It’s true that Bitcoin revolutionized the financial industry and provided society with a new perspective on decentralized payments and peer-to-peer transactions. Bitcoin also gave rise to a digital store of value that was never before possible, but the need for a bridge between fiat and crypto and digital assets with a stable price was needed, which led to the rise of stablecoins.

This guide to stablecoins will cover the following topics:

- What are stablecoins?

- The 4 major types of stablecoins

- How stablecoins work

- Why stablecoins are important

- Where to buy stablecoins

Though I am a huge fan of Bitcoin, there are just some use cases that it cannot fulfill. For example, you don’t often see people buying things like coffee with Bitcoin and there is a reason for that. With the creation and adoption of the Lightning network, this may change, but as it stands now in most cases, Bitcoin isn’t suitable as a medium of exchange for small frequent purchases for the following reasons:

- Transactions can cost anywhere from a few cents to over $50 during peak network congestion like we saw during the 2021 bull run. A $50 network fee to buy a $1 coffee? No thanks.

- Transactions can take over 10 minutes to finalize. Imagine paying for your coffee and needing to wait 10 minutes to see if your payment was successful.

- Bitcoin is too volatile for many merchants to want to accept it. If 100 people buy coffee in a day using Bitcoin, then the price drops 10%, that will significantly impact profit margin. Volatile assets also make it impossible for business owners to budget and know how much BTC needs to be set aside for payroll, bills, etc.

- Finally, many Bitcoin enthusiasts consider Bitcoin to be the “apex property” of the human race, the most important invention of our generation, and the most valuable thing we have created. It is held onto by many as an inflation hedge and an investment, often considered far too valuable to be used on daily purchases.

This is just one of the areas where stablecoins offer an attractive alternative. They also provide the liquidity needed for trading, can protect digital asset holders from downside volatility, provide a convenient way to store value after the selling of other digital assets, and provide a digital medium of exchange.

A Look at Some well-known Stablecoins. Image via Shutterstock

We are seeing a massive rise in stablecoin adoption from e-commerce sites, online businesses, and in countries where the currency is being devalued by inflation, resulting in people flocking to stablecoins to preserve their purchasing power.

Page Contents 👉

What are Stablecoins?

Stablecoins are digital currencies that are minted on the blockchain and are pegged to, or backed by physical assets such as fiat or gold to retain a stable value. Users can buy, sell, and trade stablecoins just like any other crypto assets and self-custody them by storing them in their cryptocurrency wallets.

A Look at a Few Types of Digital and Traditional Currencies. Image via Bloomberg

Two of the most popular stablecoins are USDT and USDC, both are pegged 1:1 to the United States dollar and are backed by cash, cash equivalents, commercial paper, corporate bonds, loans, and other investments as collateral.

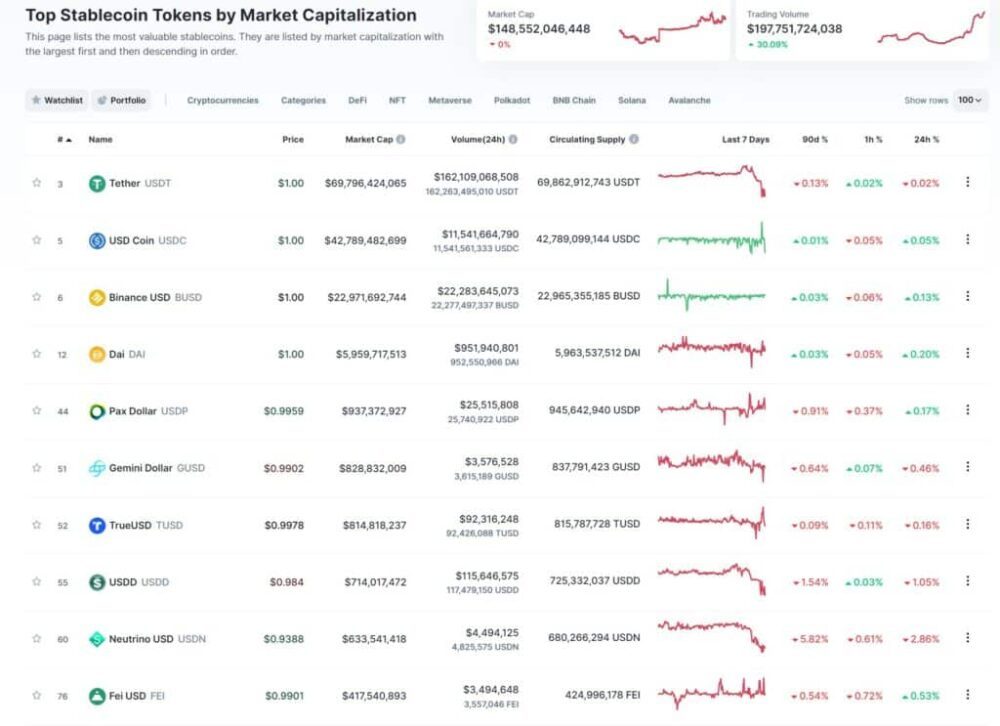

Here is a look at the 10 largest stablecoins by market cap:

Image via CoinMarketCap

Here are the common types of stablecoin collateral:

- Fiat– The most common collateral for stablecoins. The US dollar is the most widely used by a significant margin, but many other national currencies are also held for their digital counterparts.

- Precious metals– Some crypto is tied to the value of metals such as gold or silver.

- Cryptocurrencies– Some stablecoins use other cryptocurrencies like Ethereum as collateral. These stablecoins are normally overcollateralized to combat price volatility.

- Other Investments– Companies that issue stablecoins can often hold a mix of investments as collateral such as commercial paper, corporate debt, bonds, loans, and other “approved investments.”

These collateralized assets are held in reserves and help to ensure that 1 USDC or USDT is always equal to $1. Stablecoins aim to offer the benefits of both fiat and cryptocurrencies such as the high speed, security, and efficiency of crypto, along with the price stability of fiat currencies.

Other examples of stablecoins are:

- Tether Gold (AUXT)- Pegged to gold’s price

- Tether Euro (EURT)- Pegged to the Euro

- Tether Peso (MXNT)- Pegged to the Mexican Peso

- DAI- Decentralized stablecoin issued by MakerDAO

- Algorithmic Stablecoins– Supply and demand are controlled by an algorithm. DAI is an example of this.

And the list goes on. There are stablecoins pegged to many nations’ currencies, providing people with a chance to swap their national fiat currency for the equivalent amount of digital currency.

There are also more complex types of stablecoins that are collateralized by baskets of other cryptocurrencies or partially algorithmic or hybrid, but these are still yet to be proven successful and have not gained mainstream adoption.

Most stablecoins are issued by an entity or company that is responsible for managing the issuance schedule and ensuring that they are holding enough assets in reserves to adequately back the stablecoin. The four largest stablecoin issuers are Circle, Paxos, Tether, and Binance.

Some of the Most Popular USD Backed Stablecoins

Due to the unpredictable and fluctuating nature of cryptocurrencies, stablecoins hold a stable value making them more suitable for everyday use.

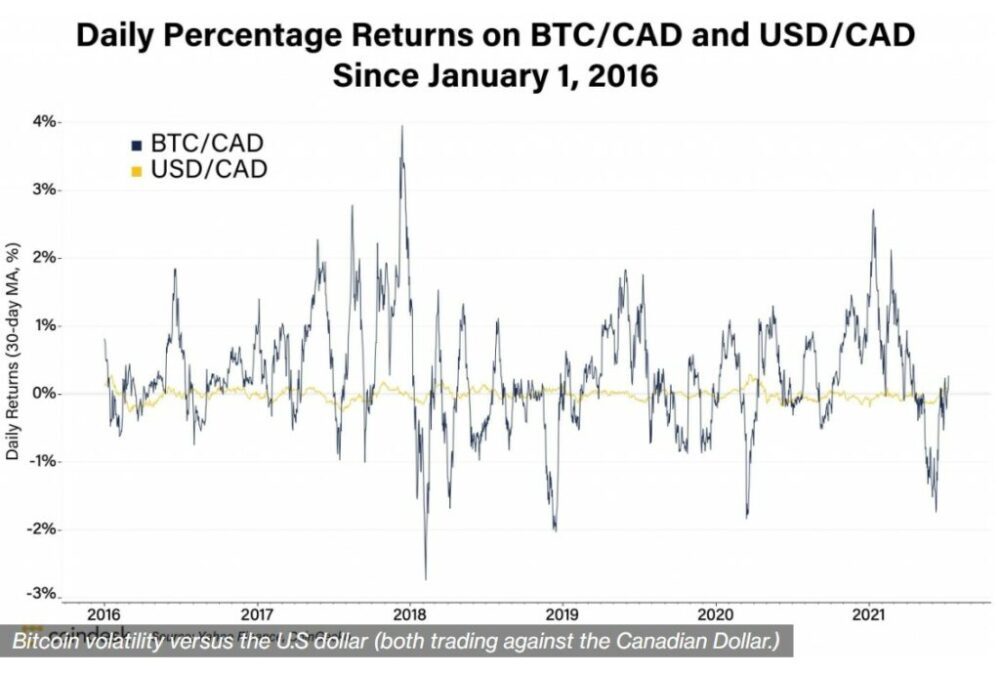

To showcase this point, here is an interesting graph showing the daily percentage returns on Bitcoin/Canadian dollar vs the US/Canadian dollar, showing how much Bitcoin fluctuates in relation to traditional currencies from 2016-2021

Image via Coindesk

With many companies running on tight profit margins and people living paycheck to paycheck, you can see why relying on an asset with so much volatility starts to have its issues.

Check out Guy’s take on Stablecoin risks below if you want another perspective:

[embedded content]

The US fiat-pegged stablecoin Tether (USDT) is widely considered to be the first stablecoin and became the most widely traded cryptocurrency in the world in 2020.

Some of the reasons for this are that many traders like to trade a crypto asset like Bitcoin against Tether, winning trades are often cashed out in Tether, e-commerce and online businesses started adopting stablecoins, and the global population finally had easy access to the US dollar and were keen to ditch their national currency for the stronger greenback.

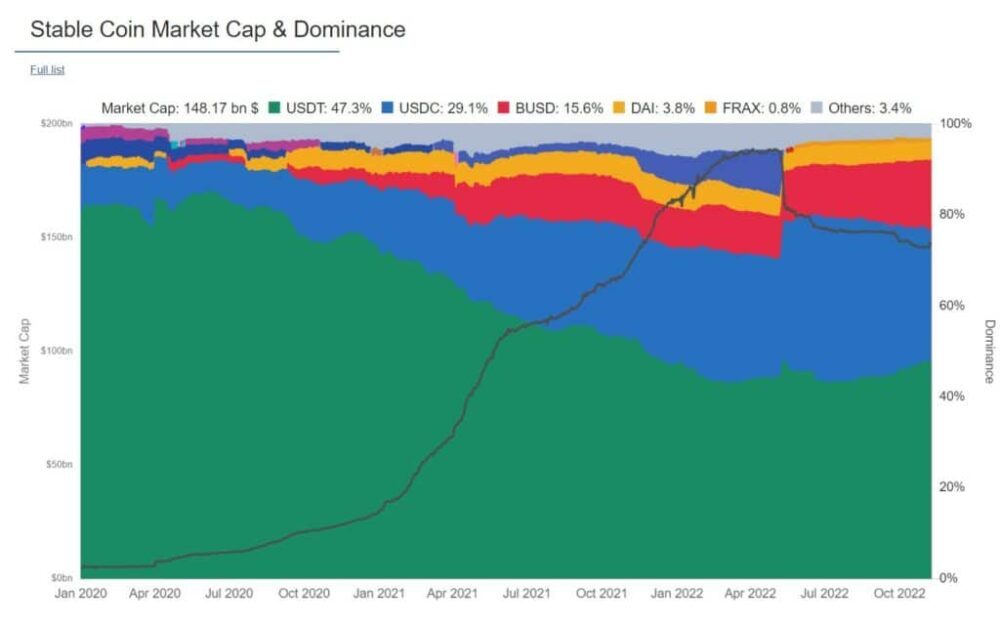

A Look at Tether’s Dominance Among Stablecoins. Image via blockchaincenter.net

The chart above shows how dominant Tether’s USDT stablecoin was in 2020 and how it has started losing market share as other stablecoins were created. People also started moving to other stablecoins like USDC as there were plenty of scandals regarding USDT and suspicion and accusations that Tether did not hold adequate reserves to back all the USDT in circulation.

Here is a great image from Crypto Potato showing Tether’s turbulent past:

Image via cryptopotato.com

4 Major Types of Stablecoins

The 4 different types of stablecoins are:

Fiat-backed

This is the most common as it is the backing method behind the most popular stablecoins. There are stablecoins linked to many of the major fiat currencies.

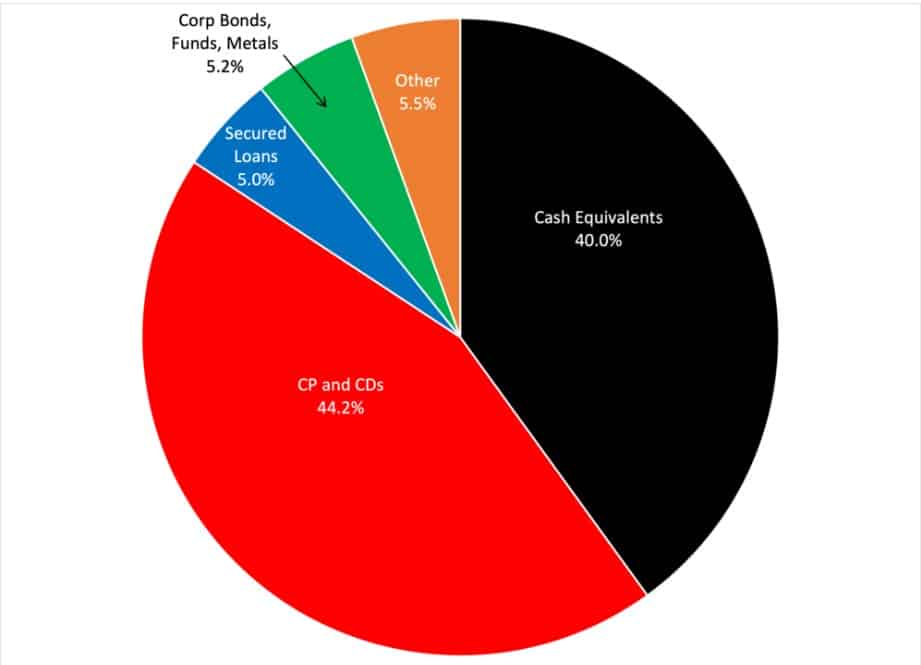

Here is a look at Tether’s 2021 consolidated reserves report showing what is backing the USDT Stablecoin:

Source: Tether Consolidated Reserves Report

Cryptocurrency-backed

Some stablecoins are pegged to the value of other well-established cryptocurrencies or backed by overcollateralized cryptocurrency reserves. A simple example of this would be a stablecoin whose value is $1 and is backed by Bitcoin, meaning that a holder could always redeem the coin for $1 worth of Bitcoin currency.

In order to adequately back the coins, the issuer would have to maintain a reserve of Bitcoin that is substantially larger than the value of issued coins so that if the value of Bitcoin dropped, the issuer could still buy back all the issued stablecoins with Bitcoin.

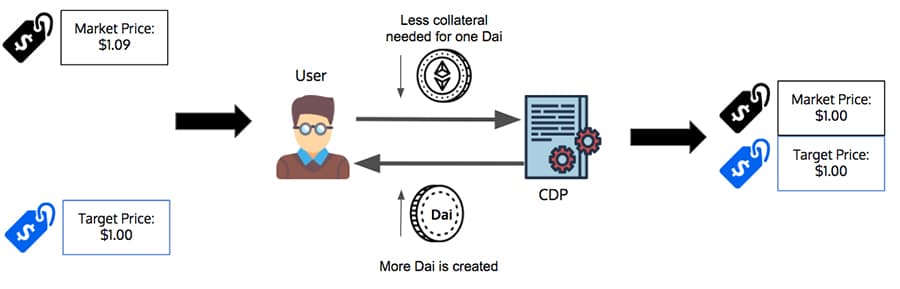

MakerDAO’s DAI stablecoin is an example of a token that does this with Ethereum. Dai is the most popular decentralized stablecoin that runs on Ethereum and attempts to maintain a value of $1. Unlike centralized stablecoins, Dai isn’t backed by US dollars held in reserves but is instead backed by collateral on the Maker platform that is deposited by users.

USD Stability in a Cryptocurrency

Commodity-backed

These stablecoins are pegged to the value of commodities like precious metals, industrial metals, oil, or even real estate. These provide investors with an incredibly convenient and easy way to gain exposure to commodity investments without needing to source or store the commodity. Investing in a digital token representing oil sure beats buying and storing barrels of oil in your living room.

Many investors believe that someday, every investible asset will have its value stored and available on the blockchain.

Some cryptocurrencies have been created that are based on the value of an index consisting of multiple commodities. Gold-backed stablecoins like PAXG are the most common commodity-backed cryptocurrencies but there are also assets like Tiberius, which is backed by a combination of seven precious metals, or SwissRealCoin, which is pegged to the value of a portfolio consisting of Swiss real estate.

Algorithmic

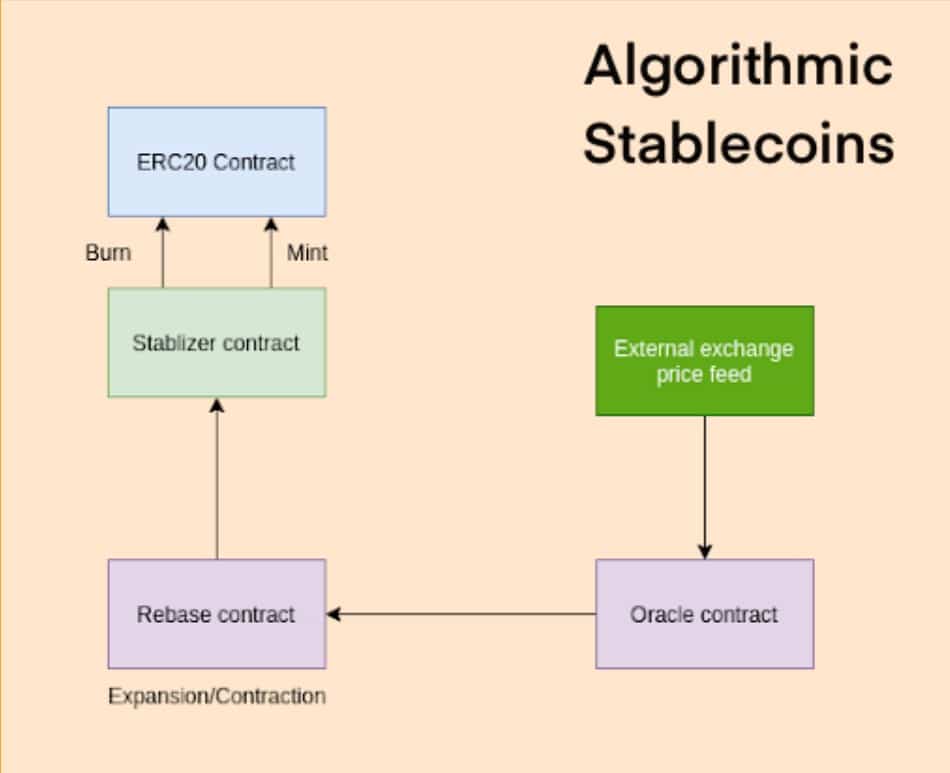

Algorithmic stablecoins are not backed by anything and rely on algorithms to regulate the supply based on market demand. These algorithms will automatically burn or mint new coins based on fluctuating demand for the stablecoin at the current time.

A flowchart explaining the working of algorithm stablecoins. Source: blog.accubits.

It is also worth mentioning quickly a newer kind of stablecoin was introduced called Fractional Algorithmic Stablecoins, or Hybrid Stablecoins. These are partially backed by collateral and partially stabilized algorithmically. The price is supported by a flexible collateral mix that consists of other stablecoins and a separate “seigniorage token.” These are not commonly used or adopted, something that may change. A popular example of this hybrid stablecoin is Frax.

How Stablecoins Work

Normally, the entity or company behind a centralized stablecoin will set up a reserve where it securely stores the asset or basket of assets that back the stablecoin. Audits are performed regularly on major stablecoin issuers like Tether, Circle, and Paxos to ensure they are holding enough assets in reserves to cover the value of the stablecoins they issue.

This ensures that stablecoins are pegged to real-world assets. The money in reserves serves as collateral for the stablecoin, so whenever a stablecoin holder cashes out their tokens, an equal amount of whatever asset backs it is taken from the reserve, ensuring the peg remains balanced and stable.

The peg does not always stay perfectly balanced though, stablecoin prices can and often do fluctuate from the associated fiat price by a percent or two, which is far less than the fluctuations experienced by other crypto assets.

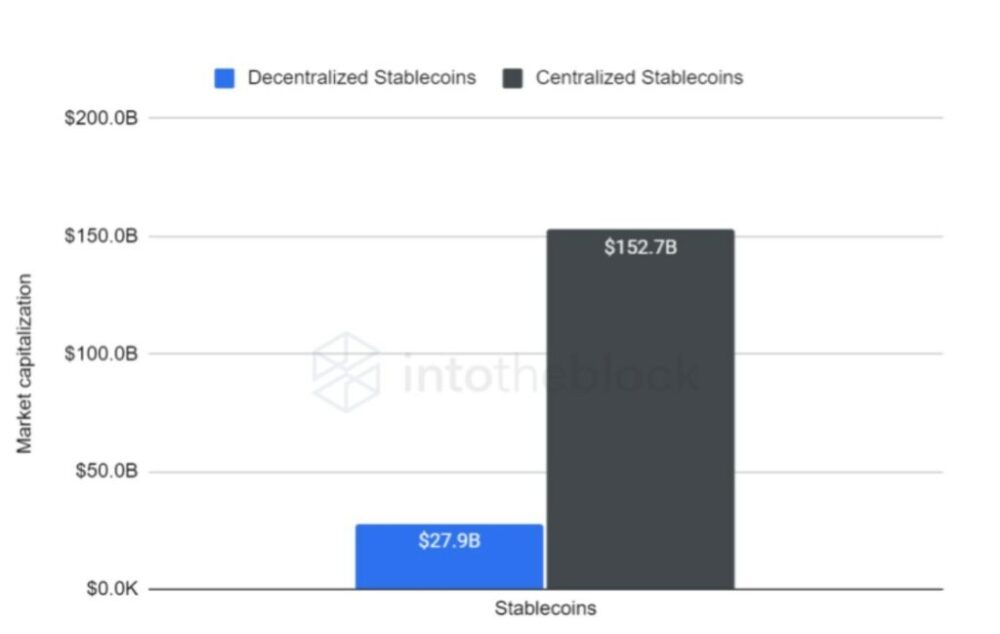

It is good to note that centralized stablecoins make up a significantly larger portion of the stablecoin market than decentralized stablecoins:

Market Capitalization of decentralized and centralized stablecoins as of Feb 22, via Coingecko.

This is due to the fact that the companies that issue these stablecoins also need to ensure adequate reserves, there haven’t been many proven ways to accomplish this task or ensure the stable peg of a token without a centralized entity behind the project.

While the majority of stablecoins are highly centralized, MakerDAO provides a decentralized approach to stablecoins and is the most prominent example of this. MakerDAO is run by a decentralized autonomous organization (DAO) and issues DAI stablecoins to borrowers, ensuring that its reserve assets are always overcollateralized. Overcollateralization means that the reserve holds more assets than DAI’s total supply value. Maker only holds cryptocurrencies such as Ethereum and USDC in the reserves.

Users of Maker lock up their crypto collateral in a smart contract, and once the contract knows the collateral is secure, a user can then borrow freshly minted DAI stablecoin tokens.

The Maker Target Rate Feedback Mechanism. Image via Medium

Then we have algorithmic stablecoins, which are not collateralized by anything. Instead, coins are either burned or created to keep the coin’s value in line with a target price, normally $1.

The way algorithmic stablecoins work is that if the stablecoin drops from $1 to $0.75, the algorithm will automatically destroy a number of the coins to introduce scarcity, pushing the price back up. If the price goes above $1, the algorithm will create new tokens, increasing the supply and dropping the price back down.

While algorithmic stablecoins may sound solid in practice and like a great idea as it works on simple supply and demand economics, this type of protocol has proven incredibly difficult to get right.

There Have Been Plenty of Failed Stablecoin Projects to Date. Image via cryptosec.info

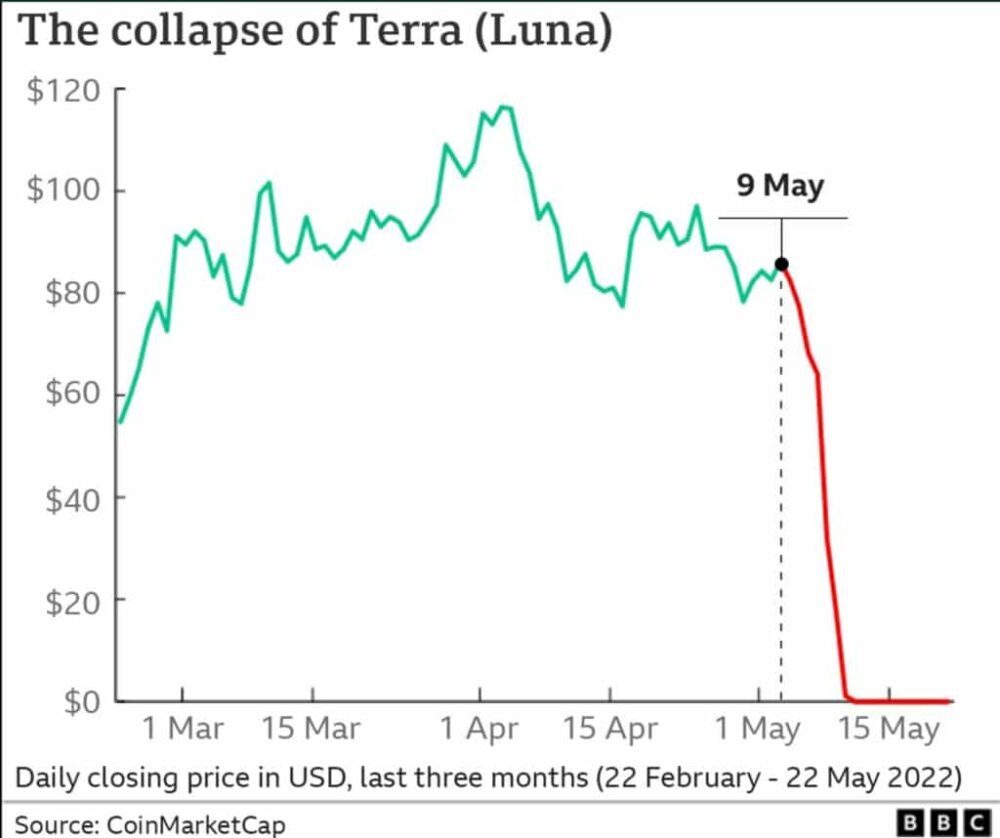

Algorithmic stablecoins have been attempted multiple times in the past with multiple failures and billions of dollars worth of customer assets being lost. The Terra Luna collapse is the most damaging example of this as billions were lost with many people losing their life savings.

A Look At The Collapse of the Terra Luna Token. Image via BBC.

The historic Luna collapse will go down as one of the darkest days in crypto history. An estimated $60 billion was wiped out during the collapse, sparking regulatory action and panic among investors and global regulators. The failed project led many to believe that the possibility of a successful algorithmic stablecoin is unlikely. Time will tell.

Benefits of Stablecoins

Stablecoins complement our ever-increasing global economy and digital age. Stablecoins prove a solution to some key problems that stifle the exchange of money:

- Stablecoin users do not need international bank accounts or need to rely on banks to send money cross-borders. A crypto wallet is all that is required, and funds are sent instantaneously. This is a massive improvement over the slow, expensive, and prohibitive legacy system.

- Stablecoins make peer-to-peer digital transfers possible without the need for third-party intermediaries.

- Stablecoins cut down on fees and transfer times, and do away with much of the red tape that often comes with international exchanges.

- Stablecoins can be utilized without the need for KYC, enhancing privacy and anonymity. Though it is important to note that blockchain transactions can be traced and tracked, and centralized stablecoin transactions can be halted and controlled due to their centralization. Despite all this, utilizing stablecoins remains significantly more private than going through the banking system. For now.

The primary goal of a stablecoin is to simply deliver the benefits of blockchain digital assets in a currency that isn’t affected by substantial rises and decreases in price.

Stablecoin Drawbacks

Stablecoins are not without their pain points and have certain drawbacks to be aware of.

If the issuing company stores its reserves with a bank or a third party, there is counterparty risk present. If the bank goes insolvent or there is a security exploit, funds are at risk. This doesn’t just go for stablecoins, but anytime you are trusting any authoritative entity with anything there is an element of third-party risk.

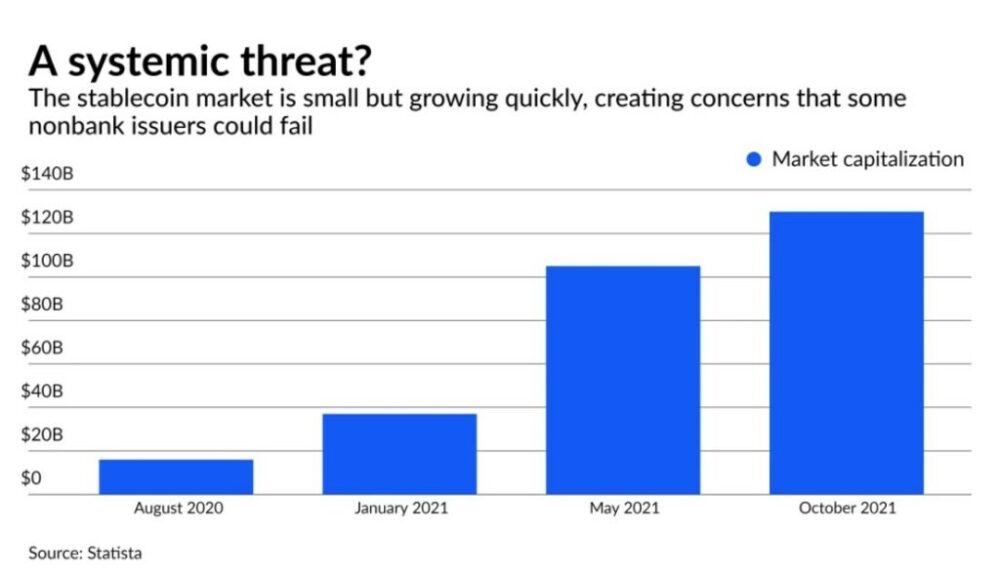

Regulatory risk is also a big one with stablecoins. Stablecoins are something global regulators and governments are watching very closely as they are disrupting the financial system and posing a systemic threat in a multitude of ways as we are seeing tens of billions of dollars flowing out of the traditional banking system and into stablecoins.

It is not yet known how regulators will approach the stablecoin situation as they likely do not appreciate the loss of control over a monetary system and their plans to roll out their own CBDCs may have significant impacts on the future of stablecoins.

Image via American Banker

On the flip side, US regulators especially are in a tricky spot as global adoption of US-backed stablecoins is increasing the global reliance on USD, which is good for the US dollar, though the adoption is of a version of the US dollar that they do not control, which is a concern. Regulators have a tough choice balancing what is best for the global dependence on the US dollar and how much control they are willing to give up.

A core ethos of cryptocurrency is the ability to not trust, but verify. Thanks to blockchain technology, features and aspects of transactions and token issuance details are completely transparent and verifiable by anyone. This leads crypto users not needing to trust other people or entities, as they trust the code, the algorithms, and the blockchain. Centralized stablecoins require an element of trust in the issuing company, which is a concern for many.

Stablecoins generally require a custodian to regulate the currency and maintain fiat reserves. This means that users need to rely on the honesty and integrity of the issuing party in honouring deposits and withdrawals. Stablecoins are mostly centralized, require third-party trust, and transactions can be blocked and controlled by the company behind some stablecoins. These features all go against the true ethos of cryptocurrency, which is why there is a strong desire for an algorithmic stablecoin that works.

Then, of course, the final drawback comes from algorithmic stablecoins. When too much liquidity is taken from a stablecoin market too quickly, the price of the peg can drop, which spooks investors, who also go to sell, dropping the price even more and causing what is known as a death spiral as we saw with the above charts of Terra Luna’s token.

Image via Delphi Digital

Many people held a significant value of their portfolio in Terra Luna, only to watch it go to zero. Algorithmic stablecoins are something to be very wary of until someone comes up with a working model for creating one.

Stablecoin Growth

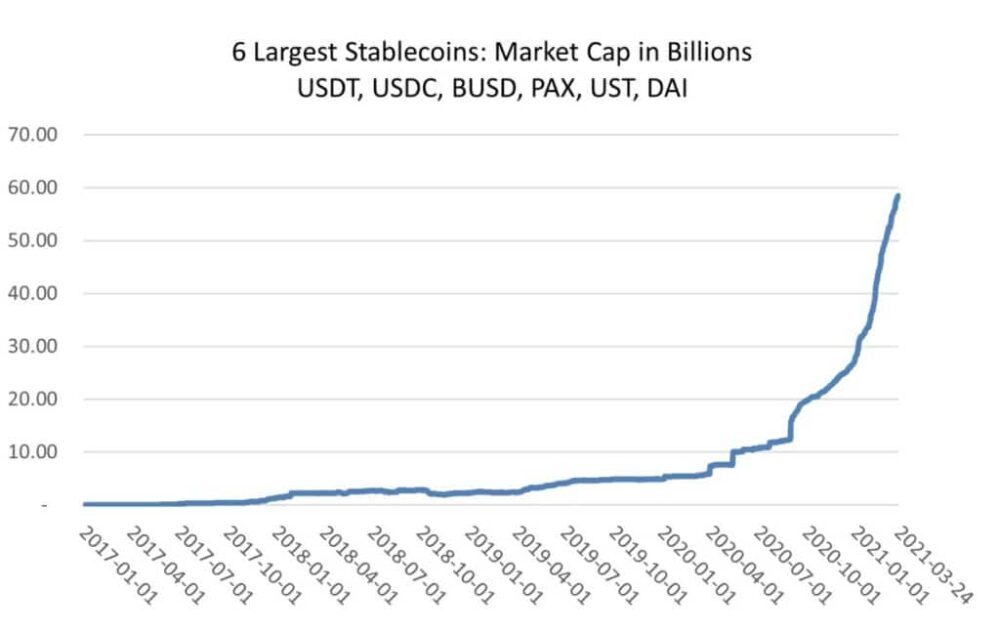

Stablecoins make up the most liquidity in the crypto market and witnessed unprecedented growth in 2020. According to CoinMetrics, popular stablecoins registered astronomical numbers in terms of percentage growth of the total market cap.

USDC saw a 700% rise in adoption in Q1 of 2020 and the 6 largest stablecoins hit a market cap in the billions in 2021:

Image via Coin Metrics

Circle, the company behind USDC’s CEO said that much of the demand is from regular businesses, not just crypto traders as companies were quick to realize the benefits of stablecoins. Stablecoins were largely adopted by e-commerce businesses and online companies.

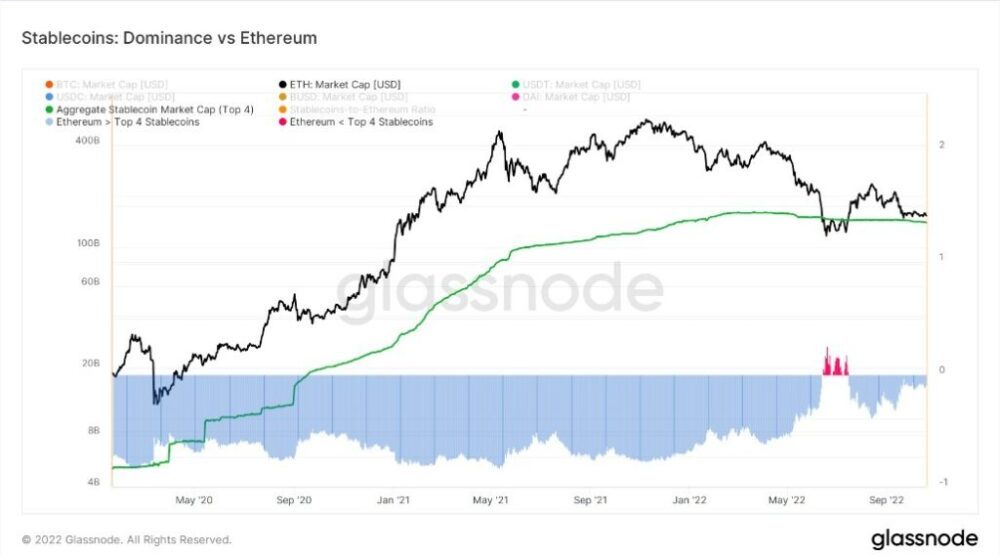

As we are getting deeper into a bear market, market cap dominance of stablecoins continues to grow as investors look to flock to a stable asset as the broader crypto market experiences significant losses. We can see that as of September 2022, stablecoin dominance was nearly equal to Ethereum’s.

Image via Glassnode

It is clear that stablecoins make up one of the foundational cornerstones of the cryptocurrency industry and are not going away any time soon.

How to Buy Stablecoins

Stablecoins are available on pretty much every cryptocurrency exchange and DEX. As they are the most common instrument for trading cryptocurrencies against and providing traders with a stable store of value and medium for exchange, they are very important which is why some form of stablecoin is supported anywhere that crypto can be traded.

The place I recommend buying stablecoins is on Binance, as they are highly secure, regulated, and reputable, and is the #1 crypto exchange in the world for a reason. Users can buy stablecoins on Binance via debit/credit card or through bank wires/transfers. You can find out more about Binance and purchasing methods in our dedicated Binance review.

👉 Sign up to Binance to receive an exclusive 20% trading fee discount for life and up to a $600 bonus!

If you are new to cryptocurrency or just looking for an incredibly user-friendly place to buy and trade crypto, then SwissBorg is my top pick as they have an excellent user interface and a multi-award-winning app and product. Users can buy stablecoins and other crypto assets on SwissBorg with a bank card or bank transfer. You can find out more about SwissBorg in our SwissBorg review.

👉 Sign up to SwissBorg and get up to €100 FREE!

Stablecoins: Closing Thoughts

As crypto adoption continues to grow and further utility is rolled out, stablecoins will play an ever-increasing role in the industry. Stablecoins provide the perfect blend of a stable-priced asset that benefits from blockchain technology. Stablecoins are a crucial part of the crypto ecosystem and without them, cryptocurrency would not be where it is today. Stablecoins bridge the gap between TradFi and DeFi and are necessary for liquidity and increasing global crypto adoption.

The major downside is the heavy centralization inherent in stablecoins, which contradicts why many of us are attracted to the crypto industry in the first place. Time will tell if centralized stablecoins are the future, or if CBDCs will knock stablecoins out of the running. Many crypto users have their fingers crossed that someone will crack the decentralized algorithmic stablecoin conundrum for once and for all, providing the industry with a robust and trustworthy decentralized stablecoin.

Stablecoin FAQs

What is a Stablecoin?

While the term has not been legally defined, stablecoin generally refers to a type of digital asset that runs on blockchain technology. It is a cryptocurrency whose value is pegged, or tied to, another currency, commodity, or financial instrument. Stablecoins provide the benefits of cryptocurrencies, but without the price volatility as the price remains more stable. Most stablecoins are pegged for a 1-to-1 value with the United States Dollar, but there are stablecoins pegged to other currencies as well.

Why Do Stablecoin Prices Change?

Stablecoin prices can vary temporarily by a percent or two in some cases depending on supply and demand. The fluctuations tend to even out over time as the price rebalances to its peg.

Are Stablecoins Safe?

Most stablecoins are considered relatively safe and can help keep investors protected against price volatility. Many believe the that the most trusted and transparent stablecoins are Circle’s USDC and the stablecoins issued by Paxos, as these companies are transparent with their reserve audits and play friendly with regulators.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

- algorithmic stablecoin

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- Coin Bureau

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DAI Stablecoin

- decentralized

- DeFi

- Digital Assets

- ethereum

- Guides

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- stablecoin

- Stablecoins

- Tether

- USDC

- W3

- zephyrnet