Southeast Asia’s money transfer market is a dynamic and fast-evolving sector that has been impacted by increased digitalization, rapid adoption of digital wallets, and the rise of so-called super-apps.

A new report by FXC Intelligence, a financial data company specializing in the international payments, payment cards, cryptocurrency and e-commerce industries, looks at the state of Southeast Asia’s money transfer market, delving into the region’s key players, emerging trends and disruptive forces.

The report highlights the dynamism of the market, which today comprises both new market entrants and incumbents that are actively innovating to keep up with meet changing customer expectations and rising demand for faster, more effective transfers in the region.

Cross-border payment providers in Southeast Asia, Source: FXC Intelligence, Dec 2022

Across Southeast Asia, super-apps are entering the space and rapidly gaining ground, the report says. These companies have large user bases they’ve built over the years by providing superior customer experiences and greater convenience.

Through a single portal, super-apps provide their users with access to a wide range of products and services, often encompassing online messaging, social media, food delivery, ride-hailing and financial services.

Popular super-apps across Southeast Asia include Singapore’s Grab, the Philippines’ GCash, as well as Thailand’s TrueMoney Wallet.

Grab provides ride-haling, food delivery, logistics, mobile payment, insurance and investment services. Grab’s e-wallet and digital payment capabilities are reportedly supported at nine million acceptance points in the Asia Pacific (APAC) region and count almost 190 million users. The company entered the remittance industry in 2019 by launching a wallet-to-wallet transfer service.

GCash is a finance-focused super-app owned by Mynt, a venture of Alipay, Ayala Group and domestic telco provider Globe Group. The company operates one of the Philippines’ largest e-wallets with 66 million registered users, and provides services such as bill payments, money transfers, remittances, online shopping, insurance, buy now, pay later (BNPL), and credit.

In Thailand, Ascend Money runs the TrueMoney Wallet, one of the country’s most popular e-wallets and a financial super-app. Its services include domestic and international money transfers, cashless payments, online shopping, as well as virtual debit cards. TrueMoney Wallet claims 14 million monthly active users and is now looking to expand its foothold in the micro, small and medium-sized enterprises (MSMEs) segment.

Leading e-wallets in Southeast Asia, Source: FXC Intelligence, Dec 2022

Remittance incumbents ramp up innovation

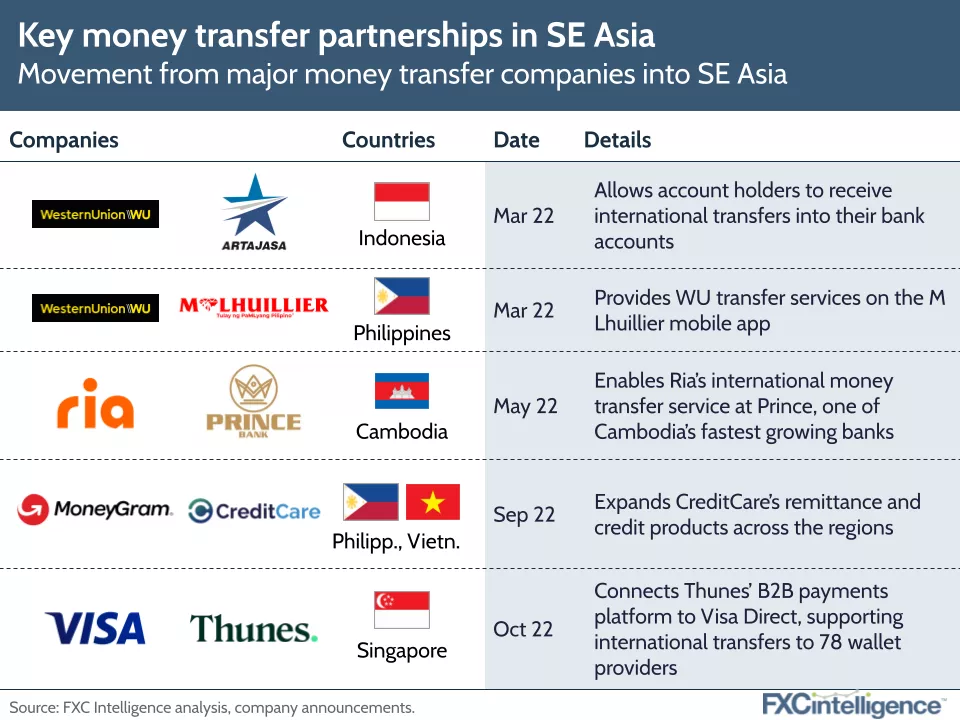

Besides new market entrants and digital challengers, Southeast Asia is also home to a number of incumbents, which, over the past couple of years, have been upgrading their products, launching new solutions, and teaming up with young and innovative startups to provide services that are more in tune with customer needs.

MoneyGram, for example, started rolling out stablecoin-based remittances this year, launching in key markets in June including the Philippines, Kenya, Canada and the US. The service is the result of a partnership between MoneyGram and the Stellar Development Foundation announced in October 2021.

In March 2022, Western Union teamed up with Artajasa, a banking infrastructure network provider in Indonesia, to allow customers to receive international money transfers in near real-time into their bank accounts across all major banks in the country. Western Union said payout into digital wallets in Indonesia would be launched later in the year.

The partnership between Western Union and Artaja is just one of many collaborations the money transfer firm has inked over the past years to increase its account-based payout options, including bank accounts, wallets or card payouts, and ensure connectivity for customers.

Today, Western Union claims it’s able to process payouts into billions of bank accounts, including millions of wallets and cards across more than 130 countries and territories, with real-time capabilities in 100 of these countries.

Finally, payment network Visa announced a partnership with Singapore-based business-to-business (B2B) payment platform Thunes in October 2022 to expand the reach of Visa Direct, the company’s remittance service, with an additional 1.5 billion new endpoints.

Key money transfer partnerships in Southeast Asia, Source: FXC Intelligence, Dec 2022

Southeast Asia’s remittance industry is supported by the region’s large population of migrant workers and its overseas diasporas. The money these people send back home to their families and friends can be an essential lifeline, helping fund spending on essentials, lower extreme poverty and support healthcare and education.

According to data from the World Bank, of the world’s top 20 remittance recipients in 2020, four are Southeast Asian countries: the Philippines, which ranked third in total value with US$34.9 billion received; Vietnam, which ranked 11th with US$17.2 billion; Indonesia, which ranked 17th with US$9.6 billion; and Thailand, ranked 19th with US$8.3 billion.

Featured image credit: edited from Freepik

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- Fintechnews Singapore

- international money transfer

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Remittance

- Revolut

- Ripple

- Southeast Asia

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet