- We look at vanilla swaps, inflation swaps and futures.

- Some markets have seen volumes reduce by over 50%.

- Whilst others recorded all-time record volumes in August 2022.

- What is driving such different outcomes across a single derivatives market?

With Liz Truss the newly anointed Prime Minister, the FT had an interesting take on UK markets yesterday:

In light of which, I thought it was a good opportunity to take a look at what has been happening in GBP swap markets recently. It turns out that some corners of the derivatives markets may not agree with the FT.

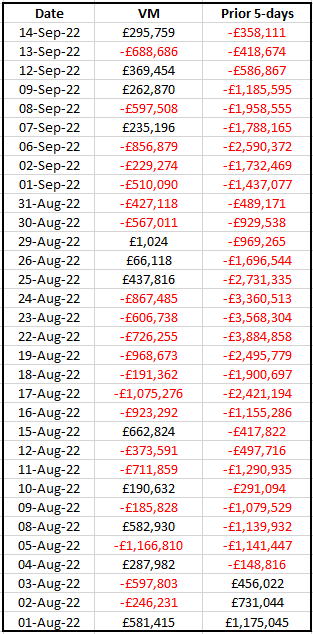

Total Cleared Volumes

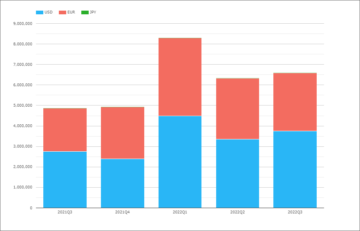

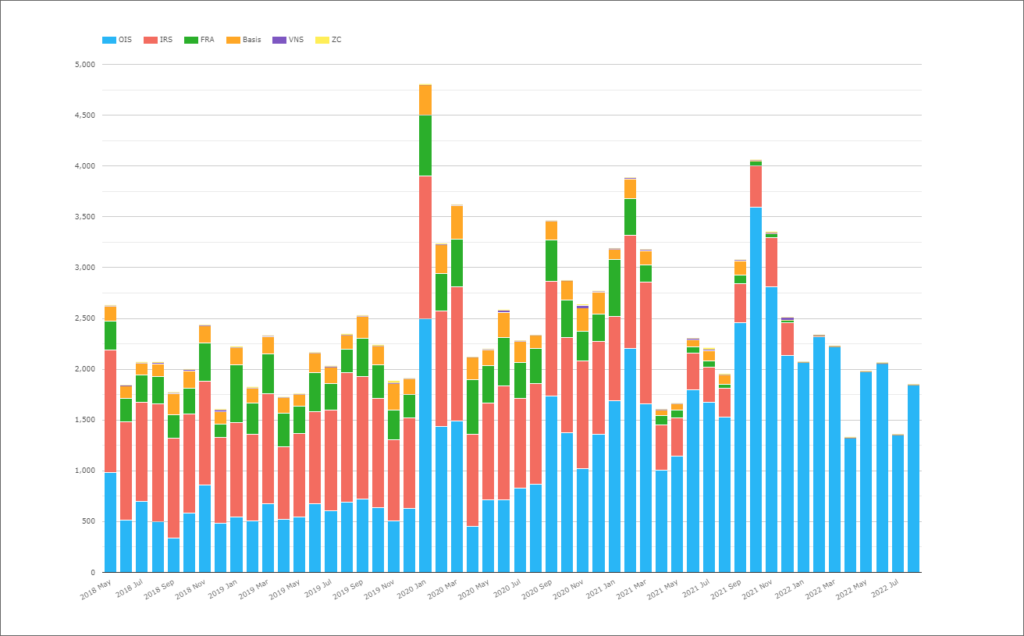

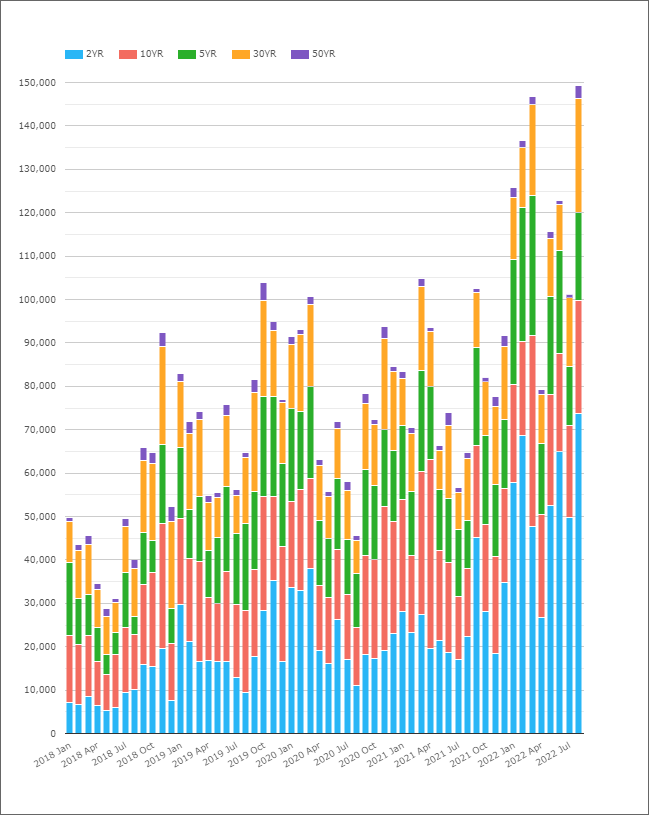

Looking at notional volumes in Interest Rate Derivatives from CCPView presents a pretty interesting chart:

The data behind the chart covers a number of topics:

- The chart shows millions of GBP cleared each month. With the big move in FX this year, I thought it better to present the volumes in native currency.

- The product mix has fundamentally changed.

- There is no longer any IRS being traded in GBP markets. This is due to LIBOR cessation and we covered it here:

- There are no longer any FRAs trading either. This was well flagged, and volumes reduced drastically well ahead of the actual LIBOR cessation, with February 2021 seeing the last meaningful volumes. Again, we covered this below:

- Basis swap volumes have also disappeared. Amir was on the case with this one:

- Zero coupon swaps have also stopped trading, and Variable Notional Swaps (“VNS” or amortisers) were never a significant contributor to volumes.

- This leaves us with OIS and Inflation. Inflation swap volumes have been soaring in UK markets, covered below:

- Whilst RFR Adoption remains at pretty much 100% in UK swap markets, meaning that SONIA volumes are at all-time highs.

- Have OIS markets completely taken up the slack in UK derivatives trading, though? Or are volumes down overall?

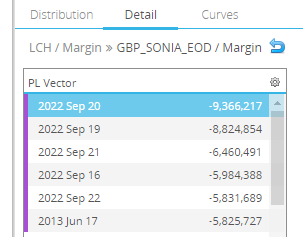

Total DV01 Traded

The easiest way to answer this is to run DV01 metrics from CCPView. This gives us the unequivocal answer as to whether the amount of risk transferred in UK swap markets is up or down. Looking at monthly figures:

Showing;

- Unsurprisingly, a very similar chart to notional volumes. However, note that this is in millions of USD DV01 as we calculate the conversion from notional to DV01 using a standardised curve.

- The out-sized volumes back in September-November 2021 really stand-out on this time-series.

- So much so that I was motivated to run YTD figures instead. How does January-August 2022 compare to the same periods in previous years?

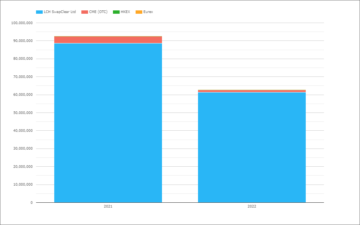

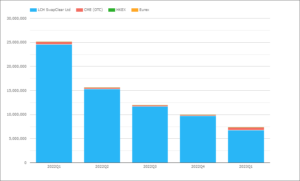

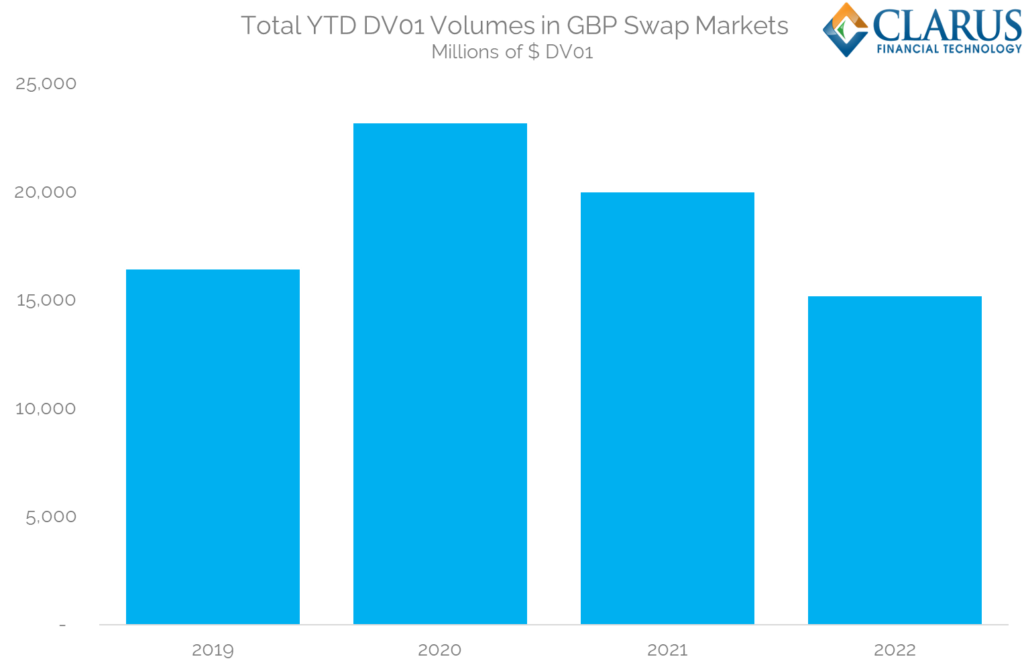

DV01 YTD

And….oh dear:

Showing;

- If you know a GBP Swaps trader, maybe offer to give them a hug?

- The chart shows YTD volumes traded up to the end of August in each year. It excludes Inflation Swap volumes (we don’t calculate a DV01 for those).

- For vanilla swap markets, volumes are the lowest we have on record.

- Given that the September-November 2021 period was so stellar for volumes, I doubt the whole-year 2022 will be matching 2021 volumes.

- Given that 2021 was already down on 2020 (admittedly a crazy year), it has not been a good run for GBP.

- For some perspective, volumes are down by 24% compared to last year.

- So when your GBP swaps trader is telling you about terrible liquidity (which they do tend to moan about….), then they may be right this time. Maybe give them a break in Q4?

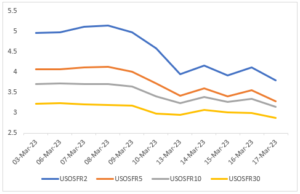

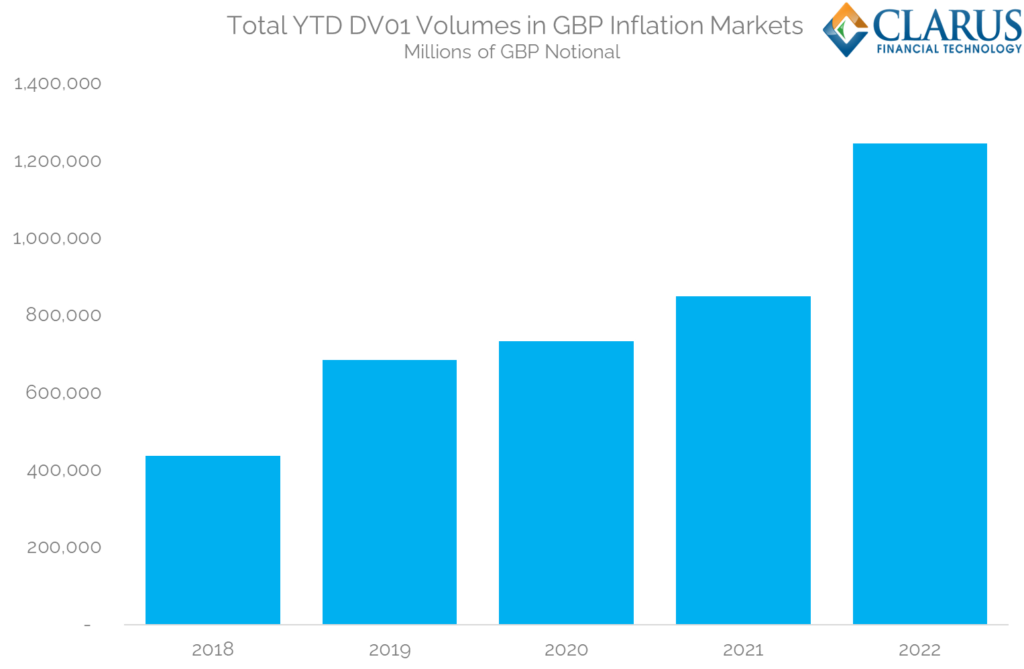

Inflation Swaps

I don’t want to turn into a broken record, but it is hard to avoid the fact that GBP Inflation Swaps have flourished this year:

In fact, now that we look at Inflation volumes in GBP terms, and that the full month of August is completed, we see that August 2022 was the record month ever for GBP Inflation Swap volumes. Wow.

We know that the inflation story is a big one in the UK (and look at that huge growth in 2Y tenors trading since 2021), but I am surprised volumes in inflation can be so high when volumes in underlying swap markets are suffering. The YTD volumes for Inflation really drive this point home:

YTD volumes are 47% higher this year than last!

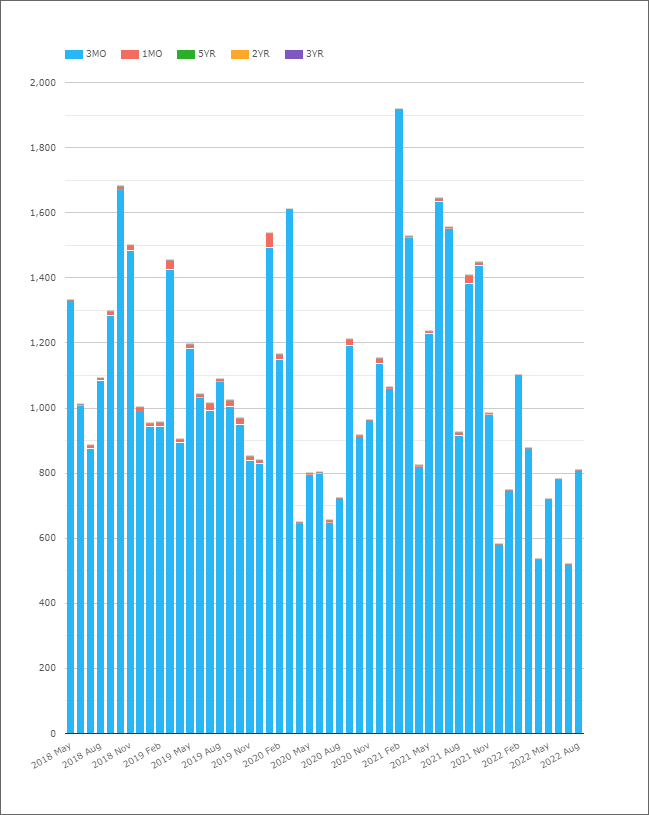

Futures

But….Futures show us what is happening in the most vanilla part of the market – short-end trading.

Look at the DV01 traded each month in Short Sterling/SONIA futures:

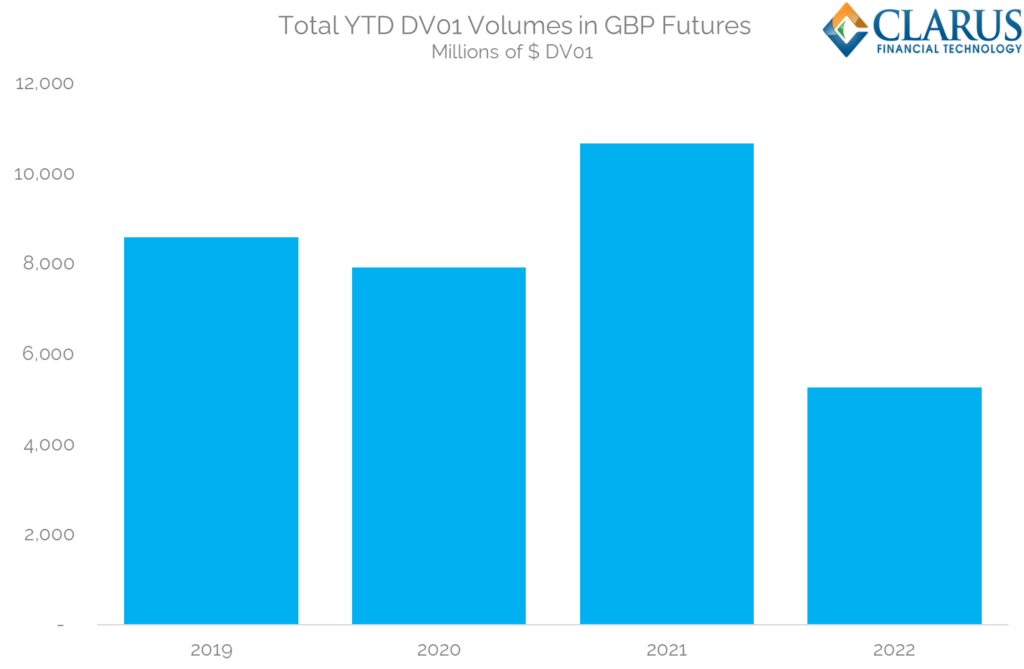

And on a YTD basis:

Showing;

- Futures volumes (for STIR contracts) are down just over 50% in GBP markets compared to this time last year.

- Activity in these markets is even more subdued than in the swap markets.

- Trading is down at least 33% compared to prior years. So even if 2021 was a “bumper year” as LIBOR cessation and market conditions dictated trading conditions (the first rate hike. anyone?) , activity in 2022 is far below expectations.

What is this down to?

It is really hard to put a finger on what has caused volumes to reduce by quite so much. Is it:

- LIBOR cessation reducing the number of products to trade?

- Market conditions being less favourable?

- A weakening GBP in FX markets causing UK-based risk taking to be less significant on the global scale?

- The UK behaving like a banana-republic, increasing volatility and so lowering “risk appetite” in terms of DV01/notional at risk?

And how does this speak to the fact that volumes have reduced more in Futures markets than Swap markets, and yet Inflation volumes are at all-time highs – seemingly driven by short-end inflation trading?

I don’t have the answers, but from a LIBOR cessation perspective we can likely state:

- No FRA trading reduces IMM-dated Futures activity.

- No term fixings reduces hedging activity in Futures.

- No term basis trading (3s1s, 3s6s) reduces Futures activity (no need to “hedge” the first period).

- No LOIS basis trading (LIBOR vs OIS) reduces Futures activity (both from Swap markets and from native futures positions).

I can think of plenty of negative impacts from LIBOR cessation on volumes! But equally, an inflationary shock should also have led to a huge spike in activity in vanilla swap markets. What would activity have been like minus the inflationary backdrop? It seems strange…..and I didn’t even mention Brexit!

In Summary

- GBP Inflation Swap volumes are 47% higher YTD than last year and hit all-time records in August 2022 at nearly GBP150bn notional.

- GBP vanilla swap volumes are 24% lower than last year as measured by DV01.

- GBP futures markets see volumes over 50% lower than last year and at least 33% lower than other years.

- Likely drivers of these large changes in activity are LIBOR cessation, the inflationary shock and the large weakening of GBP in FX markets.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- Clarus

- coinbase

- coingenius

- crypto conference fintech

- Derivatives

- fintech

- fintech app

- fintech innovation

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet