Aave and Compound are two of the most popular cryptocurrency lending protocols with competitive rates. As such, Aave and Compound are frequently compared.

Aave’s rise from its early days as ETHlend and its growing influence in the DeFi (Decentralized Finance) space makes for an impressive narrative. The upstart platform often battles and sometimes even bests the upper echelon of DeFi protocols such as Maker, Uniswap, and Curve Finance.

Compound launched in 2017 and saw a dramatic increase in popularity with investors in June 2020– its COMP governance token doubled in price in just 5 days of trading. The price was also impacted by the early support of major cryptocurrency exchanges like Coinbase, which made it available to the average US investor. Coinbase was also an early investor in Compound and offers around $40 in COMP for learning about the project on Coinbase Learn.

Aave and Compound compete against each other while competing for greater dominance of the DeFi space, using unique concepts and services to get an edge on the competition.

The following article will explore and compare Aave and Compound, their investment platforms, tokens, and various DeFi lending products they offer.

Aave vs. Compound TL;DR: Aave and Compound offer investors an opportunity to borrow funds against their idle crypto tokens as collateral, or lend their cryptocurrency for fairly competitive interest rates. Aave is a newer platform and offers a few unique features that Compound doesn’t and has grown very quickly in popularity in the last year.

How Does DeFi Lending and Borrowing Work?

Traditional banks that do long-term lending and borrowing typically use instruments like a mortgage, an auto loan, or a student loan. Short-term lenders in money markets use instruments such as CDs (certificates of deposits), Repos (repurchase-agreements), Treasury Bills, and a few others.

Lending and borrowing in the DeFi world are concretely different.

All borrowing, lending, and managerial functions are decentralized.

The process is permissionless.

This is in stark contrast to the centralized and permission structure of traditional banking and short-term lending industries.

In DeFi, lending and borrowing occur through protocols, such as Compound and Aave. These decentralized protocols don’t require the identification or financial history of either party.

Some of the lending transactions are done via Decentralized Exchanges (or DEXs), which facilitate these peer-to-peer transactions without the interference of a central bank or intermediary that retains the custody of cryptocurrencies.

In other words, there isn’t a third-party organization that holds and distributes capital to enable one party to lend to or borrow from another. These functions are fulfilled by smart contracts, which automatically execute the terms of an agreement once certain criteria are met.

Traditionally, these third-parties charge a fee or percentage for their services. Since DeFi is directly peer-to-peer, in theory, a greater amount of the total value being transacted is able to flow through rather than going to another party’s pockets.

The magic in the case of Aave and Compound occurs through Decentralized Apps (dApps.)

DeFi Apps are decentralized in both the app’s governance and custody of data, which is a revolutionary concept for the traditional finance industry. These features combined with a speculative boom of attention for DeFi tokens is a strong reason why many have formed a bullish case for the DeFi industry.

Both Aave and Compound are non-custodial, which means that the lender’s cryptocurrency remains in the owner’s wallet, and the platform doesn’t take electronic custody of it.

Having full custody of your digital assets was one of the primary motivations for the invention of cryptocurrencies over a decade ago, and DeFi advocates point to this feature as a necessity for decentralization.

For example, Satoshi Nakamoto, the Founder of Bitcoin, imagined the cryptocurrency to be a full-fledged financial system neither controlled by nor benefits any single entity.

What is Aave?

Aave (pronounced “ah-veh”) originated as a peer-to-peer lending platform called ETHlend, which was rebranded to become Aave in 2020.

ETHlend was a peer-to-peer marketplace, much like a job board, where lenders and borrowers could hash out the terms without any middle-men.

Founder Stani Kulechov rebranded the project to Aave in a swoop of updates to make it a more attractive option for investing for institutional and retail investors. In other words, the rebrand was a facelift to enter the DeFi space as a serious competitor.

Aave provides both variable and stable interest rates. In contrast, Compound only offers variable interest rates on borrowed funds.

Aave’s stable interest rate reflects an average of interest charged in the market for a given asset, which is visible on Aave’s platform for both borrowers and lenders.

Aave also allows users to switch from stable to variable rate at any point by simply paying the transaction cost of the ETH gas fee.

Aave’s variable interest is determined by an algorithm that tracks how the amount of funds borrowed from user pools. The greater the borrowing amount, the higher the demand and consequently, the higher the variable interest rate.

The Aave aToken

Aave has two tokens, the aToken and the “AAVE” token.

The aToken represents the value of funds lent or borrowed and allows investors to earn interest whereas the AAVE token is a governance token.

When a lender or a borrower with collateral lists its crypto assets with Aave, the user receives an equivalent amount of an aToken, Aave’s native token that acts as a 1:1 peg for another asset; for example, aBTC, aETH, and so on. aTokens allows the user to earn interest on either the funds lent, or it can be put up as collateral for a loan.

AAVE was formerly known as LEND, and was migrated in a 100 LEND to 1 AAVE ratio in October 2020. LEND was launched in 2017 during Aave’s ICO. The platform changed the name in its rebrand. The functionality remains relatively similar; AAVE is an ERC-20 token that acts as a governance token that grants holders a say in Aave’s future.

Flash Loans

Interest on Aave is earned in real-time, updated every second, and added in the form of a fraction of an aToken. As this aToken is added to the user’s wallet, users can essentially simultaneously withdraw it from their funds.

The feature that made Aave famous is short-term loans known as Flash Loans. Flash loans made Aave a darling for speculative investors and consequently influenced the growth of its market share.

Compound Finance:

Like Aave, Compound is a decentralized lending platform. Compound was created in September 2018 by Compound Labs, Inc., a California based company.

Initially, Compound was a centralized lending platform but largely shifted to being a decentralized platform throughout 2019 and 2020. By July 17th, 2020, it became the largest community-driven decentralized lending platform and a decentralized autonomous organization (DAO) in DeFi following the introduction of its governance token COMP.

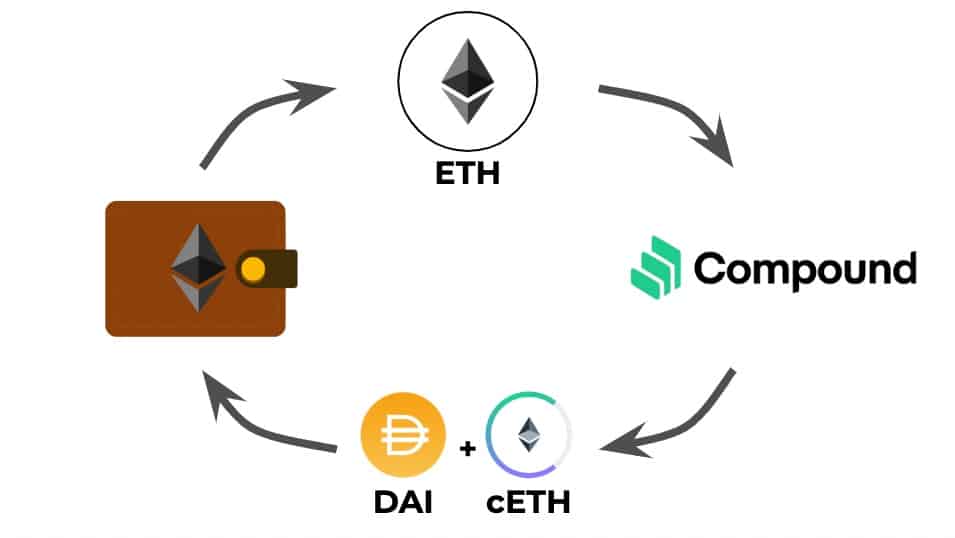

Unlike traditional lending, both Compound and Aave have created asset pools that lenders can contribute their cryptocurrency to, and from which users borrow.

This is particularly helpful when an investor needs to pay a debt in a currency it does not own. So, if an investor owns ETH and needs to make payment in DAI, they can do so instantly by using an Ethereum smart contract they have used to contribute to a Compound asset pool.

Borrowing assets on DeFi

However, users seeking to borrow from either platform usually contribute more than the borrowed amount as collateral– usually up to a maximum of 75% of the crypto assets added to the pool can be borrowed.

The value (in USD) of the collateral must hold above the threshold set by the platform. The digital currencies put up as collateral are liquidated in the event that the value of crypto collateral dips below the established threshold.

The collateral is then made available and can be used borrowed by other users on the platform with the applicable fees at a variable interest rate.

Compound and Aave both keep the prices of the assets up to date by using an oracle (such as Chainlink) that supplies up to date price information of various crypto assets.

Since cryptocurrency assets can be incredibly volatile, both platforms require declaring a small percentage from each pool as reserves to hedge against volatility within the protocol.

Aave vs. Compound: Which is Better?

Aave vs Compound

When it comes to the versatility of offerings and offering more for your money, we found Aave to be a better bargain.

Aave offers a larger number of assets.

For starters, Aave accepts far more variety of crypto assets to its borrowing pool than that by Compound.

Aave offers 23 different crypto assets from investors compared to 9 by Compound.

This attracts a larger variety and number of investors, which may make the platform more appealing to a greater number of people holding the variety of tokens.

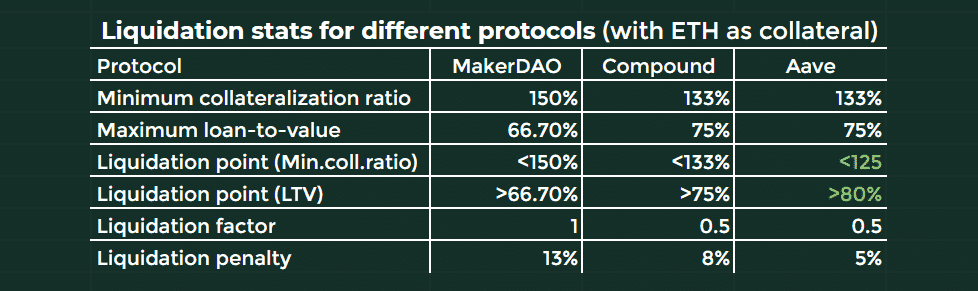

Aave’s allows for higher borrowing amounts compared to collateral.

Aave offers more money to borrowers in return for their collateral.

Compound offers only up to 66.6% borrowing against 100% collateral.

Aave allows borrowing as much as 75% of their amount of collateral.

Liquidation thresholds on various platforms

Aave offers Flash Loans

Aave’s short-term collateral-less loan service, called Flash Loan, is a reason may borrowers have explored the platform.

It is a recent phenomenon in Decentralized Finance (DeFi) that allows loans without collateral for a very short period of time and is only available on the Ethereum network.

How Does an Aave Flash Loan Work?

Much of arbitrage either in centralized markets of DeFi works on borrowed money. However, centralized markets provide such instruments as CDs (certificates of deposits), Repos (repurchase- agreements), and Treasury Bills to lend this money for short-term use for leveraging arbitrage opportunities.

One such arbitrage opportunity, for example, is where investors take advantage of the price difference on different cryptocurrency exchanges by quickly buying and selling the assets, profiting on the difference.

Most loans require collateral, so that if a loan isn’t paid back, the lender can liquidate, or sell, the collateral and get some or all of their money back.

Flash loans are unsecured, meaning they don’t require collateral. If a Flash loan isn’t paid back, the loaned amount is sent back by replacing the original transaction with a zero (0) transaction. Aave proponents argue that this arbitrage opportunity wasn’t possible before blockchain due to smart contracts and the intricacies of Ethereum’s network.

Flash loans use smart contracts that are programmed into the Ethereum network in such a way that it does not let the ownership of crypto assets change hands until certain conditions are met.

For the speculators, Flash loans have been a godsend. Flash loans were primarily created to help users exploit arbitrage opportunities: the loan is made and retrieved in the same contract and during the same transaction block where the loan originated. The entire operation of providing the loan and payback happens almost instantly. This gives the user a window of a few seconds to purchase and sell the same assets.

Flash Loans generate 0.3% in revenue for Aave for every transaction. Aave loaned out over $2B in Flash loans in 2020.

Aave vs. Compound Rates

Aave’s rates and Compound’s rates change frequently (as all DeFi platform rates do), but Aave tends to offer 2% higher on most assets. We recommend checking for yourself, as this information could change as soon as we finish writing this sentence.

Final Thoughts: Aave vs. Compound

DeFi lending and borrowing are at the forefront of innovation, and as such, they can be very volatile and risky.

Compound and Aave both provide well-developed solutions for lending out cryptocurrency and earning interest.

When it comes to comparing Aave and Compound, an argument can be made that Aave has surpassed Compound in terms of innovation and execution. Aave provides a greater variety of cryptocurrency assets, and offers unique products such as Flash Loans.

However, there is still plenty of room for Compound to grow. On December 17, 2020, Compound announced plans to create Compound Chain, a blockchain that can uniquely provide money market and financial services across multiple networks. Unlike most of the DeFi exchanges currently, which can only operate in the Ethereum Blockchain, a Compound Chain will be able to swiftly interlink to any blockchain as well as other networks.

This move could hypothetically allow Compound to link to Digital Currencies rumored to be issued by various Central Banks across the globe.

The Compound Chain Whitepaper states:

“Compound Chain is a reimagination of the Compound Protocol as a stand-alone distributed ledger, capable of solving these limitations and proactively preparing for the rapid adoption & growth of digital assets on a variety of new blockchains, including Eth2 and central bank digital currency ledgers.”

Overall DeFi lending market is very competitive

However, Aave and Compound aren’t alone in the DeFi race and are faced with strong competition According to DeFibase, despite the popularity of Aave and Compound, Maker Dao is the market leader in cryptocurrency lending DeFi Exchanges.

- "

- &

- 2019

- 2020

- 9

- Adoption

- ADvantage

- Agreement

- agreements

- AI

- algorithm

- All

- announced

- apps

- arbitrage

- around

- article

- asset

- Assets

- auto

- autonomous

- Bank

- Banking

- Banks

- Bills

- Bitcoin

- blockchain

- board

- boom

- Borrowing

- Bullish

- Buying

- california

- capital

- Cash

- Central Bank

- central bank digital currency

- Central Banks

- certificates

- change

- charge

- charged

- checking

- coinbase

- company

- competition

- Compound

- content

- contract

- contracts

- crypto

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchanges

- Cryptocurrency Lending

- currencies

- Currency

- curve

- Custody

- DAO

- DApps

- data

- Debt

- Decentralization

- decentralized

- Decentralized Finance

- decentralized lending

- DeFi

- Demand

- digital

- Digital Assets

- digital currencies

- digital currency

- Distributed Ledger

- Early

- Edge

- ERC-20

- ETH

- ethereum

- ethereum network

- Event

- Exchanges

- Exploit

- Feature

- Features

- Fees

- finance

- financial

- financial services

- Flash

- flow

- form

- founder

- full

- funds

- future

- GAS

- governance

- grants

- Grow

- Growing

- Growth

- hash

- history

- hold

- How

- HTTPS

- ICO

- Identification

- Inc.

- Including

- Increase

- industries

- industry

- influence

- information

- Innovation

- Institutional

- interest

- Interest Rates

- investing

- investment

- investor

- Investors

- IT

- Job

- July

- Labs

- learning

- Ledger

- lending

- LINK

- Lists

- Loans

- major

- maker

- Market

- Market Leader

- marketplace

- Markets

- money

- Most Popular

- move

- network

- networks

- offer

- offering

- Offerings

- Offers

- Opportunity

- Option

- oracle

- Other

- Pay

- payment

- People

- platform

- Platforms

- Plenty

- pool

- Pools

- Popular

- price

- Products

- project

- purchase

- Race

- Rates

- real-time

- retail

- Retail Investors

- revenue

- Satoshi

- Satoshi Nakamoto

- sell

- Services

- set

- Share

- Short

- small

- smart

- smart contract

- Smart Contracts

- So

- Solutions

- Space

- Student

- support

- Switch

- system

- time

- token

- Tokens

- Trading

- traditional banking

- traditional finance

- transaction

- Transactions

- Uniswap

- Updates

- us

- USD

- users

- value

- Volatility

- Wallet

- Whitepaper

- within

- words

- Work

- works

- world

- writing

- year

- zero