Bitcoin, the world’s largest cryptocurrency by market capitalization, rose 11.7% from Jan. 5 to Jan. 12, trading at US$18,830, at 2 p.m. in Hong Kong. Ether gained 13.7% in the same timeframe, changing hands at US$1,428.

“It’s very difficult to determine what causes short-term price swings in the Bitcoin market,” Joe Burnett, head analyst at Blockware Solutions, wrote to Forkast.

“Traditional equity indexes rallying over the last week has certainly provided some tailwinds for BTC and ETH. Most weak hands have already left the BTC market, so I think a lack of sell-side liquidity becomes obvious as any potentially bullish catalyst exists.”

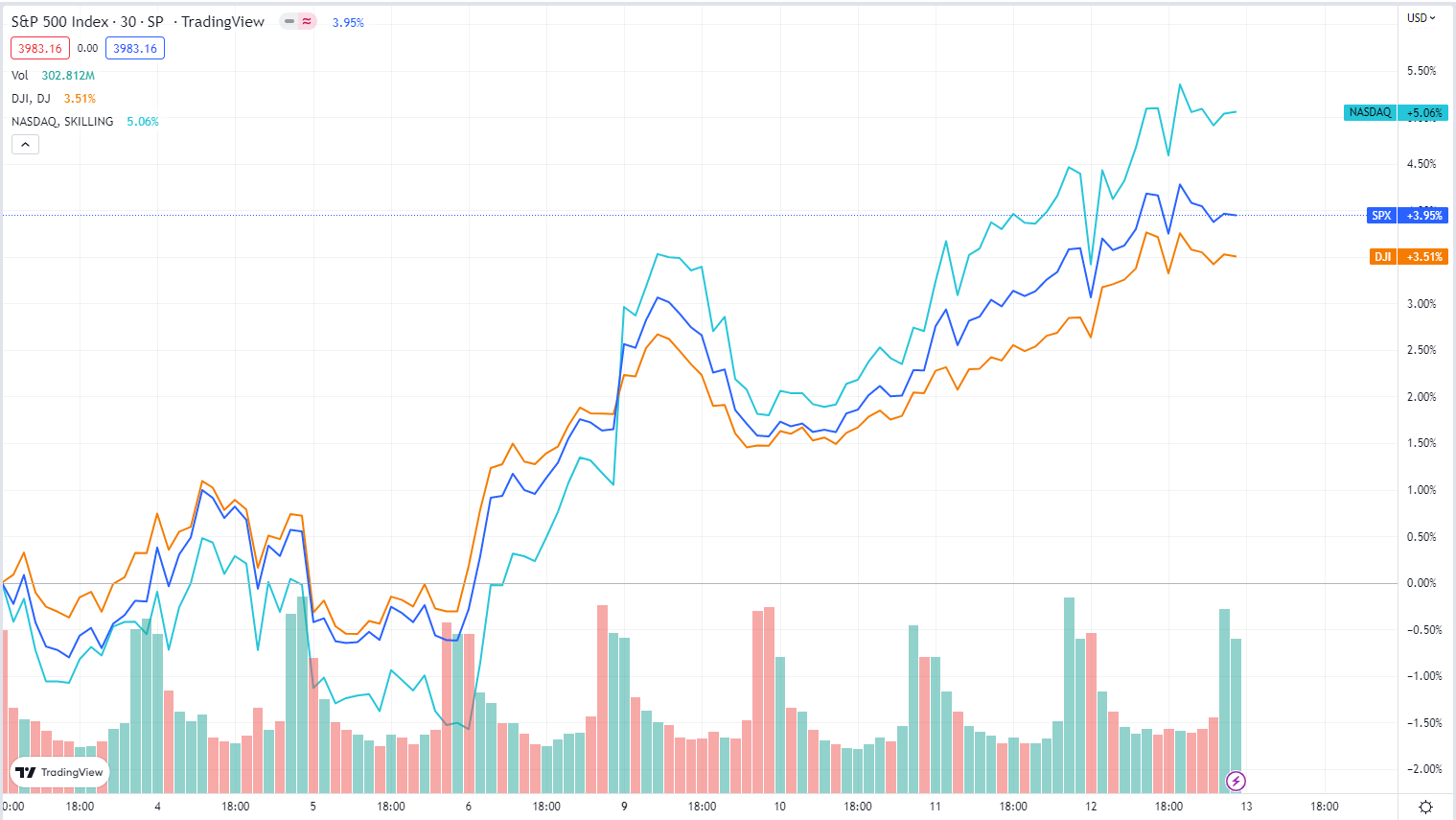

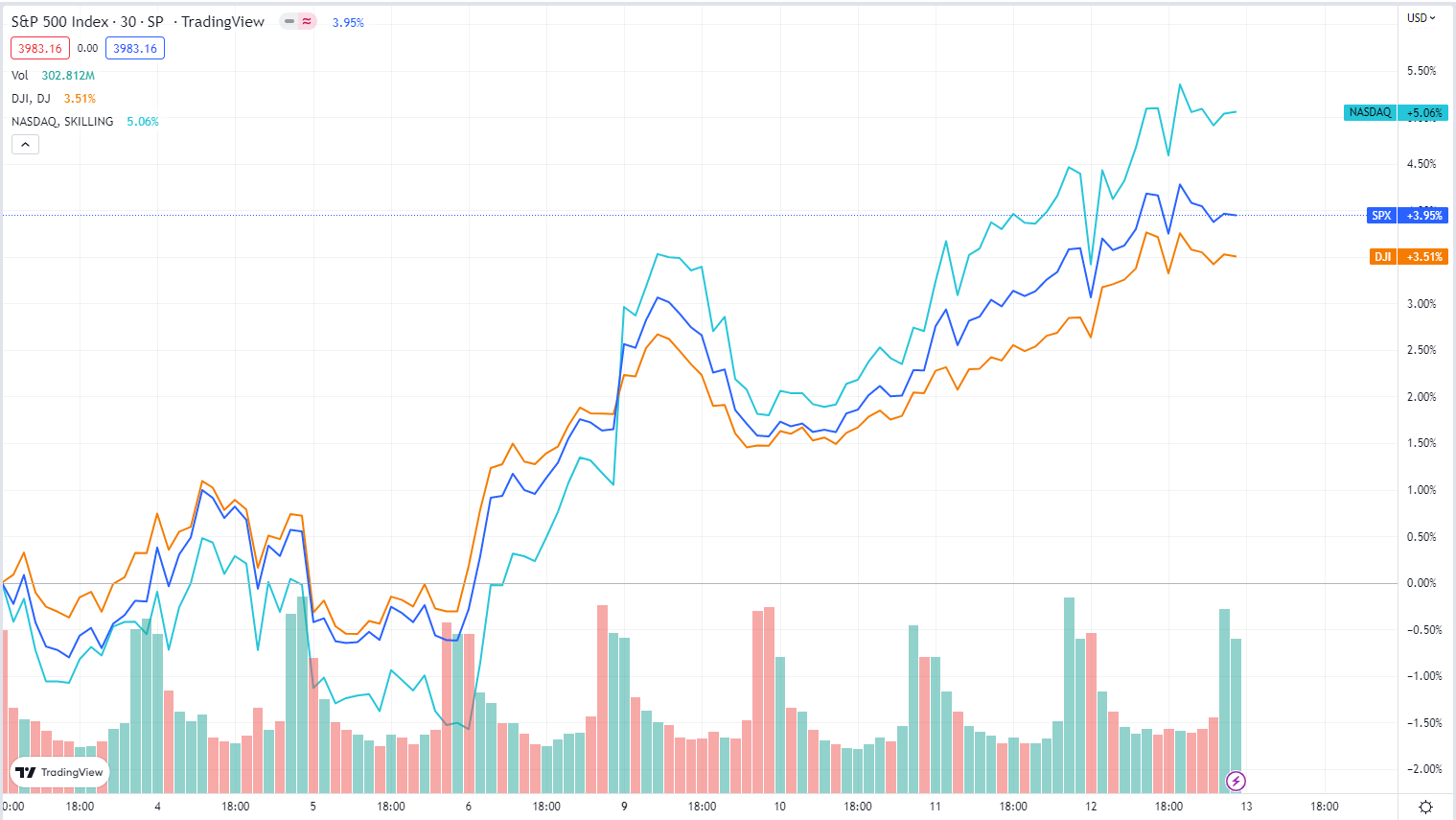

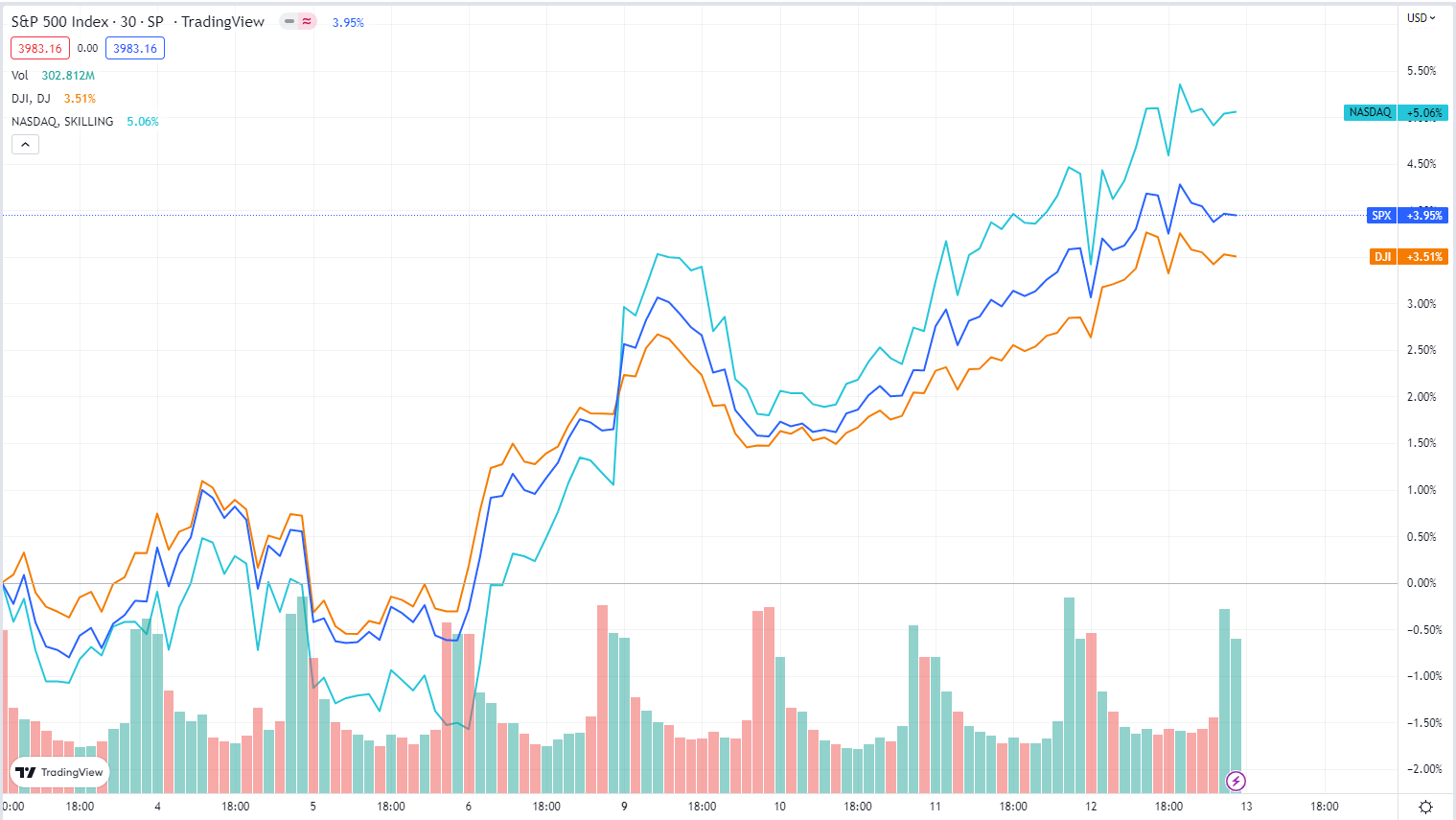

Dr. Karl-Michael Henneking, chief marketing officer at institutional DeFi yield protocol Spool, said Bitcoin and Ether are moving with the stock market and tech stocks.

“The chart shows similar patterns as the S&P 500 and Nasdaq 100. Crypto hasn’t decoupled from stock markets yet and won’t likely do so within the next couple of months. The FED is the crypto market maker at the moment,” wrote Henneking.

“It could be the bullish ETH emotion on the eve of the Shanghai upgrade, or it could be the better US CPI data for December 2022,” James Wo, founder and chief executive officer of blockchain investment firm Digital Finance Group (DFG), wrote to Forkast.

Cardano’s ADA was the biggest gainer among the top 10 non-stablecoin cryptocurrencies, rallying 23.6% in the past 7 days, to trade at US$0.33, according to CoinGecko data. Lido DAO (LDO) saw the biggest increase this week, having gained 48.2% to trade at US$2.30 after developers established the date for Ethereum’s Shanghai upgrade.

According to Ark Invest’s monthly Bitcoin report, 47% of all Bitcoin supply has not moved in 2 years, which is nearly an all-time high. Ark notes that we’ve only seen this metric twice at similar levels, in late 2022 and early 2017, with “both instances preceding impulsive bullish price action.”

“Bitcoin holders are some of the most persistent capital allocators. They are willing to hold BTC as the price takes a 75% hit. Bitcoin’s volatility is designed to shake out the weak hands,” wrote Burnett. “This is what enables BTC to go on massive parabolic bull runs. I expect high volatility and adoption cycles to continue.”

The elephant in the room: Digital Currency Group (DCG)

Investors are also focused on positioning for the potential fallout from Digital Currency Group (DCG). The crypto conglomerate is under investigation by U.S. prosecutors over questionable transfers between DCG and a subsidiary. On Thursday, the U.S. Securities and Exchange Commission (SEC) charged DCG-owned Genesis Global Capital and crypto exchange Gemini Trust with selling unregistered securities to retail investors.

The investigations were announced a week after DCG shut down its wealth management unit called HQ, shortly after Gemini co-founder Cameron Winklevoss claimed that DCG had borrowed US$1.675 billion from Gemini that it hadn’t repaid. While DCG’s Barry Silbert denied the allegations, investors are worried that DCG may become another casualty in the string of bankruptcies in the crypto industry over the past year.

“Since the company involved is reputable, it is likely to cause a new round of market panic,” wrote Wo, adding that it remained too early to determine if the market has priced in the DCG situation.

“Potential DCG collapse is not priced in, the same situation as with Celsius and FTX, where there were rumors before their defaults and only shortly before facts were revealed did the market start to react heavily,” wrote Henneking.

What’s in store for next week?

“If [the CPI] is negative it could be a catalyst for the Fed to potentially become more dovish moving forward,” wrote Burnett, adding that “a big move is likely [always] ahead for Bitcoin.”

As Bitcoin rallied above US$18,200, over 13% of the circulating supply and 60.5% of the total supply have returned to profit, according to on-chain analytics firm Glassnode.

“BTC is sandwiched between two major monthly levels of US$13,900-19,500,” wrote pseudonymous crypto analyst Rekt Capital, adding that Bitcoin returning above US$19,500 would signal bullish momentum.

See related article: Will crypto’s decentralized application layer boost mass adoption in 2023?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://forkast.news/weekly-market-wrap-bitcoin-rebounds-us18000-ether-gains-13/

- 000

- 1

- 10

- 100

- 11

- 2%

- 2017

- 2022

- 2023

- 7

- a

- above

- According

- Action

- ADA

- Adoption

- After

- ahead

- All

- already

- always

- among

- analyst

- analytics

- and

- announced

- Another

- Application

- Ark

- article

- bankruptcies

- Barry Silbert

- become

- becomes

- before

- Better

- between

- Big

- Biggest

- Billion

- Bitcoin

- Bitcoin market

- Bitcoin supply

- blockchain

- Blockware Solutions

- boost

- BORROWED

- BTC

- bull

- Bullish

- called

- Cameron Winklevoss

- capital

- capitalization

- Catalyst

- Cause

- causes

- Celsius

- certainly

- changing

- charged

- Chart

- chief

- chief executive officer

- circulating

- claimed

- Co-founder

- CoinGecko

- Collapse

- commission

- company

- conglomerate

- continue

- could

- Couple

- CPI

- CPI data

- crypto

- crypto analyst

- crypto exchange

- Crypto Exchange Gemini

- Crypto Industry

- Crypto Market

- cryptocurrencies

- Currency

- cycles

- DAO

- data

- Date

- Days

- DCG

- December

- decentralized

- defaults

- DeFi

- DeFi Yield Protocol

- designed

- Determine

- developers

- DID

- difficult

- digital

- digital currency

- digital currency group

- Digital Currency Group (DCG)

- Dovish

- down

- Early

- enables

- equity

- established

- ETH

- Ether

- Ethereum's

- eve

- exchange

- executive

- Executive Officer

- exists

- expect

- fallout

- Fed

- finance

- Firm

- focused

- Forward

- founder

- from

- FTX

- Gains

- Gemini

- Genesis

- Genesis Global

- Global

- Go

- Group

- Hands

- having

- head

- heavily

- High

- Hit

- hold

- holders

- Hong

- Hong Kong

- HTTPS

- impulsive

- in

- indexes

- industry

- Institutional

- institutional DeFi

- Investigations

- investment

- Investors

- involved

- IT

- Jan

- JOE

- Karl-Michael Henneking

- Kong

- Lack

- largest

- Last

- Late

- layer

- LDO

- levels

- likely

- Liquidity

- major

- maker

- management

- Market

- Market Capitalization

- market maker

- market wrap

- Marketing

- Markets

- Mass

- Mass Adoption

- massive

- metric

- moment

- Momentum

- monthly

- months

- more

- most

- move

- moving

- Nasdaq

- Nasdaq 100

- nearly

- negative

- New

- next

- next week

- non-stablecoin

- Notes

- obvious

- Officer

- On-Chain

- Panic

- parabolic

- past

- patterns

- plato

- Plato Data Intelligence

- PlatoData

- positioning

- potential

- potentially

- price

- PRICE ACTION

- Profit

- prosecutors

- protocol

- provided

- React

- rekt capital

- related

- remained

- reputable

- retail

- Retail Investors

- returning

- Revealed

- Room

- ROSE

- round

- Rumors

- S&P

- S&P 500

- Said

- same

- SEC

- Securities

- Securities and Exchange Commission

- Selling

- Shake Out

- shanghai

- short-term

- Shortly

- Shows

- Signal

- similar

- situation

- So

- Solutions

- some

- Spool

- start

- stock

- stock market

- Stock markets

- Stocks

- store

- subsidiary

- supply

- Swings

- takes

- tech

- tech stocks

- The

- the Fed

- their

- this week

- timeframe

- to

- too

- top

- Top 10

- Total

- trade

- Trading

- transfers

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- unit

- unregistered

- unregistered securities

- upgrade

- us

- US CPI

- Volatility

- Wealth

- wealth management

- week

- weekly

- What

- which

- while

- willing

- Winklevoss

- within

- world’s

- worried

- would

- wrap

- year

- years

- Yield

- zephyrnet