Each month, fintech analyst Philip Benton explores a new topic and assesses the “state of play”, providing an in-depth analysis and understanding of the market landscape.

This month is a little different we provide a fintech industry “state of play” as we recap key themes and trends at Money 20/20 Europe.

Money 20/20 Europe returned in full force for the first time in three years as the annual fintech event took place at the RAI Amsterdam during 7-9 June 2022. Although the event did make a return in September 2021 after a COVID-enforced hiatus, this year saw Money 20/20 Europe return to its usual June slot with more than 4,000 attendees present across three days of lively presentations, discussions and parties.

Pre-pandemic, the event would attract up to 6,000 attendees so encouraging to see a strong turnout and it felt back to normal with facemasks optional and handshakes encouraged. The 4,000 attendees were from 1,900 companies with 34% senior leaders present and representatives from banking (14%), payments (33%) and tech (27%) with over 90 countries present but understandably the vast majority being from Europe.

Key highlights at Money 20/20 Europe 2022:

- Fintech/incumbent convergence,

- open banking monetisation,

- digital identity,

- BNPL 2.0 and, of course,

- crypto.

Whilst the macroeconomic environment remains challenging and much of the talk was about unit economics and profitability as opposed to growth and scale, there were some fundraising announcements during the show with the most significant being the €120 million raised by Backbase which now values the digital banking vendor at €2.5 billion.

Fintech maturity

With it being more than a decade since the fintech movement took off, the convergence between fintechs and banking is increasing. A challenging macroeconomic climate is forcing neobanks to prioritise unit economics and profit as opposed to growth and scale. This was discussed throughout Money 20/20 Europe with the chief executives of N26, Starling Bank, and Zopa all supporting the view.

N26 CEO Valentin Stalf admitted the neobank had tried to grow too rapidly “we expanded internationally too fast, that was a mistake”, which comes after high profile exits in the UK and US. Conversely, Anne Boden the CEO of Starling Bank hinted that the long-term goal is to be a “global tech company that just happens to own a bank in the UK”. Zopa, a digital bank based in Britain, had hoped to go public by the end of 2022. But this is looking less likely as inflation shocks exacerbated by the war in Ukraine have led to a slump in both public and private markets.

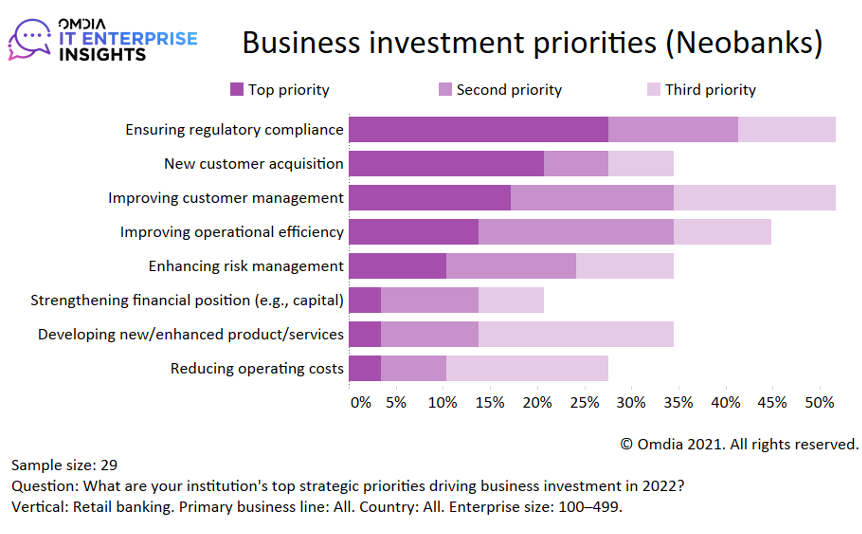

This is reflective in Omdia’s IT Enterprise Insights 2022/23 survey which found that neobanks (those with less than 500 employees) were prioritising ensuring regulatory compliance over anything else. Whereas the number one priority for more established banks was to improve customer management.

What are your top business investment priorities for 2022? (Retail banks with 100 – 499 employees)

Source: Omdia

It’s not just the neobanks that recognise that the balance sheet is the most important priority of 2022 with Crypto.com CEO Peter Smith outlining “we are shifting from growth being the most important thing to free access to cashflow”. Tink CEO Daniel Kjellen echoed this sentiment in first keynote of the event “it’s never been more important to build a profitable business now, it’s a trade-off between speed and profitability”.

Partnerships paving the way for embedded finance and much more

Embedded finance was a much spoken about trend during Money 20/20 Europe but the underlying partnerships/ecosystem was a bigger trend which Omdia took note of. Modern technology stacks have enabled new entrants in financial services to adopt an “a la carte” approach to deploying banking products. This has enabled banks to offer their products “as a service” to non-financial services brands through embedded finance, by consuming specific pieces of the banking stack. Omar Haque, head of group e-commerce at Nexi Group, the paytech commented that “the only natural path for embedded finance is ‘increased complexity and fragmentation’ which is why you need to choose your partners carefully”.

The early days of the fintech revolution were about “disrupting” banking but incumbents and fintechs now increasingly work together to lead innovation. US incumbent Bank of America and UK payments start-up Banked recently partnered to launch a new online payments solution and UK banking incumbent NatWest Group worked with paytechs TrueLayer, GoCardless and Crezco to launch its variable recurring payments (VRP) solution.

Technology is moving at such a rapid pace that building in-house makes little sense as the value-add is how you develop on top of the technology stack, not in building the foundations. If JP Morgan Chase, with the world’s largest technology investment budget (according to Omdia), opts to partner with Thought Machine – a challenger core banking technology provider – to use their platform as opposed to using their vast team of developers to build one in-house from scratch then this should be a signal to the rest of the industry.

Embedded finance is just one of a number of emerging trends which will alter the relationship banks (and fintech) have with their customers, thus establishing and maintaining strong partnerships is critical to ensuring relevance in the future of financial services.

Monetisation of open banking will be the “enabler” for real-time payments

Despite some suggestions open banking is moving too slowly, open banking now has six million active users in the UK, five years after launch. It took contactless payments seven years to reach the same milestone. It took ten months to grow the number of users from one million to two million in 2020 but in contrast it took just five months to grow from four million to six million in 2022, with much of this growth linked to HMRC’s incorporation of “Pay by bank” option into its annual self-assessment process.

The UK is seen as the model to follow if open banking can be monetised with participants of the “how can banks monetise open banking?” panel suggesting that if open banking will be the enabler for real-time payments “we need to educate banks about the opportunity to monetise”.

There was much excitement around premium APIs and enabling the birth of variable recurring payments (VRP) which will allow payments to be invisible by removing authentication on every single transaction.

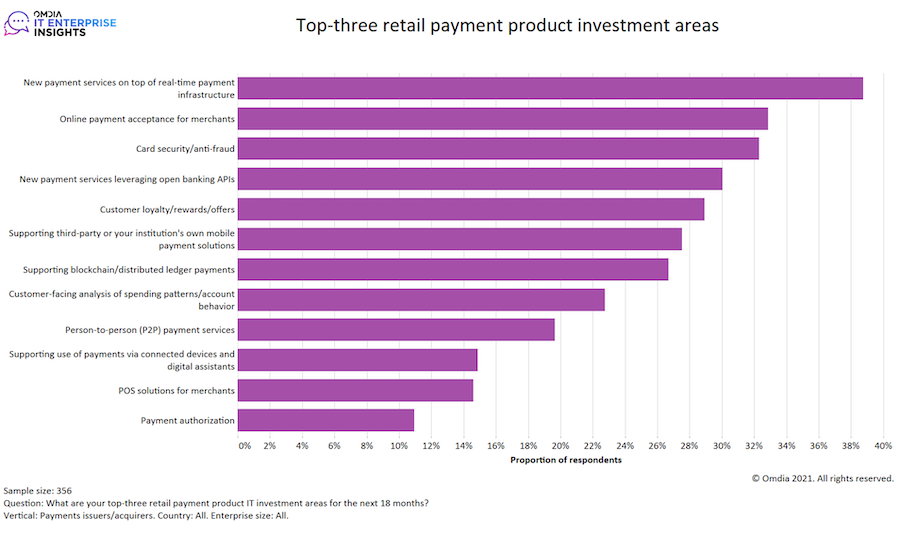

Top priority retail product IT investment areas for next 18 months (payment issuers/acquirers)

Source: Omdia

Use cases being built on real-time payment rails are expanding with Omdia’s IT Enterprise Insights Survey finding almost 40% of respondents deemed it a top priority for retail payments, with account-to-account (A2A) payments, request-to-pay (R2P), and the aforementioned VRP being seen as having the highest potential for consumer and merchant adoption.

Regulation is dead, long live regulation

Unusually there was a lot of optimism that more regulation would be good for the industry particularly around crypto/stablecoins, buy now, pay later and digital identity. Regulators were initially slow to liaise with fast-growing fintechs with Valentin Stalf, CEO of N26 noting “we had a banking license for five years without much interaction with regulators but since the Wirecard and Greensill scandals, regulators are more closely monitoring new business models”.

Crypto, despite being decentralised by nature, is increasingly more welcoming to regulation to bring uniformity, with Peter Smith, CEO of Blockchain.com, commenting that “regulation is becoming more defined which is helping standardisation”. Although Smith also noted that regulators need to be equally as welcoming to emerging cryptocurrencies “you either accept all cryptocurrencies or none at all, it’s about accepting the technology”.

Buy now, pay later (BNPL) has been under pressure to face increased scrutiny by regulators because of its inherent nature to encourage consumer debt with the topic of policy discussed widely during the “What’s next for BNPL” panel where it was suggested “we are at the point now that BNPL 2.0 is needed – it should be more structured, regulated and easier to manage multiple BNPL payments/providers”. Affordability checks was called out as a key point for what the regulation of buy now, pay later needs to include as well as clear guidance on consumer protection and standardisation.

Digital identity was a big topic at Money 20/20 Europe with digital identity exhibitors being one of the largest segment in attendance at the event. The shift to society being digital-first has prompted identity to be a key challenge to overcome if we are able to embrace the new world of crypto, web3 and the metaverse. During the panel on “Will there ever be European pan-rules and rails to pay?” it was noted the importance of a regulated digital ID being in force before a central bank digital currency could be mass adopted “the digital euro and identity need to be natively integrated”. During many embedded finance sessions, the topic was raised too “in fintech 3.0, identity will be the core identifier which is when embedded finance will really take off”.

- "

- 000

- 100

- 2020

- 2021

- 2022

- a

- About

- access

- According

- across

- active

- Adoption

- All

- Although

- america

- amsterdam

- analysis

- analyst

- Announcements

- annual

- APIs

- approach

- around

- attendance

- Authentication

- Bank

- Bank of America

- Banking

- Banks

- because

- becoming

- before

- being

- between

- bigger

- Billion

- blockchain

- Blockchain.com

- brands

- bring

- budget

- build

- Building

- business

- buy

- cases

- central

- Central Bank

- central bank digital currency

- ceo

- challenge

- challenging

- chase

- Checks

- chief

- Choose

- commented

- Companies

- company

- compliance

- consumer

- Consumer Protection

- Core

- could

- countries

- critical

- crypto

- Crypto.com

- cryptocurrencies

- Currency

- customer

- Customers

- Days

- dead

- Debt

- decade

- deploying

- Despite

- develop

- developers

- DID

- different

- digital

- digital banking

- digital currency

- Digital ID

- digital identity

- discussions

- during

- e-commerce

- Early

- Economics

- educate

- embedded

- embrace

- emerging

- employees

- enabling

- encourage

- encouraging

- ensuring

- Enterprise

- Environment

- established

- Euro

- Europe

- European

- Event

- executives

- exits

- expanded

- expanding

- Face

- FAST

- finance

- financial

- financial services

- finding

- fintech

- First

- first time

- follow

- found

- Foundations

- Free

- from

- full

- Fundraising

- future

- goal

- good

- Group

- Grow

- Growth

- having

- head

- helping

- High

- highlights

- How

- HTTPS

- Identity

- importance

- important

- improve

- include

- increased

- increasing

- increasingly

- industry

- inflation

- inherent

- Innovation

- insights

- interaction

- internationally

- investment

- IT

- jp morgan

- JP Morgan Chase

- just one

- Key

- landscape

- largest

- launch

- lead

- leaders

- Led

- License

- likely

- little

- live

- Long

- long-term

- looking

- Majority

- make

- MAKES

- manage

- management

- Market

- Markets

- Merchant

- Metaverse

- million

- model

- money

- monitoring

- Month

- months

- more

- Morgan

- most

- movement

- moving

- multiple

- Natural

- Nature

- needs

- next

- normal

- noted

- number

- offer

- online

- online payments

- open

- Opportunity

- Option

- own

- panel

- participants

- particularly

- partner

- partnered

- partners

- partnerships

- Pay

- payment

- payments

- pieces

- platform

- Play

- Point

- policy

- potential

- Premium

- present

- Presentations

- pressure

- priority

- private

- private markets

- process

- Product

- Products

- Profile

- Profit

- profitability

- profitable

- protection

- provide

- provider

- providing

- public

- reach

- real-time

- recap

- recently

- recognise

- regulated

- Regulation

- Regulators

- regulatory

- Regulatory Compliance

- relationship

- remains

- removing

- REST

- retail

- return

- same

- Scale

- segment

- sense

- sentiment

- Services

- sessions

- shift

- show

- significant

- since

- single

- SIX

- So

- Society

- solution

- some

- specific

- speed

- stack

- Start-up

- State

- strong

- structured

- Supporting

- Survey

- Talk

- team

- tech

- Tech Company

- Technology

- The

- thing

- three

- Through

- throughout

- time

- together

- top

- topic

- transaction

- Trends

- Uk

- Ukraine

- under

- Understandably

- understanding

- us

- use

- users

- vendor

- View

- war

- Web3

- What

- without

- Work

- worked

- world

- world’s

- would

- year

- years

- Your