Mozart’s first crowdfunding attempt in 1783 was unsuccessful, but he rebounded the next year when supporters contributed to assist him perform three piano concertos. The committee for the Statue of Liberty had insufficient financing for the statue’s completion in 1884. In five months, Joseph Pulitzer took matters into his own hands, bringing together 160,000 donors from all walks of life to donate $101,091, enough to complete the costs.

Crowdfunding is when a business’ community of customers, family, friends, and investors come together to support the business by raising funds. According to Market Watch, the crowdfunding global market is expected to grow to $2.58 billion by 2027, nearly double its value of $1.22 billion in 2020.

If you believe in a company and want to help them develop and flourish, crowdfunding allows you to purchase shares in the company and be part of the business’ journey. There’s also a considerable group of individual investors who actively invest in private companies to achieve a strong return on investment. If the company’s value increases, the value of its shares will increase. Similarly, if the value of the company falls, the value of your shares will also fall.

Houst is a short-let management company making it easy for property owners to host on Airbnb, Booking.com, Expedia and more. Houst has crowdfunded a few times on our platform raising a total of £10,952,852 from 2,526 investors. Houst’s valuation has increased by 3,279.4% which means there’s been an increase in share price and holding value.

The fact that you don’t have to be a High Net Worth individual to get started and build an investment portfolio of private companies makes crowdfunding an appealing alternative investment asset. Seedrs’ objective is to democratise venture capital and make private investing accessible to the average retail investor. In our first podcast episode with Seedrs co-founder and Executive Chairman, Jeff Lynn, you can learn more about our mission.

Investing in early-stage businesses carries a high level of risk. The majority of early stage businesses fail, so returns are not guaranteed. The lack of liquidity in the shares is another risk in crowdfunding, which is why we built the Secondary Market. Rather than waiting for an exit, shareholders can sell their shares to other investors through the market.

How is equity crowdfunding different from venture capital and angel investing?

Online platforms such as Seedrs and Republic allow a group of investors (referred to as the “crowd”) to invest funds in a business in exchange for equity in that business. Instead of just one or a small number of investors, there may be hundreds, if not thousands.

One recent example is SPOKE, which is building the world’s most personal menswear brand. SPOKE offers a flawless, personalised fit, without the hassle or expense of bespoke. By finishing to order, they’re able to run more than 400 size options where traditional brands offer 30 or 40. In March 2022, they raised just over £4.7 million from 1,579 investors, overfunding by 312%!

Venture Capitalists (VCs) invest in startups using funds raised from limited partners including pension funds, endowments and HNW individuals. Investment thesis’ vary from VC to VC, with different firms focussing on different industries, company stages, geographies etc. On the whole, most VCs look to invest in very early stage businesses that they believe will be successful and provide the firm a 10-100x return on investment. Many VCs are ex-startup operators and investors, so can often bring a team of individuals with experience and skills that the startup might not have.

Angel Investors are individuals, or groups of individuals arranged into syndicates, who invest funds in businesses while also providing expertise, contacts, and credibility to help that startup grow. Angel investors often invest in enterprises right at the start of their development journey, before the company takes on venture investment from other sources, like VCs.

More information on the differences between equity crowdfunding, venture capital, and business angels can be found here.

What are the different types of crowdfunding?

Equity crowdfunding

The sale of equity in a business to a large number of investors in exchange for their money is known as equity crowdfunding. It’s comparable to how you’d buy and sell regular stock on a stock exchange.

Rewards-based crowdfunding

When a group of individuals donate money to a business or project with the anticipation of receiving products or services from the business in exchange for their contribution at a later date.

Donation-based crowdfunding

This is when a group of people donate money towards a charitable project with no financial or material gain expected in return. GoFundMe is an example of an online platform where donation-based crowdfunding takes place.

Peer-to-peer (P2P) lending

Peer-to-peer lending is the same process of borrowing capital from many investors as you would if crowdfunding. However, instead of offering equity, you are instead repaying back the money with interest – almost like a loan from the bank.

Don’t just take our word for it

While every investment comes with risk, and past results cannot be a reliable indicator of future performance, many of our investors have experienced some great success. Just look at what Dale had to say:

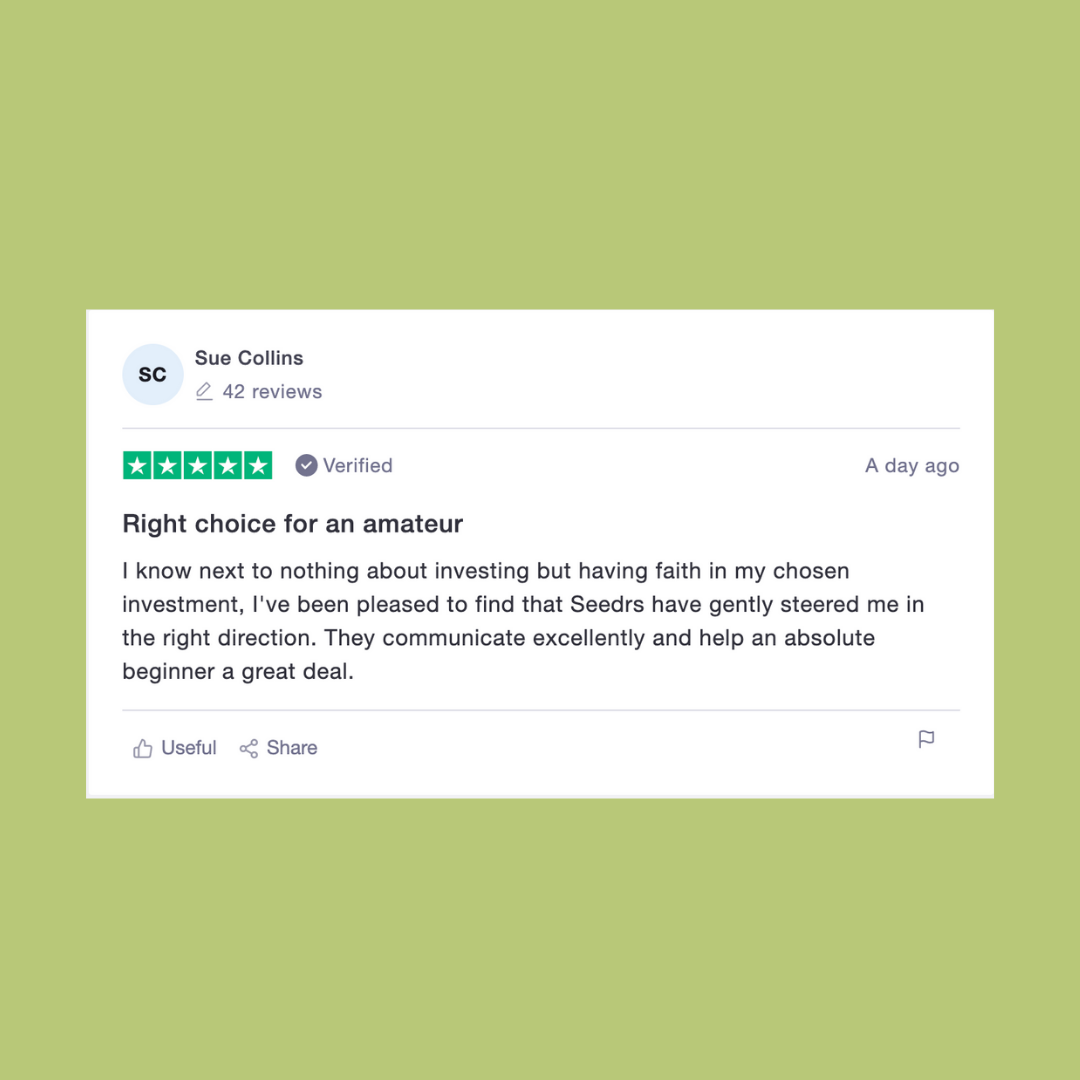

Not only can you see great returns, it’s also pretty easy to get started with as Sue states here:

Visit our Trustpilot to see how others find the crowdfunding experience with Seedrs here.

[Button: Make your first investment here today!]

Keywords:

Crowdfunding: The combined effort of family, customers, friends and investors to help a business raise capital.

Equity Crowdfunding: The sale of a stake in a business to a number of investors in return for their investment.

The ‘crowd’: A group of investors.

Venture capital: Private equity used to finance startups with potential exponential growth opportunities.

HNW: High net worth individual

IPO: Initial public offering

Angel investor: These investors are individuals, or a community of individuals, who invest capital in early-stage businesses.

Related content:

- Should you invest in startups? 5 reasons why the answer is yes.

- Equity crowdfunding and the democratisation of Venture Capital

- Entrepreneurs Biggest Crowdfunding Misconceptions

- Business Angels vs VC vs Crowdfunding

The post What is crowdfunding? appeared first on Seedrs Insights.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. FREE ACCESS.

- CryptoHawk. Altcoin Radar. Free Trial.

- Source: https://www.seedrs.com/insights/blog/investing/what-is-crowdfunding-2?utm_source=rss&utm_medium=rss&utm_campaign=what-is-crowdfunding-2

- 000

- 2020

- 2022

- 7

- a

- About

- accessible

- According

- Achieve

- All

- allows

- alternative

- angels

- Another

- answer

- anticipation

- appealing

- asset

- average

- Bank

- before

- between

- Biggest

- Billion

- Borrowing

- brand

- brands

- bring

- build

- Building

- business

- businesses

- buy

- capital

- chairman

- Co-founder

- combined

- come

- community

- Companies

- company

- Company’s

- complete

- content

- contributed

- Costs

- Credibility

- Crowdfunding

- Customers

- develop

- Development

- different

- donate

- double

- Early

- early stage

- effort

- enterprises

- equity

- etc

- example

- exchange

- executive

- Exit

- expected

- experience

- experienced

- expertise

- family

- finance

- financial

- Firm

- firms

- First

- fit

- flourish

- found

- from

- funds

- future

- Global

- great

- Group

- Group’s

- Grow

- Growth

- guaranteed

- help

- here

- High

- holding

- homepage

- How

- However

- HTTPS

- Hundreds

- Including

- Increase

- increased

- individual

- individuals

- industries

- information

- interest

- investing

- investment

- investor

- Investors

- IT

- journey

- just one

- known

- large

- LEARN

- Level

- Liberty

- Limited

- Liquidity

- Look

- Majority

- make

- MAKES

- Making

- management

- March

- Market

- material

- Matters

- means

- might

- million

- Mission

- money

- months

- more

- most

- net

- next

- number

- offer

- offering

- Offers

- online

- operators

- opportunities

- Options

- order

- Other

- own

- owners

- p2p

- part

- partners

- pension

- People

- performance

- personal

- platform

- Platforms

- portfolio

- potential

- pretty

- price

- private

- Private Equity

- process

- Products

- project

- property

- provide

- providing

- public

- purchase

- raise

- raising

- reasons

- recent

- regular

- reliable

- Results

- retail

- return

- returns

- review

- Risk

- Run

- sale

- same

- sell

- Services

- Share

- Shares

- Similarly

- Size

- skills

- small

- So

- some

- Stage

- stages

- stake

- start

- started

- startup

- Startups

- States

- stock

- Stock Exchange

- strong

- success

- successful

- support

- team

- The

- thousands

- three

- Through

- times

- together

- towards

- traditional

- types

- Valuation

- value

- VC

- VCs

- venture

- venture capital

- What

- What is

- while

- WHO

- without

- world’s

- worth

- would

- year

- Your