RALEIGH – Now with another month of better-than-expected jobs numbers coming in on Friday, the Federal Reserve is almost certain to raise interest rates, economist Dr. Michael Walden told WRAL TechWire on Friday. And that could have continued impact on housing and labor markets, including in the Triangle.

The probability of a big rate hike coming at the November meeting of the Federal Reserve saw a big move on Friday following the release of the employment situation data by the U.S. Bureau of Labor Statistics. According to the CME FedWatch Tool, the probability of another three-quarters of one percent interest rate hike jumped almost 10% between Thursday and Friday following the release of the jobs report. As of Friday at 2 PM ET, the tool put an 84.3% probability of that 75-basis point rate hike coming in November.

“Inflation still has to be tamed,” said Jon DeHart, branch leader at Movement Mortgage, who told WRAL TechWire on Friday that he would bet the Federal Reserve moves to raise interest rates by 75 basis points, or three-quarters of one percent, at the November meeting.

Jobs news means ‘more rate hikes from the Fed,’ says NCSU economist

A slowdown

That could further slow the housing market, because as mortgage interest rates rise, the cost of borrowing increases, and the monthly cost and total cost of borrowing money to pursue homeownership increases as well.

“Volume is lower,” said DeHart. How low?

Image: Wake County Register of Deeds.

In Wake County, lending activity decreased by 14% in September compared to August, according to the latest data from the Wake County Register of Deeds, which released its monthly data report on Friday morning.

And compared to September 2021, lending activity decreased by 48% in September 2022.

One reason is that mortgage refinance activity, which also includes home equity lines of credit and home loans, has plunged.

Climbing mortgage rates scaring buyers; Triangle prices are falling

Crash coming?

Nationally, mortgage loan applications dropped by 14.2% in the first week of October, as well, according to a report from the Mortgage Bankers Association.

And Friday’s jobs report might mean housing markets may slow even further.

“In terms of the housing markets, we still see supply constraints on housing, but higher interest rates are raising the cost of buying a home, so we’re seeing downward pressure on construction,” explained Dr. Gerald Cohen, speaking during a virtual event on Friday. “So housing is still in demand from a demographic standpoint, but higher interest rates may soften that demand.”

In the Triangle, however, while there are signs that some buyers and sellers are feeling spooked by a rapidly changing mortgage market, demand for housing persists.

Jobs report is ‘strong’ but ‘very few cracks in economy,’ UNC professor says

Good news?

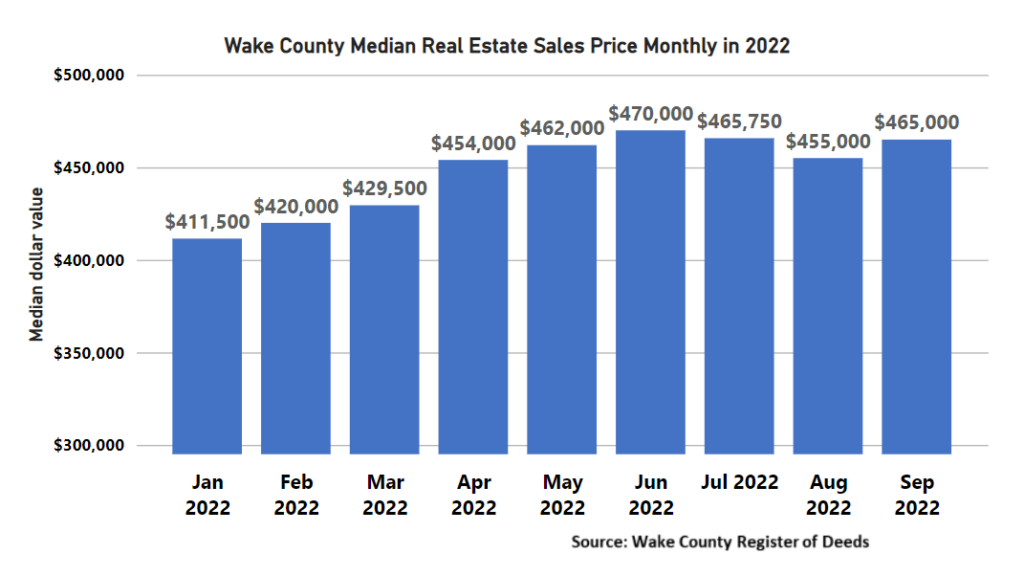

Despite a 14% decrease in the total number of real estate transactions in Wake County, the report from the Wake County Register of Deeds found that the median sale price jumped back up to $465,000 in September 2022.

The median sale price across all real estate transactions reached an all-time high in June 2022, at $470,000, then fell to $465,750 in July 2022, and fell again in August 2022 to $455,000.

Such changes in the median sale price of real estate in the county come from the core market, the report notes, with 94% of all transactions in September as those in the core market, which the report notes consists of properties that sold at a value of $1 million or less.

Image: Wake County Register of Deeds.