Posted May 21, 2024 at 10:19 am EST.

This past weekend, a Binance report on tokens with high fully diluted valuations and low initial circulating supplies, also known as “low float, high FDV” coins got the crypto community buzzing.

After numerous response tweets and longer articles by crypto OGs like Cobie, Haseeb Qureshi, and others, on Monday, Binance also responded to concerns about the growing trend by announcing a strategic shift towards listing small to medium-sized projects.

The reason for the controversy is that low float, high FDV tokens often leave little upside for traders after the token generation event (TGE). Analysts differ on why the price of these tokens has dropped in recent months, with some pointing to VCs, and others to market conditions. Meanwhile, there’s no agreement on a solution on how to distribute tokens whose value doesn’t go down immediately.

Read more: How ‘Fully Diluted Valuation’ Can Be a Very Dangerous Metric for Crypto Markets to Rely On

The Binance report published Friday highlighted the negative impact of low float, high FDV coins on retail investors and loyal community members. “If such a trend becomes an industry norm, sustainable growth will be increasingly difficult without a corresponding inflow of capital to match the billions of token unlocks in the coming years,” they wrote.

Shortly after Binance published its report, SwissBorg researcher “tradetheflow” ignited the wider discussion by posting on X: “Yes, more often than not, tokens launching on Binance are not investment vehicle anymore – all their upside potential are already taken away.” He also noted that the prices of the new tokens listed on Binance in the past six months were all down since then, with the exception of five coins, three of which were memecoins (only one of which had any VC investors but “[n]o tier 1 VC”), and JUP and JITO, whose gains he attributed to “[b]ig Solana momentum.”

Crypto OGs Weigh In—and Are Divided

In a Substack post published Sunday, Jordan Fish, aka ‘Cobie,’ wrote that most of the upside for new tokens is now captured privately before they even exist, leading to inflated valuations, little for public market participants and even “phantom markets” where investors with locked tokens sell their tokens at massive discounts to the public price, indicating a dislocation between the public and private markets. Cobie wrote that “new launches have become uninvestable” and called for investors to opt out of buying inflated FDV tokens.

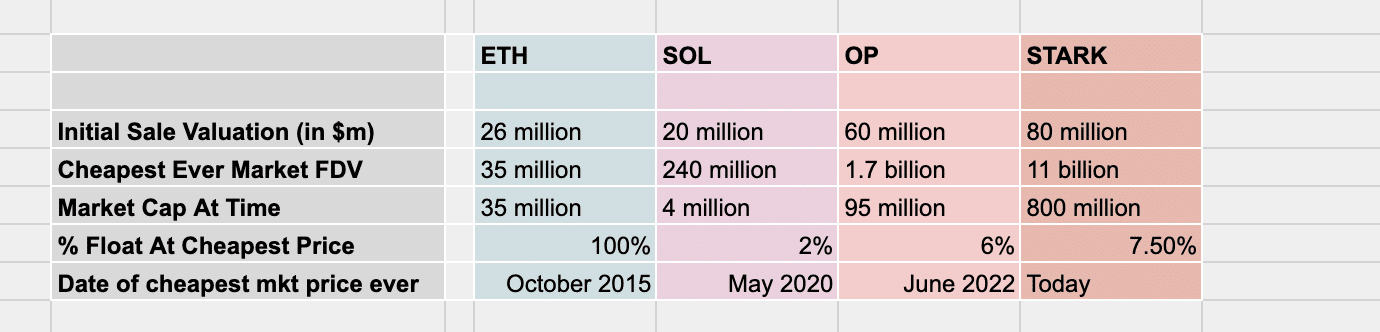

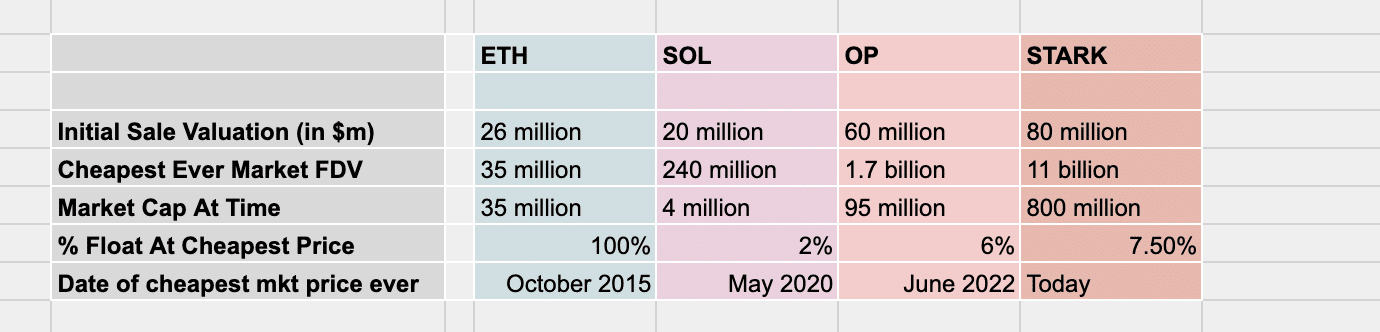

As examples, he cited the facts that Ethereum’s Initial Coin Offering (ICO), which was public, was at ~$26 million, while the following seed rounds had these fully diluted values: Solana, ~$20 million FDV; Optimism, ~$60 million FDV; StarkNet, ~$80 million FDV. He then noted, “modern seed rounds for comparable projects are now >$100m FDV.”

In other words, he noted that Ethereum’s ICO returns were 1.5x higher than what was available on the market, while Solana’s seed round returns were 10x higher than what was available on the market, OP’s seed round returns were 30x higher, and STRK’s seed round returns “are infinity times higher than those available at market, because today is STRK’s lowest ever price, meaning all public market buyers have lost money — but the seed is up 138x.” He concluded, “As you can see, the returns are increasingly captured in private.”

He said the core problem with low float, high FDV coins is that “in fact actually because the price discovery has taken place in a private market that is either rigged, delusional or both.”

Learn more: What Is Tokenomics? A Beginner’s Guide

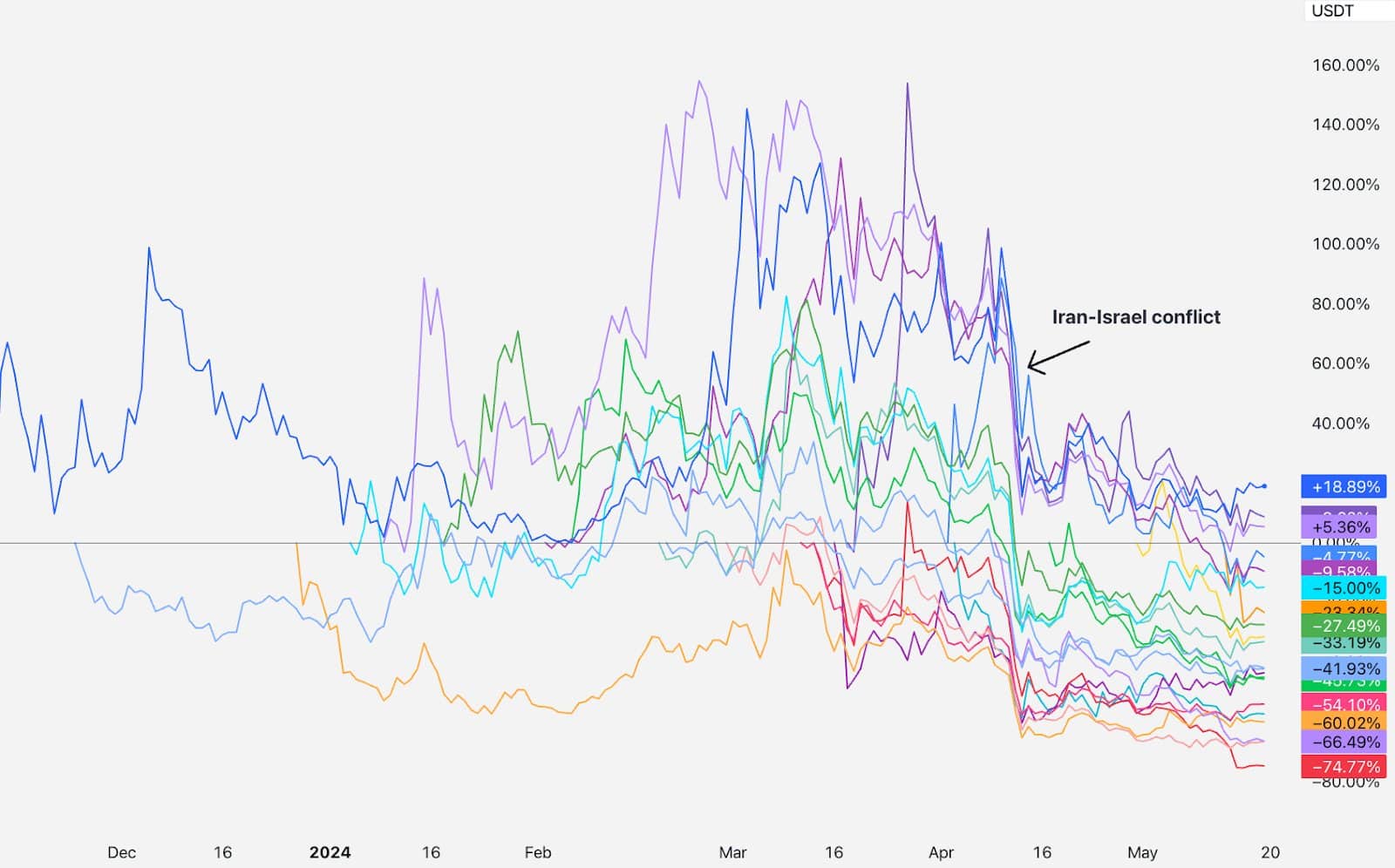

On the other hand, in a long 11-minute read on X, Haseeb Qureshi, managing partner of crypto VC firm Dragonfly, examined three theories about why low float, high FDV tokens are struggling: VC dumping, retail investors favoring memecoins, and inadequate supply for price discovery. After a detailed analysis with charts debunking each of these theories, Qureshi then showed a chart that started in late 2023 (a shorter timeframe than Cobie’s analysis) of how the prices of all the coins listed on Binance (and analyzed by Swissborg’s tradetheflow) took a nosedive in mid-April. “For the first couple months, these tokens mostly traded about flat from their listings, until mid April,” he wrote. “Suddenly Iran and Israel started threatening WW3, and markets tanked. Bitcoin recovered, but these coins didn’t.”

Also, Qureshi pointed out that the Binance chart that has dominated Crypto Twitter is wrong: “My brother in Christ, I was around in 2022, projects were not launching with circulating supplies of 41%.”

Is There a Solution?

Addressing the issues with low float and high FDV tokens has sparked various suggestions from industry experts. In his article, Qureshi reviewed several proposed solutions, including bringing back ICOs, unlocking 100% of tokens immediately, using bookrunners like traditional IPOs, and listing tokens at lower prices. However, he found these solutions either impractical or ineffective. Instead, Qureshi suggested that free markets will naturally correct mispricings over time, saying that market forces would push for lower FDVs, exchanges would adjust their listing strategies, and VCs would communicate realistic valuations to founders. “[I]f you are a team whose token went down, don’t worry,” he wrote. “You’re in good company. Remember: AVAX was down ~24% 2 months after listing. SOL was down ~35% 2 months after listing. NEAR was down ~47% 2 months after listing.”

Read more: 5 Best Airdrop Practices All Crypto Protocols Should Follow

Rob Hadick, general partner at Dragonfly, emphasized the need for a fundamental shift in how tokens are issued and valued: “The best way to solve this is move towards a variable supply of tokens in protocols subject to governance for new issuance (vs fixed supply).” Hadick argued that the present system incentivizes short-term gains and detrimental behavior from founders and VCs, hurting retail investors and pushing them towards memecoins. By increasing the percentage of liquid tokens at launch and adopting a variable supply approach, he said he believes the market can foster healthier dynamics and robust price discovery.

Wassielawyer, a pseudonymous crypto lawyer, had a novel idea: “Maybe low float high FDV coins should switch to price based unlocks vs time based unlocks. Very crude instrument but if people know VCs can’t start dumping till 1b FDV instead of 3 months from TGE there is a bit more alignment.”

Davo, chief janitor at Solana-based dapp Drift, suggested another potential solution: launching tokens at the last private round valuation. “A project that launches at a low FDV that allows its community to buy at reasonable prices is going to be far more anti-fragile and resilient when compared against the community member who buys for hype at an inflated price only to experience down-only action,” he wrote. By aligning the launch price with the latest private valuation, he said he believes projects can avoid artificially inflated prices and ensure that early supporters benefit from the project’s success.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/whos-to-blame-for-the-underperformance-of-low-float-high-fdv-tokens/

- :has

- :is

- :not

- :where

- $UP

- 1

- 10

- 19

- 1b

- 2022

- 2023

- 2024

- a

- About

- Action

- actually

- adjust

- Adopting

- After

- against

- Agreement

- airdrop

- aka

- aligning

- alignment

- All

- allows

- already

- also

- am

- an

- analysis

- Analysts

- analyzed

- and

- Another

- any

- anymore

- approach

- April

- ARE

- argued

- around

- article

- articles

- AS

- At

- available

- AVAX

- avoid

- away

- back

- based

- BE

- because

- become

- becomes

- before

- behavior

- believes

- benefit

- BEST

- between

- billions

- binance

- Bit

- Bitcoin

- both

- Bringing

- but

- buy

- buyers

- Buying

- Buys

- Buzzing

- by

- called

- CAN

- capital

- captured

- Chart

- Charts

- chief

- circulating

- cited

- Cobie

- Coin

- Coins

- coming

- communicate

- community

- company

- comparable

- compared

- Concerns

- concluded

- conditions

- controversy

- Core

- correct

- Corresponding

- Couple

- crude

- crypto

- Crypto Lawyer

- Crypto Markets

- Dangerous

- dapp

- detailed

- differ

- difficult

- diluted

- discounts

- discovery

- discussion

- dislocation

- distribute

- Doesn’t

- dominated

- Dont

- down

- Dragonfly

- dropped

- dynamics

- each

- Early

- either

- ensure

- Ethereum's

- Even

- Event

- EVER

- examples

- exception

- Exchanges

- exist

- experience

- experts

- fact

- facts

- far

- fdv

- Firm

- First

- Fish

- five

- fixed

- flat

- Float

- following

- For

- For Investors

- Forces

- Foster

- found

- founders

- Free

- Friday

- from

- fully

- fundamental

- Gains

- General

- generation

- Go

- going

- good

- got

- governance

- Growing

- Growth

- had

- hand

- Haseeb Qureshi

- Have

- he

- healthier

- High

- higher

- his

- How

- How To

- However

- HTTPS

- Hype

- i

- ICO

- ICOs

- if

- ignited

- immediately

- Impact

- impractical

- in

- incentivizes

- Including

- increasing

- increasingly

- indicating

- industry

- industry experts

- Infinity

- initial

- Initial Coin Offering

- instead

- instrument

- investment

- Investment vehicle

- Investors

- Iran

- Israel

- issuance

- Issued

- issues

- ITS

- Jordan

- Jordan Fish

- jpeg

- Know

- known

- Last

- Late

- latest

- launch

- launches

- launching

- lawyer

- leading

- Leave

- like

- Liquid

- Listed

- listing

- Listings

- little

- locked

- Long

- longer

- lost

- Low

- lower

- lowest

- loyal

- managing

- managing partner

- Market

- market conditions

- market forces

- Markets

- massive

- Match

- max-width

- May..

- meaning

- Meanwhile

- member

- Members

- Memecoins

- metric

- Mid

- million

- Momentum

- Monday

- money

- months

- more

- most

- mostly

- move

- naturally

- Near

- Need

- negative

- New

- no

- noted

- novel

- now

- numerous

- of

- offering

- often

- on

- ONE

- only

- opt

- Optimism

- or

- Other

- Others

- out

- over

- participants

- partner

- past

- People

- percentage

- Place

- plato

- Plato Data Intelligence

- PlatoData

- pointing

- posted

- potential

- practices

- present

- present system

- price

- Prices

- private

- private markets

- privately

- Problem

- project

- projects

- proposed

- protocols

- public

- Public Market

- published

- Push

- Pushing

- Read

- realistic

- reason

- reasonable

- recent

- rely

- remember

- report

- researcher

- resilient

- responded

- response

- retail

- Retail Investors

- returns

- reviewed

- rigged

- robust

- round

- rounds

- Said

- saying

- see

- seed

- Seed Round

- sell

- several

- shift

- short-term

- shorter

- should

- showed

- since

- SIX

- Six months

- small

- SOL

- Solana

- solution

- Solutions

- SOLVE

- some

- sparked

- starknet

- start

- started

- Strategic

- strategies

- Struggling

- subject

- success

- such

- sunday

- supplies

- supply

- supporters

- sustainable

- Sustainable Growth

- Swissborg

- Switch

- system

- taken

- Tanked

- team

- than

- that

- The

- The Coins

- their

- Them

- then

- There.

- These

- they

- this

- those

- three

- tier

- till

- time

- timeframe

- times

- to

- today

- token

- tokenomics

- Tokens

- took

- towards

- traded

- Traders

- traditional

- Trend

- tweets

- Unchained

- unlocking

- unlocks

- until

- Upside

- using

- Valuation

- Valuations

- value

- valued

- Values

- variable

- various

- VC

- VCs

- vehicle

- very

- vs

- was

- Way..

- weekend

- weigh

- went

- were

- What

- when

- which

- while

- WHO

- whose

- why

- wider

- will

- with

- without

- words

- worry

- would

- Wrong

- wrote

- X

- years

- You

- zephyrnet