Summary: Our thesis is that long-term holding of the Solana token (SOL) is like investing in the Solana ecosystem. To find out whether the ecosystem is healthy, we identified the top projects building on Solana, which you can compare against other L1 chains like Ethereum.

Created in 2017, Solana is a Layer 1 blockchain platform (read: Ethereum rival) that hosts decentralized and scalable applications. Currently, over 350 projects are built on the Solana blockchain, with about 1,000 active developers.

Solana offers lower transaction fees than other popular blockchains like bitcoin and Ethereum. Theoretically, the blockchain can process over 50,000 transactions per second, and it claims to be the “fastest blockchain in the world.”

As long-term crypto investors, our view is that the quality of a blockchain is defined by the quality of the apps built upon it. The technology does not matter as much as the ecosystem of developers, users, and killer apps.

For investors thinking of buying and holding Solana’s native token SOL over the long term, we’ve listed the top Solana projects, so you can judge the quality for yourself.

| Market Cap | 24-Hour Trading Volume | Total Value Locked (TVL) | Daily Active Users | |

| Marinade Finance (MNDE) | $6.7M | $20.5k | $248.4M | N/A |

| Serum (SRM) | $283.9M | $28.2M | $225.7M | 10,207 |

| Solend (SLND) | $13.7M | $110k | $246.3M | N/A |

| Raydium (RAY) | $103.5M | $9.4M | $235M | 1,050 |

| Tulip Protocol (TULIP) | $2.6M | $91.5k | $157.8M | N/A |

| Mango Markets (MNGO) | $44.3M | $163.7k | $128.2M | 584 |

| Orca (ORCA) | $16.7M | $318.7k | $100.9 | 1,461 |

| Saber Swap (SBR) | $3.2M | $116.4k | $87.6M | 1,369 |

| Aldrin (RIN) | $1.5M | $14.7k | $73.9M | 642 |

Marinade Finance (MNDE)

Marinade Finance (MNDE)

Market Cap: $6.7M

24-Hour Trading Value: $20.5k

Total Value Locked (TVL): $248.4M

Daily Active Users: N/A

Marinade Finance is a non-custodial liquid staking protocol operating on the Solana blockchain. The platform allows users to stake their SOL tokens through predetermined staking strategies. In return for staking, participants get “marinated staked SOL tokens” (mSOL). These tokens can be used to maximize yield using Marinade’s decentralized finance (DeFi) features. They can also be used in Solana’s broader ecosystem.

Alternatively, participants can swap their staked SOL back for regular SOL at any time they wish, once they unstake it. Marinade Finance also offers zero lockup periods, and participants can gain access to their assets at any time. The platform also offers an extensive network of validators to maintain decentralization and security.

Serum (SRM)

Serum (SRM)

Market Cap: $283.9M

24-Hour Trading Value: $28.2M

Total Value Locked (TVL): $225.7M

Daily Active Users: 10,207

Serum is a decentralized exchange (DEX) built on Solana. Using Solana, Serum can take advantage of the cost-effectiveness and speed of transactions settled on its blockchain.

Serum comes with a decentralized order book run by smart contracts that aim to mimic traditional exchanges by matching sellers and buyers. This gives participants flexibility with order sizes and pricing when they submit orders to Serum, allowing them complete control over their trading.

Serum aims to compete with DEXes built using an automated market maker, such as SushiSwap, Uniswap, or Bancor.

Serum also offers cross-chain support, meaning users can trade tokens built on other platforms like Ethereum or Polkadot. Existing DeFi projects can also access Serum’s liquidity and features, regardless of what blockchain they’re building on.

Serum’s utility token, SRM, allows holders to receive up to a 50% discount on their trade fees, and stakers can vote and participate in the platform’s governance mechanism.

Solend (SLND)

Solend (SLND)

Market Cap: $13.7M

24-Hour Trading Value: $110.0k

Total Value Locked (TVL): $246.3M

Daily Active Users: N/A

Solend is a borrowing and lending platform on the Solana network. It describes itself as an “autonomous interest rate machine.” Through low fees and fast transactions, participants can earn interest and borrow up to 16 assets on over 40 pools.

Solend offers an easy-to-use and user-friendly dashboard. When depositing assets on Solend, participants receive a portion of the interest automatically calculated by the algorithm.

Solend plans to gradually transition its governance to a decentralized autonomous organization (DAO), allowing the community to participate in project governance.

Raydium (RAY)

Raydium (RAY)

Market Cap: $103.5M

24-Hour Trading Value: $9.4M

Total Value Locked (TVL): $235M

Daily Active Users: 1,050

Raydium is an automated market maker (AMM) built on the Solana blockchain that shares liquidity with Serum’s decentralized exchange. As an AMM, it enables cryptocurrencies and other digital assets to be traded in a permissionless way through liquidity pools.

By combining the flexibility of an AMM with Serum’s reliability, Raydium supports the fast, liquid and low-fee trading of digital assets on Solana with an additional source of liquidity.

Users who offer liquidity to Raydium are incentivized with rewards in the form of RAY, the utility token of the Raydium ecosystem. In turn, participants can stake RAY to earn additional crypto rewards.

Tulip Protocol (TULIP)

Tulip Protocol (TULIP)

Market Cap: $2.6M

24-Hour Trading Value: $91.5k

Total Value Locked (TVL): $157.8M

Daily Active Users: N/A

Tulip Protocol was the first yield aggregation platform built on the Solana blockchain. It offers three major yield products: Lending, Vault, and Leveraged Farming. Its vault strategies compound consistently, thanks to Solana’s low-cost and fast-performing network. Because of this, it can offer its users significant benefits, such as a larger APY and low gas fees.

The name “Tulip” is a nod to Holland’s infamous tulip mania. This market bubble popped during the 1600s when speculation over tulip bulbs drove prices to astounding heights. Invest in tulips, or in TULIP, at your own risk.

Mango Markets (MNGO)

Mango Markets (MNGO)

Market Cap: $44.3M

24-Hour Trading Value: $163.7k

Total Value Locked (TVL): $128.2M

Daily Active Users: 584

Mango Markets is a decentralized exchange on the Solana blockchain that offers traders as much as 20x leverage on trading pairs. Transactions are cheap, fast, and permissionless, and Mango Markets offers a host of features that make it unique.

Like other decentralized exchanges on Solana, Mango Markets offers an on-chain order book (in the same style as a centralized exchange) without suffering from order latency and the high costs that plagued previous decentralized exchanges before the automated market maker model was brought in. The on-chain DEX model is possible because of Solana’s extremely cheap and fast transactions.

Mango Markets offers a small but well-curated selection of spot trading pairs. This includes assets in the Solana ecosystem, such as COPE, RAY, SOL, SRM, and MNGO, as well as wrapped versions of BNB, BTC, ETH, FTT, and LUNA. You can also trade futures for most of these pairs, including ADA.

Orca

Orca

Market Cap: $16.7M

24-Hour Trading Value: $318.7k

Total Value Locked (TVL): $100.9

Daily Active Users: 1,461

Orca is a decentralized exchange on Solana. Orca aims for low-fee, nearly-instantaneous token swaps through an automated market maker (AMM) model. On the DEX, participants supply tokens to liquidity pools, and algorithms set market prices based on supply and demand. In addition, participants can use ORCA tokens to vote on the protocol’s future.

Orca also plans to offer a yield farming program known as an Aqua Farm. A set of liquidity pools will soon become Aqua Farms. Presently, liquidity providers in Orca pools can earn trading fees. In contrast, liquidity providers in Aqua Farms will be able to earn both ORCA tokens and trading fees. Orca also plans to add a function that will allow other projects to add their tokens as rewards in the future.

Saber (SBR)

Saber (SBR)

Market Cap: $3.2M

24-Hour Trading Value: $116.4k

Total Value Locked (TVL): $87.6M

Daily Active Users: 1,369

Saber is a decentralized exchange on Solana that focuses on stablecoin swapping and staking. Currently, there are swapping opportunities for around 30 cryptocurrencies.

Users can also stake their funds in liquidity pools. The Saber exchange currently offers around 25 liquidity pools, each representing a swap pair, for example, USDT-USDC. Liquidity providers can earn yield based on each swap transaction on the platform that involves the pair. Saber offers fast transaction times, low transaction fees, and low slippage rates.

Aldrin (RIN)

Aldrin (RIN)

Market Cap: $1.5M

24-Hour Trading Value: $14.7k

Total Value Locked (TVL): $73.9M

Daily Active Users: 642

Aldrin is a decentralized cryptocurrency exchange built on the Solana network that aims to simplify the crypto trading process for rookie and advanced traders alike.

Participants can already trade over 160 token pairs on the exchange. Aldrin offers a comprehensive and informative trading dashboard, with the option for participants to review important token data before conducting a trade. Aldrin makes it simple for traders to find a token’s website, its trade analytics, and other crucial data.

Investor Takeaway

As you can see, many exciting projects are being built on the Solana blockchain. It’s no surprise that the leading projects are all DeFi related, because “that’s where the money is.”

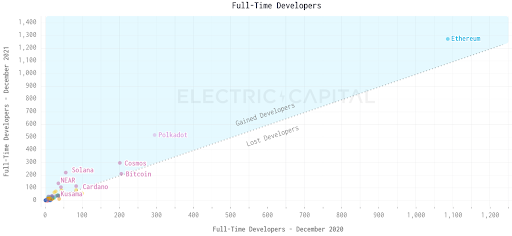

The question is whether Solana can keep building its developer community, because developers build apps, and apps build users. While Solana is adding net new developers (bottom left), it has a long way to go to catch up with Ethereum (top right).

Many assume that the best technology will win out, but history shows that’s not the case. The fastest blockchain is only useful if it has a rich variety of killer apps built on top of it. Solana is growing quickly – but at this rate, not quickly enough to overtake Ethereum.

Our thesis is that technology platforms consolidate into two big winners (iPhone vs. Android, Mac vs. PC) or one big monopoly (Google). This is how we believe the L1 market will eventually mature.

An investment in SOL, then, is either a bet on a multi-chain future (and one in which Solana is one of the L1 chains that survives), OR a bet that Solana will overtake Ethereum as one of the last chains standing. While Solana has impressive technology, neither bet is one we would take.

Subscribe to our daily newsletter to get the latest investor insight on SOL, plus other top L1 tokens.

- Altcoin Investing

- Bitcoin

- Bitcoin Market Journal

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet