Uniswap and SushiSwap registered gains. Buyers, nonetheless, must be confirmed once UNI/USDT and SUSHI/USDT close above $23 and $10, respectively.

Uniswap (UNI)

The swapping protocol Uniswap is the most valuable project in DeFi using UNI for governance.

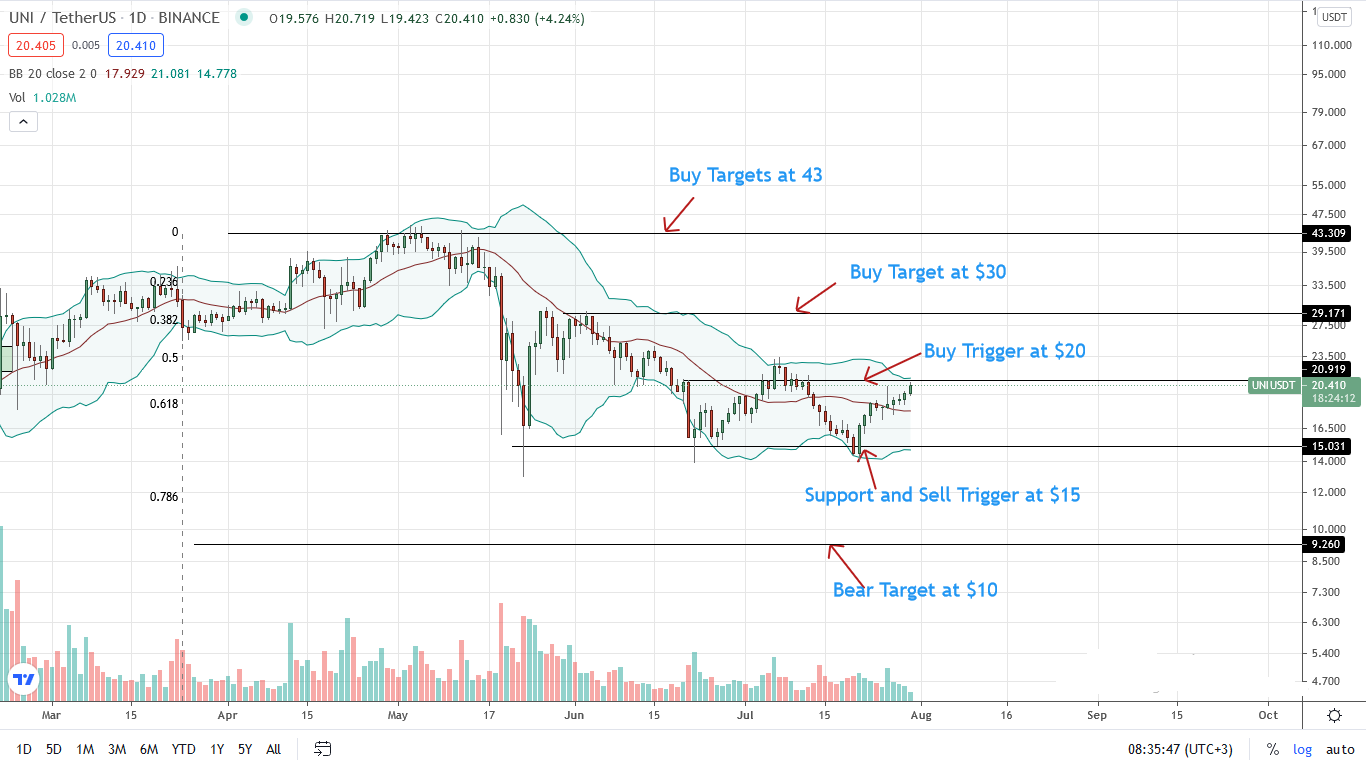

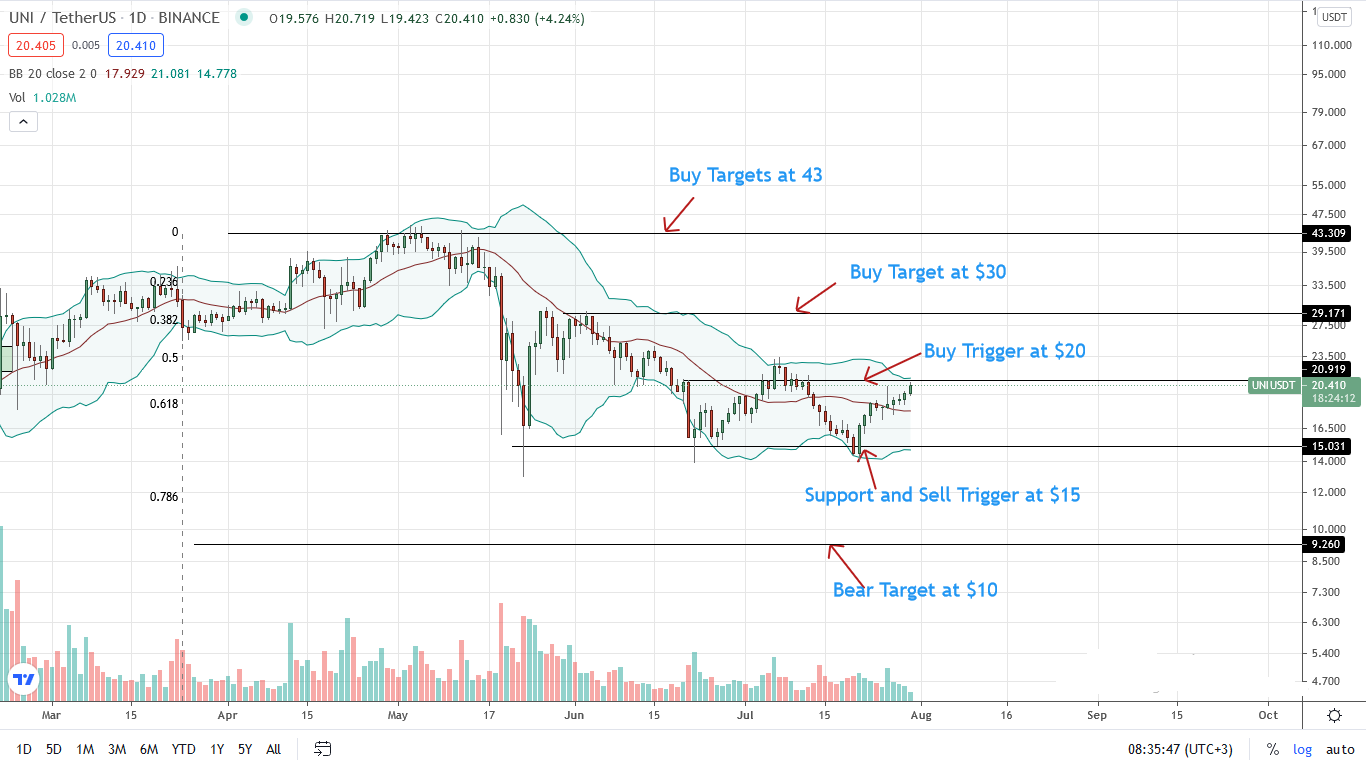

Past Performance of UNI

There are flickers of hope as per the token’s price action in the daily chart.

All the same, a mark of trend reversal demands a high-volume, comprehensive close above $20. This ought to be with high trading volumes and a wide-ranging bar mirroring that of June 20.

At the time of writing, UNI is stable, adding eight percent versus the USD.

However, it is trending below the psychological resistance level, calling to question the strength of buyers and how far the underlying momentum could thrust determined bulls.

Day-Ahead and What to Expect

Undoubtedly, UNI buyers are in control even though capped below $20.

The short-to-medium trend depends on whether buyers will overcome strong liquidation between $20 and $23—blasting above June 2021 highs.

UNI/USDT Technical Analysis

The path of the least resistance is, at present, northwards.

Accordingly, confident UNI buyers may search for entries in lower time frames in anticipation of a strong close above $20 and June 2021 highs. In that case, UNI/USDT may glide towards $30.

Meanwhile, a contraction below $17 may see UNI prices rejected back towards July 2021 lows of around $15.

SushiSwap (SUSHI)

As of July 30, the SushiSwap protocol manages over $3.1 billion of diverse assets using the SUSHI token for governance.

Past Performance of SUSHI

Despite market-wide confidence and expectation, SUSHI is flat-lining as buyers struggle to sustain the upswing.

Diverging from most DeFi tokens, SUSHI prices are printing lower lows relative to the upper BB.

The token is up three percent on the last trading day.

Day-Ahead and What to Expect

Technically, SUSHI/USDT prices stand a chance to change course after a value-draining bear run.

There were glimpses of strength that could fade if SUSHI bulls don’t flow back to ignite demand in the short term.

Presently, resistance stands at $10—an imposing door and a gateway to $23.

SUSHI/USDT Technical Analysis

Even with recent gains, token holders are apprehensive—unwilling to stake confidently. The result is way price action lacking definite direction.

This week’s higher highs must be confirmed only with a close above $10. It would likely trigger demand, lifting SUSHI/USDT back towards $23 as buyers flourish.

Rejection of higher prices would otherwise see bears stream back, clipping buyers and pouring cold water on the uptrend. In this case, SUSHI could sink back to $5.

- "

- &

- Action

- active

- analysis

- around

- Assets

- Bears

- Billion

- border

- Bulls

- change

- confidence

- day

- DeFi

- Demand

- Figure

- flow

- governance

- High

- How

- HTTPS

- Ignite

- IT

- July

- Level

- Liquidation

- mark

- mirroring

- Momentum

- performance

- Posts

- present

- price

- project

- Run

- Search

- Short

- stake

- tax

- Technical

- Technical Analysis

- time

- token

- Tokens

- trade

- Trading

- trending

- Uniswap

- USD

- Versus

- volume

- Water

- writing