Method

Token unlocks are significant events that have the power to sway the market.

CryptoSlate looked at price data for six different crypto projects, ranging from high-cap to mid-cap, to better understand how their token unlocks affected the market.

Polygon (MATIC)

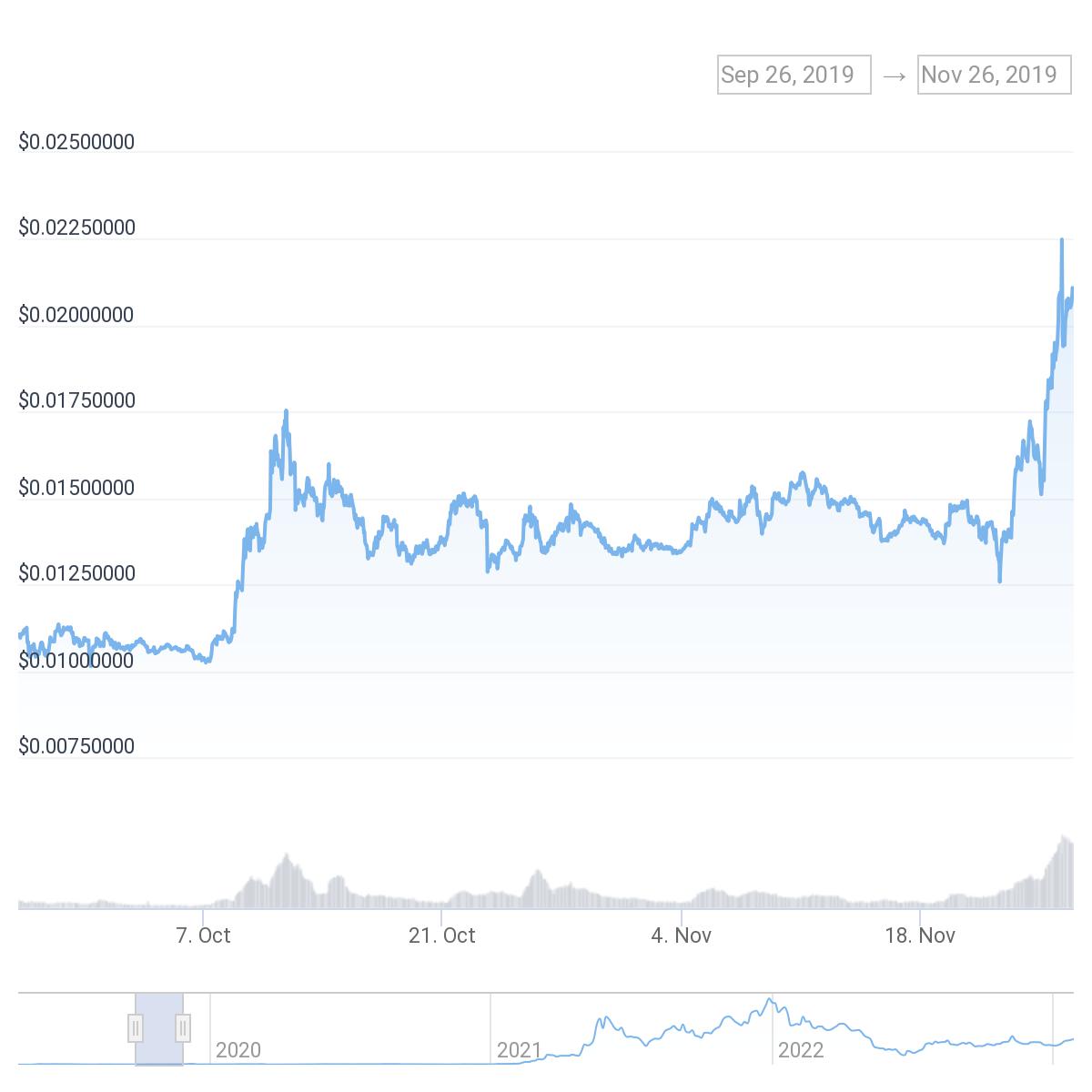

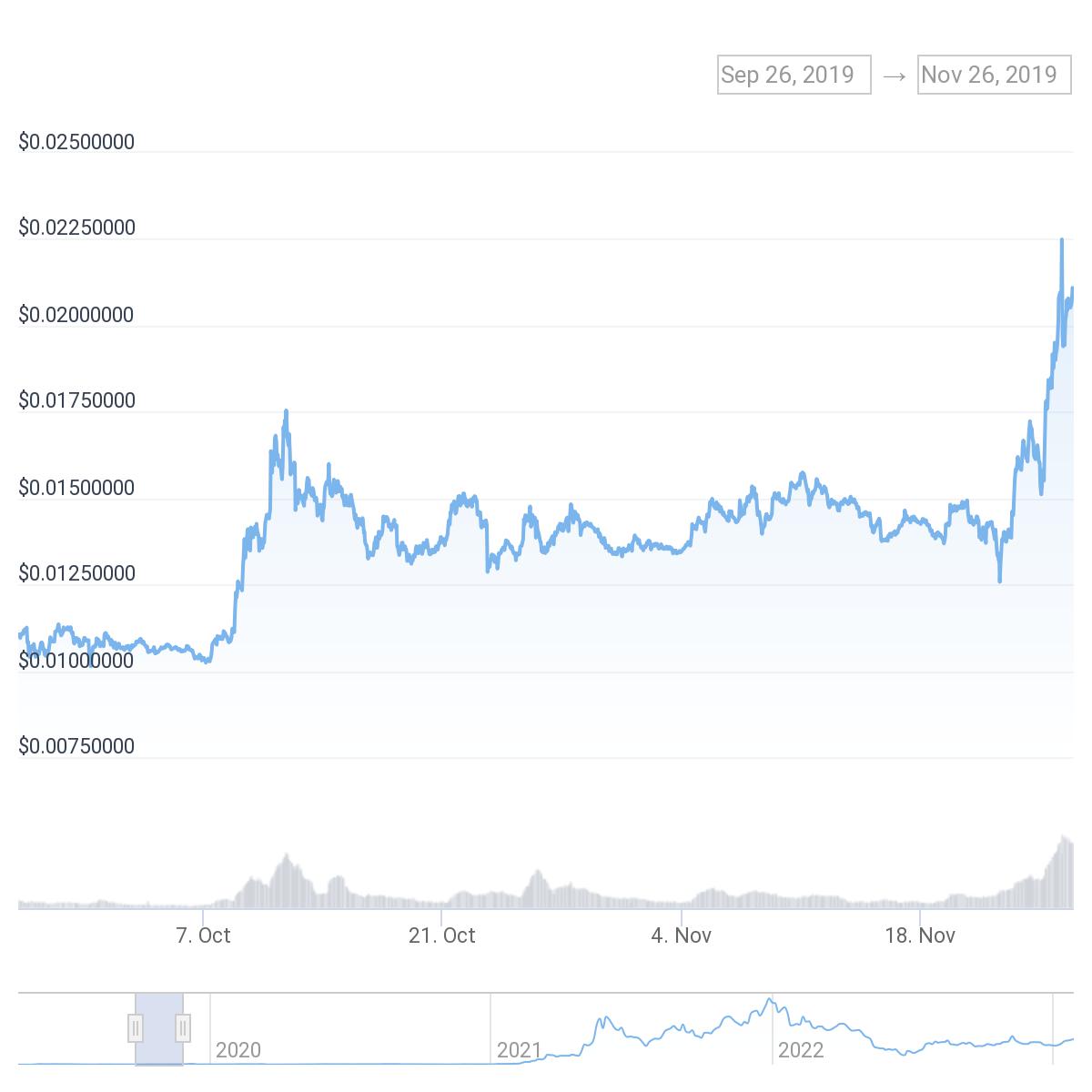

On Oct. 26, 2019, the Polygon network unlocked 190 million MATIC. The tokens were distributed to private investors and early supporters who participated in Polygon’s funding rounds.

The price action MATIC saw in the month and week leading up to the unlock matches the trend seen in most token unlocks. The market was gearing up for the token unlock, creating a buying pressure that pushed its price up almost 30%.

After the tokens were airdropped, increased selling pressure kept MATIC’s price relatively flat. However, in the month following the unlock, MATIC saw its price increase by over 80%.

- 30 days before TU: $0.0108

- 7 days before TU: $0.0138

- Day 0 of TU: $0.0135

- 7 days after TU: $0.0137

- 30 days after TU: $0.0244

LidoDAO (LDO)

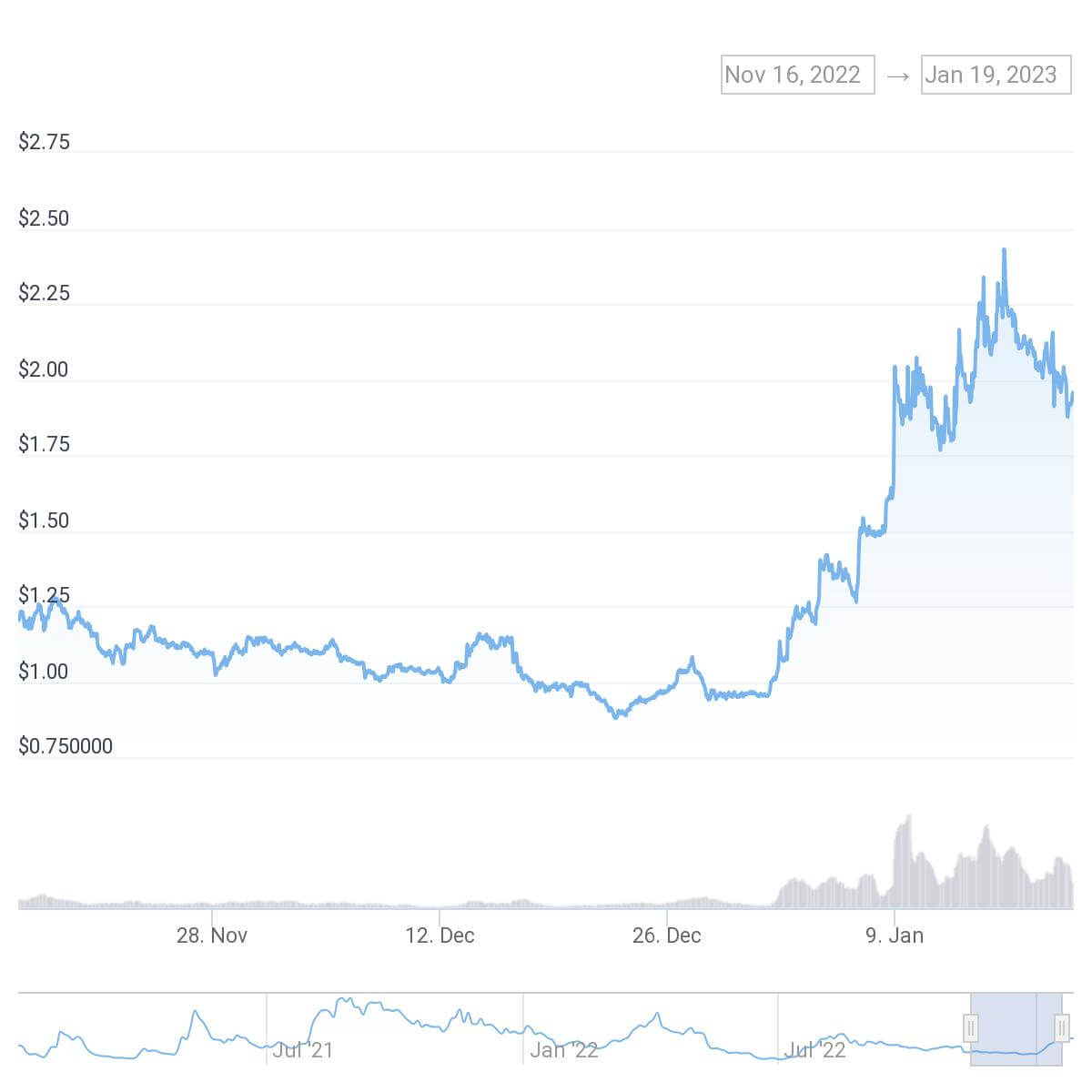

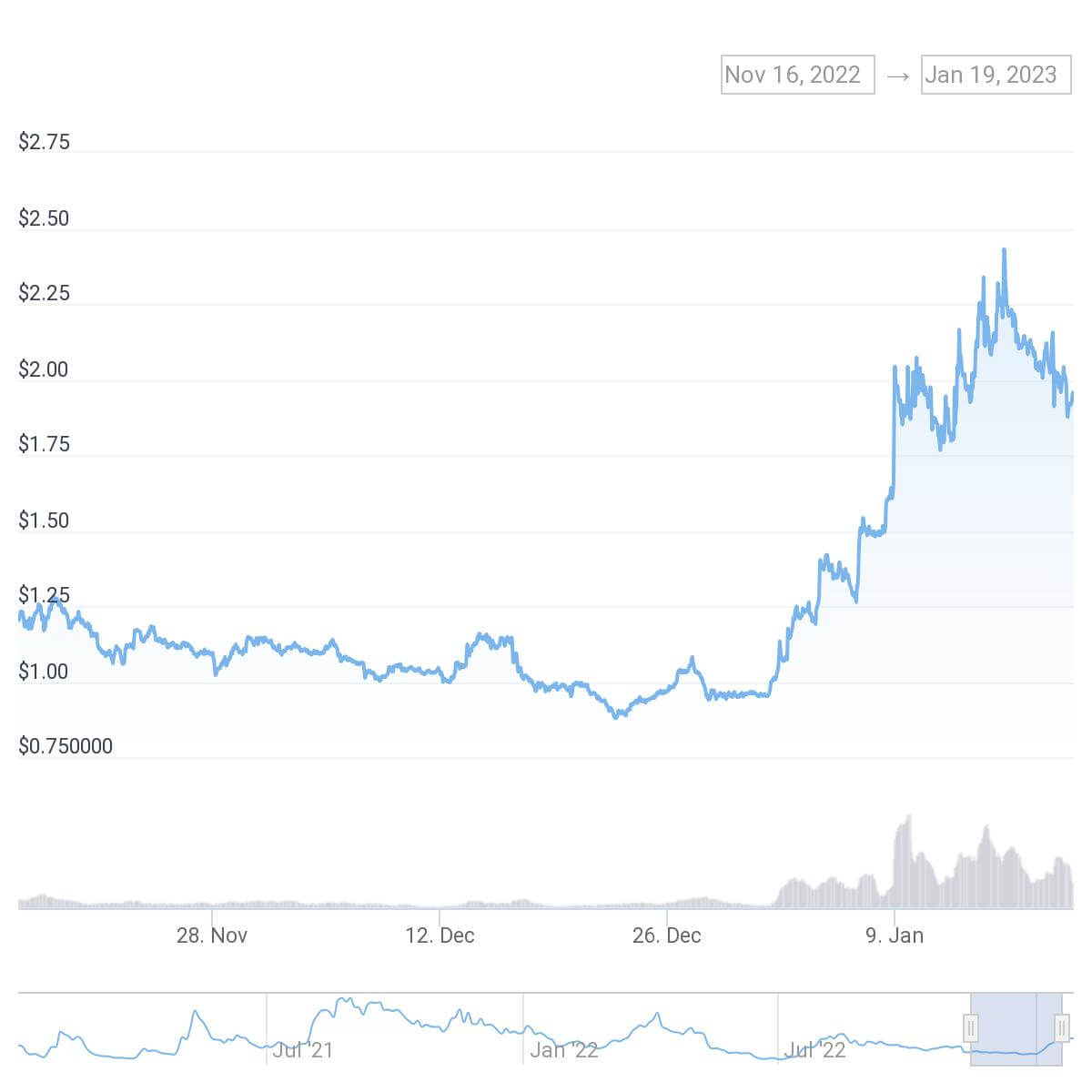

Lido has seen its popularity increase significantly in 2022, as Ethereum’s transition to a PoS network made it its most valuable player. Its LDO token saw a notable uptick ahead of the Merge, so the month leading up to its December token unlock saw little positive price action.

On Dec. 18, 2022, 1.65 million LDO tokens were unlocked and distributed to the project’s team, investors, and validators.

The week after the token unlocks marked the culmination of LDO’s selling pressure, which saw its price almost double in the month following the unlock.

- 30 days before TU: $1.22

- 7 days before TU: $1.03

- Day 0 of TU: $0.98

- 7 days after TU: $0.97

- 30 days after TU: $2.01

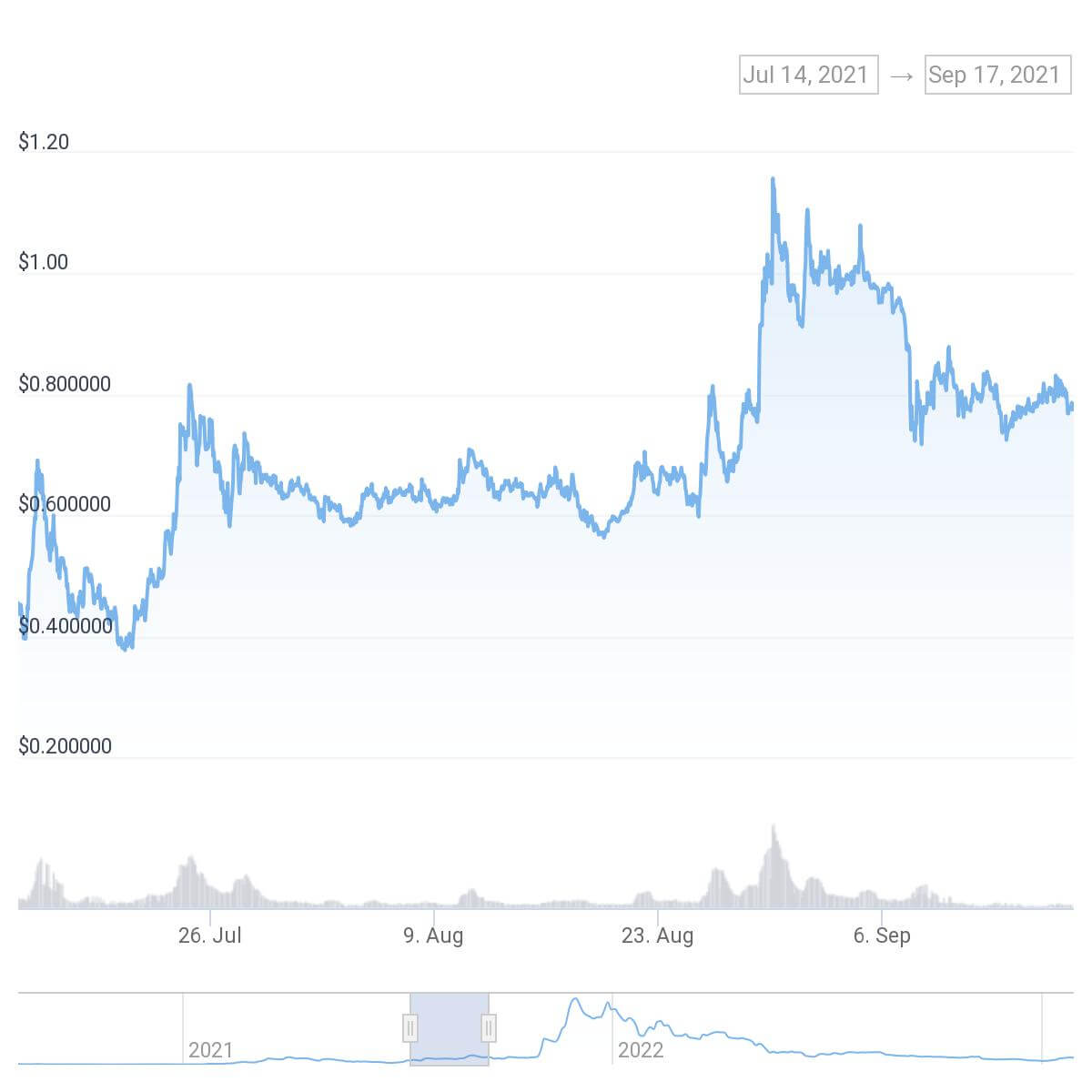

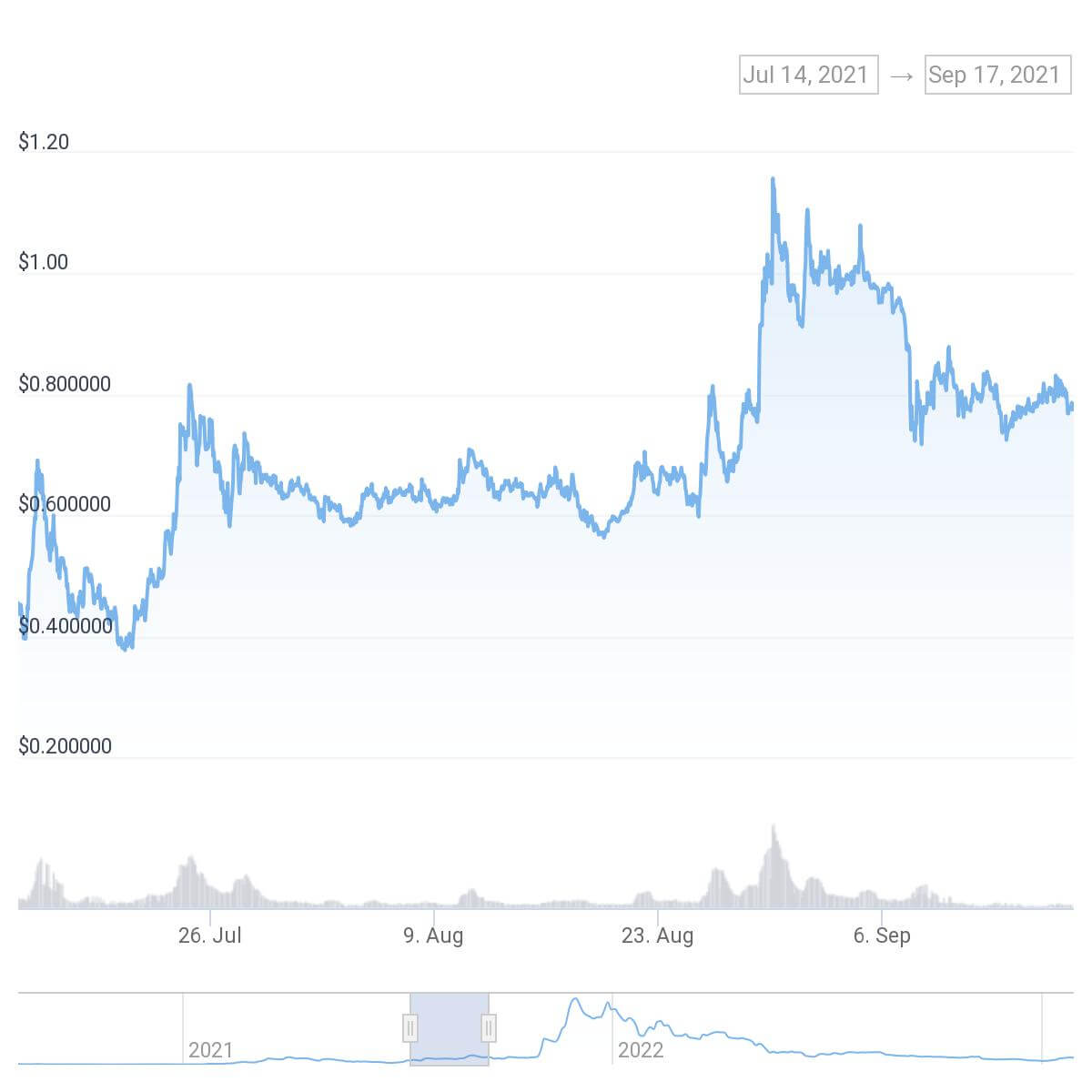

The Sandbox (SAND)

The Sandbox was among the first major metaverse platforms to hit the market and enjoyed notable success in 2020 and 2021.

A year after its high-profile token sale on Binance Launchpool, Sandbox unlocked 397.7 million SAND tokens on Aug. 16, 2021. The tokens were distributed to investors, advisors, and the company reserves, increasing the project’s liquidity and popularity.

SAND followed the same trend as Polygon’s MATIC did, where increasing buying pressure ahead of the unlock pushed its price to yearly highs. A brief price consolidation turned into a positive price action that saw the token gain almost 30% in the month following the unlock.

- 30 days before TU: $0.48

- 7 days before TU: $0.62

- Day 0 of TU: $0.64

- 7 days after TU: $067

- 30 days after TU: $0.82

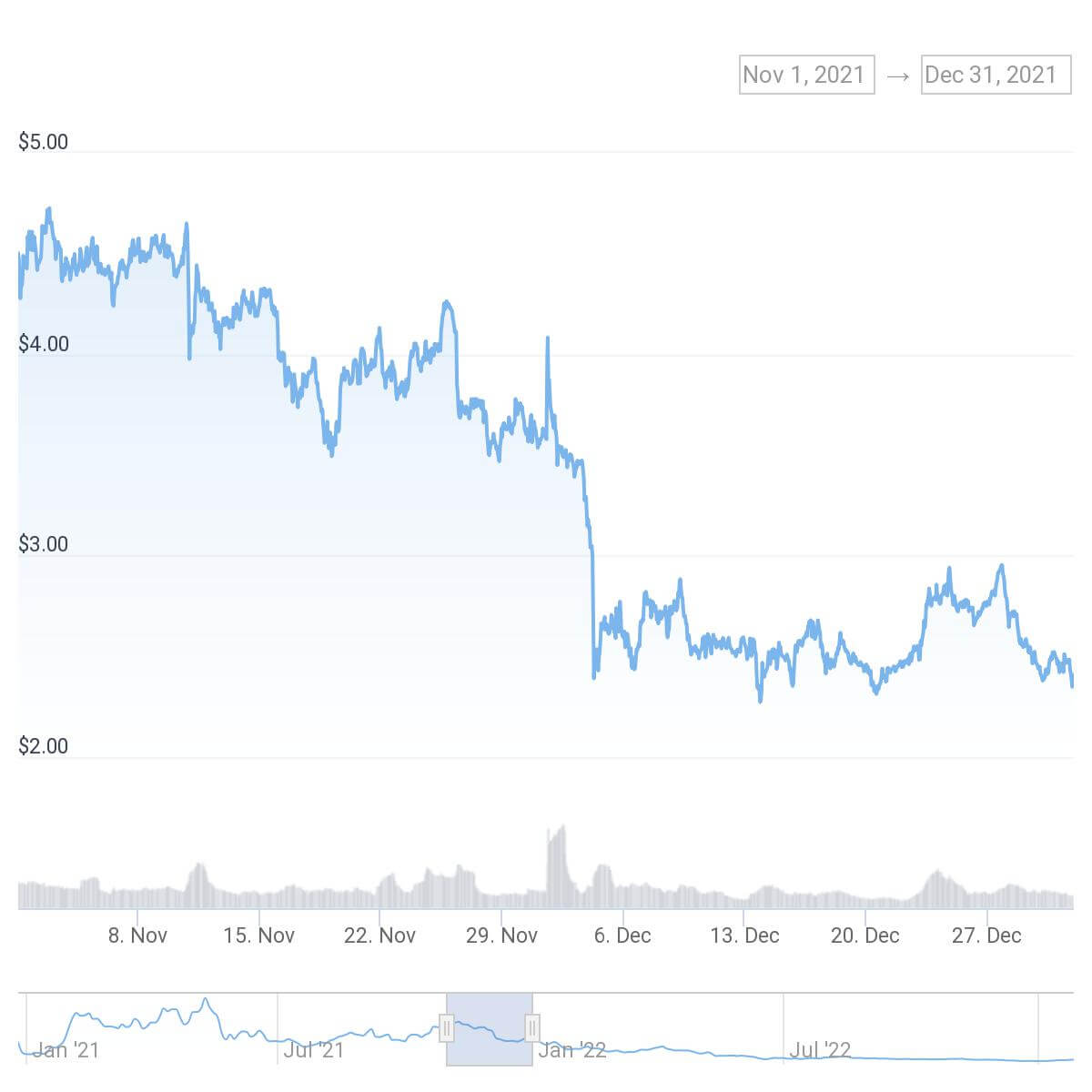

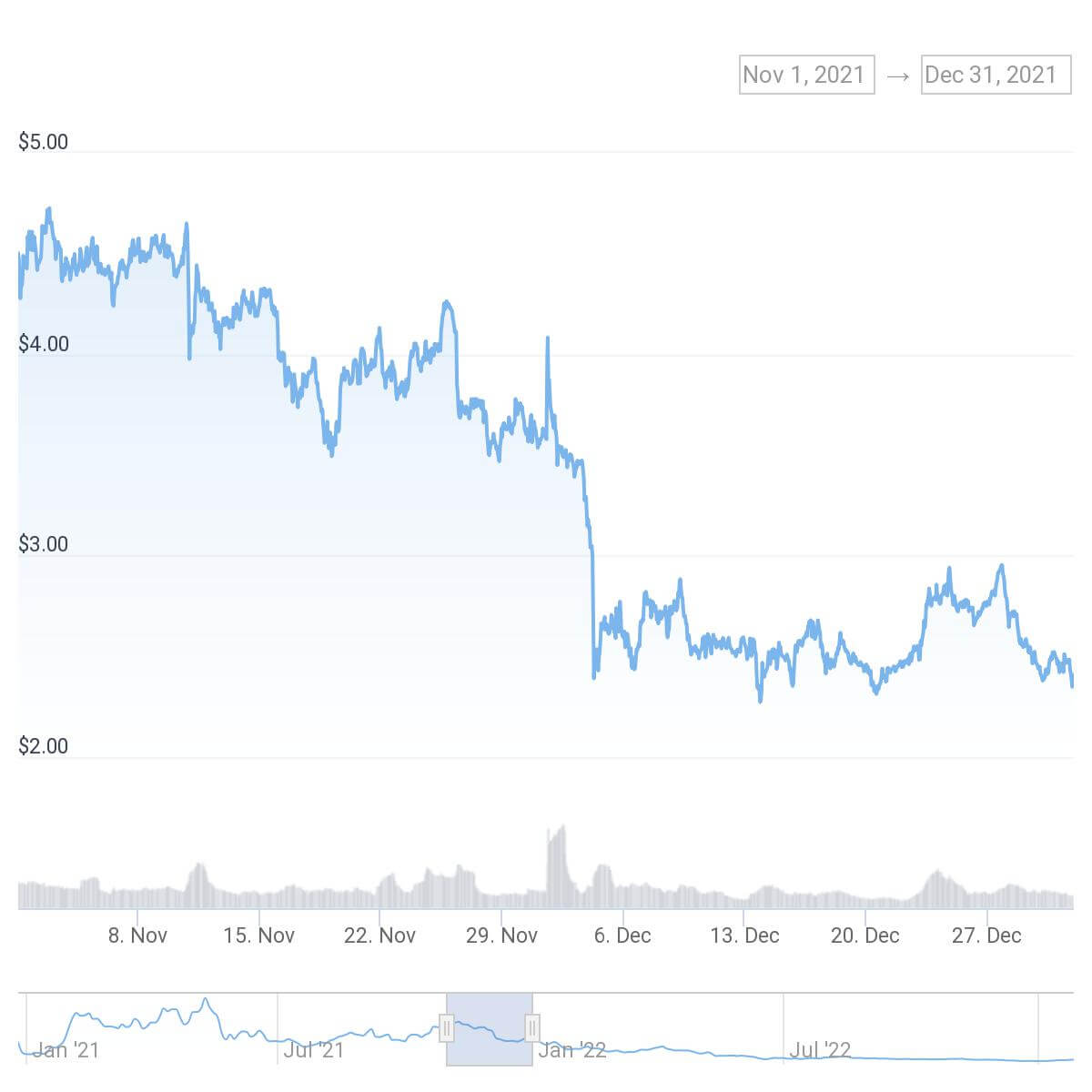

1inch Network (1INCH)

The 1inch Network peaked during the 2020 DeFi Summer, capitalizing on the market’s newfound fascination with decentralized finance.

Wanting to capitalize on its success, the DEX launched its native token 1INCH in late 2020, allocating around 97.5 million tokens to various community initiatives. 1INCH surged in value throughout 2021 as the exchange saw a record number of users and a growing transaction volume.

The 231.7 million tokens allocated to the 1inch team, its advisors, and outside investors were unlocked on Dec.1, 2021. This was followed by an even larger unlock distributed to seed investors and the company’s reserves, which saw another 295.2 million tokens hit the market.

- 30 days before TU: $4.58

- 7 days before TU: $3.99

- Day 0 of TU: $3.69

- 7 days after TU: $2.72

- 30 days after TU: $2.39

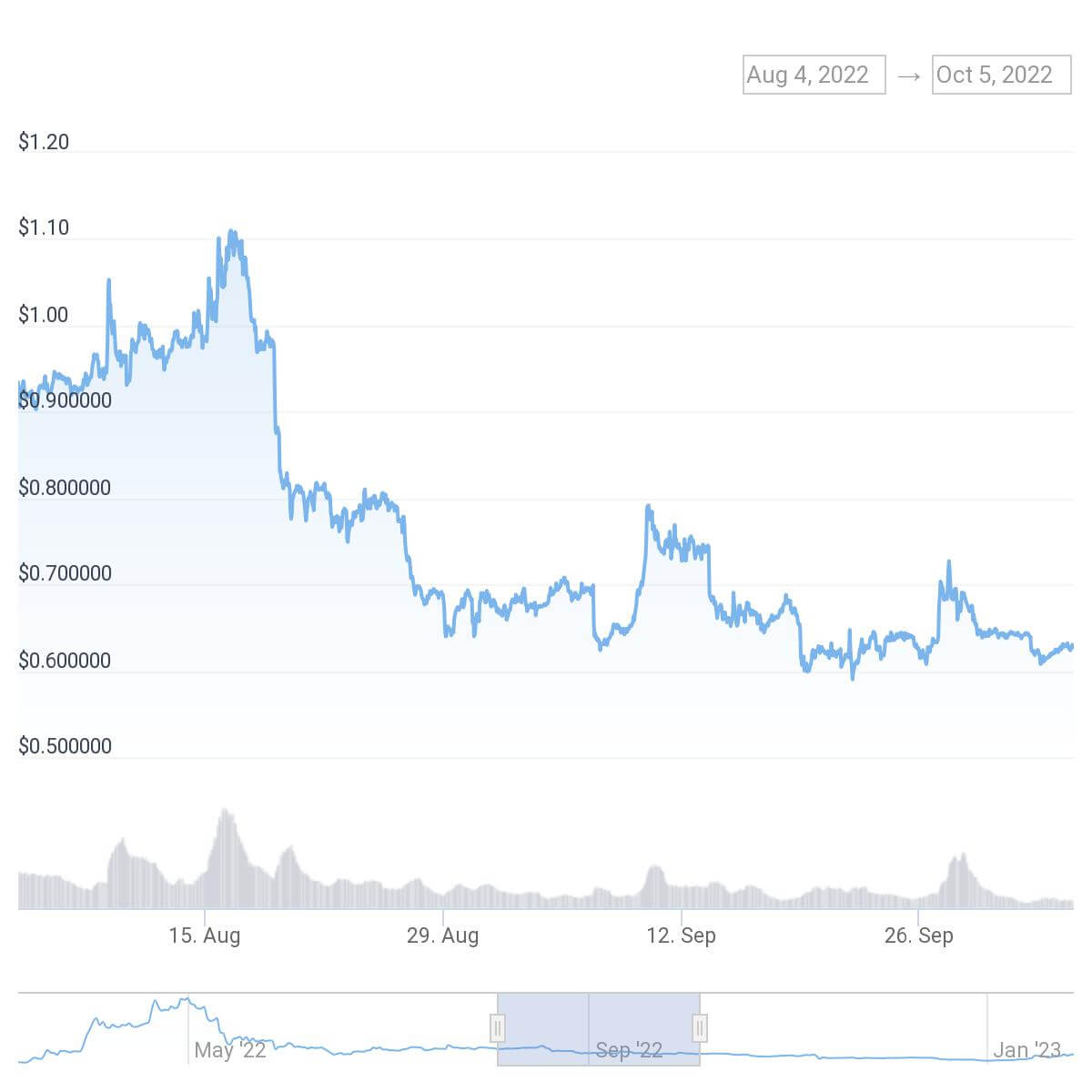

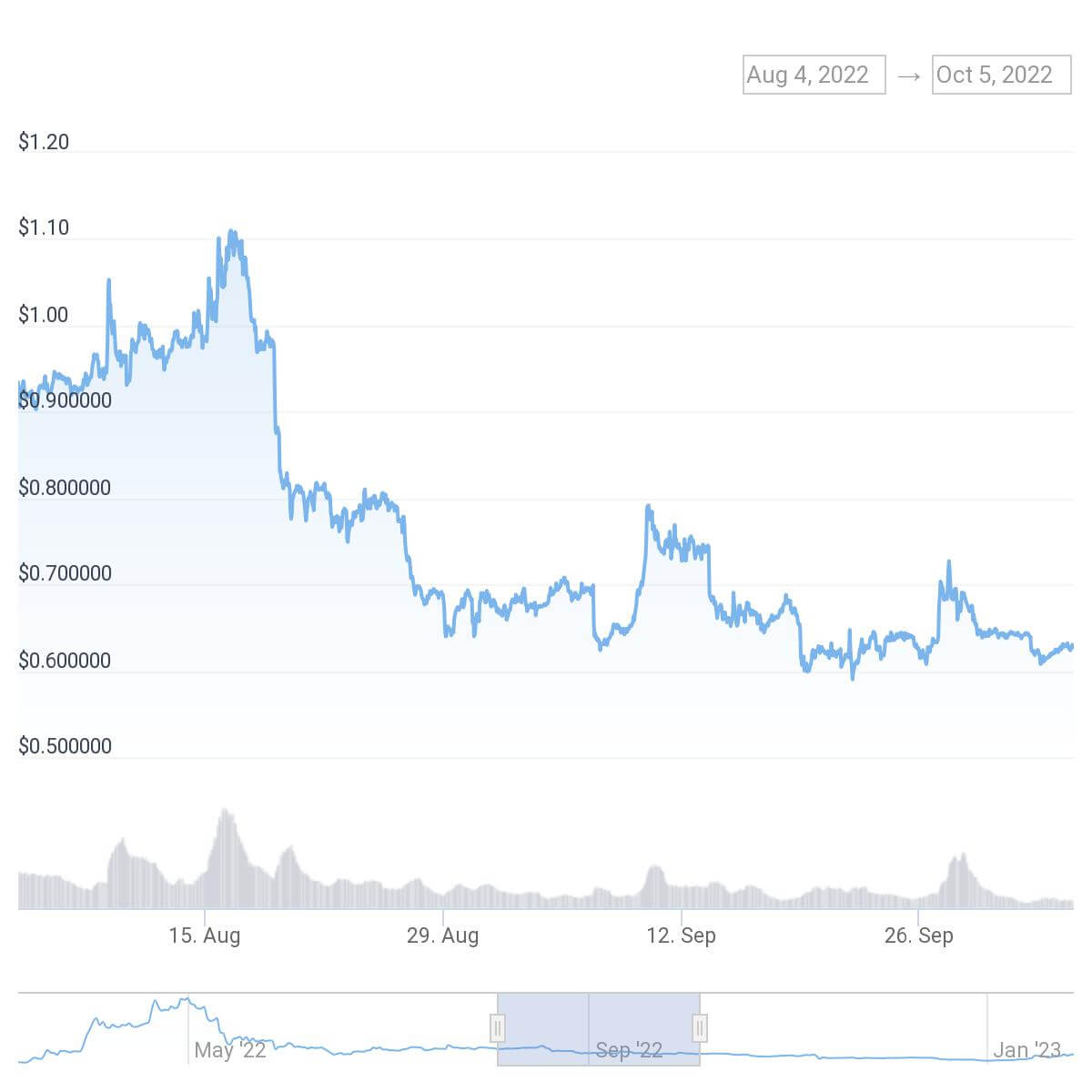

STEPN (GMT)

A pioneer in the move-to-earn space, STEPN was one of the best-performing platforms in the first half of 2022. Its native token GMT reached its all-time high in April, as thousands of users rushed to the platform to capitalize on its attractive reward model.

At the beginning of September 2022, a total of 4.2 million GMT tokens were distributed to users as part of its move-to-earn reward program. The event was followed by weekly unlocks of around 5 million GMT tokens distributed to users.

- 30 days before TU: $0.93

- 7 days before TU: $0.65

- Day 0 of TU: $0.69

- 7 days after TU: $0.73

- 30 days after TU: $0.62

Takeaways

The price movements before, during, and after major token unlocks show a repeating trend.

The majority of tokens see buying pressure ramping up toward notable scheduled unlocks, which is then followed by a price correction. In most cases, this price correction is short-lived and quickly turns into a slow and steady growth for the token.

However, some tokens fail to follow this pattern.

The above-mentioned trend is most often seen in large-cap tokens, where a token unlock creates a network effect that puts the project on the map and attracts new users. It’s also evident in projects that distribute a significant quantity of its tokens to users.

Projects that distribute a large number of their tokens to private investors and internal teams are the ones that see their price decrease following major unlocks. With most unlocks being transparent to the public, the market usually anticipates a big dump and tries to outpace the downward price action.

Some unlocks also come at an unfortunate time for a token and its holders. For example, STEPN’s GMT reward distribution came after the protocol’s heyday and coincided with a broader downturn caused by FTX.

There is also the factor of timing. The earlier in a project’s life the unlock happens, the bigger effect it will have on its token’s price. Large-cap, highly-liquid projects such as Polygon are often unfazed by unlocks, as their huge network quickly absorbs any price volatility.

For most tokens, unlocks bring increased liquidity and create a more stable price environment. In the months following an unlock, most tokens stabilize their price with significant gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://cryptoslate.com/market-reports/token-unlocks-short-term-volatility-brings-long-term-growth/

- $3

- 1

- 10

- 1inch

- 2019

- 2020

- 2021

- 2022

- 2023

- 7

- a

- Action

- advisors

- After

- ahead

- allocated

- among

- and

- Another

- April

- around

- attractive

- Attracts

- Aug

- AUGUST

- before

- Beginning

- being

- Better

- Big

- bigger

- binance

- bring

- Brings

- broader

- Buying

- capitalizing

- cases

- caused

- CoinGecko

- come

- community

- company

- Company’s

- consolidation

- create

- creates

- Creating

- crypto

- crypto projects

- data

- Days

- December

- decentralized

- Decentralized Finance

- decrease

- DeFi

- Dex

- DID

- different

- distribute

- distributed

- distribution

- double

- DOWNTURN

- downward

- dump

- during

- Earlier

- Early

- effect

- Environment

- Ethereum's

- Even

- Event

- events

- example

- exchange

- FAIL

- finance

- First

- flat

- follow

- followed

- following

- from

- FTX

- funding

- funding rounds

- Gain

- Gains

- gearing

- GMT

- Growing

- Growth

- Half

- happens

- High

- high-profile

- Highs

- Hit

- holders

- How

- However

- HTTPS

- huge

- in

- Increase

- increased

- increasing

- initiatives

- internal

- Investors

- IT

- January

- July

- large

- larger

- Late

- launched

- LDO

- ldo token

- ldo tokens

- leading

- Life

- Liquidity

- little

- long-term

- looked

- made

- major

- Majority

- map

- marked

- Market

- Matic

- max-width

- Merge

- Metaverse

- metaverse platforms

- million

- model

- Month

- months

- more

- most

- Move-to-earn

- movements

- native

- network

- New

- notable

- November

- November 2021

- number

- Oct

- october

- ONE

- outside

- part

- participated

- Pattern

- pioneer

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- player

- Polygon

- Polygon’s

- popularity

- PoS

- PoS Network

- positive

- power

- pressure

- price

- PRICE ACTION

- Price Increase

- price up

- private

- Program

- project

- projects

- protocols

- public

- pushed

- Puts

- quantity

- quickly

- ramping

- ranging

- reached

- record

- relatively

- report

- reserves

- Reward

- rounds

- sale

- same

- SAND

- sandbox

- scheduled

- seed

- Selling

- September

- short-term

- show

- significant

- significantly

- SIX

- slow

- So

- some

- Source

- Space

- stabilize

- stable

- steady

- STEPN

- success

- such

- summer

- supporters

- Surged

- Sway

- team

- teams

- The

- The Merge

- their

- thousands

- throughout

- time

- timing

- to

- token

- TOKEN SALE

- Tokens

- Total

- toward

- transaction

- transition

- transparent

- Trend

- Turned

- understand

- unFaZed

- unfortunate

- unlock

- unlocks

- users

- usually

- validators

- Valuable

- value

- various

- Volatility

- volume

- week

- weekly

- which

- WHO

- will

- year

- zephyrnet