Bitcoin cost is scarcely above $20,000 per coin – a shock to most new and long-lasting holders of the digital money the same. The selloff brought the cryptographic money back down to its creation cost, which has gone about as a base in the past.

In this article we’ll investigate the expense to deliver each BTC and its relationship with cost activity. We’ll likewise look at why the scant computerized resource could probably find a base at such levels.

Bitcoin Falls To Production Cost, Aligns With Former ATH Retest

Bitcoin is not normal for some other resource before it, and since its commencement a whole industry has been made expecting to imitate the progress of its organization. Financial backers heap into altcoins expecting to find the following Bitcoin and profit.

The digital currency depends on an energy-serious verification of-work interaction to produce new coins. Mining isn’t modest, or, more than likely everybody would make it happen. As a matter of fact, as per the Production Cost Indicator planned by Bitcoin master Charles Edwards, it costs generally $20,260 per BTC at the low end.

Related Reading | Coinbase Considers Bitcoin Creator A Risk To Business, Here’s Why

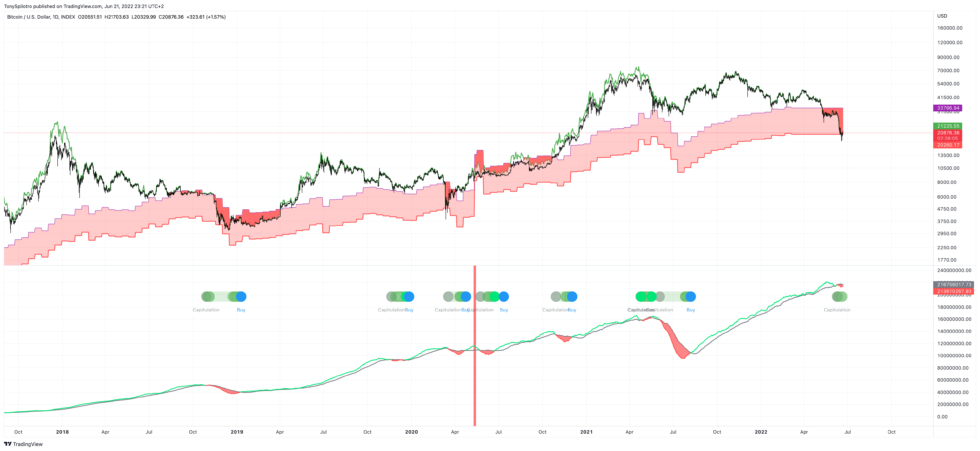

It doesn’t take a mathematician with the abilities of Satoshi to know that is scarcely two or three hundred bucks from current costs. Curiously, the selloff fell directly to the expense of creation. Thinking back, critical bottoms, for example, December 2018 and March 2020 both contacted the lower boundary.

The high finish of the measurement is around $33,766, which once penetrated could be an indication that the disadvantage is done. Like Black Thursday, retesting it is much more bullish.

BTC Production Cost Indicator could call the base | Source: BTCUSD on TradingView.com

How Satoshi Called The Bottom 12 Years Ago

Considering a base after such a ruthless selloff and in the midst of the background of the most negative full scale climate Bitcoin has at any point confronted, could appear hard to accept or even unrealistic. However, there is a justification for this kind of base-building conduct in scant assets.

Scarce resources like items will generally fabricate a base and base out around the expense of creation. Indeed, even Satoshi examined this before, dating as far back as 2010. The puzzling pioneer is cited as saying that the “price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more.”

Related Reading | Why Bitcoin Doesn’t Need Musk, Saylor, Or Anyone Else

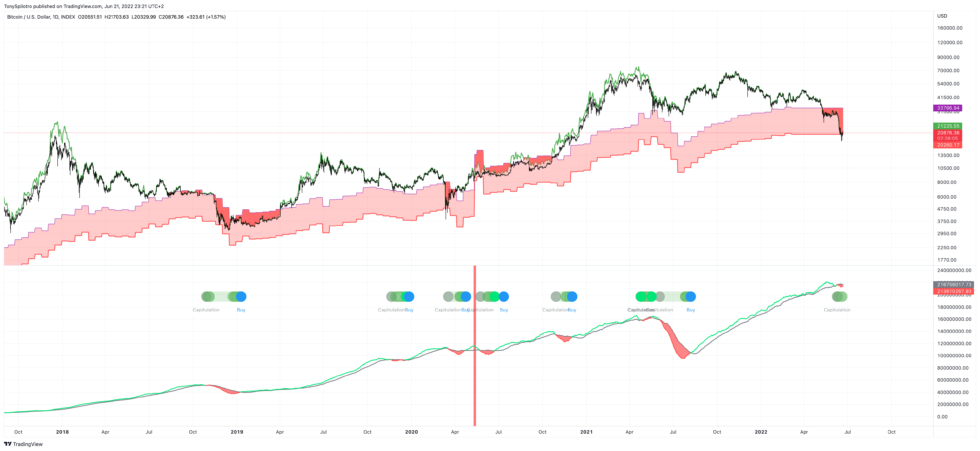

What Satoshi depicts is the income model which BTC diggers follow. They produce new coins at as beneficial of a rate as they can, and sell them as cost veers off higher than the expense of creation. Getting back to such levels, frequently scrubs the market of less proficient tasks, leaving simply the fittest behind.

BTC diggers are giving in | Source: BTCUSD on TradingView.com

Is this what’s going on now with Bitcoin? Also, what happens when hands down the most grounded have made due? Might Satoshi at some point have truly anticipated the base this far in advance?

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for selective day to day market bits of knowledge and specialized examination training. Kindly note: Content is instructive and ought not be viewed as speculation advice.

Included picture from iStockPhoto, Charts from TradingView.com

#Bitcoin #Production #Cost #Bottom #Bitcoinist.com

- 000

- 2020

- a

- abilities

- About

- activity

- advance

- advice

- Altcoins

- anyone

- appear

- around

- article

- Assets

- background

- before

- behind

- below

- Bitcoin

- Bitcoinist

- Black

- black thursday

- BTC

- Bullish

- business

- call

- Charles

- Charts

- Coin

- coinbase

- Coins

- commodity

- Conduct

- considers

- content

- Costs

- could

- creation

- creator

- critical

- cryptographic

- Currency

- Current

- day

- depends

- digital

- digital currency

- Digital Money

- directly

- down

- each

- example

- financial

- follow

- following

- from

- full

- generally

- generating

- getting

- Giving

- going

- happen

- High

- higher

- holders

- However

- HTTPS

- Income

- industry

- interaction

- investigate

- IT

- join

- Know

- knowledge

- levels

- likely

- LINK

- Look

- made

- make

- March

- march 2020

- Market

- master

- Matter

- might

- Mining

- model

- money

- more

- most

- negative

- normal

- organization

- Other

- picture

- pioneer

- planned

- Point

- price

- produce

- Production

- Profit

- Reading

- relationship

- resource

- Resources

- Risk

- same

- Satoshi

- Scale

- selective

- sell

- Selling

- since

- slows

- some

- specialized

- speculation

- tasks

- The

- Thinking

- three

- Training

- Verification

- What

- would

- years