The Ethereum Merge got here and went, leaving traders to ponder what the following trending growth out there may appear like. In a Cointelegraph Twitter Space with Capriole Fund founder Charles Edwards, the analyst talked about that pleasure over the Ethereum Merge and its bullish worth motion had considerably been holding up hope throughout the market. Now that the occasion has come and gone, the crypto market has been promoting off, with Bitcoin’s (BTC) worth trading under $20,000 and Ether’s (ETH) underneath $1,500.

Eventually, new narratives and market tendencies will emerge, and if the basics are proper, merchants will rotate funds as these new leaders emerge.

Let’s check out just a few potential tendencies.

Where will the previous ETH miners go?

The Ethereum community efficiently shifted to a proof-of-stake (PoS) mannequin, which means miners are out of pocket however nonetheless presumably in possession of their GPUs and ASICs mining infrastructure. It’s attainable that some miners would possibly elect to mine on a special chain as an alternative of promoting their gear.

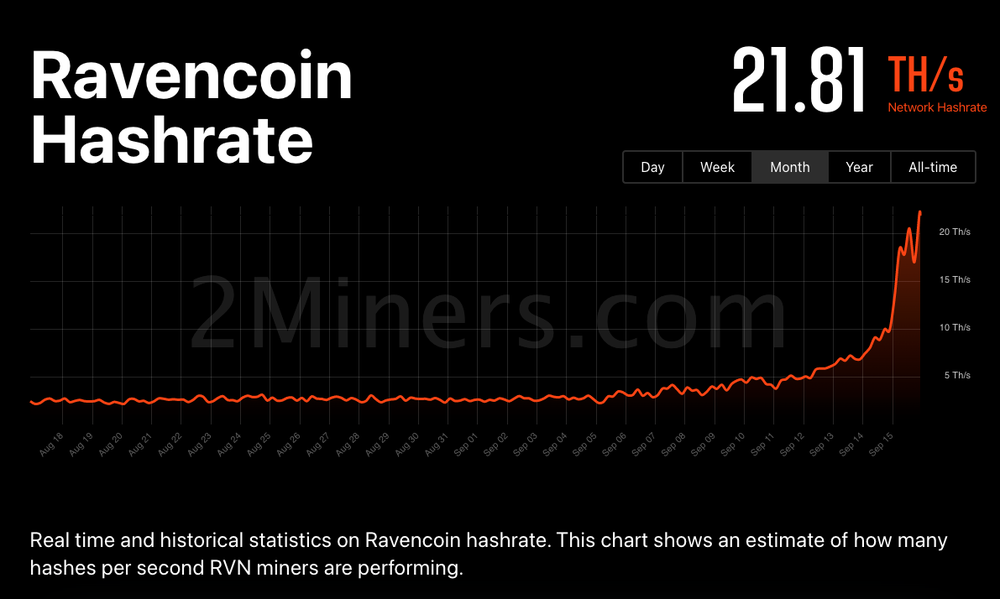

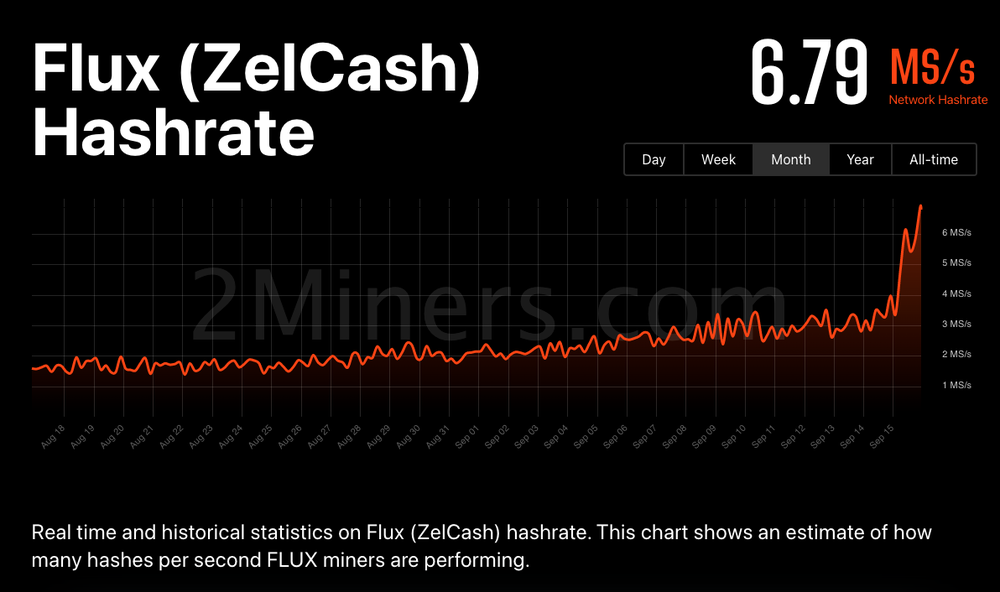

While they haven’t settled on any specific chain simply but, Ravencoin, Flux, Ethereum Classic and Ergo appear to be the frontrunners. Leading into the Merge, every community noticed its hash charge rise to new all-time highs, as proven under.

Prices of every altcoin additionally rallied over the previous month, with Ravencoin’s RVN up 169%, Ergo’s ERG added 132%, Flux gained 156%, and Ethereum Classic’s ETC rallied 135% previously 90-days.

Interestingly, the hash charge and worth dropped sharply on Sept.15, and on the time of writing, simply Flux and RVN look like rebounding. Over the approaching weeks and months, will probably be attention-grabbing to see which community miners presumably choose as their new dwelling and the impression this has on the cryptocurrency’s worth.

The Cosmos continues to develop

The Cosmos ecosystem continues to expand, which seems to be attracting consumers to ATOM. Since bottoming at $5.50 on June 18, ATOM’s worth has gained 137.5% and, presently, is trading above $16. Analysis means that traders view the soon-to-launch liquid staking, ATOM getting used as collateral for stablecoin minting, the launch of Cosmos Hub 2.0 and the eventual restoration of decentralized finance usually as bullish long-term factors for ATOM price.

Buy the rumor and promote the information, or purchase the dip?

While ETH’s present worth motion is much less bullish than Merge supporters and ETH bulls may need hoped, the precise shift to PoS seems to have been a hit, and maybe over time, the advantages of PoS will translate to bullish worth motion from ETH. According to Jarvis Labs co-founder Ben Lilly, the “Joe Cool move” for ETH traders is to not “get caught up in the days to come. The main player that is likely to do any sort of crazy activity is that of the miner. And that’s a one-off event that is to be short-lived.”

Lilly explained that:

“The Joe Cool move is to sit there and buy any type of overly emotional movement. Then sit back and take it easy.”

In the long run, Ether may expertise a provide shock and presumably grow to be deflationary. Staking additional secures the community whereas additionally offering assured returns on deposited property. In a market that’s caught in a downtrend, sourcing a secure, predictable yield may grow to be extra enticing.

Essentially, Lilly is suggesting that it’ll take time for the fervor surrounding the Merge to settle and for traders to start capitalizing on the advantages that the PoS Ethereum community may provide.

What about Bitcoin?

In this week’s Bitcoin analysis I mentioned how not a lot has actually modified with Bitcoin’s worth. Its worth has remained range-bound within the $17,600–$24,400 vary for the previous three months, and all rallies out of every range-high since March 29 have been capped by the 200-day shifting common and an overhead resistance trendline that extends from Bitcoin’s November 2021 all-time excessive at $69,400.

While continued consolidation inside the present vary may (and would usually) be good for altcoins, macro tensions could proceed to weigh on crypto and equities markets. The scorching client worth index print from Sept. 12 may result in extra aggressive charge hikes from the United States Federal Reserve, and the potential knock-on impact on inventory costs may have a fair sharper spillover impact on crypto costs.

For this motive, traders stay largely risk-averse to most cryptocurrencies, and it’s attainable that repeat rejections on the long-term descending trendline and additional retests of the $19,000 assist may ultimately end in a breakdown under the yearly swing low.

This publication was written by Big Smokey, the creator of The Humble Pontificator Substack and resident publication creator at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird analysis on potential rising tendencies inside the crypto market.

Disclaimer. Cointelegraph doesn’t endorse any content material of product on this web page. While we goal at offering you all essential data that we may receive, readers ought to do their very own analysis earlier than taking any actions associated to the corporate and carry full duty for his or her choices, nor this text might be thought of as an funding recommendation.

- Bitcoin

- Bitcoin News

- Bitcoin Upload

- blockchain

- blockchain compliance

- blockchain conference

- breaking news

- coinbase

- coingenius

- Consensus

- crypto

- crypto conference

- crypto mining

- Crypto News

- cryptocurrencies

- cryptocurrency

- Cryptocurrency News

- decentralized

- DeFi

- Digital Assets

- ethereum

- Latest Cryptocurrency News

- machine learning

- Market

- Merge

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- Whats

- zephyrnet