In a recent

study by Charles Schwab UK, a striking generational divide has emerged among UK retail investors, revealing that Gen Z and Millennial investors are adopting more active and open investment strategies than their older counterparts.

This new

generation of investors, dubbed „Gen T” for their trader-like behaviors, is

reshaping the investment landscape.

The

research highlights that younger investors are making significantly more

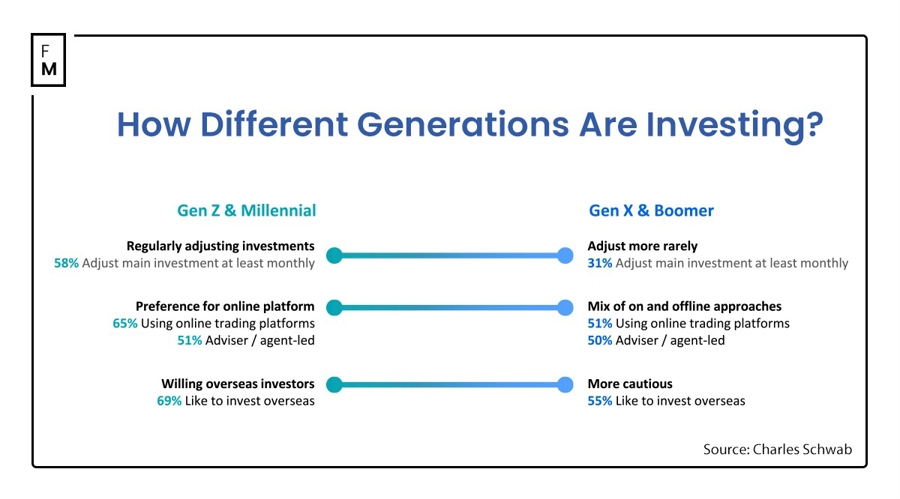

regular changes to their investment portfolios. A staggering 58% of Gen Z and

Millennials make trades and adjustments every month, nearly double the

rate of Gen X and Boomers at 38%. Furthermore, 8% of younger investors make

daily changes, compared to just 4% of older investors.

Copy

trading, a style of investing that allows individuals to mirror positions taken by other investors automatically, is also gaining popularity among younger

generations. 77% of Gen Z and Millennial investors already use or consider copy trading, while only 49% of Gen X and Boomers show interest in

this approach.

“We

are seeing a clear divide emerge between more seasoned retail investors and

those that have more recently entered the field,” commented Richard Flynn, the UK

Managing Director at Charles Schwab, “It will be

interesting to see whether the rise of Gen T yields stronger investment

performances, and whether this is the beginning of a surge in interest in

trading in the UK.”

However, last year’s TopBrokers study suggested that Millennials and Gen Z might be one of the weakest investment generations in recent decades. Although they have a greater appetite for risk, they have not yet proven to be competitive with the Baby Boomer generation.

Influencers not so influential

The study also revealed a very interesting trend that contradicts current beliefs about the young generation of investors.

Since late 2021, the impact of social media influencers focused on finance has diminished by 13% among Gen Z (declining from 50% to 37%) and by 10% among Millennials (dropping from 52% to 42%). Concurrently, celebrities who share their investment strategies have seen their influence wane by 19% among Millennials (from 51% to 32%) and by 10% among Gen Z (from 45% to 35%) during the same period.

A year ago, a separate study by the Cypriot market watchdog revealed that more than 30% of retail traders rely on financial influencers’ tips and ideas.

Embracing Global Opportunities and Diverse

Asset Classes

Younger

investors demonstrate a greater appetite for overseas investments and a

wider range of asset classes. 69% of Gen Z and Millennials believe there are

good investment opportunities in overseas markets, compared to 55% of Gen X and

Boomers. This trend extends to US investments, with 71% of younger investors

finding them appealing, versus 62% of older investors.

Gen Z and

Millennials are also more open to investing in less familiar asset classes. 64%

view futures as a good investment option, with 26% already investing in them.

In contrast, only 10% of Gen X and Boomers currently invest in futures, and

fewer than half consider them viable investments. Similarly, 65% of younger

generations are willing to consider Fractional Shares, compared to 42% of older

investors.

“The

younger ‘Generation Trader’ cohort welcomes a wider range of investment

opportunities, be it in overseas markets or in less familiar asset classes,

while investors at a later stage of life are more likely to stick with what

they know,” Flynn added.

Charles

Schwab conducted an internet-based survey to gauge the perspectives and

actions of UK investors amidst prevailing market conditions. All 18-year-old participants held investments in at least one asset class or financial

instrument. This study, which concluded in February 2024, gathered insights from

1,000 UK participants.

In a recent

study by Charles Schwab UK, a striking generational divide has emerged among UK retail investors, revealing that Gen Z and Millennial investors are adopting more active and open investment strategies than their older counterparts.

This new

generation of investors, dubbed „Gen T” for their trader-like behaviors, is

reshaping the investment landscape.

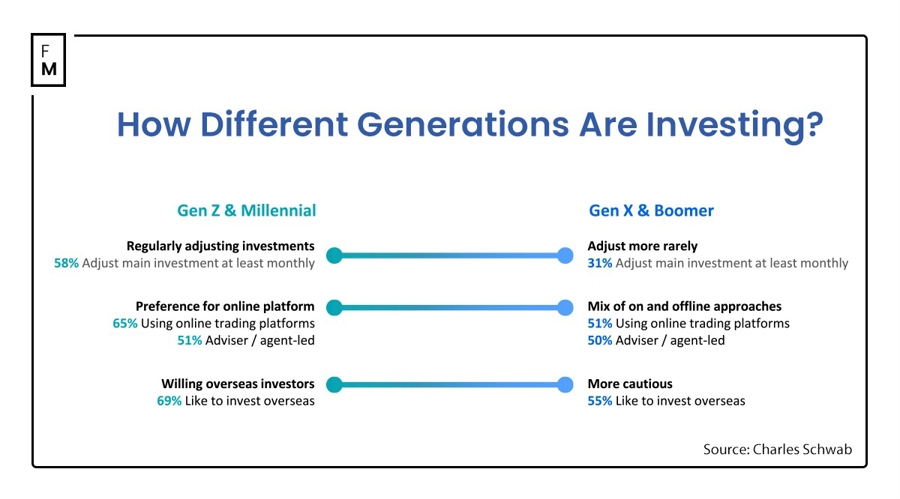

The

research highlights that younger investors are making significantly more

regular changes to their investment portfolios. A staggering 58% of Gen Z and

Millennials make trades and adjustments every month, nearly double the

rate of Gen X and Boomers at 38%. Furthermore, 8% of younger investors make

daily changes, compared to just 4% of older investors.

Copy

trading, a style of investing that allows individuals to mirror positions taken by other investors automatically, is also gaining popularity among younger

generations. 77% of Gen Z and Millennial investors already use or consider copy trading, while only 49% of Gen X and Boomers show interest in

this approach.

“We

are seeing a clear divide emerge between more seasoned retail investors and

those that have more recently entered the field,” commented Richard Flynn, the UK

Managing Director at Charles Schwab, “It will be

interesting to see whether the rise of Gen T yields stronger investment

performances, and whether this is the beginning of a surge in interest in

trading in the UK.”

However, last year’s TopBrokers study suggested that Millennials and Gen Z might be one of the weakest investment generations in recent decades. Although they have a greater appetite for risk, they have not yet proven to be competitive with the Baby Boomer generation.

Influencers not so influential

The study also revealed a very interesting trend that contradicts current beliefs about the young generation of investors.

Since late 2021, the impact of social media influencers focused on finance has diminished by 13% among Gen Z (declining from 50% to 37%) and by 10% among Millennials (dropping from 52% to 42%). Concurrently, celebrities who share their investment strategies have seen their influence wane by 19% among Millennials (from 51% to 32%) and by 10% among Gen Z (from 45% to 35%) during the same period.

A year ago, a separate study by the Cypriot market watchdog revealed that more than 30% of retail traders rely on financial influencers’ tips and ideas.

Embracing Global Opportunities and Diverse

Asset Classes

Younger

investors demonstrate a greater appetite for overseas investments and a

wider range of asset classes. 69% of Gen Z and Millennials believe there are

good investment opportunities in overseas markets, compared to 55% of Gen X and

Boomers. This trend extends to US investments, with 71% of younger investors

finding them appealing, versus 62% of older investors.

Gen Z and

Millennials are also more open to investing in less familiar asset classes. 64%

view futures as a good investment option, with 26% already investing in them.

In contrast, only 10% of Gen X and Boomers currently invest in futures, and

fewer than half consider them viable investments. Similarly, 65% of younger

generations are willing to consider Fractional Shares, compared to 42% of older

investors.

“The

younger ‘Generation Trader’ cohort welcomes a wider range of investment

opportunities, be it in overseas markets or in less familiar asset classes,

while investors at a later stage of life are more likely to stick with what

they know,” Flynn added.

Charles

Schwab conducted an internet-based survey to gauge the perspectives and

actions of UK investors amidst prevailing market conditions. All 18-year-old participants held investments in at least one asset class or financial

instrument. This study, which concluded in February 2024, gathered insights from

1,000 UK participants.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.financemagnates.com//forex/watch-out-boomers-the-gen-t-retail-traders-are-coming/

- :has

- :is

- :not

- 000

- 1

- 2021

- 2024

- 26%

- 35%

- a

- About

- actions

- active

- added

- adjustments

- Adopting

- ago

- Alibaba

- Alibaba Cloud

- All

- allows

- already

- also

- Although

- amidst

- among

- an

- and

- appealing

- appetite

- approach

- ARE

- AS

- asset

- asset class

- At

- automatically

- Baby

- BE

- Beginning

- behaviors

- beliefs

- believe

- between

- by

- capable

- celebrities

- Changes

- Charles

- charles schwab

- class

- classes

- clear

- click

- Cloud

- Cohort

- coming

- commented

- compared

- competitive

- concluded

- conditions

- conducted

- Connections

- Consider

- contrast

- copy

- copy trading

- counterparts

- cross-border

- Current

- Currently

- daily

- decades

- Declining

- dedicated

- demonstrate

- Director

- diverse

- divide

- double

- Dropping

- dubbed

- during

- emerge

- emerged

- entered

- Every

- extends

- familiar

- FAST

- February

- fewer

- field

- finance

- financial

- finding

- focused

- For

- forex

- fractional

- from

- Furthermore

- Futures

- gaining

- gathered

- gauge

- Gen

- Gen Z

- generation

- generational

- generations

- Global

- Globally

- good

- greater

- Half

- Have

- Held

- helps

- highlights

- HTTPS

- ideas

- Impact

- in

- individuals

- influence

- influencers

- insights

- instrument

- interest

- interesting

- Internet-based

- Invest

- investing

- investment

- investment opportunities

- Investments

- Investors

- IT

- jpg

- just

- Know

- landscape

- Last

- Last Year

- Late

- later

- least

- less

- Life

- likely

- make

- Making

- managing

- Managing Director

- Market

- market conditions

- Markets

- Media

- might

- Millennial

- Millennials

- mirror

- Month

- more

- nearly

- New

- of

- older

- on

- ONE

- only

- open

- operate

- opportunities

- Option

- or

- Other

- out

- overseas

- participants

- performances

- period

- perspectives

- plato

- Plato Data Intelligence

- PlatoData

- popularity

- portfolios

- positions

- proven

- range

- Rate

- recent

- recently

- regular

- rely

- research

- reshaping

- retail

- Retail Investors

- Revealed

- revealing

- Richard

- Rise

- Risk

- s

- same

- scenarios

- seasoned

- securely

- see

- seeing

- seen

- separate

- Share

- Shares

- show

- significantly

- Similarly

- So

- Social

- social media

- social media influencers

- Solutions

- stable

- Stage

- staggering

- strategies

- stronger

- Study

- style

- surge

- Survey

- taken

- than

- that

- The

- the UK

- their

- Them

- There.

- they

- this

- those

- tips

- to

- Traders

- trades

- Trading

- Trend

- Uk

- us

- use

- Versus

- very

- viable

- View

- Watch

- watchdog

- we

- Welcomes

- What

- whether

- which

- while

- WHO

- wider

- will

- willing

- with

- X

- year

- yet

- yields

- young

- Younger

- zephyrnet