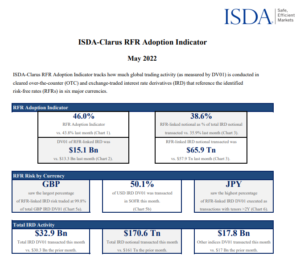

- The ISDA-Clarus RFR Adoption Indicator retained its all-time high of 46.4% in July 2022.

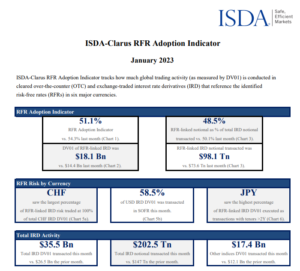

- SOFR adoption hit a new record at 51.7% of the market.

- 20.3% of EUR risk traded versus €STR, below last month’s all-time high.

- July 2022 was a relatively quiet month for trading activity, with the total risk traded falling by ~25% from last month.

The ISDA-Clarus RFR Adoption Indicator for July 2022 has now been published.

Showing;

- SOFR adoption increased to a new record at 51.7%.

- GBP and CHF continue to see nearly 100% of risk traded as RFRs.

- 20.3% of EUR risk was versus €STR.

- July 2022 saw $29.5Bn of DV01 traded across all Rates products, some 25% lower than last month.

- See my “Summer Lull” blog for other data points regarding subdued trading activity last month.

For today’s blog, I noticed that we haven’t yet taken a detailed look at what is happening in USD futures. We put that right below.

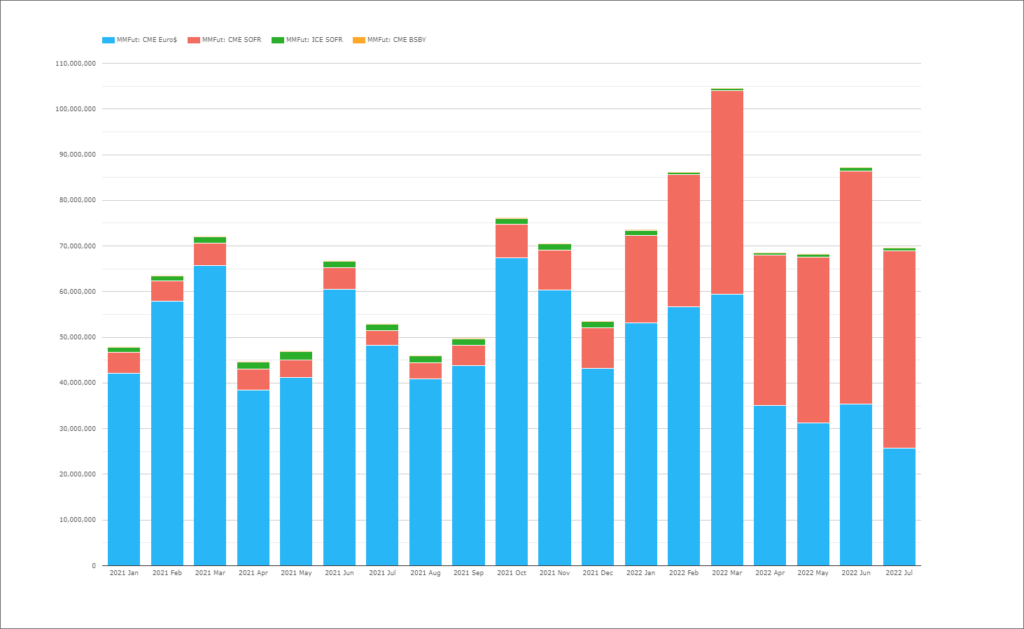

More SOFR Futures traded than Eurodollars in July

The most significant milestone we can highlight is that the notional equivalent amount of SOFR futures trading now surpasses the equivalent in Eurodollar contracts. Remember that I am often shocked just how large the Eurodollar market is, so this is really quite some achievement:

Digging a bit deeper into the data;

- Embarrassingly, I am slow to pick up on this fact! The notional amount of SOFR first surpassed Eurodollars way back in May 2022. Shame on me for missing this….

- At least I’ve left it long enough to comment that it has now been the case for 3 straight months, and therefore suggests that we can claim some type of victory/entrenched trend.

- The amount of SOFR notional traded in futures was $43.3Trn last month versus just $25.7Trn in Eurodollars.

- Put another way, the SOFR market was 69% bigger than Eurodollars in July 2022!

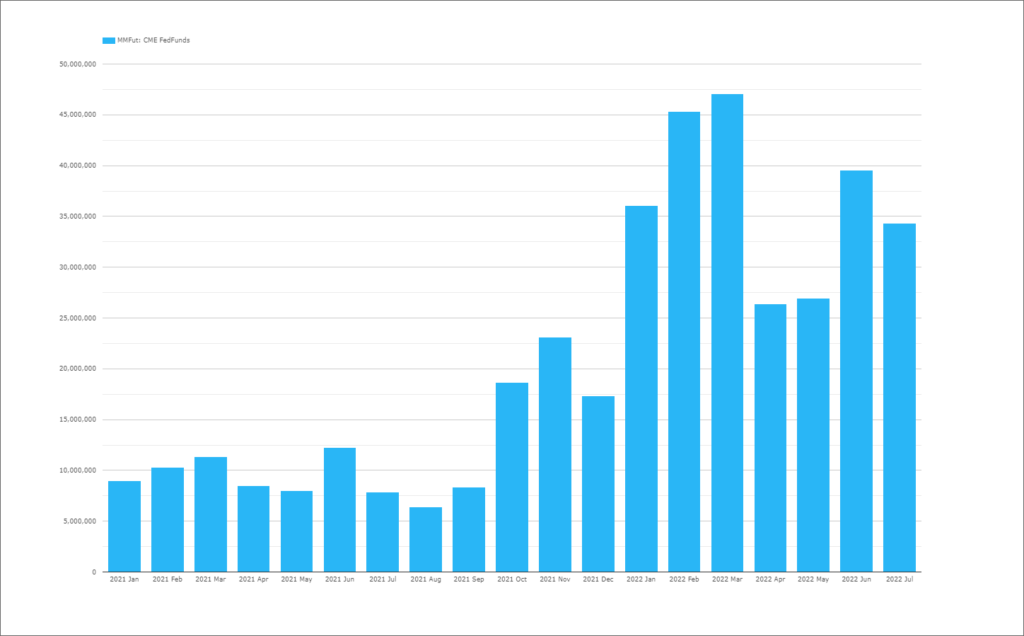

Fed Funds Futures still trade

For the purposes of our RFR Adoption Indicator, we look at all other indices trading that are not RFRs. The most significant outside of IBORs is undoubtedly Fed Funds. And we continue to see significant volumes trading in Fed Funds futures, particularly with central banks so active in raising rates:

Showing;

- Fed Funds futures average monthly volume in 2021 was $11.8Trn.

- Fed Funds futures average monthly volumes in 2022 so far are $36.5Trn!

- A 3.1x increase in activity, as huge back-to-back interest rate rises are announced by the Fed.

- I just checked, and the FOMC are indeed continuing to target the Federal Funds rate, not SOFR.

- Hence it “makes sense” to trade the underlying future.

- It would have been great to have seen this activity transition to SOFR in terms of RFR adoption. Shame.

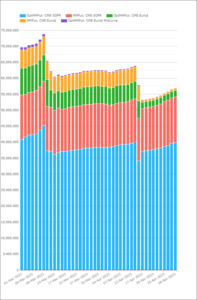

More “Other Rates” Traded than SOFR in July

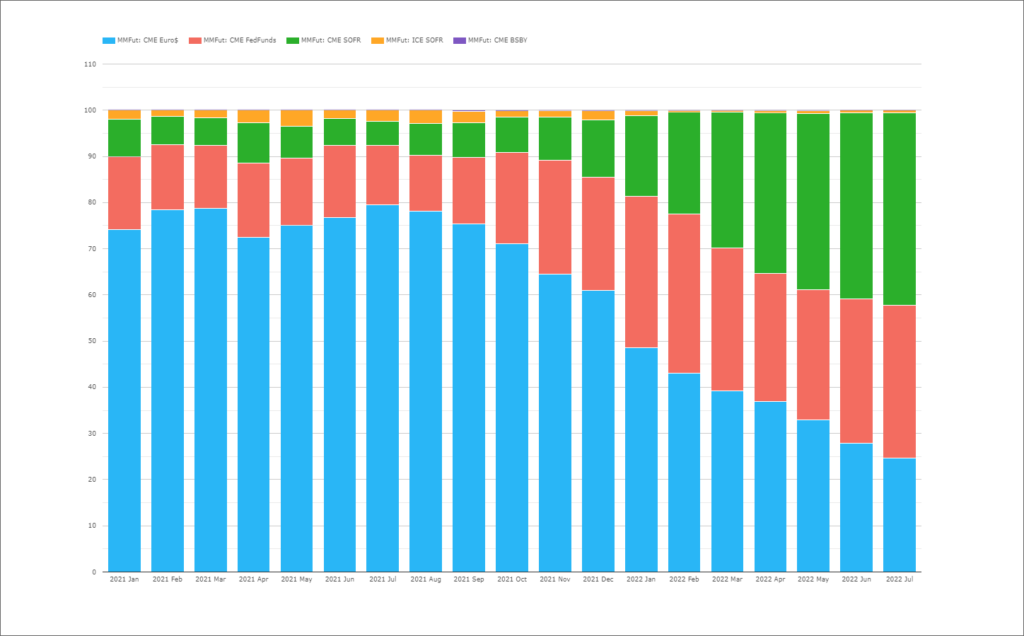

Putting this into context, across all USD STIR futures:

Showing;

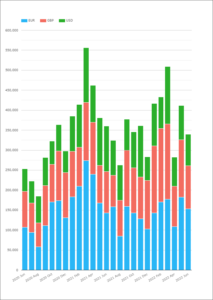

- The proportion of the USD STIR market traded in SOFR is really increasing (green bars above).

- The increase in SOFR STIR futures activity means that SOFR is now the single largest market amongst USD STIRs, at 41.7% of total activity.

- However, the combo of Fed Funds and Eurodollars is still larger than outright SOFR trading.

- From a transition viewpoint, it is reassuring to see the large drop in Eurodollar activity (blue bars).

- 33% of activity was in Eurodollars in May 2022, shrinking to just 24.7% in July. This is the lowest proportion of activity on record.

- If only we could see some more of the Fed Funds activity in SOFR! They are both overnight rates at least….

Currency Perspective

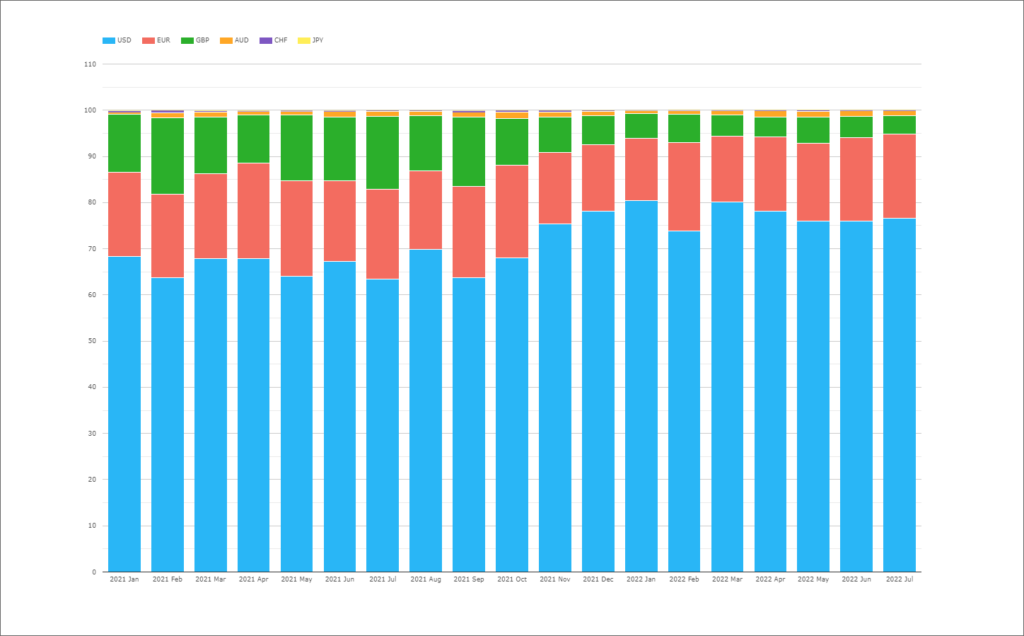

As I said, it always strikes me how large the Eurodollar/USD STIR market is. It is therefore “fun” to plot the relative volumes by currency of all STIR contracts traded:

Showing;

- USD STIRs account for 77% of all STIR activity in the six currencies monitored in our Adoption Indicator.

- Given SOFR is about 42% of all USD STIRs, this means that SOFR volumes now account for ~32% of all STIR activity across our six currencies.

- The largest non-USD STIR contract is not an RFR contract. EUR Euribors account for ~18% of the market, and this has been consistent since before LIBOR disappeared.

- SONIA futures remain pretty small on a global scale – just 4% of global volumes in recent months.

Long term, I think it remains to be seen what the balance between SOFR and Fed Funds activity will be like.

And finally, in Q4 this year we are likely to have a new RFR future to monitor. This time in EUR, with CME announcing the upcoming launch of €STR futures:

Stay tuned to the Clarus blog as we continue to monitor the data.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- Clarus

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- IBOR/RFR

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet