Sun has received airdrop allocations from crypto projects such as EigenLayer and EtherFi, and is also earning points from his deposits into Swell and Puffer Finance.

Wallets identified as belonging to Sun recently claimed more than 3.6 million EIGEN tokens worth about $28 million.

(Wikimedia Commons)

Posted May 14, 2024 at 6:14 pm EST.

Justin Sun, the controversial founder of the Tron blockchain network, has been very active as an airdrop farmer recently.

On May 11, four wallets (0x79a, 0xdc3, 0x176, and 0x7a9) based on blockchain data and identified by onchain analytics firm Nansen as belonging to Sun had collectively claimed more than 3.6 million EIGEN tokens worth about $28 million, one day after EigenLayer activated its airdrop claims.

Sun accumulating EIGEN tokens in his addresses comes roughly two months after one of the wallets claimed about 25,000 ETHFI, the governance token for liquid restaking protocol Ether.Fi, worth about $83,000.

In total, Sun’s wallet is eligible to claim 3.45 million ETHFI tokens worth roughly $11.43 million at current market prices. However, Sun can’t claim the entirety of his ETHFI airdrop allocation because he must follow EtherFi’s vesting schedule, which ensures “fairness, long term growth, and stability,” according to EtherFi’s claims page. Sun’s ETHFI airdrop allocation resulted from the Tron founder depositing 120,000 into the liquid restaking protocol on March 13.

The recent airdrop allocations to Sun’s wallets are a continuation of what he was doing last year when another address of Sun’s had claimed 5,250 ARB in March 2023, worth nearly $7,000 at the time, data from DeFi portfolio firm DeBank shows.

Read More: 8 Reasons Why LayerZero’s Upcoming Airdrop Could Be the Most Complex Ever

Earning Points, Too

Sun’s focus didn’t stop at EigenLayer, EtherFi, and Arbitrum; his associated wallets were also contributing to other protocols that have yet to conduct their token genesis event. For example, Sun has deposited large amounts of crypto assets into liquid restaking protocols Swell and Puffer Finance, both of which have yet to release their tokens.

According to DefiLlama and Etherscan, Sun deposited about $345.5 million of his crypto assets into Swell’s simple staking smart contract on May 5, which helped Swell’s total value locked increase 29% from about 450,700 ETH worth about $1.4 billion on May 4, to roughly 580,470 ETH worth more than $1.8 billion the next day.

Swell protocol team members are currently using a points program to give people the opportunity to earn what they call “pearls,” which are redeemable for SWELL at its token genesis event. The Swell team also announced plans for the layer 2 network which has not rolled out on mainnet. But to attract liquidity, Swell lets crypto traders transfer assets into Swell’s L2. Those who deposit into Swell’s L2 are eligible for airdrops from both Swell and projects building on Swell’s rollup, according to the protocol’s documentation.

Meanwhile, on Feb. 8, Sun locked 58,000 stETH, worth approximately $167.4 million, into Puffer Finance, which has $1.3 billion in total value locked, according to blockchain explorer Etherscan and DefiLlama. This means that Sun, from a single wallet address, is responsible for about 12% of Puffer Finance’s TVL.

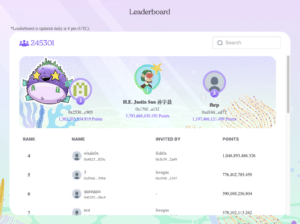

Puffer Finance, which is currently constructing its governance mechanism, has implemented a points program and as of presstime, Sun has the most points of anyone.

Read More: Top 10 Crypto Projects With Points Programs That Haven’t Held Airdrops Yet

Andrew Van Aken, a data scientist at blockchain analytics firm Artemis, had doubts about whether Sun has been seriously farming airdrops, however. “Even if rewards were given on how ‘much’ you stake, [it] would be impossible for him to sell given liquidity,” Van Aken wrote to Unchained through Telegram. “I think [Sun is] looking for additional yield and is up to date on crypto, so he finds these opportunities.”

In March 2023, the Securities and Exchange Commission charged Sun and three of his companies for not only offering and airdropping unregistered crypto asset securities Tronix (TRX) and BitTorrent (BTT) but also for “fraudulently manipulating the secondary market for TRX through extensive wash trading.”

At the time of publication, Justin Sun’s onchain portfolio exceeded $1 billion, per Arkham Intelligence.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/trons-justin-sun-has-become-quite-the-airdrop-farmer-of-late/

- :has

- :is

- :not

- $1 billion

- $UP

- 000

- 10

- 11

- 120

- 13

- 14

- 2023

- 2024

- 25

- 250

- 31

- 33

- 43

- 58

- 700

- 8

- a

- About

- According

- active

- Additional

- additional yield

- address

- addresses

- After

- airdrop

- Airdrops

- allocation

- allocations

- also

- amounts

- an

- analytics

- and

- announced

- Another

- anyone

- approximately

- arbitrum

- ARE

- Artemis

- AS

- asset

- Assets

- associated

- At

- attract

- based

- BE

- because

- become

- been

- belonging

- Billion

- BitTorrent

- blockchain

- BLOCKCHAIN ANALYTICS

- blockchain data

- Blockchain network

- Blue

- both

- BTT

- Building

- but

- by

- call

- claim

- claimed

- claims

- collectively

- comes

- commission

- Commons

- Companies

- complex

- Conduct

- constructing

- continuation

- contract

- contributing

- controversial

- could

- crypto

- crypto asset

- crypto projects

- crypto traders

- crypto-assets

- Current

- Currently

- data

- data scientist

- Date

- day

- DeFi

- deposit

- deposited

- deposits

- doing

- doubts

- earn

- Earning

- eligible

- ensures

- entirety

- ETH

- eth worth

- Ether

- etherscan

- Event

- example

- exceeded

- exchange

- explorer

- extensive

- farming

- Feb

- finance

- finds

- Firm

- First

- Focus

- follow

- For

- founder

- four

- from

- Genesis

- Give

- given

- governance

- Governance Token

- Growth

- had

- Have

- he

- Held

- helped

- High

- him

- his

- How

- However

- HTTPS

- identified

- if

- implemented

- impossible

- in

- Increase

- Intelligence

- into

- IT

- ITS

- jpeg

- Justin

- Justin Sun

- l2

- large

- Last

- Last Year

- Late

- layer

- Layer 2

- Lets

- Liquid

- Liquidity

- locked

- Long

- looking

- mainnet

- manipulating

- March

- March 13

- Market

- Market Prices

- max-width

- May..

- means

- mechanism

- Members

- million

- months

- more

- most

- must

- Nansen

- nearly

- network

- next

- of

- offering

- on

- Onchain

- ONE

- only

- opportunities

- Opportunity

- Other

- Other Protocols

- out

- page

- People

- per

- Place

- plans

- plato

- Plato Data Intelligence

- PlatoData

- pm

- points

- portfolio

- posted

- Prices

- Program

- Programs

- projects

- projects building

- protocol

- protocols

- Publication

- quite

- reasons

- received

- recent

- recently

- redeemable

- release

- responsible

- Rewards

- Rolled

- rollup

- roughly

- s

- schedule

- Scientist

- SEC

- secondary

- Secondary Market

- Securities

- Securities and Exchange Commission

- sell

- seriously

- Simple

- single

- smart

- smart contract

- So

- Stability

- stake

- Staking

- stETH

- Stop

- such

- Suit

- Sun

- swell

- team

- Team members

- Telegram

- term

- than

- that

- The

- their

- These

- they

- think

- this

- those

- three

- Through

- time

- to

- token

- Tokens

- Total

- total value locked

- Traders

- Trading

- transfer

- TRON

- Tron Blockchain

- TRX

- TVL

- two

- Unchained

- unregistered

- upcoming

- using

- value

- van

- very

- Vesting

- Wallet

- Wallets

- was

- wash trading

- were

- What

- when

- whether

- which

- WHO

- why

- with

- worth

- would

- wrote

- year

- yet

- Yield

- You

- zephyrnet