In parallel, accelerated digitalization and changing customer preferences have led to an increase in the adoption of digital financial services, fueling with it wealthtech.

Moving forward, digital wealth providers will need to shape their offerings according to evolving customer demand. Several research have pointed out to rising interest in climate-based investments, especially among younger generation of millennial and Gen Z investors, it notes.

Additionally, digital assets, including cryptocurrencies and non-fungible tokens (NFTs), continue to see strong consumer interest among both institutional and retail investors.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- Fintechnews Singapore

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- Singapore

- square fintech

- stripe

- tencent fintech

- wealth management

- wealthtech

- xero

- zephyrnet