The accounts payable is an accounting term that refers to the money that a company owes to a vendor or a supplier – for having availed of their products or services.

When a company buys products/services from a vendor/supplier with an arrangement to pay later, the amount is called the accounts payable – until the payment is made. It is a form of credit offered by the vendor/supplier.

The account payable is recorded when an invoice is approved for payment. It’s recorded in the General Ledger (or AP sub-ledger) as an outstanding payment or liability until the amount is paid. The payables can be Trade Payables (purchase of physical goods that are recorded in an Inventory) or Expense Payables (purchase of goods and services that are invoiced, e.g., advertising, entertainment, travel, office supplies, and utilities).

Automate data capture, build workflows and streamline the Accounts Payable process in seconds. No code required. Book a 30-min live demo now. Automate invoice payments with AI.

Table of Contents

Looking to automate your manual 3 way match processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

An example of Accounts Payable

ABC bakery orders 50 lbs of sugar from the wholesale retailer, XYZ Traders at the rate of 50 cents per pound. XYZ Traders offers a credit period of 30 days after delivery to the bakery, within which ABC should pay the bill of $25. Until the bakery pays XYZ traders, the amount of $25 will be called accounts payables and is shown as liability towards creditors in the bakery’s balance sheet.

The $25 is recorded as an asset in the balance sheet of XYZ traders until the payment is received.

Accounts payable includes, beyond purchase of goods, the following:

- Transportation and Logistics

- Power / Energy / Fuel

- Leasing

- Licensing

- Services (Assembly / Subcontracting)

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

The importance of Accounts Payable

AP is important because of the following reasons:

It ensures payment of bills on a timely basis, which in turn improves the credit rating of the company and long-term relationships with vendors.

- Timely payment of invoices ensures uninterrupted flow of supplies and services, which leads to seamless flow of business operations.

- Timely payment avoids overdue payments, penalties and other late fees.

- Organized AP allows systematic tracking of invoices and payments.

- AP eases cash flow by making payments only when due, and using credit facilities offered by the vendor.

- Stringent AP avoids vendor fraud and theft.

AP is not without its drawbacks. It is often considered a financial burden for suppliers who must wait for payment after delivery of products and services. From the company’s side, a balance sheet with prolonged accounts payable indicates a precarious cash position. These drawbacks can be overcome through ethical, legal and logical AP processes.

Components of the Accounts Payable process

Account Payable is a multistep process and comprises some essential steps:

- AP commences with the company’s decision to procure goods/services on a credit system.

- Choosing suppliers who offer credit facilities.

- Comparing the credit policies of the suppliers in terms of credit days allowed, delayed payment charges, cash discount on early payment etc. and choosing the supplier with the terms that best suit the company.

- Following the procurement process – purchase requisition, purchase order, invoice, receipt – of the business.

- Accounting the invoices/bills in the books as Accounts Payable once the goods are received.

- Bookkeeping helps with internal and external audits in the company and in analysing spend patterns, which, in turn helps in financial planning and meeting standards and regulations.

- Tracking the dates on bills to ensure payment before the due date.

- Making payment before the due date

- Communicating with the vendor that the payment has been made.

Taking full advantage of the credit duration will help manage cash flow efficiently. However, it must be remembered that the most efficient use of credit terms is in knowing when to honour bills.

The conventional Accounts Payable department

A team responsible for manual Account Payable processes is responsible for recording and processing financial transactions relating to procurement and suppliers.

A range of professionals are employed for this purpose:

- The data entry analyst inputs the invoices into the digital system once they are received.

- The payment processing analyst is in charge of paying invoices on the date in which they are due

- The exceptions analyst addresses discrepancies in invoices and handles payment failure issues.

- The vendor management personnel create and manage the supplier database and correlate it with various procurement operations.

- The Accounts Payable manager coordinates with the team for error-free and seamless invoice management.

All members of the team work towards creating and maintaining strong supplier relationships. The team must also keep a close watch on the AP expenditures and maintain internal controls to protect the cash outflow.

An efficient and well-managed accounts payable workflow can save companies considerable amounts of time and money with regard to the AP process. Organisations, on rare occasions, could also outsource AP functions to external agencies.

Challenges to the manual Accounts Payable process

Manual accounts payable processes have the following problems:

- Problems associated with manual data entry: Manual entry of invoices into the system can be time-consuming, inefficient and prone to errors. All of these can take a toll on the functioning and bottom line of the company.

- Delays in payment: Manual oversight and mistakes can result in late payments and unhappy suppliers. It can also affect credit rating and credibility of the company as a client to the vendor.

- Unhappy employees: The mundane, repetitive nature of many of the tasks involved in the AP process may lead to work dissatisfaction and related problems including employee turnover.

- Unwieldy information: As a company grows in size and there are more invoices to be handled, the amount of information regarding vendors, products, services, costs, delivery, and due dates can become overwhelming. It also becomes difficult to locate documents and bookkeeping can become a nightmare.

- Opacity of data: Tracking paper invoices and physical AP documents can become difficult if not impossible when the AP department grows in size to tackle a lot of procurement processes.

- Fraud proclivity: The lack of visibility in manual accounts payable systems can expose your company to security vulnerabilities and fraud.

Benefits of automating the Accounts Payable Process

Automating the Account Payable Process leads to the following benefits:

- Time savings: It is said that 25% of a work week is spent on mundane manual invoice management tasks, time that can be better spent on more productive activities.

- Cost savings: Manual processing of a single invoice has been found to cost $12-15. Automation can eliminate much of this cost. In addition, automated solutions keep track of invoice due dates and help pay the invoice at an optimum time, thereby improving cash flow, avoiding late payment charges and maintaining better relationships with vendors.

- Revenue generation: Timely payments enabled by automation can not only avoid late payment charges but also improve the credit rating of the company and make it open to discounts and rebates from vendors.

- Reduction of errors: Manual invoice management is associated with errors due to human oversight. Automation can eliminate much of the errors associated with manual accounts payable processes.

- Flexibility of payment: Automation can enable decision making on when and how to pay invoices (e.g. paper check, ACH, or through virtual cards where you earn cash-back rebates).

- Better maintenance of data: Manual sifting through paperwork can be torturous and error prone. The maintenance of a digital database allows better access and retrieval of data, thereby streamlining the procure-to-pay cycle. Such management also enables analytics for reporting and tracking the purchases and cash flow of the company.

- Security: Accounts payable automation solution can store data in a centralized server or the cloud which affords security

What to look for in an Accounts Payable software

It is important to choose an AP automation software that provides maximum return on investment. An account payable automation software must include data capture, invoice processing, automated approvals, and payments. The basic features that must be sought when looking for an AP automation software include:

- Accurate Invoice Data Capture: The conversion of invoice data into a common digital format is the single most important aspect of creating efficiency in AP automation. Manual data entry is expensive, prone to errors and time consuming. A good OCR tool allows intelligent capture of relevant data without human intervention, thus saving time, money and human errors.

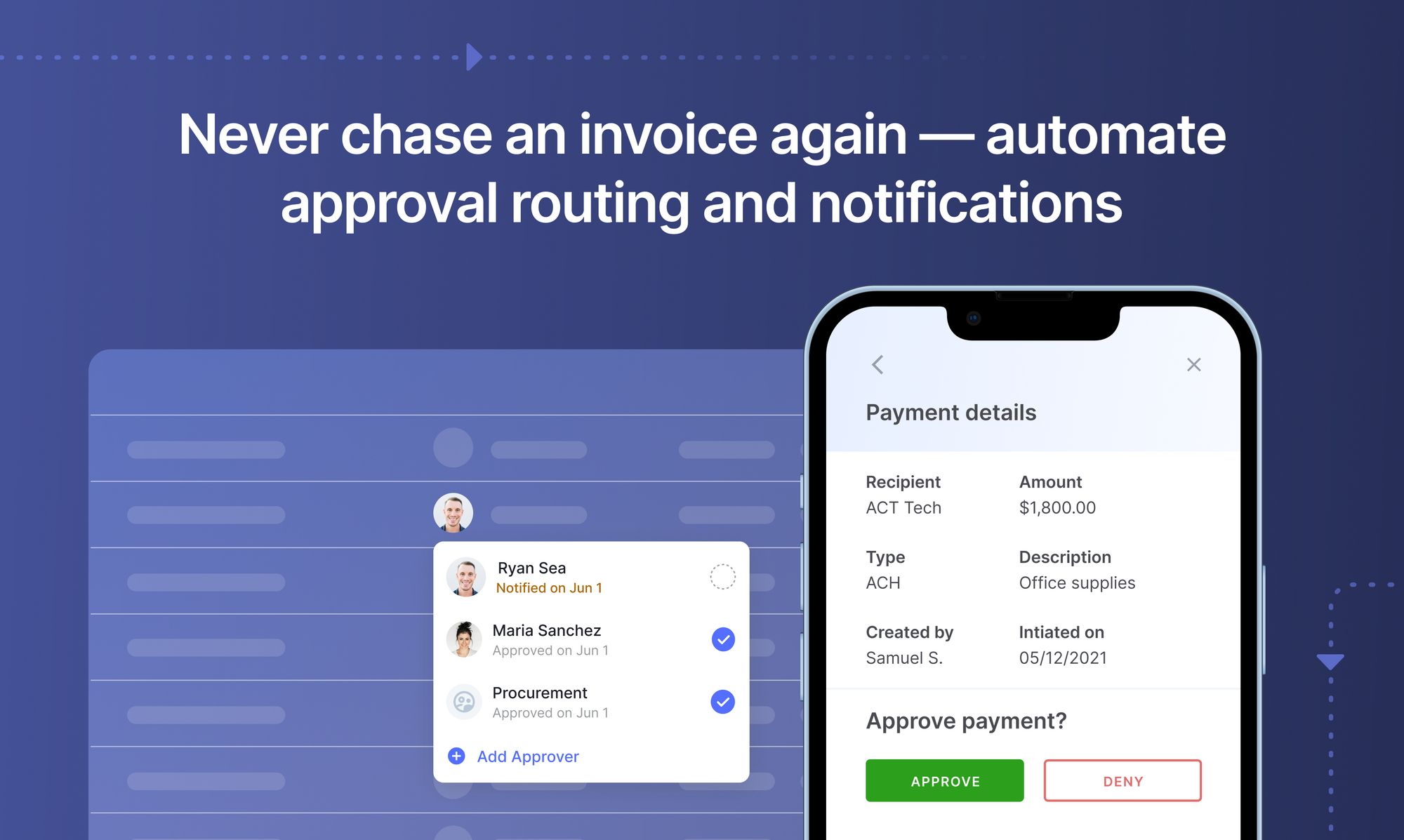

- Easy Invoice Approvals: The people who approve invoices are often busy managers and executives and the automated invoice approval must be easy, intuitive and convenient for such personnel. The approving person must be able to see and approve an invoice with a single click irrespective of the device from which they access the invoice.

- Ability to track AP invoices in real time: Workflow tools must also allow any stakeholder to easily track the invoice. This will avoid delays, miscommunication and mismanagement in the accounts processing process.

- Integration with existing accounting system: The company may use other digital platforms and software and the AP tool must be able to integrate with them to prevent mismatch in data and operations.

- Automation of payments: The final step in the AP process is payment. After all the approvals have been recorded, the software must be capable of initiating and processing the payment towards the supplier to complete and close the Accounts Payable process for that particular procurement.

- Data storage: Depending on the company’s needs, all AP data can be stored on a centralized server or cloud. The type of storage will have to be decided by the company before launching on AP automation.

Conclusion

Automation of the accounts processing operations can eliminate the problems associated with manual processes, such as time delays, errors, and wastage of human effort.

Efficient AP software such as Nanonets can enable better procure-to-pay processes, ensure tax compliance, automate 3-way matching, optimise AP days or DPO, prevent fraud, streamline cash flows, maintain vendor relationships and store data for posterity. Automation breeds efficiency and can orchestrate the procure-to-pay process for long-term value. Digitally enabling the AP process would advance business strategies by turning vendor-client relationships into a competitive advantage.

- accounts payable

- accounts payable automation

- AI

- AI & Machine Learning

- ai art

- ai art generator

- ai robot

- artificial intelligence

- artificial intelligence certification

- artificial intelligence in banking

- artificial intelligence robot

- artificial intelligence robots

- artificial intelligence software

- blockchain

- blockchain conference ai

- coingenius

- conversational artificial intelligence

- crypto conference ai

- dall-e

- deep learning

- google ai

- machine learning

- plato

- plato ai

- Plato Data Intelligence

- Plato Game

- PlatoData

- platogaming

- scale ai

- syntax

- zephyrnet